Today’s edition is brought to you by Muzify. A platform to unlock your music fandom through quizzes, stats and a lot of fun tools. Can you guess the track in 5 seconds 🫵

A historic Thursday for Bitcoiners - We've finally hit the magical six figures 🎉

Bitcoin's genesis block was mined on January 3, 2009.

Today's issue is all about celebration.

Pour that coffee, grab those party hats, and maybe even pop some early morning champagne.

We're breaking down the 10 biggest reasons why December 5, 2024, will be remembered as the day Bitcoin proved everyone wrong.

For everyone who HODL'd through the storms, stacked through the dips, and believed when others doubted - this one's for you.

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 175,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

5,815 days.

15 years.

873,279 blocks.

21 million dreams.

And finally ... $100,000.

Remember when they called it a scam?

Remember when they said it would go to zero?

Remember when $100K was just a meme?

How the tables have turned …

Today isn't just about a price milestone.

It's about validation.

From the cypherpunks who started it all, to the Wall Street suits who finally got it, to every pizza buyer who has a story that starts with "I once spent Bitcoin on..."

This one's for you.

Read: Bitcoin: Inches Away From History 💯

Before we dive into the celebration list, let's appreciate what this means.

Satoshi's untouched stash of 1.1 million BTC is now worth $100 billion.

Those famous two pizzas that cost 10,000 BTC? That's now a billion-dollar dinner.

Here are 10 things making today Bitcoin's biggest party ever.

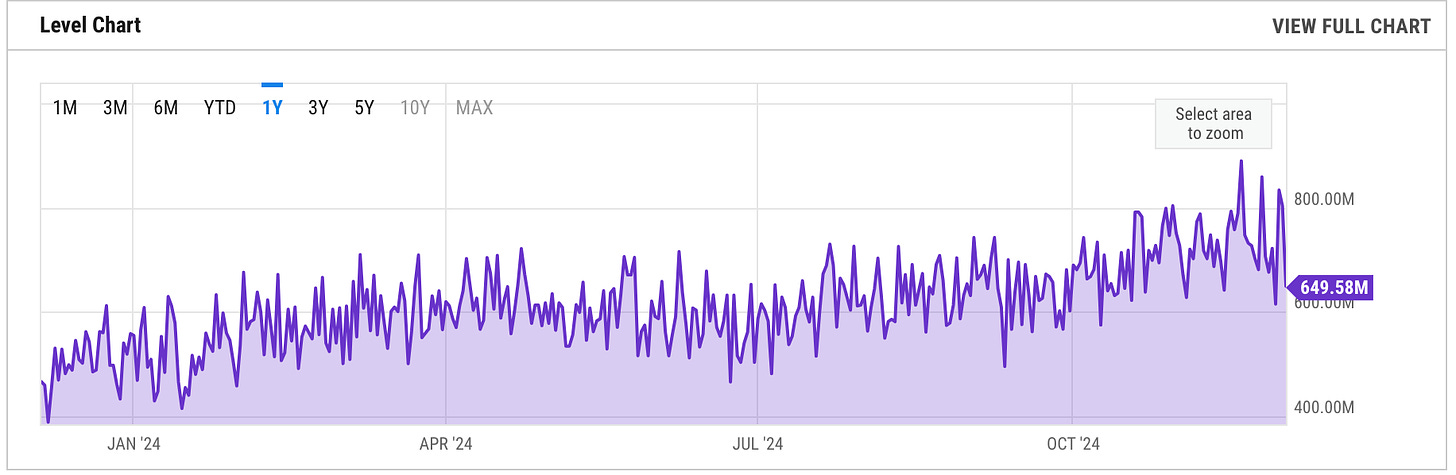

1. This Particular Graph

💯

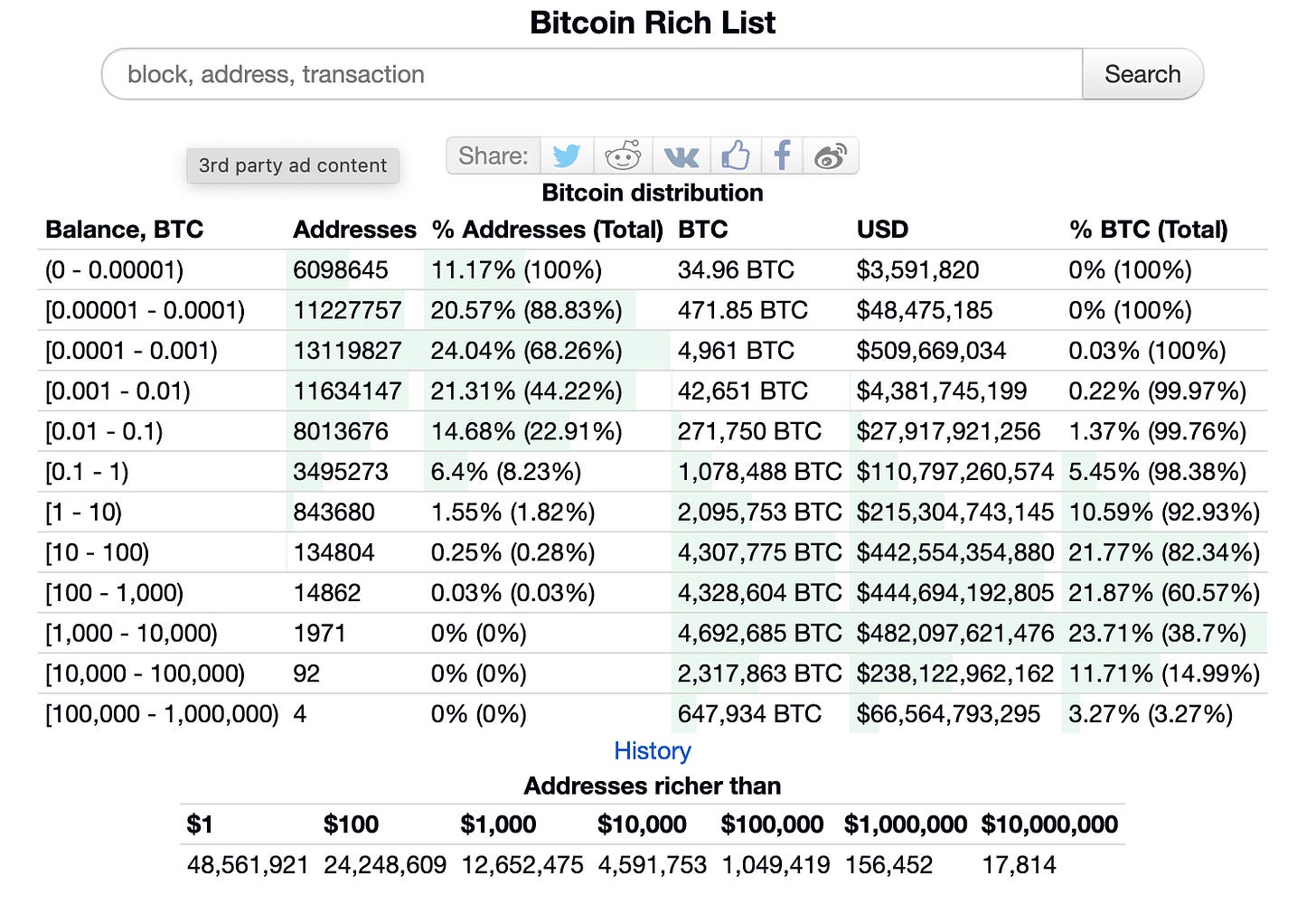

2. The Whale Watch

Just 4 wallets control over 647,934 BTC ($65B)

48.5M addresses hold more than $1

14,813 addresses hold 100-1,000 BTC

Only 1,970 addresses hold 1,000-10,000 BTC Worth celebrating: Bitcoin's wealth distribution shows significant institutional holdings while maintaining broad retail participation.

At $100K per BTC, we're looking at a new generation of crypto millionaires.

3. SEC's New Chapter

Gary Gensler, crypto's biggest critic, announced he's leaving on January 20.

And we have a crypto-friendly successor.

Trump's pick? Paul Atkins, a former SEC commissioner who believes in "the promise of robust, innovative capital markets."

Remember Atkins? He's the guy who called Gensler's approach "disingenuous" and led industry efforts to develop best practices for digital assets. The crypto winter's biggest roadblock is finally clearing.

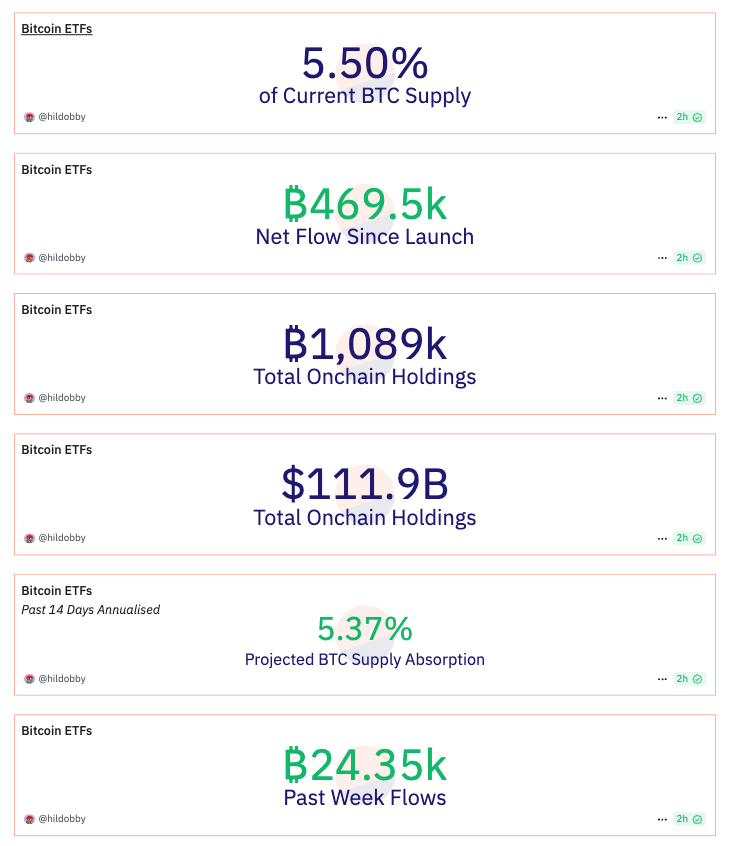

4. ETF Tsunami

Wall Street's Bitcoin ETFs are drinking up supply like there's no tomorrow.

5. Trump's Crypto Vision

The President-elect takes office January 20, bringing the most pro-crypto cabinet in history. His picks?

A Treasury Secretary who understands Bitcoin, a Commerce head who backs blockchain innovation, and an SEC chair who called crypto "a new and exciting asset class." Plus, there's serious talk about creating a national Bitcoin reserve.

America might just become the world's crypto hub.

The Home for All the Music Lovers

Muzify is a journey into the world of music. An interactive experience through quizzes, stats and a lot of fun tools.

For artists it’s a powerful tool to connect with their fans. For fans it’s building deeper connect with the artists.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

6. The Corporate Race

MicroStrategy's not alone anymore.

Their 331,200 BTC strategy that everyone called crazy? Now everyone's copying it.

Hut 8 just announced a $500M Bitcoin buy plan. Japan's Metaplanet is raising $62M for more Bitcoin. Genius Group converted 90% of their reserves. Even traditional companies are joining - Tesla's still holding strong with $750M worth.

7. Powell's Gold Paradigm

When the Fed Chair says "Bitcoin is a competitor to gold, not the dollar," you know the game has changed.

Jerome Powell's admission marks a crucial shift in central bank thinking. They're no longer dismissing Bitcoin - it's official recognition of Bitcoin as a store of value.

Powell even dismissed concerns about Bitcoin threatening the USD's dominance, effectively giving institutional investors the green light. When the Fed Chair starts comparing your asset to gold, you know times have changed.

8. Uncle Sam's Bitcoin Bet?

The unthinkable might just become reality. The United States could soon add Bitcoin to its national reserves, joining gold and foreign currencies in the nation's financial safety net.

With Donald Trump's return to the White House imminent and his pro-crypto stance well-known, the idea is gaining serious momentum. The US already holds 200,000 BTC from seizures, but Senator Cynthia Lummis wants more – much more.

Her ambitious Bitcoin Act proposes acquiring 1 million BTC over five years. Think that's bold? States like Pennsylvania aren't even waiting for federal action, already exploring their own Bitcoin investments.

9. King Bitcoin's Dominance

All that "altseason" talk last week?

Bitcoin just reminded everyone who's king. Market dominance bounced back to 57% as BTC outperformed everything else.

The network's never been stronger - hash rate hit 800 EH/s.

10. The Prophecies Turn True

While Bitcoin crossing $100K on December 5 has already fulfilled some of these predictions ahead of schedule, the broader forecasts paint an even more ambitious picture.

Remember Balaji Srinivasan's infamous $1 million Bitcoin bet in 2023? Though premature, that moonshot doesn't seem quite as crazy anymore. And today's predictions, backed by institutional analysis rather than Twitter bravado, suggest we're just getting started.

The analytical community remains bullish on Bitcoin's trajectory:

Standard Chartered sees Bitcoin pushing toward $200,000

Tim Draper and Fundstrat's Tom Lee maintain their $250,000 targets

Michael Saylor, who's been vindicated by the $100K milestone, still sees $1M as inevitable

Cathie Wood projects $650,000 by 2030, with potential upside to $1.5M

Token Dispatch View 🔍

While $100K is a psychological milestone, the real story is Bitcoin's positioning for its next phase. The combination of political support, institutional adoption, and technical strength suggests we're witnessing not just a price milestone, but a fundamental shift in Bitcoin's role in the global financial system.

What makes today special isn't just the number, but everything it represents.

A maturing asset class that institutions can no longer ignore

A regulatory landscape that's finally embracing innovation

A technology that's evolved from a cypherpunk experiment to global financial infrastructure

A community that's grown from basement miners to Wall Street traders

The $100K Bitcoin represents not an end but a beginning - the start of Bitcoin's transition from alternative asset to global financial infrastructure.

But here's the real kicker: We're still early. When your grandkids ask about the early days of Bitcoin, you'll tell them about today - when you could still buy a whole coin for "just" $100,000.

Pop the champagne, Bitcoiners. You earned this one 🍾

The Surfer 🏄

Cryptocurrency trading volume hit record high in November, exceeding $10 trillion across spot and derivatives markets on centralised exchanges, according to CCData. Driven by Trump's election win, spot trading volumes up 130% to over $3.4 trillion, while derivatives markets up 90% to almost $7 trillion.

YouTube views of crypto influencer content hit a 12-month high of 4.72 million for the week of Nov. 25, with Coin Bureau and Crypto Banter leading the surge.

Cryptocurrency founders have made a significant impact on Forbes' "30 Under 30" list for 2025 in the finance category, showcasing the growing influence of the crypto industry in the financial sector.

The CFTC achieved a record $17.1 billion in monetary relief for fiscal year 2024, primarily from cryptocurrency enforcement actions. The agency recovered $12.7 billion from the FTX case, marking the largest recovery for victims and sanctions in its history.

Circle-backed Layer 1 blockchain Xion has officially launched its mainnet, enhancing its ecosystem. Introduced a "Double or Nothing" mechanism for its initial token airdrop, allowing participants to potentially double their rewards or lose them via a spinning wheel.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us ... either ways do tell us✌️

So long. OKAY? ✋

♥️☀️☮️🌈🏁