Today’s edition is brought to you by Muzify. A platform to unlock your music fandom through quizzes, stats and a lot of fun tools. Can you guess the track in 5 seconds 🫵

Just two days back, Bitcoin charted history.

But like they say: everyday is a new day, and things could go from good to bad real soon.

And they did.

In Friday’s dose of crypto, we take you through the drama that ensued in 24 hours.

The great rise and fall of Bitcoin

BTC’s resilience in bouncing back

Record-high liquidations in Bitcoin

What analysts think about BTC’s path ahead

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 175,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

That was US President-elect Donald Trump on Truth Social starting his day by taking credit for Bitcoin's historic milestone.

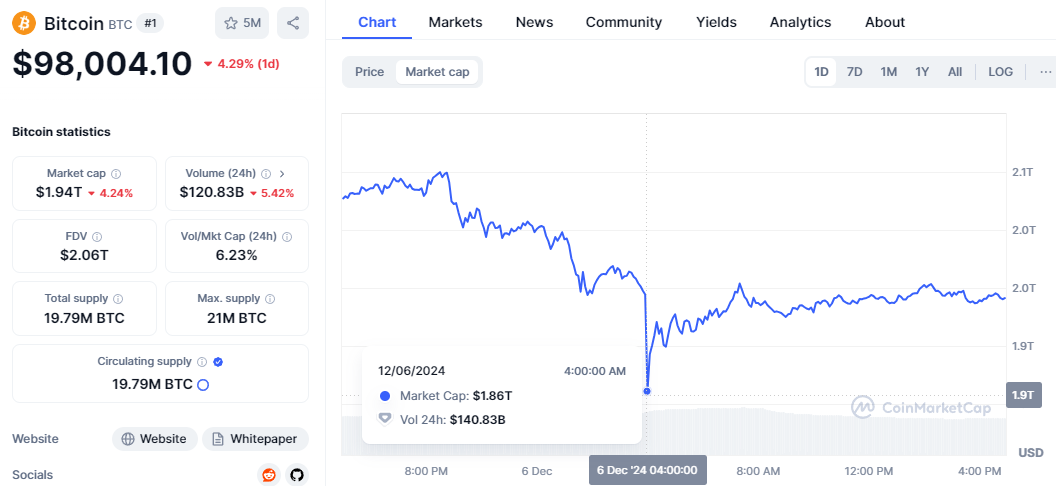

Six hours later, we saw one of the most dramatic price swings in Bitcoin history.

What happened?

Bitcoin crashed from $103K to under $92K in just minutes leading to $1.1 billion in liquidations.

The journey from $98K to $92K - much worse - in just three minutes.

Three minutes and more than 6% drop.

Bitcoin was quick to retrace back towards the $100K mark.

In four more hours, the market showed resilience as it climbed back to around $98K. And it stayed there.

So, what does anyone make out of this mad journey?

Before we get there, let's talk a quick detour to understand what actually drove this rollercoaster.

The initial pump to $100K came right after Trump nominated Paul Atkins, a pro-crypto veteran, as the next SEC Chair. The market loved it - until it didn't.

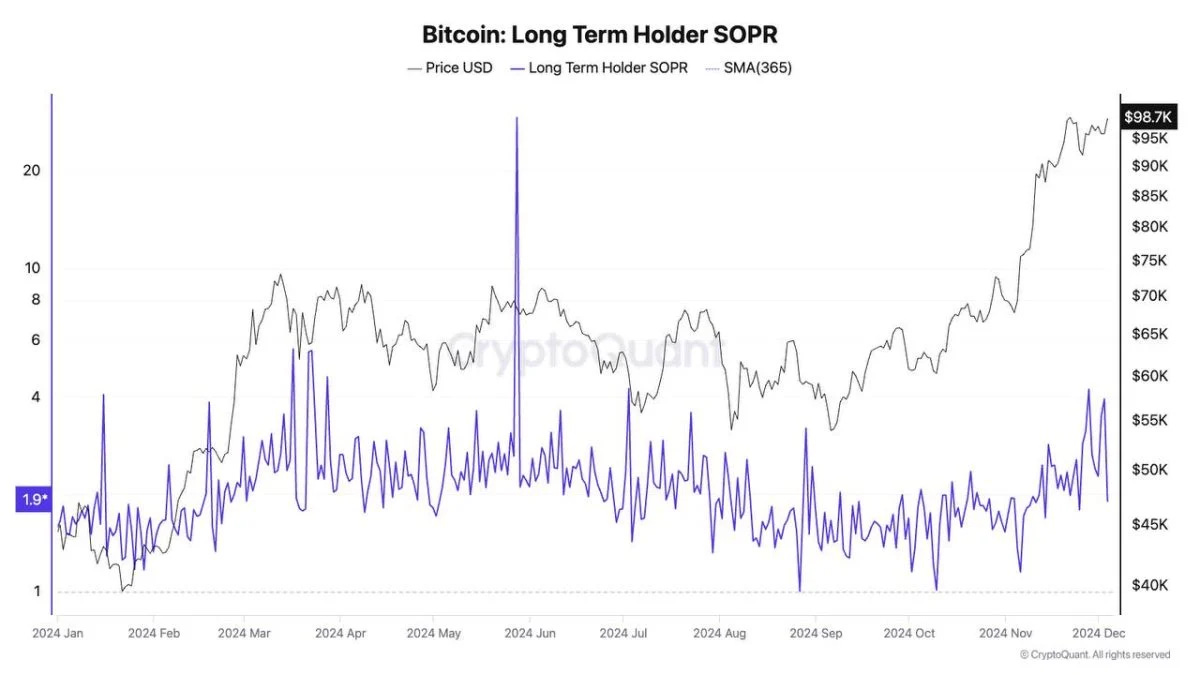

The long-term hodlers also began booking big profits.

“Long-term holders (LTH) have been taking profits as bitcoin prices rallied above $100,000, as shown by the LTH SOPR increasing towards four on our charts, indicating that coins sold by long-term holders have realised profits of four times their original purchase price,” CryptoQuant Head of Research Julio Moreno told The Block.

And what about the dump? Classic whale games.

Market makers pushed prices up, attracted retail FOMO, then triggered a cascade of liquidations. Over $815 million in long positions got wiped out after that quick slump.

So where do we go from here?

A lot could decide the fate.

Just when everyone was catching their breath from the price action, Trump dropped another pro-crypto move.

He announced the appointment of David Sacks, Yammer founder and former PayPal COO, as the White House's first-ever "AI and crypto czar."

Between this, Paul Atkins for SEC, and promises of a national Bitcoin reserve, Trump's building what could be the most crypto-friendly administration in history.

But two more macro events could determine where we go from here.

Jobs report that’s set to come out today (economists expect 200,000 new jobs)

December 18 FOMC meeting (72% chance of a rate cut)

The Home for All the Music Lovers

Muzify is a journey into the world of music. An interactive experience through quizzes, stats and a lot of fun tools.

For artists it’s a powerful tool to connect with their fans. For fans it’s building deeper connect with the artists.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

In The Numbers 🔢

$1.1 billion

That's how much got liquidated in a single day during Bitcoin's wildest 24 hours.

A few minutes. That's all it took for the historic crash, triggering the largest liquidation event since December 2021.

$200 billion in market cap? Gone. Just like that.

So, should Bitcoin hodlers worry?

Analysts don’t think so.

Strong Support for Path Ahead

Order books right now have substantial support at the $100K level with 4,600 BTC in buy orders. Meanwhile, the sell-side has just 3,400 BTC in orders below $110K.

Trading volume exploded to $98 billion today.

And the big institutional players? They shrugged it all.

ETFs casually added another $766.66 million in a single day, while exchanges saw a net inflow of 8,000 BTC.

Everyone's either taking profits or positioning for what's next.

Analysts are getting bolder with their predictions.

Even by conservative estimates, analysts expect BTC to hit $120K just by year-end.

There have been calls for $200K and more, which may seem unrealistic, but we are living in really funny days.

The analyst predictions are all over the place, but one thing's clear - nobody thinks $100K is the top.

What should you do?

Token Dispatch View 🔍

Bitcoin's journey past $100K is a classic case of market dynamics.

The rapid crash and recovery shows two things: the market is maturing (quick recovery, institutional resilience) but still has room to grow (leverage-induced volatility).

Three key factors will likely shape Bitcoin's path forward.

Trump's admin. Institutional money. Technical picture.

And, right now, all the three point towards one direction - up and onwards - for Bitcoin.

And then, also keep a close eye on how the market handles the upcoming macro catalysts. Today’s jobs report and the December 18 FOMC meeting could set the tone for the rest of the year.

For now, one thing's clear: whether you're trading or holding, size your positions wisely. The last two days showed us that in crypto, a year's worth of moves can happen in three minutes.

Stack smart and stay liquid.

The Surfer 🏄

Investors have poured a record $432 million into Ether ETFs on December 5, marking the largest daily inflow since their launch on July 23. Over the past two weeks, spot Ether ETFs have accumulated more than $1.3 billion in inflows as Ether's price approached $4,000.

The Financial Times issued a sarcastic "apology" to Bitcoiners after 13 years of criticism, coinciding with Bitcoin's price surge to $100,000 on December 5. FT Alphaville's city editor, Bryce Elder, stated they stand by their previous negative views on Bitcoin, referring to it as a "negative-sum game" and "chronically inefficient."

MicroStrategy's Bitcoin treasury has surpassed $40 billion, yielding over $17 billion in unrealised profits as BTC hit $100,000 per coin. The company has invested more than $23 billion in Bitcoin since 2020, driven by founder Michael Saylor's unique corporate treasury strategy.

Pudgy Penguins is launching its own cryptocurrency called Pengu this month on the Solana network. The total supply of Pengu will be 88,888,888,888 tokens. Approximately 25.9% of the supply will be distributed to the Pudgy Penguins community. An additional 24.12% will be allocated to other communities and new "Huddle" members.

Semler Scientific has added 303 Bitcoin to its balance sheet, totaling 1,873 BTC valued at over $189 million. The company purchased the Bitcoin at an average price of $96,779 between November 25 and December 4. Semler reports a BTC Yield of 78.7%, a key performance indicator tracking Bitcoin holdings relative to shares.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us ... either ways do tell us✌️

So long. OKAY? ✋