Today’s edition is brought to you by Trezor. The hardware wallet to protect your identity and coins. Get exclusive holiday deals with 30-50% off on select products 👇

Hello, y'all. In Friday's dose of crypto predictions for the year ahead, we are looking back at how 2024 was and what 2025 holds for stablecoins.

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

As the crypto world welcomed 2025 with Do Kwon finally being extradited to the US and facing new money laundering charges, a stark reminder of why regulated stablecoins matter flashed across the industry.

Terra's collapse in 2022 might seem like ancient history, but its lessons are shaping stablecoin's next chapter. And what a chapter 2025 promises to be.

Just two days in, and the stablecoin wars are already heating up.

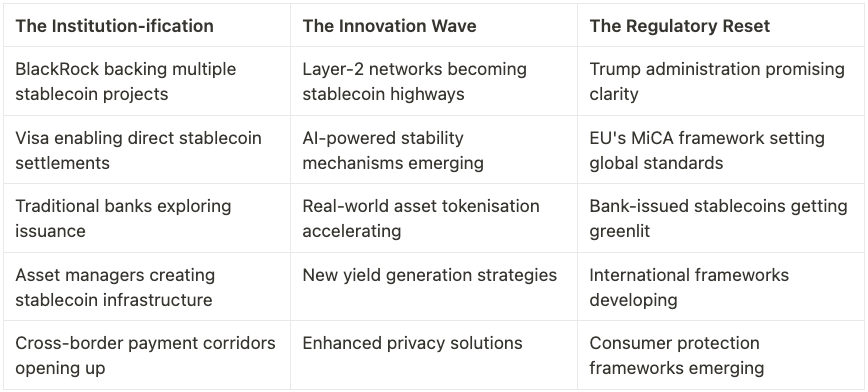

BlackRock's backing new players, Circle's doubling down on institutional partnerships, and traditional finance is no longer watching from the sidelines - they're bringing in the heavy artillery.

The 2025 Battlefield

The battle lines are being drawn differently this time. If 2022's Terra collapse taught us anything, it's that stability isn't just about algorithms - it's about trust, regulation, and real-world backing.

That's exactly where 2025's opportunities lie. Three major trends are reshaping the landscape.

What to Expect?

The Big Bold Predictions

Bitwise expects the stablecoin market cap to double to $400 billion this year.

Standard Chartered predicts a 10x growth potential. Expects stablecoins supply to shoot up to 10% of US money supply and forex transactions, from 1% today.

All this may well increase the relevance of USD, contrary to what many stablecoin critics believe - that the stablecoin demand could weaken the dollar.

Read: Stablecoins Making the USD Stronger? 🪙

Market Dominance

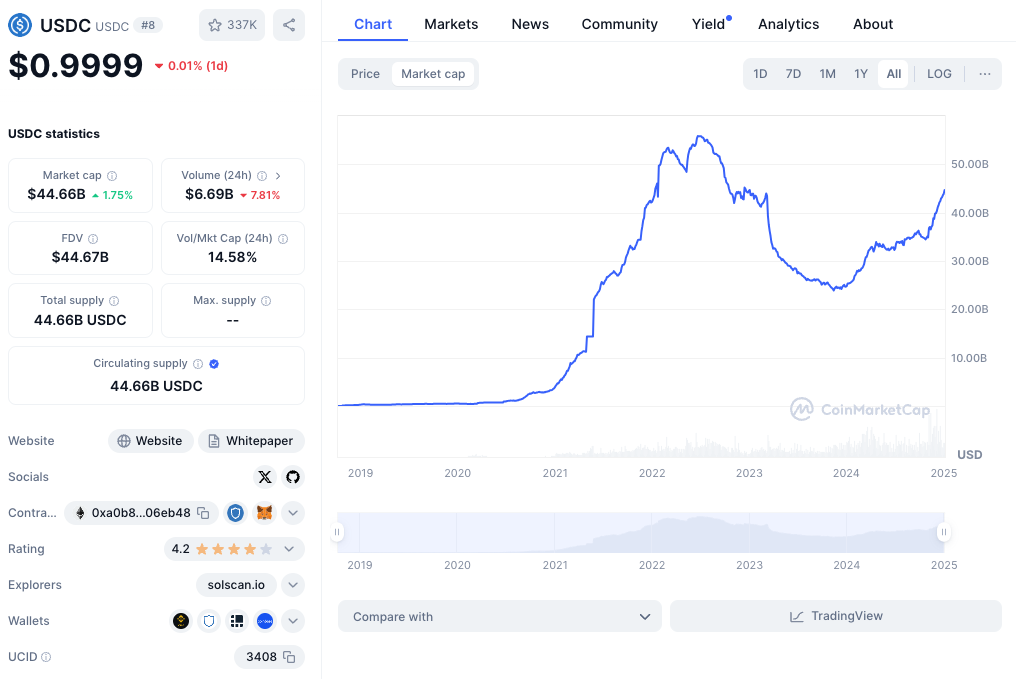

USDC is fast bridging the gap between itself and USDT.

Its market cap is about $45 billion, nearly double the 2023 low of less than $24 billion.

Wall Street giant BlackRock's also started its new year with a bang.

Their BUIDL token just got approved as backing for Frax's new frxUSD stablecoin, adding another heavyweight to the increasingly crowded ring.

This isn't just another stablecoin launch - it's traditional finance's biggest player getting cozy with DeFi darling Frax.

With BUIDL already backing Ethena's USDtb, BlackRock's clearly not picking favourites; they're betting on the whole game.

When the world's largest asset manager starts providing infrastructure for multiple stablecoin projects, it's not just participation - it's validation.

Payment Evolution

Visa's crypto chief Cuy Sheffield sees stablecoin-linked cards as the next major shift.

The numbers back this up: BitPay reports stablecoin transactions averaging $5,000, compared to Bitcoin's $1,000. This isn't just about trading anymore - it's about practical utility.

"If 2024 was the year stablecoin demand picked back up, 2025 will introduce the next pivotal opportunity: the rise of stablecoin-linked cards." - Sheffield.

Infrastructure Shifts

BitPay's Chief Market Officer expects L2 networks like Arbitrum, Optimism, and Base to become major stablecoin highways.

Lower fees, faster transactions, same dollar stability. This suggests a shift in how these assets move and scale.

Meanwhile, interoperability is becoming less of a buzzword and more of a necessity.

Yield Dynamics

The market is seeing a surge in yield-generating solutions, with PayPal USD leading the charge.

As the demand increases for stablecoins, 2025 might also bring in what True Markets founder Vishal Gupta calls "exotic" stablecoins that will offer higher yields, but with higher risks.

Regulatory Landscape

With Trump heading back to the White House and Gary Gensler out at US SEC, regulatory clarity might finally arrive for traditional banks to enter the space.

Yet, Tether will start its 2025 with a head start from a regulatory perspective.

It will have influential allies in the White House — Howard Lutnick, a top fundraiser for the President-elect. The picture remains fragmented.

While the EU moves forward with MiCA, global consistency remains elusive.

This divergence could create both opportunities and challenges, particularly in regions with clear regulatory frameworks.

Crypto Security Made Easy

Trezor has transformed crypto security from a complex puzzle to a user-friendly playground, so you can be the boss of your financial future? 🫵

Why $300 Billion? Well, Why Not? 💰

The thing about that $300 billion target everyone's talking about - it's actually not that wild if you look at how things are playing out.

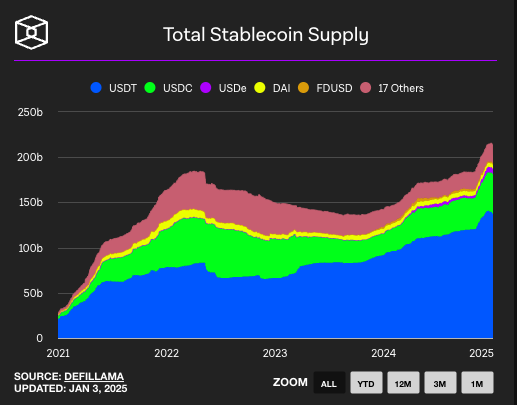

Last year saw stablecoins go mainstream with the industry crossing $200 billion in market cap, up 50% from where it started the year.

Tether's already crossed $137 billion. USDC's bouncing back strong at $45 billion. BlackRock's putting its weight behind multiple stablecoin projects. Circle's teaming up with Binance. And we're just getting started.

The way 2025's kicking off - with BlackRock's BUIDL token backing Frax's new stablecoin just two days in - suggests confidence isn't lacking.

Traditional finance isn't asking "if" anymore; they're asking "when."

Stablecoins are moving $5.6 trillion in payments. That’s more than 40% of what digital payment giant Visa processed in 12 months ending September 2024 - $13.2 trillion.

The average transaction is five times bigger than Bitcoin's, you start to see why $300 billion isn't just hopium - it's math.

Sure, there are "ifs." If regulations stay friendly under Donald Trump.

If the institutional momentum keeps up. If the real-world adoption continues growing. But for once in crypto, these "ifs" feel less like dreams and more like checkboxes being ticked off.

And when Standard Chartered throws out numbers like stablecoins capturing 10% of US money supply?

Well, suddenly $300 billion starts looking like a pitstop, not the destination.

How did the industry get there?

Stablecoins stopped being crypto's training wheels and became its engine.

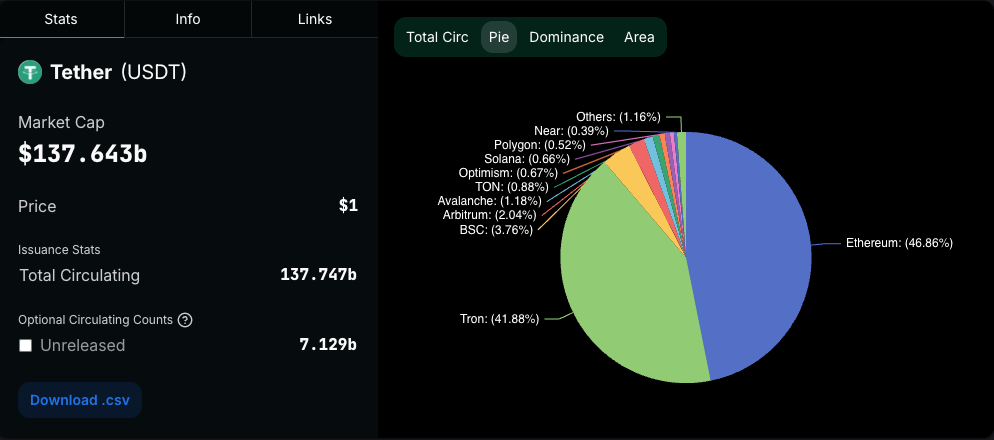

Drivers? One dominant player - Tether.

Read: Stablecoin That Conquered Crypto 👑

The USDT issuer has been busy with its printers going brrr minting billions.

Tether’s circulating USDT shot up to $137 billion at the end of 2024, from $92 billion at the start of the year.

Paolo Ardoino's team didn't just maintain their lead throughout the year but they flexed it into something unprecedented.

By December, Tether was holding more US Treasury bills than entire nations, making traditionalists nervous and critics eat their words.

Stiffening Competition

Tether’s still dominating the stablecoin pie, sure. But numbers only tell a partial story of stablecoin industry’s 2024 journey.

Just when it looked like Tether was closing the year with an unassailable lead, the fight got interesting.

Competitors tightened their game. Not one, not two. Multiple developments.

Ripple, fresh from its SEC victory dance, dropped RLUSD into the mix.

The same folks who spent years fighting regulators were now joining the stablecoin party - with regulatory blessing.

Read: Ripple Goes Stable 🎯

CEO Brad Garlinghouse dropped the announcement of its new stablecoin, RLUSD, getting a nod from New York's Department of Financial Services.

Less than 24 hours later, came the announcement from Circle, the second most dominant stablecoin.

USDC pulled off an ace with its partnership with the world's largest crypto exchange - Binance.

What about the partnership? Binance will make USDC more available across its platform and even use it for its corporate treasury. Circle, in return, will provide the technology and liquidity that makes it all work.

All this meant one thing - the stablecoin wars have begun.

But that’s not all that happened with stablecoins in 2024.

Stablecoins did not just feed crypto traders last year.

Countries with unstable domestic currencies looked up to stablecoins for stabler currencies.

From daily payments to remittances, stablecoins helped build a parallel financial system that ran on digital dollars.

Last year also saw Ethena showing up with USDe, proving that even in a "mature" market, there's room for innovation. Their yield-generating approach through clever market-neutral strategies? That's the kind of financial engineering that makes Wall Street pay attention.

Lessons for TradFi

While the stablecoin players were busy competing, traditional players took notes.

Some managed to adapt, others not so much.

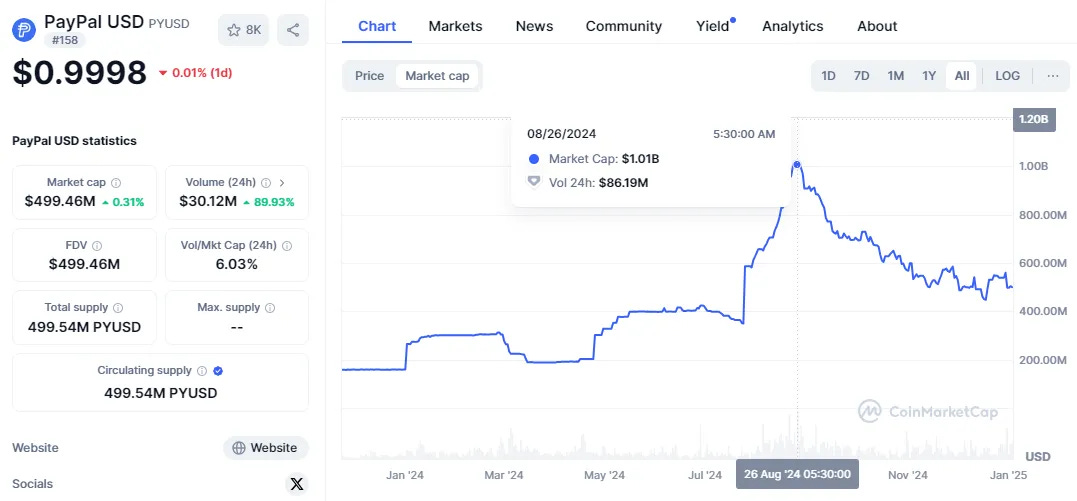

PayPal learned the hard way that having a big name doesn't automatically translate to stablecoin success. Their PYUSD's 50% market cap drop from the high of August 2024 was a reminder that in crypto, execution trumps reputation.

Token Dispatch View 🔍

In 2025, we're not debating whether stablecoins will matter anymore. It's about who will control them. Traditional finance isn't mocking them anymore; they're adapting. Regulators aren't dismissing; they're scrambling to understand.

As BitGo preps USDS and Stripe drops $1.1 billion on Bridge, one thing's clear - 2025 won't be about challenging stablecoins' relevance. It'll be about who gets to shape their future.

Market is busy speculating multiple things: Will Tether maintain its crown against growing competition? Can Circle leverage its Binance partnership into market leadership? Will Ripple's RLUSD change the game for cross-border payments?

Story of 2025 won't be about market share battles. It'll be about use cases we haven't even imagined yet. When BlackRock starts backing multiple stablecoin projects, you know the game's changing.

This isn't just about trading anymore - it's about rebuilding the very foundations of how money moves.

The lines between TradFi and DeFi are blurring faster than anyone predicted.

With Visa embracing stablecoin settlements and major banks eyeing their own entries, 2025 could be the year when "crypto-native" and "traditional" become meaningless labels in the stablecoin space.

What's most intriguing isn't just the growing number of players, but the diversity of approaches.

From Frax's BlackRock-backed model to Ethena's yield innovation, from Ripple's regulatory-first approach to Circle's exchange partnerships - we're seeing the emergence of a multi-polar stablecoin world.

If 2024 was when they got serious, 2025 might be when they become unstoppable. The crypto world's most "boring" innovation just might end up being its most revolutionary.

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us ... either ways do tell us✌️

So long. OKAY? ✋

great stablecoin summary, thank you!