Today’s edition is brought to you by KuCoin. 1 out of 4 crypto holders worldwide is with KuCoin. Limited-time newcomer bonus of 10,800 USDT (not for US users) 🫵

Welcome to Monday, where DeFi never sleeps and neither does the IRS, apparently.

Hope your yields are high and your liquidation risks low. Yes, we are talking DeFi today.

DeFi's explosive 2024 growth ($36B → $122B)

Why Wall Street giants are suddenly speaking DeFi's language

The great stablecoin surge: What $200B really means

Bitcoin DeFi: The sleeping giant awakens?

The IRS bombshell that could reshape DeFi's future

Why 2025 might be the year everything changes

First up, show us some love on X 🤞

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

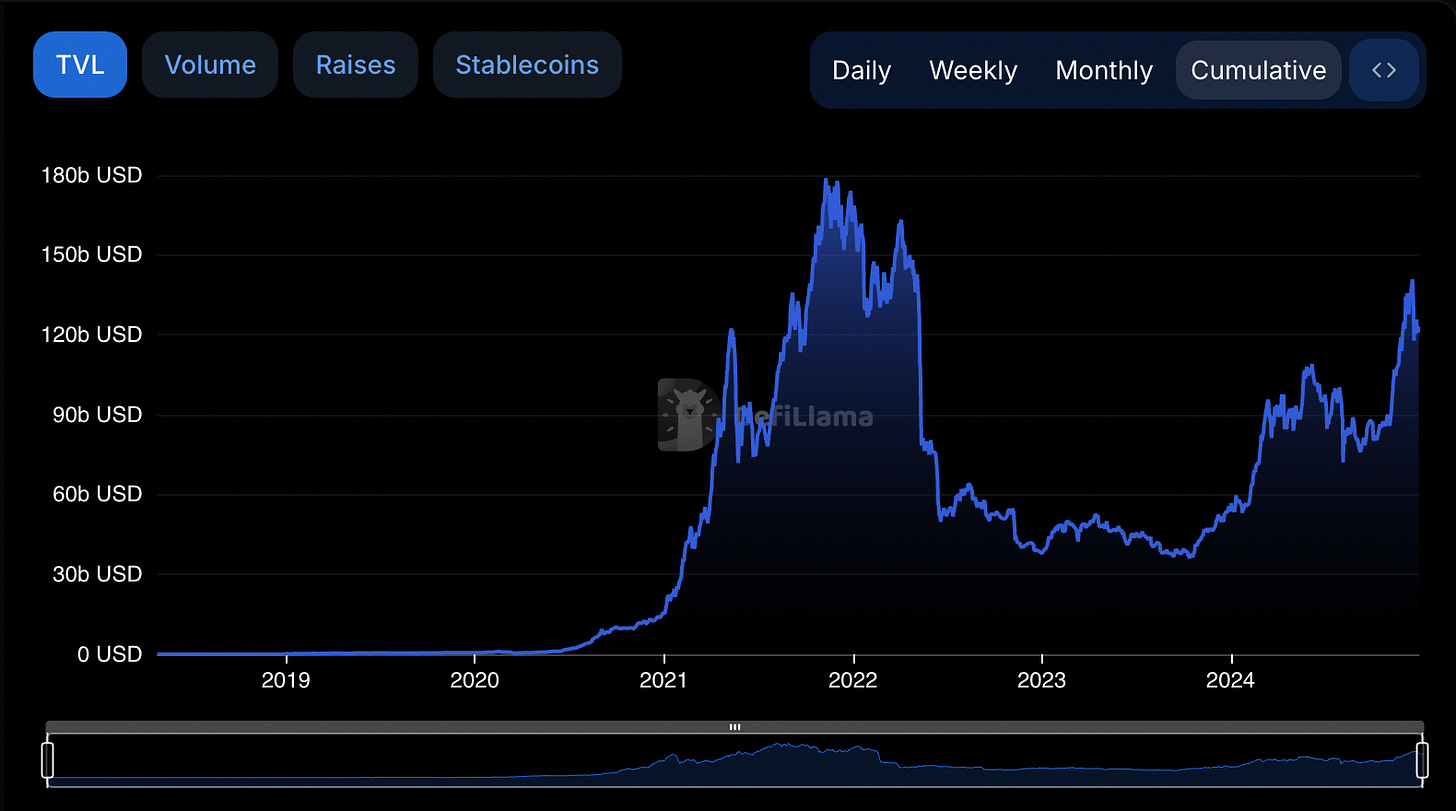

You can tell a lot about DeFi's explosive growth in 2024 by looking at a single number: $122 billion.

That's how much capital is currently locked in DeFi protocols — a stark turnaround from the $36.59-billion low of October 2023.

2024 was the year DeFi grew up, shedding its experimental image to become something that looks suspiciously like the future of finance. Let's unpack the journey?

The Great Institutional Migration

The wall between TradFi and DeFi finally crumbled in 2024. Traditional financial institutions didn't just observe from the sidelines - they became active participants.

This year saw traditional finance giants like BlackRock and Securitise diving headfirst into DeFi, not just dipping their toes.

BlackRock led the charge with their BUIDL platform reaching $500M in tokenised treasuries.

They're not here for the memes — they're here for the real-world asset tokenisation market that has ballooned to over $14 billion.

The migration makes sense.

When you can tokenise everything from US Treasury bonds to real estate, suddenly DeFi starts looking less like a casino and more like the next evolution of finance.

Read: Inside 2024's RWA Revolution 📦

That’s not all.

JPMorgan's Onyx Digital Assets platform expanded its operations using Axelar for cross-chain management.

Even Goldman Sachs, traditionally cautious about crypto, launched DeFi yield strategies for institutional clients.

The driving force? Yield.

Traditional finance, with its measly returns, simply can't compete with the yields offered by protocols like Lido Finance, which commands $33 billion in TVL while offering staking yields between 4.4% to 6.7%.

It's not just about the returns. The real revolution is in the infrastructure being built.

Infrastructure: The Unsexy Revolution

While everyone was watching Bitcoin hit $100,000, something more fundamental was happening in DeFi's engine room.

Take Ethena, for instance. They turned the stablecoin game on its head with USDe, their synthetic dollar that uses ETH as collateral through delta-hedging.

Or look at what's happening with liquid staking. Lido isn't just the biggest DeFi protocol by TVL — it's become the backbone of Ethereum's staking ecosystem.

When traditional institutions want exposure to staking yields, they're increasingly turning to liquid staking derivatives rather than running their own validators.

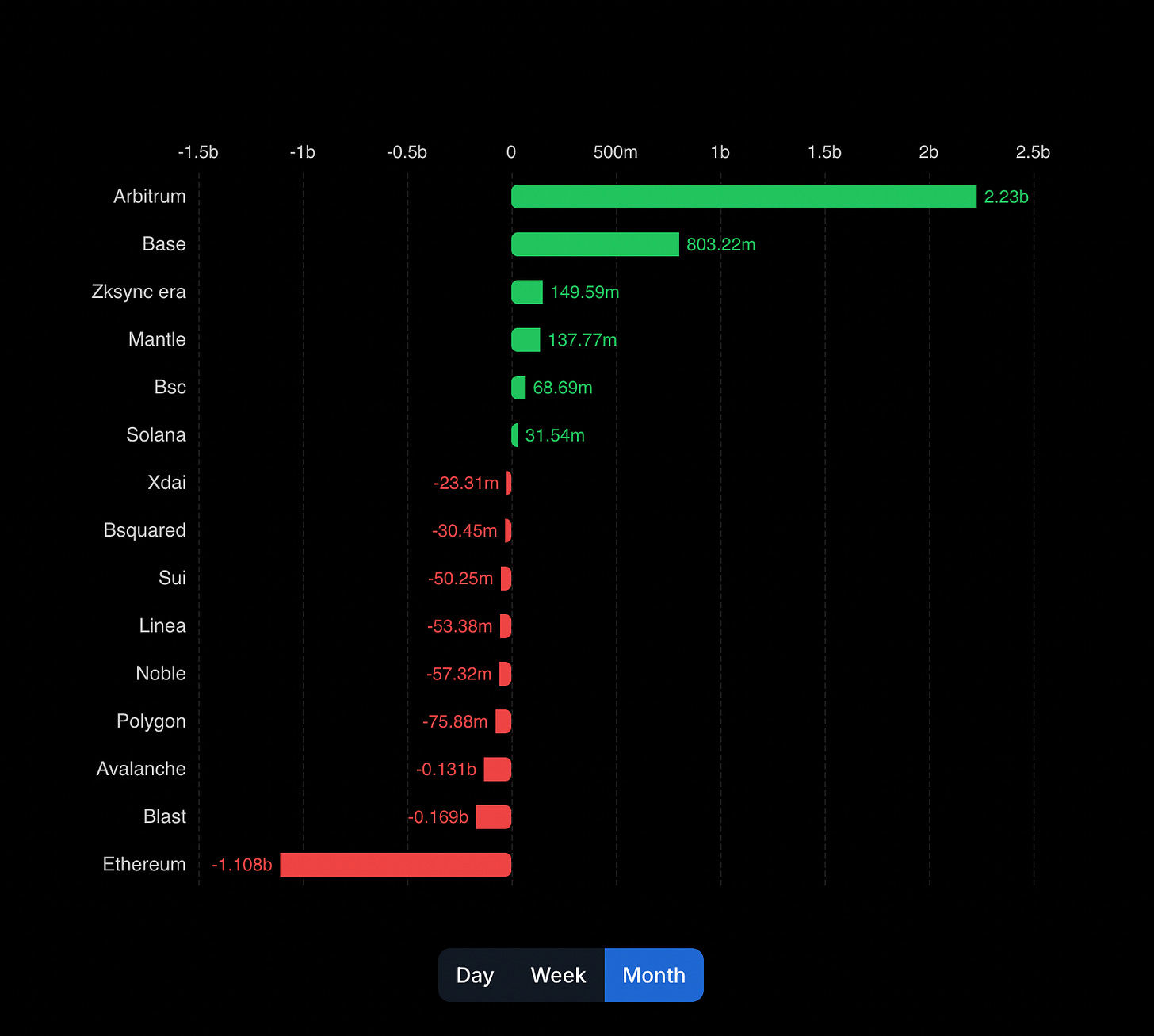

The Layer 2 Race

The future of DeFi isn't on any single blockchain — it's everywhere.

Solana had its moment in the sun when its DEX volume briefly surpassed Ethereum's in November.

The flipping might have been temporary, but it signalled something important: competition in the Layer 1 space is far from over.

Read: Can Sui & Aptos Live Up to Their Hype? 🔋

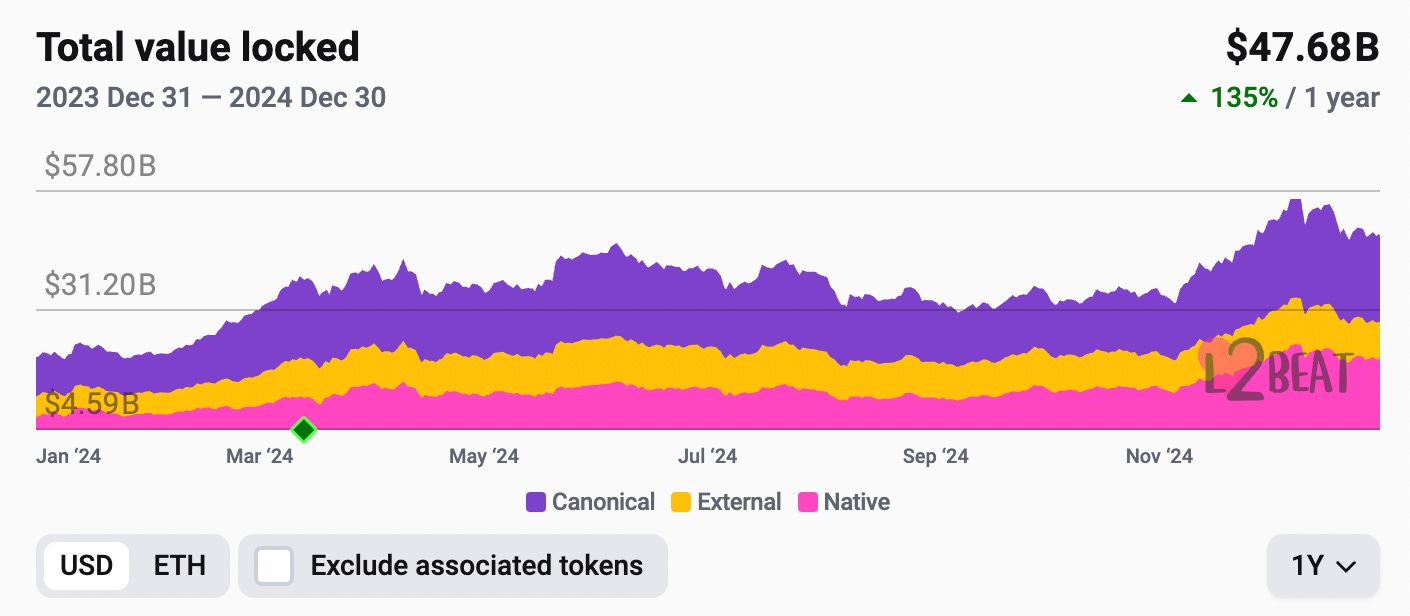

Meanwhile, Layer 2 solutions have been quietly building empires.

The total value locked across Layer 2s surged past $47 billion, with platforms like Base and Arbitrum leading the charge.

Scaling solutions? Yes.

They're becoming distinct ecosystems with their own unique advantages.

The Bridge Revolution

The most interesting development is how these different chains are talking to each other. Cross-chain bridges have processed over $24 billion in monthly volume.

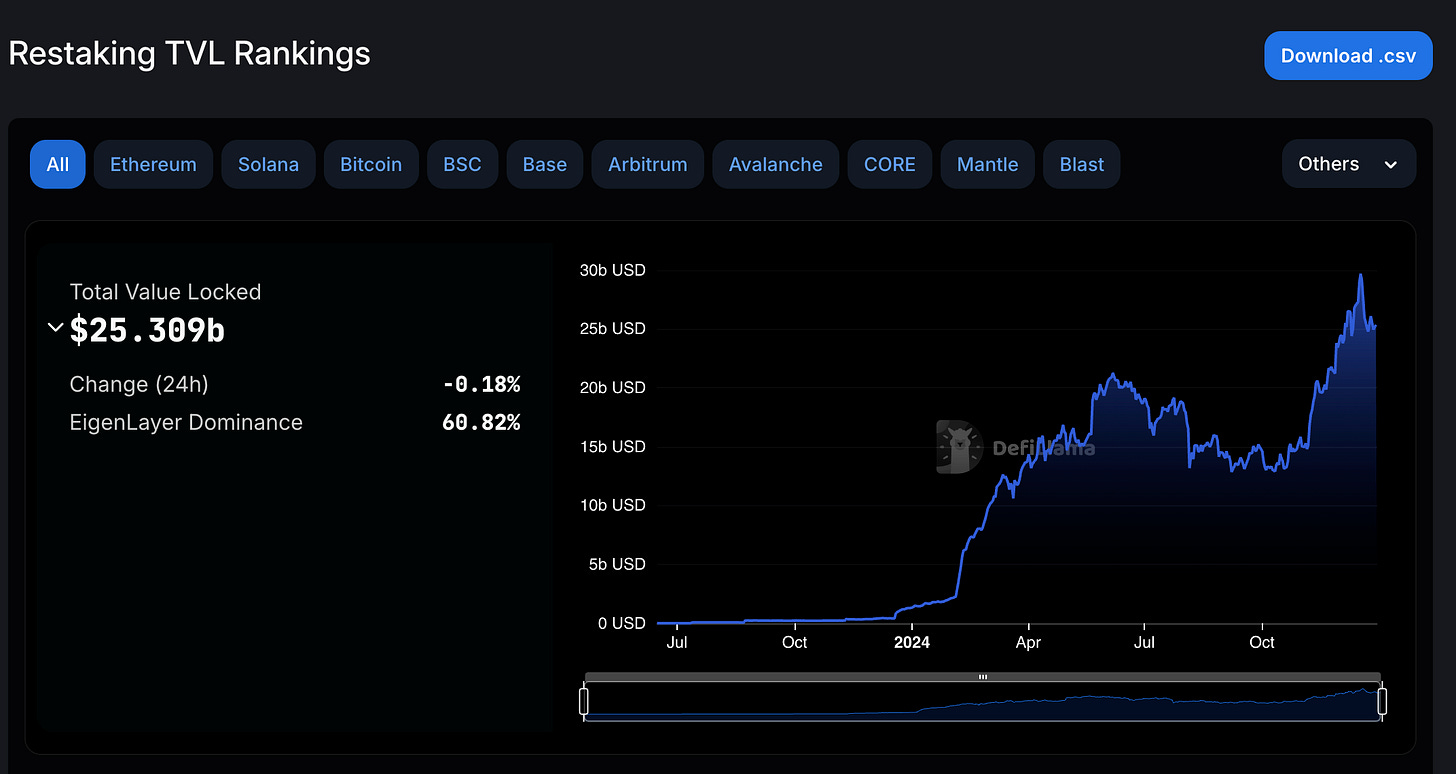

The Rise of Restaking

Restaking protocols gained massive popularity, led by EigenLayer's innovative approach.

The concept of using staked ETH as security for other protocols resonated with yield-seeking investors.

Similar protocols emerged on Solana, with Solayer and Jito Restaking gaining significant traction.

AI Integration in DeFi

Artificial intelligence made its mark on DeFi in 2024.

AI-powered trading strategies, yield optimisation, and risk management tools became commonplace.

The emergence of autonomous AI agents in trading and liquidity provision created a new category of market participants.

Read: Inside the AI Agent Revolution 🤖

In The Numbers 🔢

$200 billion

That's the total stablecoin supply as of December 2024.

While we're talking about DeFi's explosive growth, we can't ignore the quiet giant that's been steadily reshaping the landscape: stablecoins.

A testament to how far we've come from the days when crypto was synonymous with volatility.

But why does this matter for DeFi?

Because stablecoins are the bridge between DeFi's innovation and real-world adoption.

They're what make DeFi usable for everyday transactions, cross-border trade, and institutional operations.

When BlackRock deploys capital into DeFi protocols or when traders move billions between exchanges, they're not doing it with volatile cryptocurrencies — they're using stablecoins.

Visa's recent announcement about stablecoin-linked cards for 2025 signals something even bigger: the mainstreaming of DeFi infrastructure.

We're moving from a world where stablecoins were crypto's internal payment rails to one where they're becoming part of the global financial plumbing.

Trade Anytime, Anywhere with KuCoin

KuCoin is your safe and trusted crypto exchange, and new users can get up to 10,800 USDT in rewards (not for US users) 👇

🎙 Block That Quote

Coinbase’s 2025 outlook

"Stablecoins are just getting started.”

What we've seen so far is just the tip of the iceberg.

When you look at global remittance flows, international trade, and daily transactions, stablecoins are positioned to revolutionise how money moves.

The Coinbase report went even bolder, projecting stablecoins could expand 15x in the next 5 years from current levels. Not to $300 billion.

Not even $1 trillion. Try $3 trillion.

A Last-Minute Rule Drop

Welcome to 2025's first crisis. It arrived a few days early.

While most of crypto was celebrating a banner year, the IRS had one final surprise up its sleeve.

On December 27, just when everyone thought they could coast into 2025, the agency dropped a bombshell. DeFi front-ends are now brokers. Full stop.

For an industry built on the promise of decentralisation, this was an existential challenge.

The IRS's message was clear: if you're facilitating crypto transactions through a front-end interface, you're now in the same category as Coinbase and Binance.

"The outgoing administration is not leaving quietly," noted Consensys lawyer Bill Hughes, pointing out the deliberate release during the holiday lull.

But if the IRS thought the timing would dampen the industry's response, they badly miscalculated.

Within hours, the crypto industry mounted what might be its most unified response yet. The Texas Blockchain Council, Blockchain Association, and DeFi Education Fund didn't wait for the new year — they filed a joint lawsuit the same day.

"Unlawful and unconstitutional overreach," they said.

They weren't alone. Uniswap's chief legal officer, Katherine Minarik said the rule "absolutely should be challenged."

The sentiment was echoed across the industry, with Variant's Jake Chervinsky calling it "the dying gasp of the anti-crypto army on its way out of power."

Galaxy Digital's Alex Thorn, laid out the three stark choices now facing DeFi protocols: comply with the rules and become regulated brokers, block US users entirely, or strip down to bare-bones functionality — no upgrades, no fees, no revenue.

The stakes are enormous.

The IRS estimates these rules will affect up to 875 DeFi brokers and 2.6 million taxpayers when they take effect in 2027.

The real impact might be felt much sooner, as protocols scramble to adapt their strategies for a potentially more regulated future.

The Stakes for 2025

So what's next for DeFi?

This isn't your 2021 DeFi summer. Lending protocols aren't just hitting all-time highs in TVL; they're doing it with real yields backed by real assets.

Decentralised exchanges are capturing an unprecedented share of global trading volume from their centralised counterparts, suggesting a fundamental shift in how crypto trades.

Bitcoin DeFi's Emergence

With Bitcoin surpassing $100,000 and new staking protocols emerging, the original cryptocurrency is finally becoming a legitimate DeFi player.

Bitcoin's Layer 2 ecosystem is expanding rapidly, with protocols like Babylon and CoreChain paying stakers to secure their networks.

Already, Bitcoin TVL has shot up from $300 million to $6 billion in a year.

Some industry executives, including Bitwise's head of research Matt Hougan, even predict the emergence of Bitcoin staking ETFs, at least in Europe.

The RWA Revolution

Real-world asset tokenisation isn't just growing — it's exploding. According to RWA.xyz, tokenised real-world assets already command about $14 billion in TVL.

The AI Wild Card

One of the most intriguing developments in the landscape is the fusion of artificial intelligence with DeFi.

In 2024, tokens linked to agentic AIs — machines pursuing complex goals autonomously — collectively bootstrapped nearly $12 billion in market cap.

The potential applications are mind-boggling.

From AI-driven yield optimisation to autonomous trading agents, the combination of DeFi and AI could create entirely new financial primitives we haven't even imagined yet.

Novel Experiences, Novel Growth

Innovation isn't just happening in traditional DeFi verticals.

New applications like decentralised physical infrastructure (DePIN) and prediction markets are leveraging DeFi primitives in ways previously unimagined.

They are attracting users who might never have considered themselves "crypto natives."

The Trump Effect

Nothing signals DeFi's mainstreaming quite like its entanglement with presidential politics.

Donald Trump's reelection and his family's involvement in DeFi projects has set the stage for what could be a significant regulatory shift in 2025.

The implications are massive. Under a Trump administration, experts predict a more favourable regulatory environment for crypto and DeFi.

The Regulatory Renaissance

As jurisdictions worldwide roll out clearer guidelines, we're seeing something unexpected: regulation isn't killing DeFi — it's helping it thrive.

More secure, transparent platforms are emerging, making DeFi palatable to a much broader audience.

Token Dispatch View 🔍

From $36 billion to $122 billion in TVL.

From experimental protocols to institutional infrastructure. From crypto enthusiasts to Wall Street giants. DeFi's journey has been remarkable, but 2025 will be its defining year.

Three challenges will shape its future.

The Regulatory Gauntlet: The IRS broker rules aren't just about reporting requirements — they're the first major test of DeFi's adaptability. How protocols respond will set the template for years of regulatory engagement to come.

The Soul of DeFi: As BlackRock and JPMorgan dive deeper into DeFi, a crucial question emerges: Can the industry embrace Wall Street's trillions without sacrificing its decentralised soul? The answer will determine whether DeFi remains revolutionary or becomes just another fintech innovation.

The Integration Challenge: Bitcoin DeFi, real-world assets, AI agents — 2025's innovations are exciting but potentially fragmenting. The industry must ensure these new tools enhance rather than divide the ecosystem. True interoperability isn't optional anymore — it's survival.

As the industry increasingly resembles the system it sought to replace (albeit with better technology), can it maintain its revolutionary spirit?

2025 won't just be another year in DeFi's evolution.

It's the year we'll learn whether DeFi becomes the future of finance, or just another feature in traditional finance's toolkit.

The stage is set. The stakes are clear.

Finance's great disruption is about to enter its most fascinating chapter yet.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us ... either ways do tell us✌️

So long. OKAY? ✋