$2B Silk Road Bitcoin 🏃♀️

US moves the seized BTC after Trump’s stockpile pledge. Still holds 200k+. SEC’s u-turn on crypto tokens as securities. China not interested in crypto? WazirX's PR disaster after the treasury hack.

Hello, y'all. If you will, play the 👉 Music Nerd quiz game 🎵

… tell us what you score, okay?

Donald Trump made so many promises at the Bitcoin Conference 2024.

Read: Hello Bitcoiners 👋

One of them was pledging to hold onto seized Bitcoin.

Then what happened?

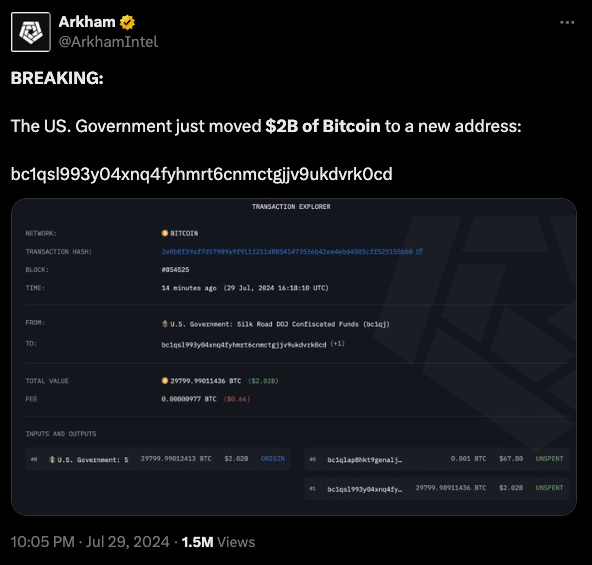

The US government transferred $2 billion worth of Bitcoin.

The BTC is linked to the infamous Silk Road.

Bitcoin reacted.

Price plummeted by over 4.5%, after touching $70K briefly.

And liquidations

Why? Investors were understandably rattled, fearing a potential government sell-off.

But it might not be a sell-off move after all.

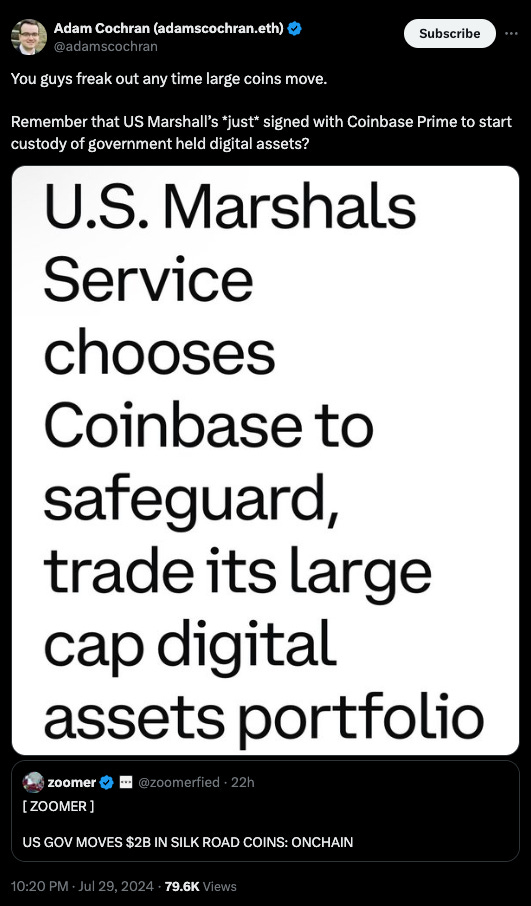

Coinbase Prime has been contracted by the US Marshals Service to manage and dispose of large-cap cryptocurrencies.

Cochran got a point.

Last month, the German government was moving Bitcoin, and the price reacted in a similar or worse way.

Read: Fire Sale 📉

Silk Road Background

Launched in 2011 as an online marketplace for illegal goods and services.

Primarily used Bitcoin for anonymous transactions.

Operated on the Tor network to conceal user identities.

Shut down by the FBI in 2013, resulting in the seizure of over 144,000 Bitcoins.

That’s Ross Ulbricht, sentenced for life. Donald Trump has promised to commute Ulbricht's sentence on his first day in office.

Major seizures by US

Silk Road seizure (November 2020):

Over 69,000 Bitcoins seized from a Silk Road-linked account.

Funds declared as criminal proceeds.

James Zhong's case (November 2021):

50,676 Bitcoins seized from James Zhong, a Silk Road thief.

Approximately $3.36 billion in value at the time.

Zhong exploited a Silk Road flaw to steal Bitcoins.

This isn't the first time the government has dealt with this crypto treasure chest.

They've been battling it out in court for years to claim ownership of the Bitcoin.

Last year, they scored a major victory when a court officially handed over the keys to this digital fortune.

A US appeals court finalised a mandate that formalised the forfeiture of 69,370 of bitcoin and other crypto connected to Silk Road.

Bitcoin as a National Treasure?

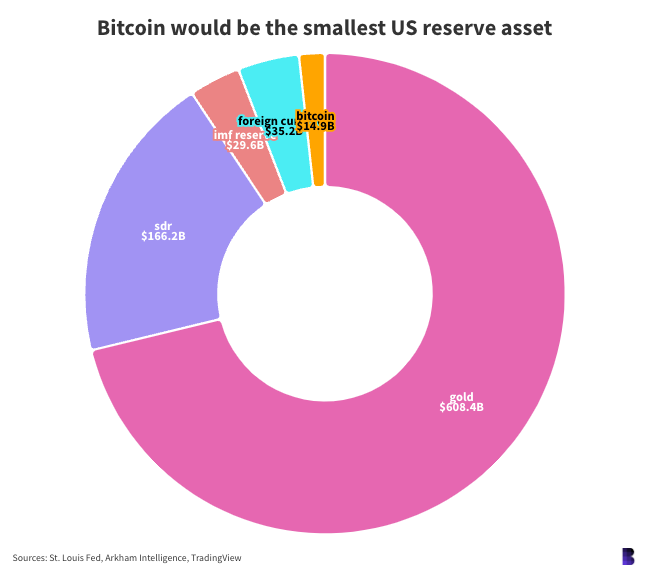

US currently holds 200k+ BTC (over $14 billion).

All seized.

Senator Cynthia Lummis has thrown a wrench into the finance world by proposing a massive government purchase of the cryptocurrency.

“It can be used for one purpose, to reduce our debt.”

What if? If this ambitious plan goes through, Bitcoin could become the fifth pillar of the US reserve, joining the ranks of gold, SDRs, foreign currencies, and oil.

While the current Bitcoin holdings from seized assets are a drop in the ocean compared to the overall reserve, Lummis' proposal would catapult Bitcoin into a major player.

It would be the third-largest reserve asset, surpassing foreign currency and IMF reserves.

Hindsight is 20/20

Looking back five years, had the US started buying Bitcoin monthly as per Lummis' plan, the Treasury would be sitting on a goldmine.

The initial investment of $31.4 billion would have ballooned to $69.44 billion. That's a return of over 120%.

Read: What would a strategic bitcoin reserve look like?

In The Numbers 🔢

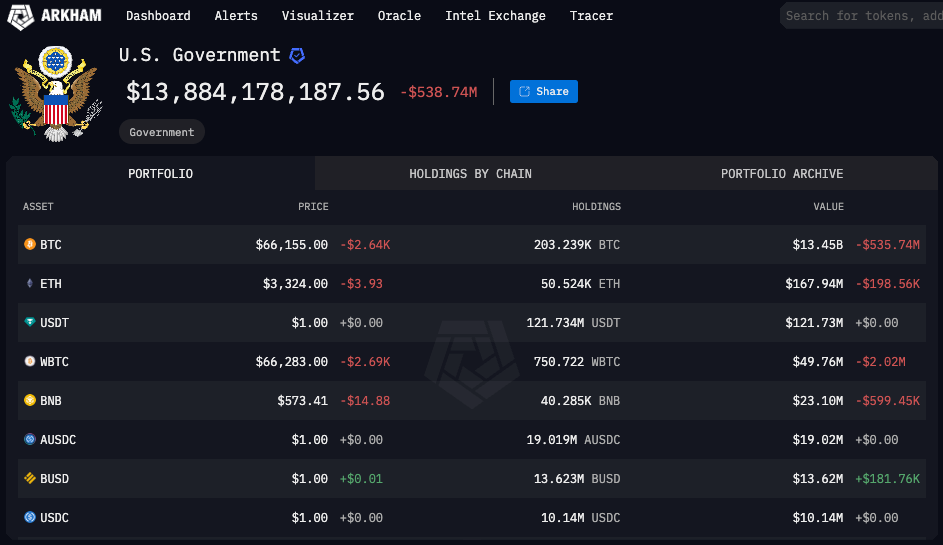

$13.8 billion

That’s the value of Bitcoin the US government is said to hold.

According to blockchain sleuths at Arkham Intelligence, the US government indeed owns a chunk of Bitcoin, Ethereum, and other popular cryptos.

We're talking over 200k+ Bitcoins, which at current prices, would make the US one of the biggest crypto whales on the planet.

Block That Quote 🎙️

American economist, Peter Schiff

“China is happy to let the US waste its resources on Bitcoin while it focuses on manufacturing goods people need.”

Schiff, a long-time Bitcoin critic, argues China isn't interested in the cryptocurrency because they've already banned mining within their borders.

The context? Donald Trump again.

He said at the Bitcoin 2024 convention in Nashville, Tennessee.

“If we don’t embrace crypto and Bitcoin technology, China will, other countries will. They’ll dominate, and we cannot let China dominate. They are making too much progress as it is.”

While China cracked down on mining, it hasn't completely shut down crypto.

Trading tokens and using overseas accounts to buy digital assets are still options for Chinese citizens.

Historically, China was a major player, hosting up to 75% of the world’s Bitcoin mining.

Read: Chinese Checkers 🧲

SEC’s U-turn on Crypto Tokens

The US Securities and Exchange Commission (SEC) is no longer demanding that a judge label Solana, Cardano, Polygon, and a bunch of other tokens as securities.

The SEC's primary focus remains on its lawsuit against Binance, alleging the exchange offered unregistered securities.

Token list: The tokens initially labeled as securities by the SEC in the Binance case included BNB, BUSD, Solana, Cardano, Polygon, Cosmos, The Sandbox, Decentraland, Axie Infinity, and Coti.

This decision comes after the SEC labeled over 68 tokens as securities in June 2023.

High stakes for both sides

SEC: A win could solidify the SEC's position as the primary regulator of the crypto industry, giving them significant power over how cryptocurrencies are traded and invested in. However, a loss could undermine their authority and potentially lead to a more fragmented regulatory landscape.

Binance: A victory would be a major win for the crypto industry, establishing a precedent that cryptocurrencies are not securities and should be regulated differently. But a loss could have severe consequences, including hefty fines and restrictions on Binance's operations.

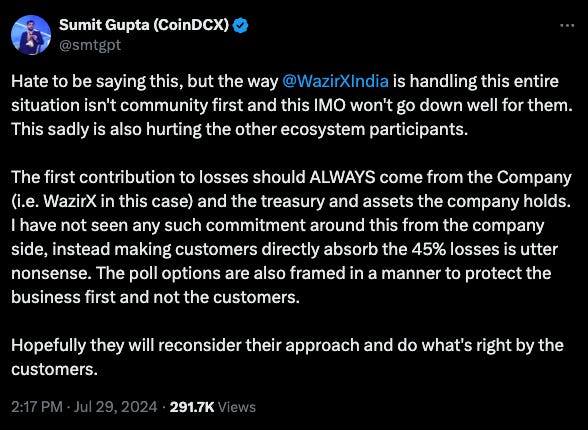

WazirX is Facing a Major PR Disaster

The Indian crypto exchange was hit with a $230 million hack in July, and its proposed solution to cover the losses – a "socialised loss strategy" – has sparked outrage among users and the broader crypto community.

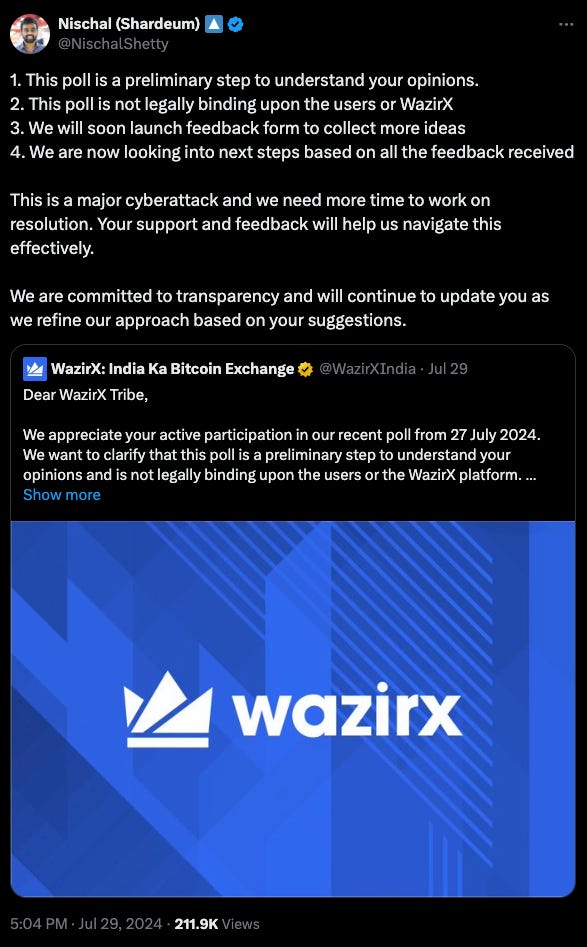

A controversial poll

WazirX suggested two options: Users could either accept a 55% loss on their funds immediately or wait for potential recovery efforts with priority access to recovered funds.

Critics argued that users who had nothing to do with the hack should not bear the brunt of the consequences.

WazirX has since backtracked on the poll, calling it a "preliminary step" and promising to gather more feedback.

But the damage is done.

The Surfer 🏄

Kamala Harris is reportedly considering Michigan Senator Gary Peters as a potential running mate for the 2024 election. Labor unions are pushing for Peters' inclusion to strengthen the Harris ticket in battleground Michigan.

Slovenia has become the first EU nation to issue a sovereign digital bond, valued at 30 million euros ($32.5 million). The bond features a 3.65% coupon and will mature on November 25, 2023.

Coinbase UK fined $4.5 million for breaching a voluntary agreement on high-risk customer onboarding. CB Payments Limited (part of Coinbase Group) allegedly onboarded 13,416 customers deemed high-risk by the FCA.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋