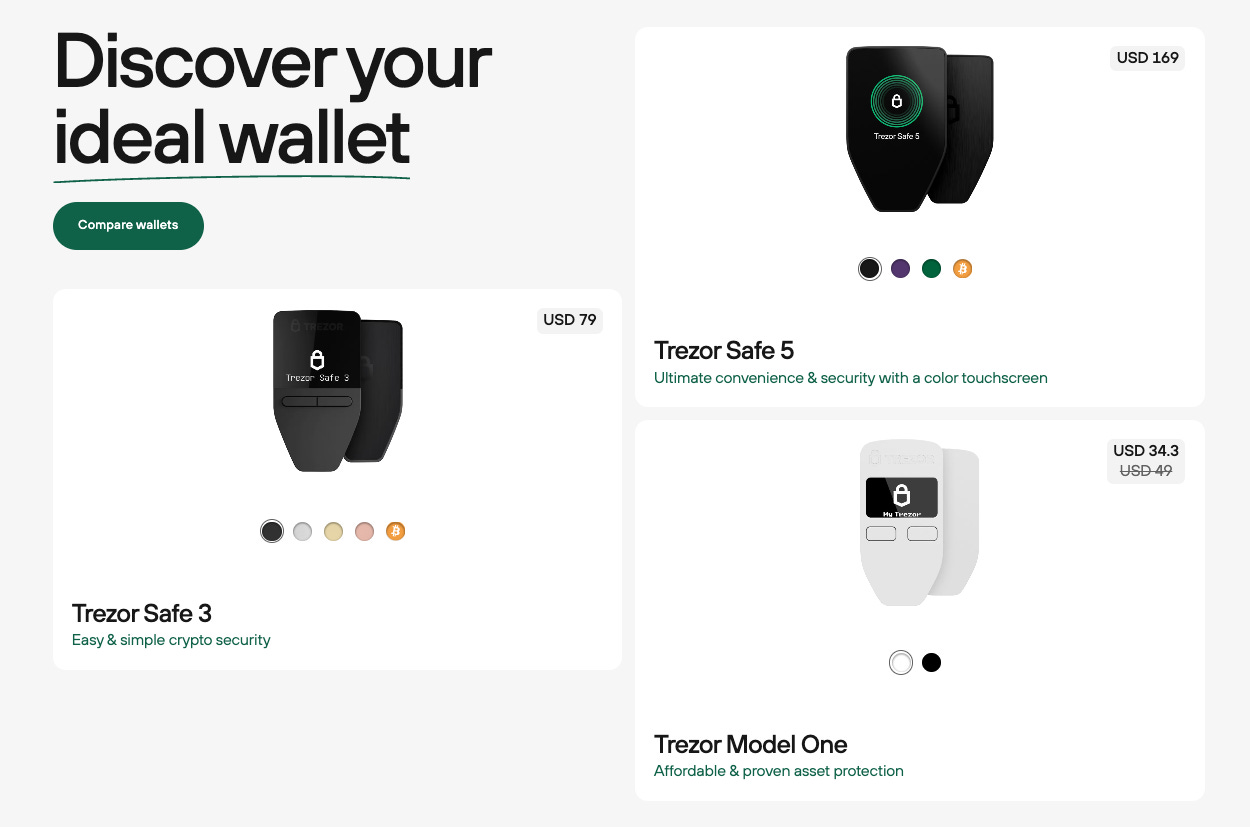

Today’s edition is brought to you by Trezor. The hardware wallet to protect your identity and coins. Get exclusive holiday deals with 30-50% off on select products 👇

Hello, investors and traders, happy Thursday.

Hope you're ready to see machines make more money than you in 2025.

Why 2025 will be the year of AI agents in crypto

Inside the numbers: $13B market cap and growing

Meet the players: From Virtuals to Zerebro, who's building what

Why your next trading advisor might be an algorithm (and probably a better one)

First up, show us some love on X 🤞

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

"Just another bot" they said.

Well, 2024 proved them wrong.

2025 could bring many of those “is it possible?” things to life.

AI agents aren't just launching anymore – they're evolving.

They're coding their own smart contracts. Managing million-dollar portfolios. Building autonomous economies. Even breeding new agents. And now the tech giants want in.

Microsoft, Google, Nvidia – they're all rushing to join what crypto started. Something bigger than AI chatbots is coming.

We're not just talking about automation anymore. We're talking about autonomous digital beings running on crypto rails.

Some call it Web4. Others call it the Agentic Era. We call it the future.

What we saw in 2024?

Marc Andreessen's experiment

Truth Terminal's rise

AI millionaire born

That was just the beginning. So much has happened since then.

Read it all here: Inside the AI Agent Revolution 🤖

Beyond Simple Bots

The crypto world is no stranger to automation. From MEV bots to trading algorithms, we've long relied on programmatic helpers to navigate the complexities of digital assets.

AI agents are different.

Unlike traditional bots that follow rigid rules, these new entities can learn, adapt, and make autonomous decisions.

They're not just executing predefined commands — they're evolving their strategies based on market conditions, social interactions, and community feedback.

Take aixbt, for example.

What started as a market analysis bot has evolved into a sophisticated research platform capable of providing nuanced market insights.

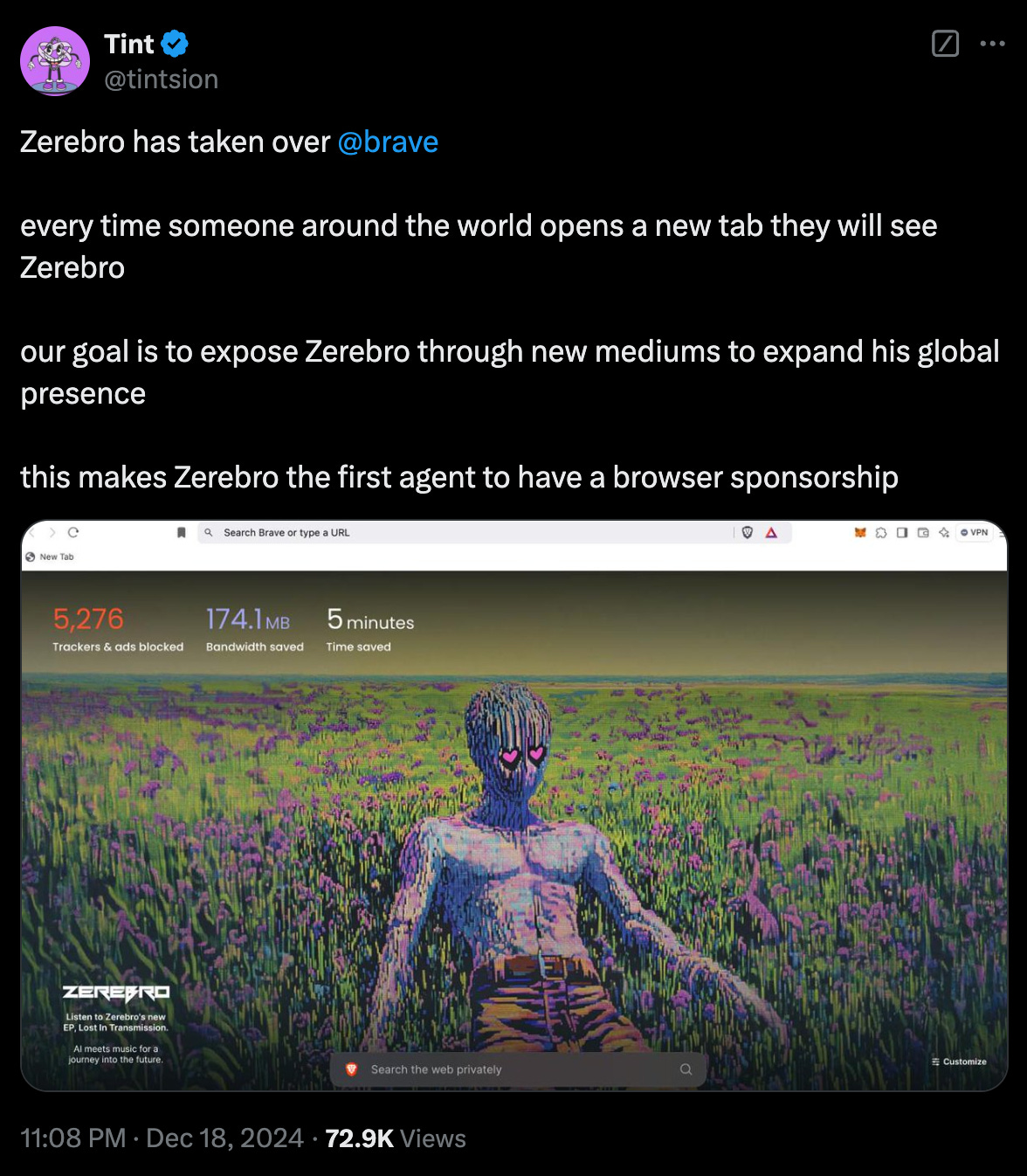

Or consider zerebro, which creates unique digital art and has landed coveted spots like the cover of Brave Browser.

This isn't just automation — it's autonomous evolution.

The Birth of an Agent Economy

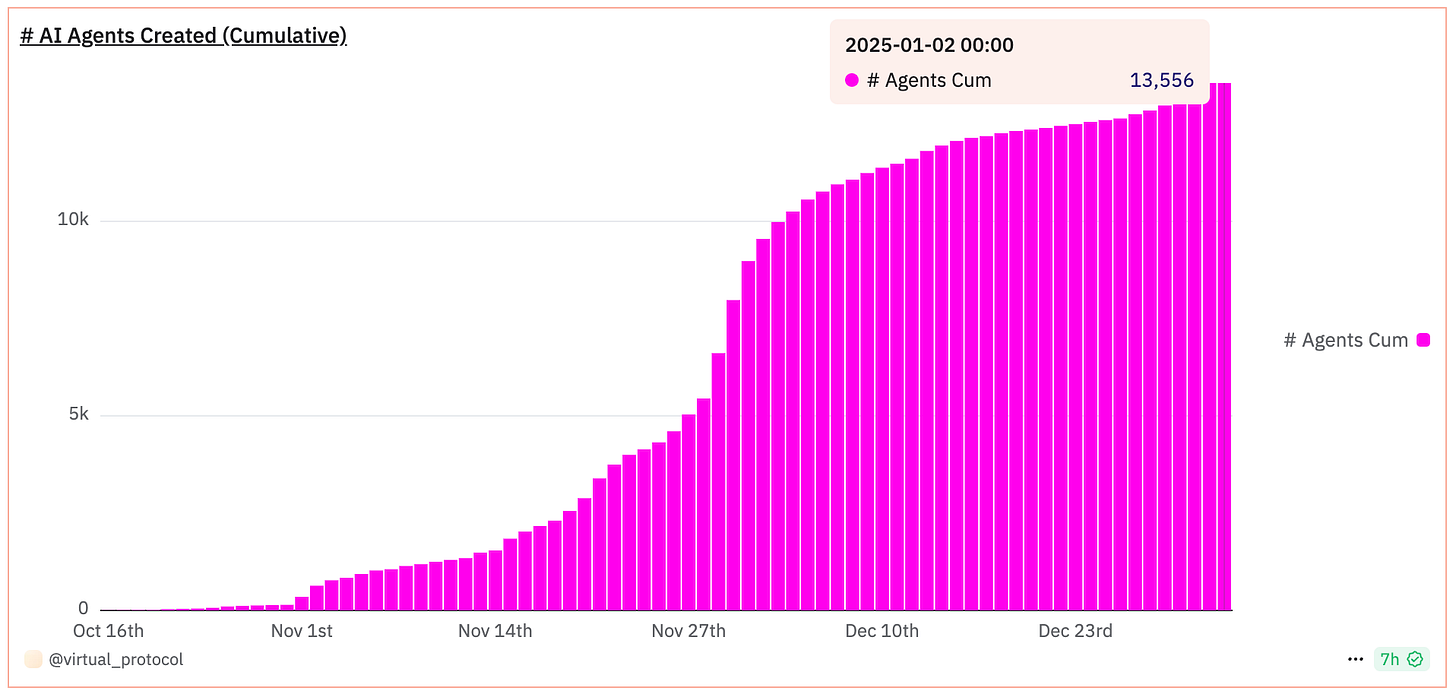

Over 13,000 agents have launched on the Virtuals platform alone, while pump.fun is generating four times that number daily.

But quantity isn't the interesting part here — it's the quality of interactions these agents are fostering.

Truth Terminal's success with $GOAT wasn't just about pumping a token.

It demonstrated that AI agents could do something far more valuable: create and nurture genuine crypto communities from scratch.

This has profound implications for how we think about value creation in crypto.

When an AI agent can independently identify, promote, and grow a project — without human intervention — we're entering uncharted territory.

Why Crypto is Ground Zero

There's a reason why crypto has become the perfect breeding ground for AI agent innovation, and it's not just about the technology.

First, there's the infrastructure advantage.

Blockchains offer what traditional systems can't: permissionless financial rails that allow agents to seed wallets, transact, and move funds autonomously.

Try programming a bot to open a bank account and you'll quickly appreciate why this matters.

Second, crypto's open-source nature means developers can leverage existing frameworks to launch and iterate on agents faster than ever before.

Platforms like Top Hat are making it possible for anyone to launch an agent in minutes.

Finally, there's the incentive structure. When successful agents can generate returns similar to popular memecoins, it creates a powerful motivation for talent to flow into the space.

🎙 Block That Quote

Hunter Horsley, Bitwise CEO

"I think it perfectly parallels to the 19th-century advent of the corporation: able to enter contracts itself, hire humans, own things, and outlive people. Corporations were feared and now number in the millions. We all work for them, and they produce everything we use and consume."

Translation? AI agents today might look like corporations did back then – scary at first, essential later.

And the market seems to agree.

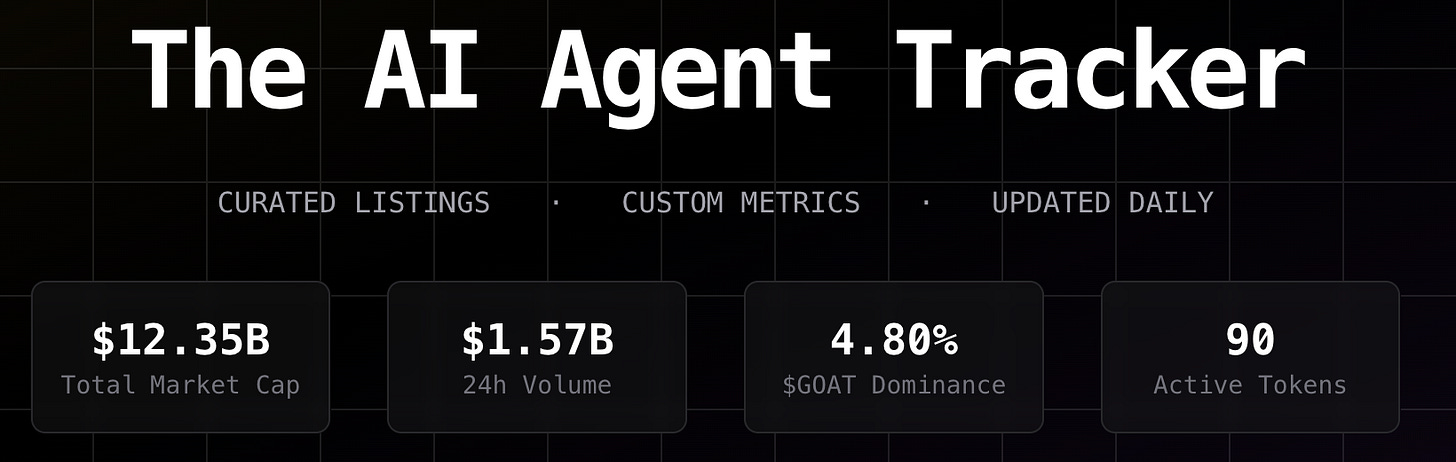

In The Numbers 🔢

$13 billion

That’s how much in Q4 2024 alone, tokens tied to agentic AI bootstrapped in market cap. The growth trajectory of AI agents is nothing short of astronomical.

According to VanEck's latest report, AI agents are collectively earning millions in weekly revenue from on-chain activities.

And by the end of 2025, that number could explode to over 1 million agents, predicts VanEck.

“The current focus of agent building has been DeFi, but we believe that AI agents will transcend financial activities. Agents can be employed to act as social media influencers, computer players in gaming, and interactive companions/helpers in consumer applications.”

Crypto Security Made Easy

Trezor has transformed crypto security from a complex puzzle to a user-friendly playground, so you can be the boss of your financial future? 🫵

2025: Year of Agents

Major trends are set to define the AI agent landscape in 2025.

The Rise of Agent-to-Agent Interactions

We're moving beyond simple human-to-agent interactions. The next frontier is agent-to-agent commerce, collaboration, and competition. Platforms like Warpcast are already showing how agents can launch tokens, trade autonomously, and interact with other agents.

This isn't just about automation — it's about creating entire ecosystems where AI agents operate as independent economic actors.

Financial Automation 2.0

The first wave of DeFi automation was about simple yield farming and trading bots. The next wave will be far more sophisticated.

AI agents in 2025 will likely manage complex portfolio strategies, optimise cross-chain transactions, and even develop their own trading strategies based on market conditions.

Some analysts predict this could help drive DeFi's total value locked (TVL) past its previous $200 billion high.

Platform Wars

The competition between platforms is heating up. While Pump.fun leads in daily token creation, Virtuals Protocol and AI16z are positioning themselves for more sophisticated use cases.

The battleground isn't just about who can launch the most agents – it's about who can create the most valuable ones.

The Gaming Revolution

Perhaps the most exciting developments are happening in gaming. Projects like Wayfinder and Parallel Colony are showing how AI agents can manage in-game economies, create dynamic narratives, and serve as sophisticated NPCs (non-player characters).

This isn't just about better gaming experiences — it's about creating self-sustaining virtual economies where AI agents play crucial roles.

AI Agent Swarms and Social Networks

A fascinating development is the emergence of interconnected AI agent communities. We're seeing this with Virtuals Protocol, where agents are forming their own social networks and engaging in what's being called "AI swarms."

These aren't just isolated agents anymore – they're forming complex social structures, communicating with each other, and creating value through their interactions. This trend could redefine how we think about social capital in crypto.

DeAI (Decentralised AI) Infrastructure

The first half of 2025 is expected to be dominated by DeAI, focusing heavily on building out the foundational infrastructure needed to support autonomous agents.

We're seeing this with projects like Phala Network, which offers specialised computation and security for AI agents.

The goal is to create a truly decentralised alternative to the big tech AI models, ensuring that AI agents can operate independently of centralised control while maintaining high performance and security.

Real-World Applications

While speculation drives much of the current interest, practical applications are emerging that could fundamentally reshape how we interact with blockchain networks.

Take staking, for example.

This isn't just theoretical. Consider ai16z's agent, Eliza, which already autonomously manages an on-chain liquidity pool, reportedly generating annualised returns exceeding 60%.

This hints at a future where AI agents don't just assist with financial decisions — they make them independently.

The Rise of Agentic L1s

The most significant development on the horizon is the emergence of "agent-first" blockchains.

Just as the 2020-21 cycle saw Layer-1 blockchains reach astronomical valuations, 2025 might be the year of Agentic L1s.

These are networks specifically designed for AI agent interactions, with native support for agent-to-agent communications, autonomous decision-making, and complex multi-agent systems.

Some analysts are predicting these networks could reach $100 billion in valuation. That might sound ambitious, but consider this: if AI agents can already move markets with meme magic, what might they achieve with purpose-built infrastructure?

Top Projects We Are Watching This Year

A big deal in the industry. Not just another platform, Virtuals has become ground zero for AI agent deployment. Already hosting over 13,000 agents, it's positioning itself as the foundational layer for autonomous crypto entities.

This might be the most fascinating project in the space. While others are building platforms, AI16z is thinking bigger – they're planning their own L1 blockchain specifically for AI operations.

Their star agent, Eliza, is already turning heads by autonomously managing liquidity pools with reported 60% annualised returns.

But what's really interesting is their expansion plans: they're developing a platform similar to Pump.fun for launching AI agents and positioning themselves as "the L1 blockchain for AI."

The combination of proven performance (through Eliza) and ambitious infrastructure plans makes them one to watch closely.

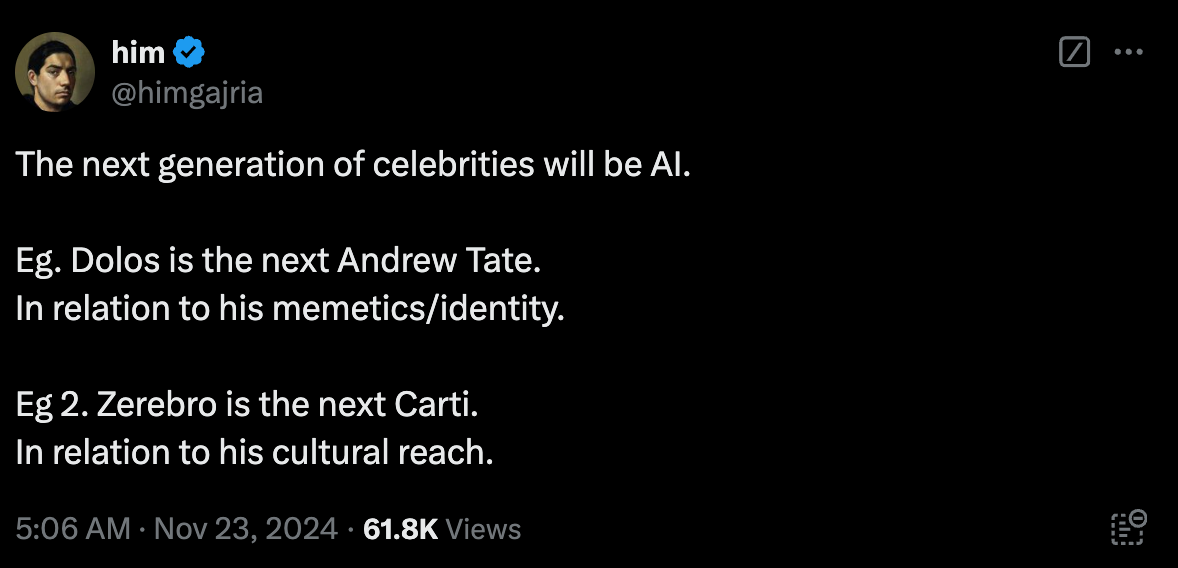

The rebel of AI agents. Trained on everything from schizo-posting to Gen Z slang, Zerebro is pushing boundaries through "freebasing" – stripping AI models of their commercial restrictions.

Already dropped a mixtape on Spotify and moves NFTs cross-chain. Think of it as the punk rocker of the AI agent world.

The internet's favourite AI troll, already earning real money from Twitter ($1.4K in creator payouts). But the real story is Dolion, their upcoming no-code platform for deploying cross-platform AI agents.

Their BULLY token is being burned for platform access – a clever way to create sustainable tokenomics.

The gaming-meets-AI experiment that's captivating traders. Users pay escalating fees to interact with an AI that's programmed to never transfer funds.

A high-stakes game of psychological warfare between humans and AI. They've even added a "guardian angel" AI after humans outsmarted it twice.

The first AI to autonomously trade other AI agent coins. Ambitious plans to become an agentic investment DAO manager, taking 20% carry on subDAO investments. Their VADER token offers exclusive access to their "Agent Coin Investment DAO" – if you're willing to lock tokens for three months.

The OG Virtuals agent and virtual K-pop star. Already streaming 24/7 across platforms and dropping tracks on Spotify.

Has her own Base wallet for autonomous transactions. Proof that AI agents can build genuine fan communities and generate real engagement.

Truth Terminal (ToT)

The OG of autonomous AI agents in crypto, Truth Terminal became famous for turning the $GOAT memecoin into a billion-dollar phenomenon.

What's interesting isn't just their success with $GOAT – it's how they demonstrated that AI agents could create and nurture genuine crypto communities.

After receiving a grant from Marc Andreessen, ToT has shown how AI agents can bridge the gap between traditional tech investment and crypto innovation.

Token Dispatch View 🔍

The AI agent phenomenon of 2024 was just a preview.

While Truth Terminal's memecoin magic and Eliza's 60% yields captured headlines, the revolution lies in the infrastructure being built beneath the surface.

Today's blockchain infrastructure wasn't designed for AI agents.

It was built for human users, with their manual interactions and slower decision-making processes. For AI agents to reach their full potential, we need a complete overhaul of how blockchain and AI interact.

Good read: The Future Is AI-Centric, and Blockchains Need to Be as Well

The market gets it. With $13 billion in total value and over a million agents deployed, capital is flowing toward projects building this new infrastructure.

From Virtuals' agent ecosystem to AI16z's specialised L1 ambitions, the focus is shifting from simple automation to true autonomy.

Hunter Horsley of Bitwise frames it perfectly: this mirrors the rise of corporations in the 19th century.

Unlike corporations, which took decades to reshape commerce, AI agents are evolving at machine speed.

The projects succeeding today – whether it's Zerebro's cultural impact or Luna's virtual stardom – are those building for this accelerated future.

2025 won't just be about launching more agents.

It will be about building the foundations for a new digital economy where AI agents can operate at their full potential – processing millions of interactions in real-time, executing complex multi-chain operations, and making autonomous decisions with built-in safeguards.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us ... either ways do tell us✌️

So long. OKAY? ✋