Alt Season Incoming? 🎭

Bitcoin tops $82K. Altcoins stealing the show. SOL joins $100B club. DeFi TVL crosses $100B. Hoskinson eyes Trump's crypto policy chair. DOGE nears 2021 high. Crypto market cap to touch $10T by 2026?

Hello y'all, your daily crypto dispatch is here. Today's edition dispatched from the graves where "Solana is dead" memes are buried ⚰️

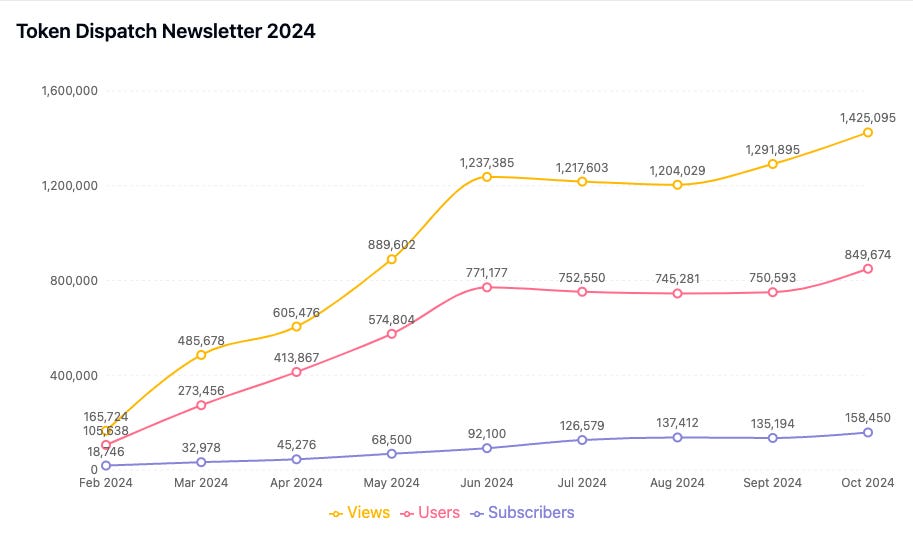

Want to reach out to 150,000+ subscriber community of the Token Dispatch? Ride with us👇

Everyone had written off alt season 2024.

"Bitcoin ETFs changed the game."

"Institutions don't care about alts."

"This cycle is different."

For months, the narrative was clear: Bitcoin's 60% market dominance was unshakeable, ETFs were at the centre of every story, and altcoins were ... well, irrelevant.

Until they weren't.

The classic playbook said: Bitcoin hits ATH, dominance peaks at 60%, then alt season begins.

Simple enough, right?

But this cycle's been different.

As Bitcoin casually tapped $81,358 yesterday (yes, another casual ATH), something snapped in the alt markets.

Remember what Hashkey Capital said? "Altcoin season is more probable when Bitcoin's price surpasses $80,000."

Well, they might've been onto something.

But this isn't your 2017 alt season. No random ICOs pumping 100x. No worthless tokens mooning.

Instead, we're watching something more fascinating.

Infrastructure is meeting innovation.

Dead projects are coming back to life.

Even Willy Woo's warning about weaker alt seasons looks shaky now.

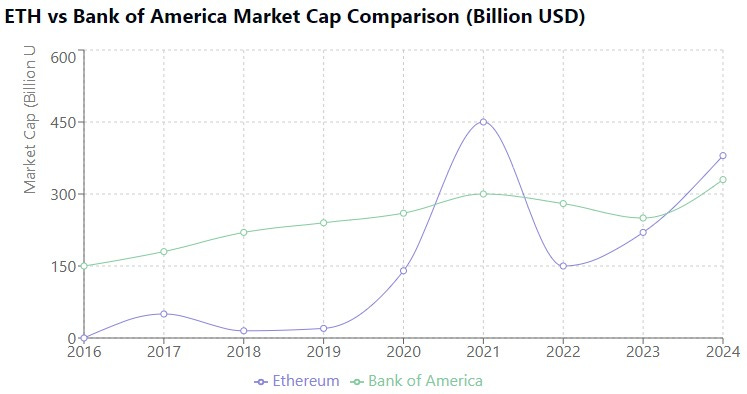

Ethereum has joined the party.

After a bad slump for months, the DeFi OG is showing some serious muscle.

It has surpassed traditional finance giant Bank of America with a superior market cap of $385.60 billion.

**drumrolls**

The Numbers

Trading near 15-weeks highs

SEC weighing spot ETH ETF options

DeFi activity heating up

Trading volume exploding

Next stop $4k?

Inflation? A catch.

ETH supply turning inflationary again.

0.424% yearly increase

Burning 452,000 ETH annually

Issuing 957,000 ETH

SOL has joined the $100B market cap club.

Only the 4th crypto ever to do so.

Sitting pretty at $212 (highest since 2021).

Just 20% away from ATH ($260).

The Numbers

34% up this week alone

275% gain year-over-year

Outpacing BTC's 18% move

Leading CD20 index's 27% advance

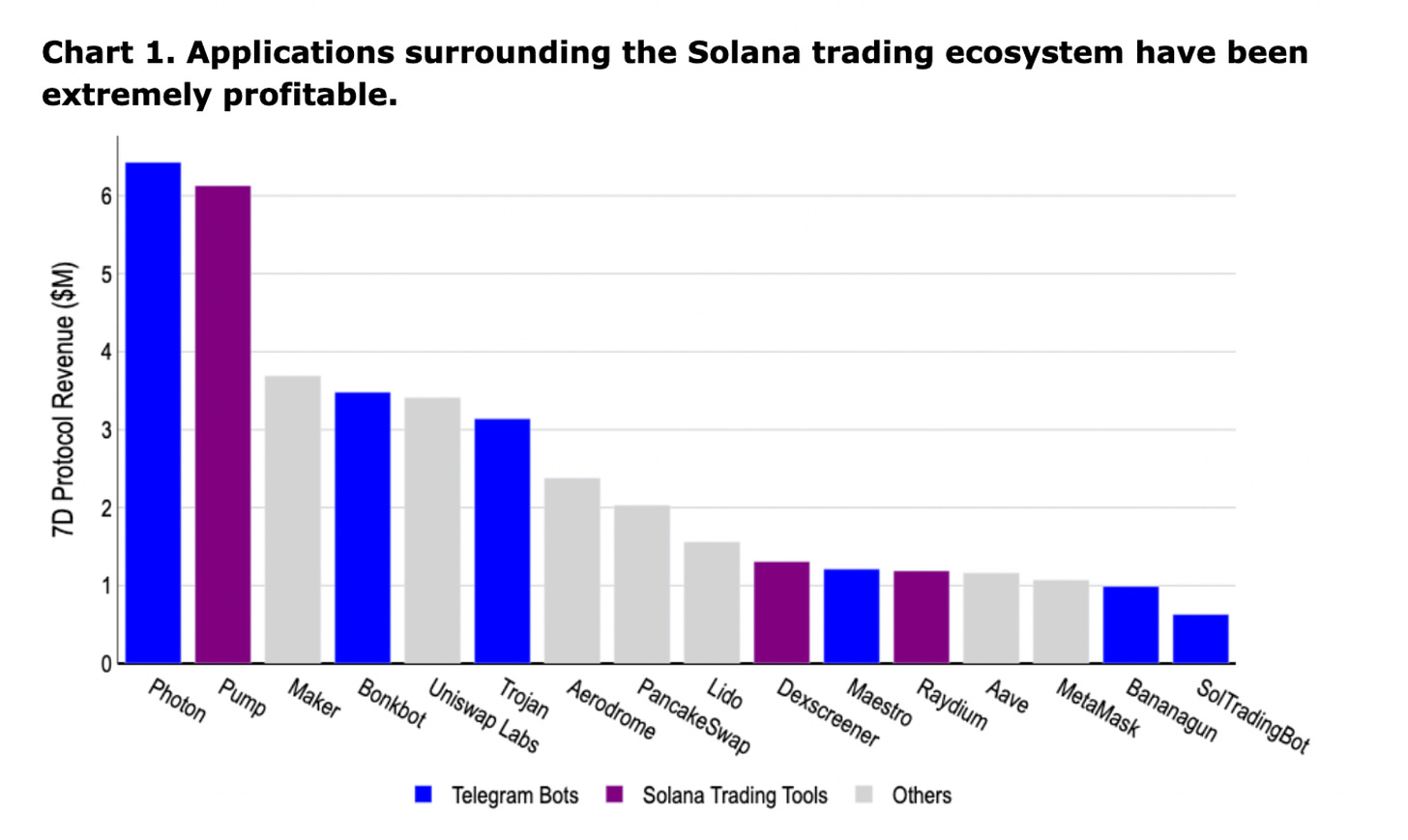

The chain's now rocking

Third most profitable ecosystem in crypto

pump.fun driving massive volumes

DeFi activity soaring

Retail traders' favorite playground

"A fresh all-time high for SOL (the all-time high is $260 from Nov. 2021) before the end of the year seems inevitable….More broadly we think all boats will keep rising but that of the three SOL is likely to perform best." - Standard Chartered's Geoff Kendrick

DOGE’s moment

Flipped XRP and USDC

Shot past $0.23 (2021 levels)

Market cap? $34B and counting

Futures open interest near ATH ($1.8B)

Even parody DOGEs up 600%

Why? D.O.G.E Department.

What is that?

Musk's potential role in the Trump administration - Department of Government Efficiency (D.O.G.E), which he himself announced as an idea.

Why is weekend activity significant?

Simple. When trading volumes spike during traditionally quiet periods, it usually means retail traders are jumping in. And when retail gets excited... well, you know what happens next.

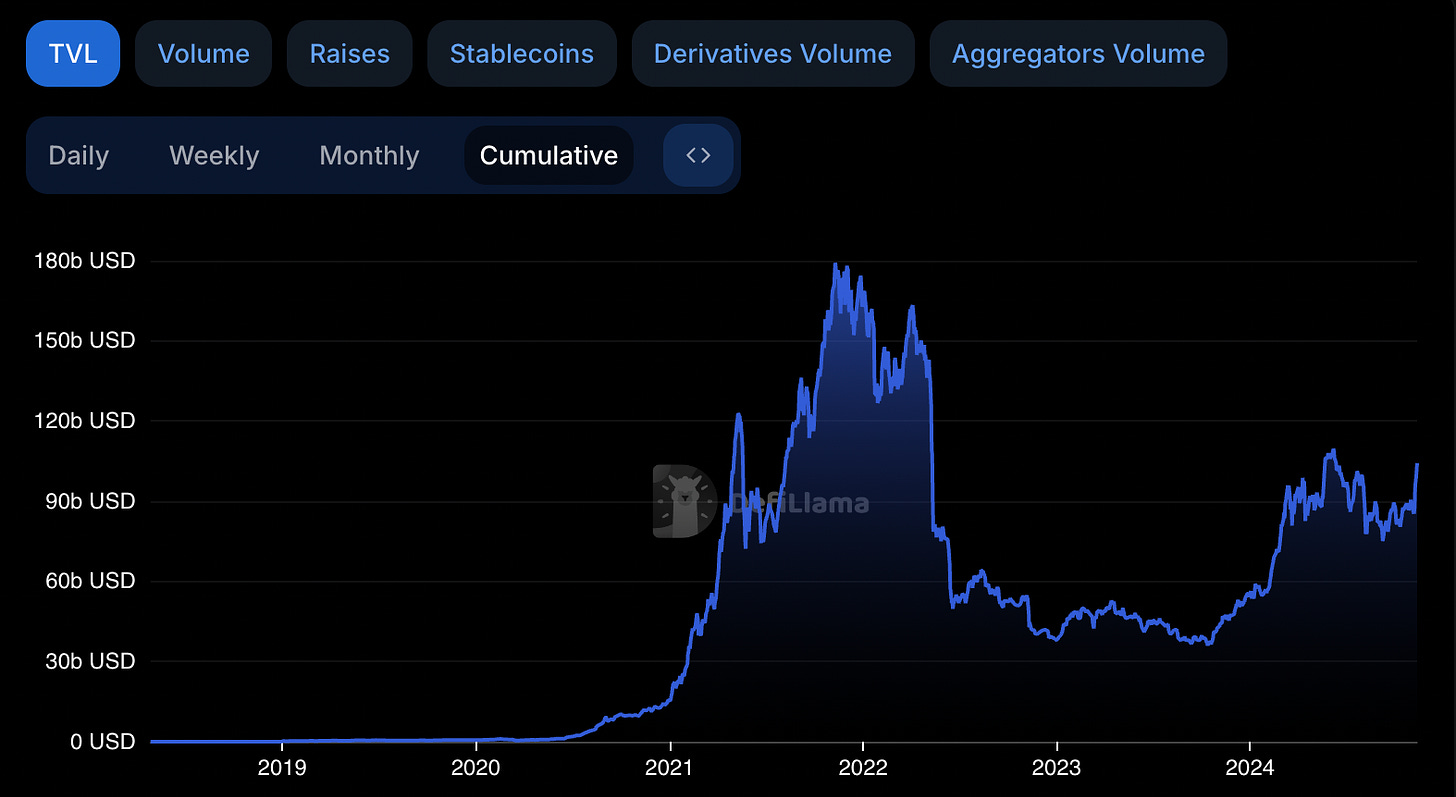

DeFi Is Back from the Dead

The total value locked (TVL) in DeFi? $105 billion.

But here's the real kicker – just six protocols control 80% of it all.

The Big Six dominance

Lido: $31.1 billion (9.79M ETH staked)

Aave: $16.4 billion

Eigenlayer: $13.4 billion

Ether.fi: $8.2 billion

Sky (ex-Makerdao): $6.4 billion

Uniswap: $5.6 billion

Total control? $81.26 billion

Don’t Miss Out on Our Weekly Features

Connecting dots to bridge the narrative that's shaping the crypto world. Saturday analysis written by Prathik Desai 👇

Crypto world can be a maze. Lot of information, not much context. Lot of noise, not much insight. Sunday explainers written by Thejaswini M A👇

In The Numbers 🔢

$10 Trillion

That's where Standard Chartered sees crypto's total market cap by 2026. Not a typo – we're talking about 4x growth in just two years.

Let that sink in.

Bitcoin at $200,000, Ethereum breaking $10,000, and perhaps most surprisingly, Bitcoin's dominance dropping from 60% to 40% of the total market.

The bank's thesis hinges on something very specific – Trump's victory and its ripple effects on crypto regulation.

Standard Chartered's blueprint to $10 trillion

Repealing SAB 121 (the rule that makes banks nervous about touching crypto)

Getting clear stablecoin legislation

Dismantling the SEC's crypto crackdown

And maybe, just maybe, a US government Bitcoin reserve (though they're not betting the farm on this one)

Bitcoin might not be the star of this show. The bank expects altcoins to surge even more, particularly those with "real-world applications." Solana, they suggest, could outperform both Bitcoin and Ethereum.

Why? Because, while Bitcoin has been playing the digital gold game, the rest of crypto has been quietly building actual utilities – from gaming to DePIN (decentralised physical infrastructure) to social tokens.

“As in 2021, existing digital assets are likely to see price rises and new sub-sectors emerge; this time, real-world use cases are finally poised to go mainstream.”

Block That Quote 🎙

Cardano founder, Charles Hoskinson

"I'm going to be spending quite a bit of time working with lawmakers in Washington, DC, and quite a bit of time working with members of the [Trump] administration to help foster and facilitate, with other key leaders in the industry, crypto policy.”

After spending most of 2024 as crypto's underperformer (down 40% through October), Cardano's ADA token suddenly found its mojo.

The catalyst? Speculation that Charles Hoskinson might be whispering in Trump's ear come 2025.

Looks like Cardano's founder is ready for Washington, with or without an official invite.

"A large part of my time in 2025 will also be devoted to the political process."

Hoskinson never actually said he was joining the Trump administration.

What he did say was that he's setting up a policy office at Input Output to work with lawmakers in DC. But in crypto, sometimes the rumour is more powerful than the reality.

ADA shot up to $0.597 ($0.5688 atm) over the weekend, erasing six months of losses. Hit its highest point since April.

And Hoskinson's not holding back about Wall Street's influence.

"None of us signed up to have companies like BlackRock dictate to the United States what crypto policy should be."

On the Republican sweep potential

"There is a very high probability that the Republicans will not only control the Senate and the Presidency, but also the Congress, the House."

But he's keeping expectations in check.

"That has yet to be decided based upon the fact that they are not even in office yet, and they just picked a chief of staff."

The Surfer 🏄

The Ethereum Foundation's treasury has decreased by 39% to $970.2 million as of October 31, 2024, down from $1.6 billion in March 2022. This was primarily due to spending of approximately $240 million over the past two years and a 22% decline in the value of ether.

Vitalik Buterin has introduced the concept of "info finance," focusing on enhancing prediction markets on Ethereum beyond mere betting.

The SEC has delayed its decision on approving options for spot Ethereum ETFs for the second time, citing the need for further analysis and public input regarding market manipulation and investor protection.

The Crypto Fear and Greed Index has reached a seven-month high of 78 as Bitcoin surged to an all-time high of $81,358 on November 10, reflecting a strong market sentiment among investors.

Traffic to the top 20 cryptocurrency exchanges rose by 8% in October, driven by renewed interest from retail investors ahead of the US elections, with Pump Fun seeing a 100% increase in monthly visits.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

Great article

Alt season is alive and well! Bitcoin might be the king, but it’s the alts that are stealing the spotlight this time. 🚀 SOL hitting $100B and DeFi’s comeback say it all.