NFTs Story - From Boom to Bust 🚨

Non-fungible tokens are down over 90% in total market cap. What can be salvaged? Community must shift its focus from speculative trading to creating genuine utility and value to regain credibility.

Hello, y'all. The music quiz game that you want to play. Over 1.7 million plays and music fandom to flex. Who are you playing with then 👇

These are Stoner Cats. Look at the adorable characters. They get stoned.

It’s not just character sketches sold as NFTs.

Stoner Cats is an animated web series around five cannabis-loving cats who gain the ability to speak after inhaling medical marijuana.

Three creators came up with a show after taking inspiration from one of their real-life experiences and grabbed the attention of Hollywood.

Mila Kunis and her Orchard Farm Productions partners took over. Lined up top voice talent, animators and creatives. Brains, technology and creativity came together.

Mila Kunis, Ashton Kutcher and Chris Rock as cats that use medical marijuana.

10,420 unique NFTs were created based on the characters in the show. These NFTs were minted and sold on July 27, 2021, in 35 minutes.

All of it fetched them Ethereum worth ~$8.2 million that time.

With all that money, they produced six episodes of Stoner Cats, accessible only to those holding the NFTs.

Digital collectibles. Token gated content access for collectors. Celebrities thrown in. Tapping on the possibilities of ownership, access and distribution in the web3 internet world.

That was possible in 2021. Back when NFTs were still cool.

They got sued by the US Securities and Exchange Commission (SEC) in 2023.

Ironically, that makes Stoner Cats a complete NFT experience. In sync with the rise and decline. Nobody wants to buy NFTs now.

In 2024, NFTs are heavy with conversations around its extinction.

Extinction? That bad? Yes.

How did NFTs get here?

In 2021, NFTs were the talk of the town. Celebrities flaunted their rare collection of Bored Apes, digital artists became overnight millionaires, and everyone from tech enthusiasts to Wall Street veterans scrambled to get a piece of the action.

The NFT landscape looks vastly different in 2024.

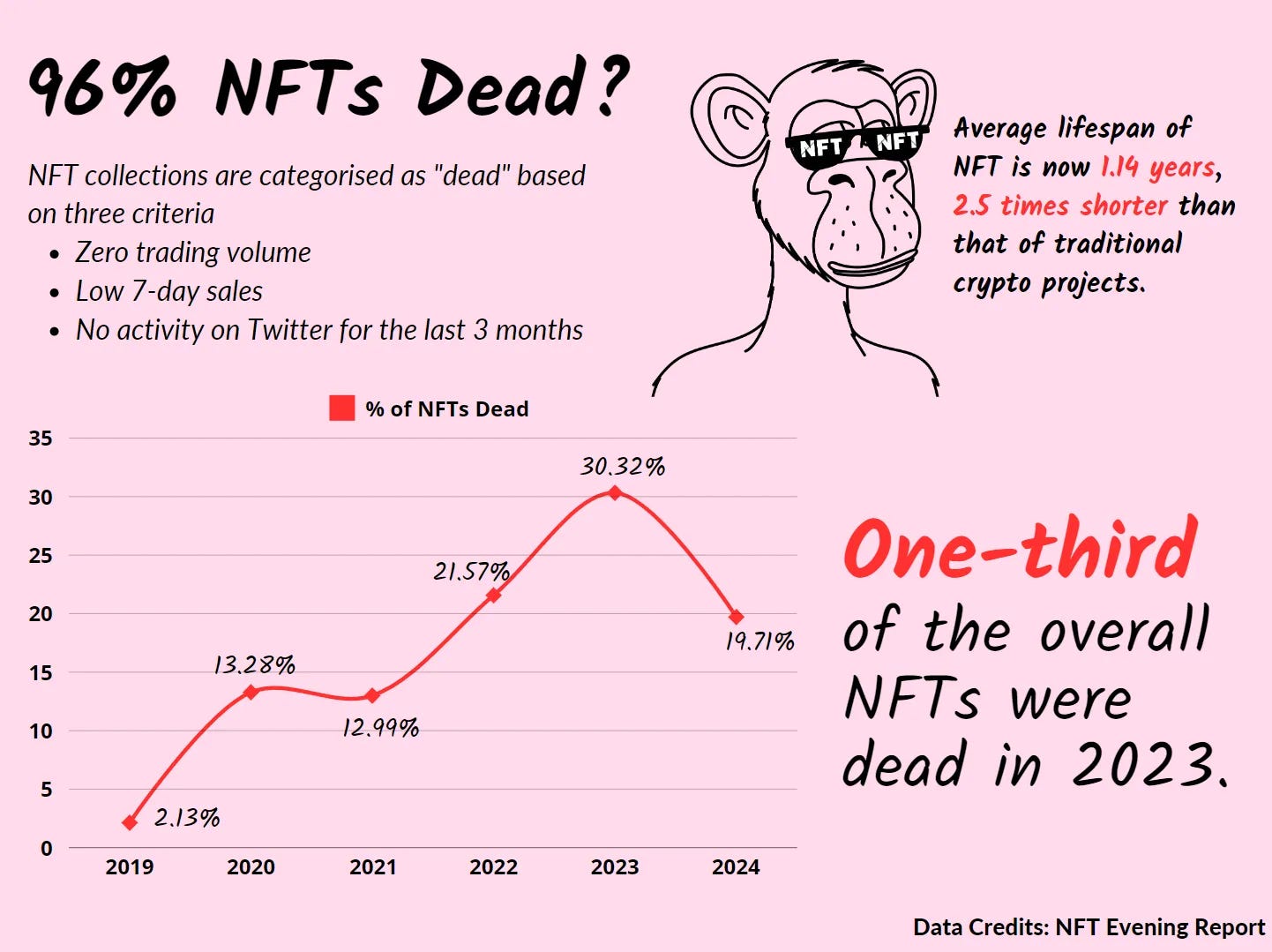

Today, about 96% of NFT projects are considered dead, with 43% of holders currently unprofitable.

The once-booming market is struggling for takers and fighting for relevance.

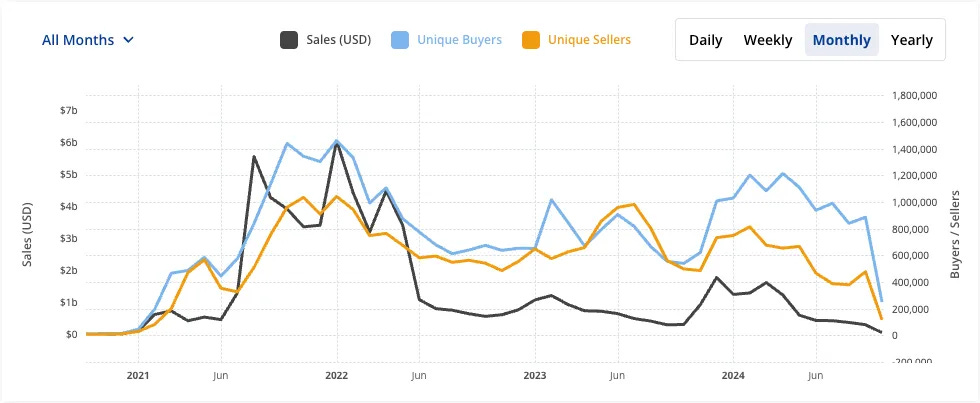

In 2021 and 2022, NFT sales volume peaked at a staggering $25 billion and $26 billion. That’s more than $2 billion per month.

As of October 2024, NFT sales per month has averaged $366 million in the last six months.

September 2024 registered a record low transactions of 5 million, least since March 2021.

Check: Top NFT Collection Prices Ranked by Market Cap

Why NFTs worked ... until they didn't

It offered a unique way to establish ownership of digital assets. For the first time, digital art, music, and even virtual real estate could be owned and traded with verifiable scarcity. NFTs democratised art ownership and empowered creators.

Broader cryptocurrency bull run and pandemic-induced digital acceleration induced a perfect condition for NFT adoption.

Beeple’s "Everydays: The First 5000 Days" getting sold for $69.3 million at Christie's in March 2021.

Until October 2020, the most expensive Mike Winkelmann — the digital artist known as Beeple — had ever sold a print for was $100.

Yeah. Let that sink in.

That was the craze NFTs had.

The initial appeal of NFTs was multifaceted.

Verifiable digital ownership: NFTs provided a way to establish provenance and scarcity for digital assets.

Artist empowerment: Creators could directly monetise their work and receive royalties on secondary sales.

Community building: NFT projects often came with exclusive access to communities and events.

Speculation: The potential for quick, high-return investments attracted many buyers.

Celebrities jumped on the bandwagon with NFTs at their peak selling for millions of dollars.

It gave way to a frenzy of get-rich-quick schemes and celebrity cash-grabs.

The market became oversaturated with low-quality projects and speculative investments, leading to a loss of trust among investors and enthusiasts.

But art is rare. And it must be kept that way if it were to be valued.

The Home for All the Music Lovers

Muzify - is more than just a platform; it's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

NFTs didn’t participate in 2024 crypto resurgence

NFTs are trapped in a brutal bear market.

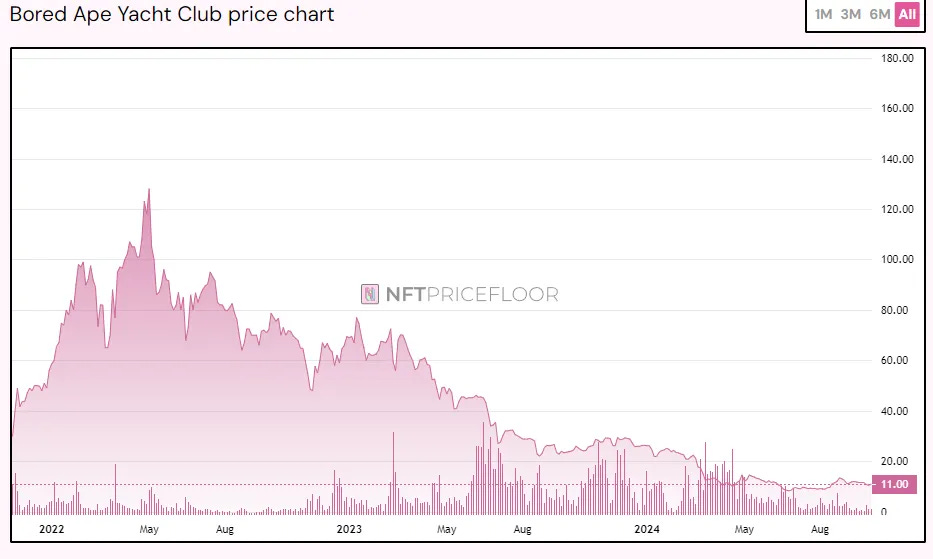

So bad that if you had bought Bored Ape Yacht Club NFTs, one of the blue-chip ones, at its peak of 152 ETH, or $429,000, in April 2022, you would have lost 93% of your investment today.

A lot of mainstream acknowledgement has been for core blockchains.

More attractive in terms of risk-to-reward ratio over NFTs for investors who wanted to diversify their portfolios. They moved their money away from NFTs.

Significance as store value in case of Bitcoin and infrastructure for the internet that Layer1 chains promise. Ethereum, Tether, Solana, TON and other ecosystem chains.

Bitcoin found takers in fund houses and public companies such as MicroStrategy bringing Bitcoin onto their balance sheets.

The others bought into spot Bitcoin ETFs that were given a nod early this year. Followed by Ethereum ETFs in July.

It’s also been memecoins that has the trader’s fancy this season.

The speculative money that flipped NFTs in the last bull run came for memecoins.

It’s not going away anywhere … why? Memecoins compared with NFTs, are fast moving consumer good (FMCG) for the trader’s appetite.

Nothing will change until crypto traders feel rich again, NFT Price Floor co-founder Nicolas Lallement had told DL News.

It’s not going to make a comeback until crypto traders feel rich. Even that scenario will bring in money only for the blue chip (reliable and valuable) collections.

Regulatory grey area

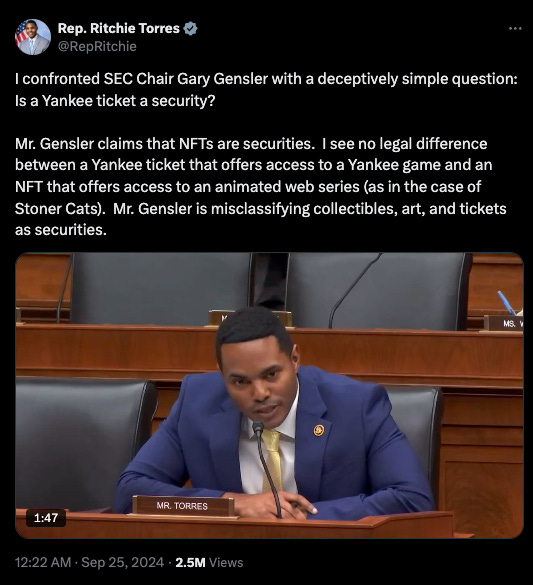

Regulatory bodies made survival tougher by considering NFTs as securities.

Remember the Stoner Cats case?

The US SEC initiated legal action against Stoner Cats, arguing that they conducted an unregistered offering of crypto asset securities in the form of NFTs.

That’s not all.

In another landmark case, the SEC alleged that OpenSea, one of the largest NFT marketplaces, allowed the trading of unregistered securities.

In another case, two artists fought back and challenged the SEC’s jurisdiction over NFTs.

Read: NFTs Are Securities? SEC v OpenSea🚨

But, ironically, the SEC itself isn’t collectively sure about their stance on NFTs.

In Stoner Cats case, two SEC Commissioners Hester Peirce and Mark Uyeda dissented with the settlement arguing that applying securities laws to NFTs creates legal ambiguity that could hinder artistic creativity.

They urged for clearer guidelines to support artists using NFTs to engage with fans.

In congressional hearings, too, Congressmen asked SEC for clarity on one thing - its stance on NFTs.

Can NFTs come back?

Yes, the NFT market has crashed, but to dismiss NFTs entirely would be short-sighted.

While the days of multi-million dollar sales for pixelated images may be over, the underlying technology of NFTs still holds promise.

How can the NFT space evolve?

Utility-focused NFTs: Projects like Ethereum Name Service (ENS) domains, which serve a practical purpose, have maintained relative stability.

Gaming integration: Major game companies like Ubisoft and Square Enix are exploring NFTs for in-game assets.

Real-world asset tokenisation: NFTs are being used to represent ownership of physical assets like real estate and luxury goods.

Improved technology: Layer-2 solutions and more energy-efficient blockchains are addressing scalability and environmental concerns.

Read: What properties make NFTs a 100x technology?

Art, finance, music, gaming - NFTs are changing the game across the board. And it will continue to do so.

Token Dispatch View

What can be salvaged from the NFT experiment?

The hype cycle exposed both the potential and pitfalls of this technology.

NFTs aren't just expensive pictures, they're verifiable ownership records for digital and real-world assets.

The challenge is to find genuine utility amidst the speculative frenzy.

The gaming industry shows promise in integrating NFTs meaningfully. Digital ownership of in-game assets could revolutionise player experiences and create new economic models.

Read: Sony's Got A Blockchain 🧱

The use of NFTs in verifying the authenticity of luxury goods or managing intellectual property rights hints at practical applications beyond mere collectibles.

Read: How Your Brand Should Use NFTs

The Pudgy Penguins is a beautiful case study in digital collectibles transcending to physical world merchandise to build wider user base and utility.

Read: It's a Pudgy World 🐧

Regulatory clarity is another crucial factor. The legal actions by the US SEC against NFT marketplaces highlight the urgent need for a clear regulatory framework.

Without it, the industry risks remaining in a legal grey area, deterring serious investors and innovators.

NFTs need to regain credibility. The community must shift its focus from speculative trading to creating genuine value.

The get-rich-quick mentality of 2021 boom was always unsustainable.

Instead, developers and artists should concentrate on how NFTs can solve real-world problems or enhance existing systems.

There’s an opportunity to build something more sustainable, more useful, and ultimately more valuable than a collection of overpriced digital apes.

The NFT experiment’s next chapter must be written with more caution, more creativity, and a keener eye on long-term value creation.

Week in Funding 💰

SecondLive. $12M. Players get access to metaverse infrastructure, economic systems, and social systems, as well as introducing artists and sports stars.

RD Technologies. $7.8M. Bridging Web2 and Web3 with HKD backed stablecoin (HKDR) and wallet to build multi-currency account for global business.

Layer. $6M. Ethereum scaling solution that allows developers to write applications in languages like rust, that can run anywhere – even on an iPhone.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

The regulatory uncertainty is a big barrier for the NFT space, and it's disappointing to see mixed messages from the SEC. Clear rules would help distinguish genuine projects from cash grabs. If artists and developers can use NFTs to empower communities, rather than chase million-dollar sales, we might see a healthy revival in the market.

This article perfectly captures the rise and fall of NFTs—it's a reminder that hype-driven bubbles can lead to great innovation but also quick crashes. The key to resurgence lies in real utility, not just collectibles. NFTs could still revolutionize ownership in gaming, real estate, and digital identity if we shift our focus away from pure speculation.