$20T by 2023 👀

Crypto and AI could add $20T to global GDP by 2030, Bitwise. CPI down. Fed keeps status-quo. Bitcoin hodlers dilemma. Ethereum is "digital oil", Chinese Bank ICBC. Terraform Labs to pay $4.5B penalty.

Hello, y'all … What’s it all mean 🎶

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

Crypto and AI could be a match made in heaven.

We not saying it? Bitwise is.

One of the largest crypto asset management company in America, with over $2.5 billion in assets under management (AUM).

Prediction? $20 trillion boost to global GDP by 2030.

Juan Leon, Senior Crypto Research Analyst at Bitwise

“The intersection of AI and crypto is going to be even bigger than people imagine. The race for AI supremacy is creating an unprecedented shortage of data centres, AI chips, and access to electricity.

The world’s four largest cloud companies (Amazon, Google, Meta, Microsoft) are expected to spend almost $200 billion on data centre build-outs in 2025 alone, largely to service increasing AI demand.”

Read: Crypto and AI: A $20 Trillion Megatrend?

Why the optimism?

Bitcoin miners and AI's Power Crunch: Miners specialised hardware and access to cheap electricity – just what AI needs. Win-win situation. Miners diversify their business and AI gets the resources it craves.

Read: Bitcoin Miners For AI Help? 🆘

Blockchain against AI mischief: Fake content and manipulation ("deepfakes") exists. Blockchain’s transparency and immutability, could help verify the authenticity of AI-generated content. Flags doctored content, or ensure ai operates within trusted parameters.

Companies are exploring these intersections

CoreWeave + Core Scientific: AI cloud provider acquired a bitcoin miner Core Scientific's for $3.5 billion deal to host CoreWeave's AI services.

Attestiv: Startup uses blockchain to create "fingerprints" for videos, making it easier to identify manipulated content.

Hosting services: Miners like Hut 8 and Iris Energy are jumping on the AI bandwagon with their own hosting initiatives.

Token Dispatch view: The valuations and projections for crypto and AI at times sound unrealistic. That is true.

A lot of optimism is riding on the success of Bitcoin’s $1.3T and Nvidia’s $3T market cap. Will it grow at the pace it has in the last few years? Nobody knows.

Industry is in the early stages. A lot has to be in sync and symphony for such growth in the light of geo-political and brittle global economic dynamics.

Yesterday was a big day?

June Rollercoaster 🎢 … did you guys read?

So what came out of the Fed meeting?

Not much, by the look of it.

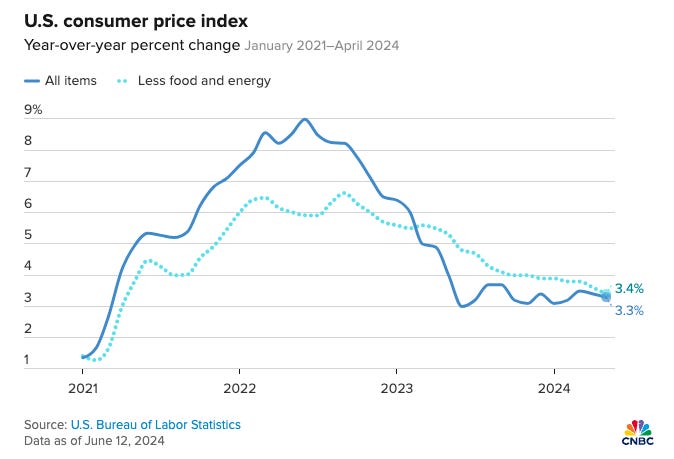

Inflation is showing signs of cooling.

But housing remain a concern.

Good News: CPI inflation dipped to 3.3% annually, down from 3.4% in April.

Status-quo: Interest rates steady at 5.25% - 5.50%.

Building hope: Fed acknowledges progress towards their 2% inflation target but remains cautious.

Reality check: Statements suggest one rate cut this year, down from earlier projections of three.

Bitcoin hodlers dilemma

We fear inflation, yet bitcoin often rises when inflation fears dip (like yesterday).

Bitcoin hedges against inflation theory? Rising money printing = higher bitcoin prices.

The opposite has happened so far.

Maybe Bitcoin isn't an inflation hedge.

So then? Hedge against crazy government spending perhaps.

A recent study suggests the US could stabilise its debt by simply reducing the deficit by 2.1% of GDP annually for 30 years.

Not impossible, right?

Read: Dollar doomers may have a surprisingly long wait - Byron Gilliam, Blockworks

Block That Quote 🎙️

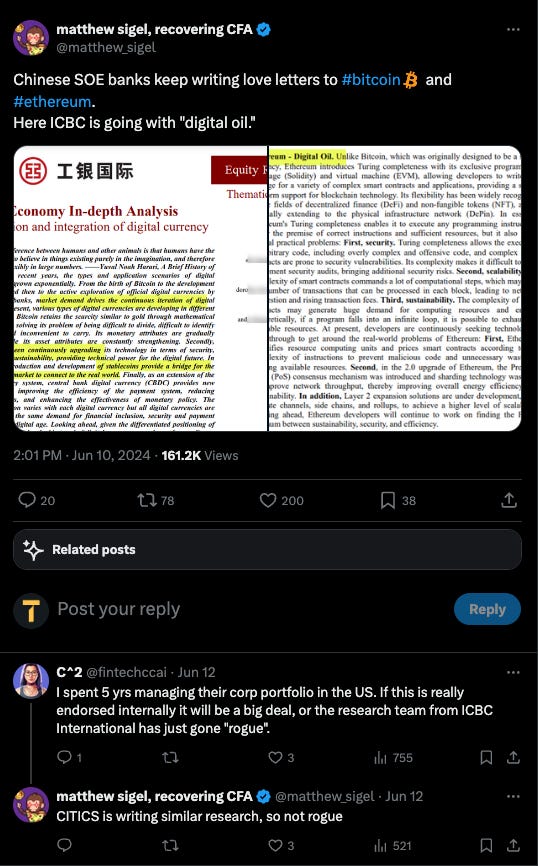

China's Industrial and Commercial Bank of China.

“Ethereum - Digital Oil”

ICBC, the world's largest lender, has green-flagged Ethereum’s future.

Why does it matter? Crypto is banned in mainland China. ICBC's stance matters.

Damn. What does that mean?

Clear way for wider crypto adoption in the region.

Endorsement recognises the importance and future potential.

In China, President Xi Jinping sent an open letter of praise to Andrew Chi-Chih Yao, chief scientist of the Conflux network and a professor at Tsinghua University.

Conflux? Layer-1 blockchain operating on a hybrid proof-of-work and proof-of-stake consensus operated by the Conflux Foundation, also known as the Shanghai Tree-Graph Blockchain Research Institute.

What else about the report?

Highlights Ethereum’s continuous advancements in security, scalability, and sustainability.

Ether's unique programmability through Solidity and the Ethereum Virtual Machine (EVM).

Positions it as a technological powerhouse for the digital future.

Who else called ETH as “digital oil”? VanEck.

Terrafrom Labs Gets $4.5 Billion SEC Ticket

Agreed to pay to resolve a dispute with the US Securities and Exchange Commission (SEC), court filing.

Terraform Labs. TerraUSD. Luna. Do Kwon.

Remember?

Tell me more.

$3.58 billion in disgorgement, essentially returning funds to investors.

$460 million in prejudgment interest

An additional $420 as a civil penalty.

Co-founder Do Kwon faces personal penalties of $204 million.

State of Kwon?

Facing criminal charges in the US.

Embroiled in an extradition battle between the US and South Korea.

Will be barred from serving as an officer or director of any public company.

So what? A precedent for future cases involving potentially unregistered securities.

Circa 2022. $19 billion market cap algorithmic stablecoin TerraUSD lost its peg to the dollar.

In a matter of days, it was all down to nothing. Along with its governance token LUNA.

SEC charges? Terraform and Do Kwon misled investors about the stability of the coin = losing billions of dollars.

In The Numbers 🔢

$19 Billion

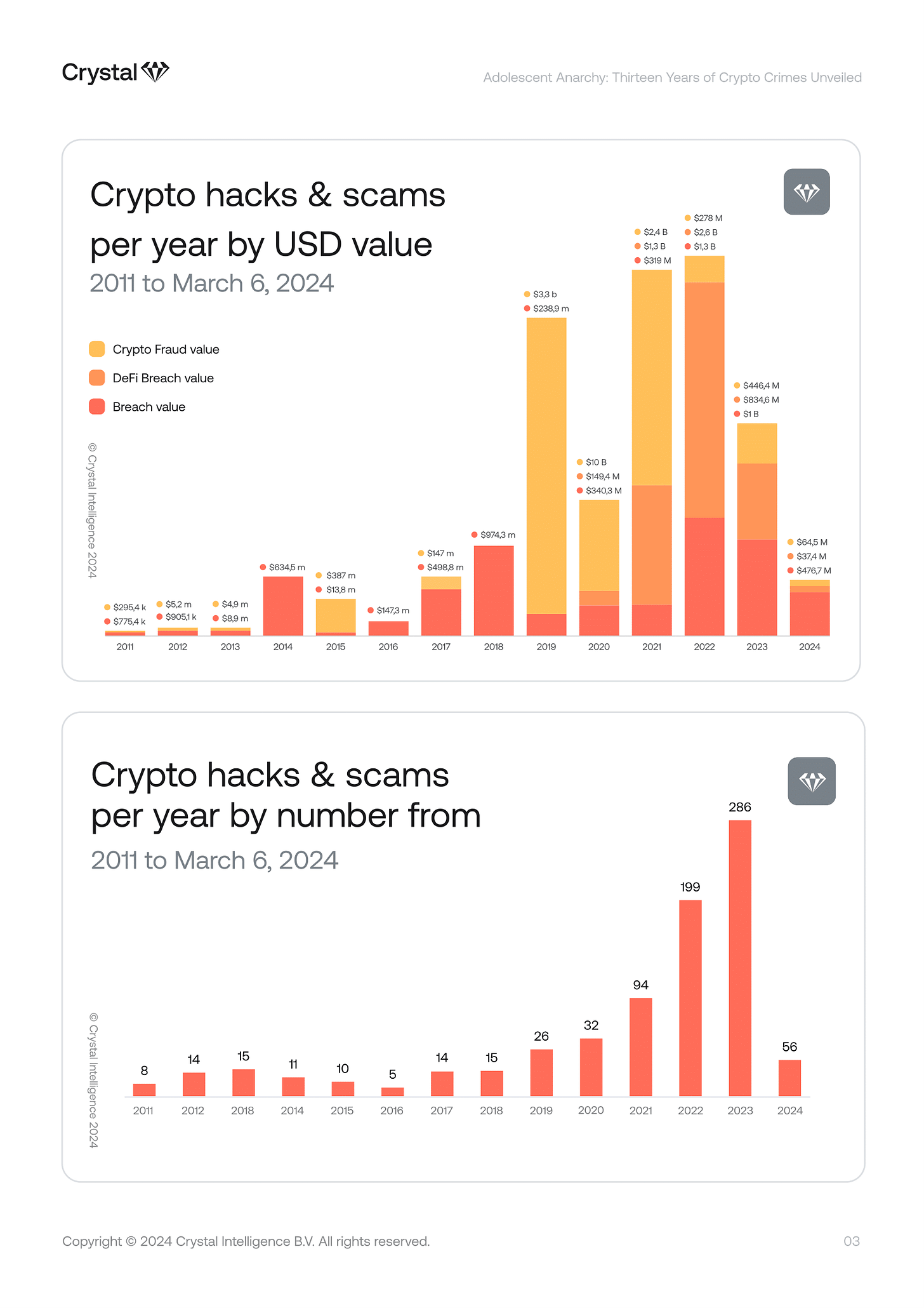

Lost to crypto hacks and exploits in 13 years.

Biggest single theft: $2.9 billion in the 2019 PlusToken fraud.

Most hacks in a year: 2023 (286 hacks).

Year with biggest losses: 2022 ($4.2 billion stolen).

DeFi hacks: Over $835 million stolen in 2023, but smaller and more frequent than security breaches.

2024 outlook: On track to potentially surpass 2023's losses ($542.7 million stolen in Q1 alone).

Concerning trend: Illegal activity on the blockchain is on the rise.

Q1 of 2024 already saw a 42% increase in stolen funds compared to the same period in 2023.

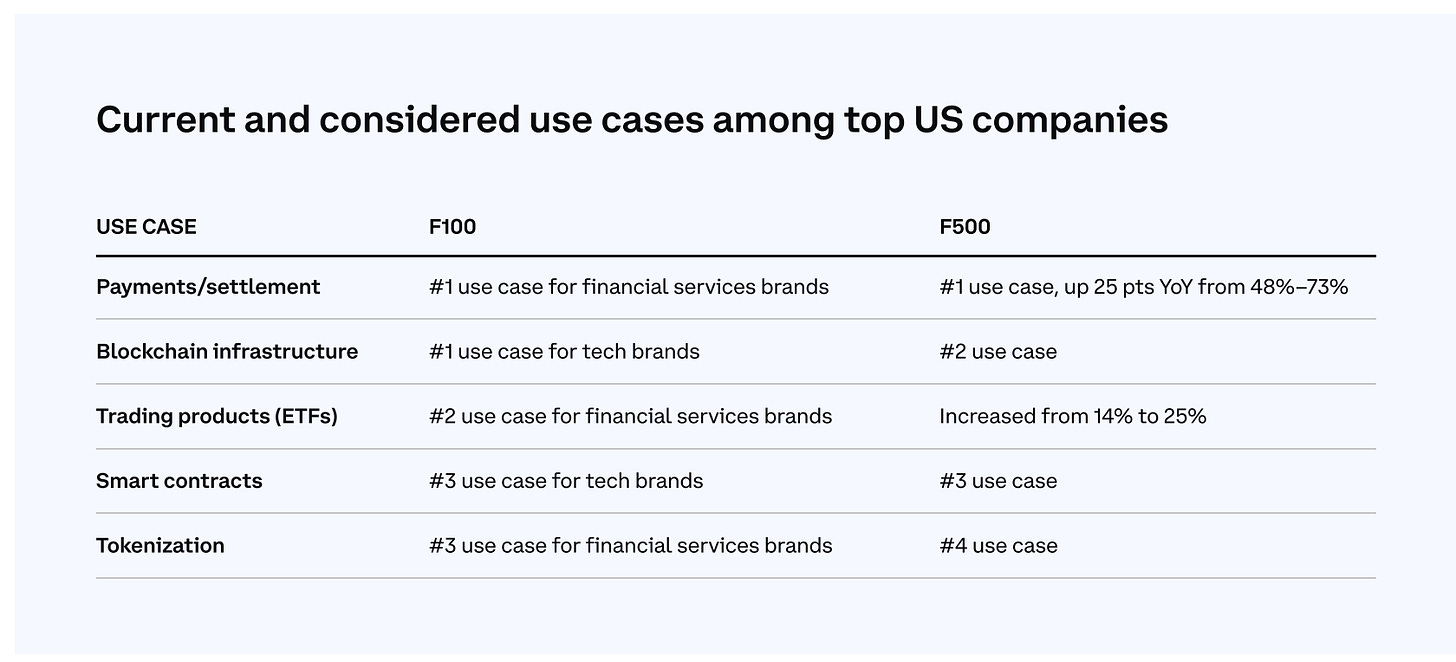

Fortune 100 Companies + Web3 ⬆️

They are undertaking more web3 initiatives. 39% jump from previous year.

Says who? Coinbase.

Read: The State of Crypto - The Fortune 500 Moving Onchain

Growing web3 sectors

Spot Bitcoin Exchange-Traded Funds (ETFs)

Real-world asset tokenisation

Stablecoins

The study also says

56% of Fortune 500 executives are developing blockchain-based projects.

Only 26% of crypto developers are now based in the US.

On-chain initiatives announced by the F100 have increased 39% YoY.

US concern: Need for clear regulation for digital assets

"It’s imperative that the US cultivate increasingly needed talent rather than continuing to lose it overseas … The increased activity increases the urgency for clear rules for crypto that help keep crypto developers and other talent in the US, fulfil its promise of better access, and enable US leadership on crypto globally."

The Surfer 🏄

President Biden's re-election team is in talks to accept crypto donations through Coinbase Commerce. This move comes after Donald Trump began accepting crypto donations through the same platform.

Taiwan has formed a crypto industry association as a major step towards self-regulation in the crypto sector. 24 crypto firms, registered with the Financial Supervisory Commission for anti-money laundering compliance, have joined the association.

Turkish Lira's crypto volume market share reaches all-time high. TRY becomes the third largest fiat currency by volume in the crypto market. High inflation and currency devaluation in Turkey drive crypto adoption.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋