Anarcho-tyranny 🤔

Vitalik Buterin criticises US government regulatory approach to cryptocurrencies. How can Ethereum stay accessible to everyone? Layer-2 unique addresses hit record highs. What is Buterin’s net worth?

Hello, y'all. ♪ Words are flowing out like endless rain into a paper cup ♪

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

The state of regs?

More like a tangled web than a clear path forward.

Meanwhile, bad actors are running wild.

Who is hurt? The good guys.

The honest developers with real ideas trying to build a better future with crypto.

Ethereum’s Vitalik Buterin calls this whole regulation confusion and the current system as "anarcho-tyranny."

What on earth is that?

Buterin's says that current regulations unfairly target responsible developers.

The worst part? The classification of utility tokens as securities.

Buterin argues this stifles valuable crypto projects by favouring "useless and vague" tokens with no clear purpose.

He suggests two extremes

Anarchy: A free-for-all where scammers and empty promises thrive – a situation many believe already exists on social media platforms.

Tyranny: Vague and uneven regulations that stifle innovation and leave everyone confused. Here, Buterin points the finger at the US approach.

The solution?

Reward Clear Vision: Projects with a strong long-term plan and a clear value proposition should face less regulatory hurdles.

Risk for Useless Hype: Issuing tokens based on empty hype or speculation should be considered riskier by regulators.

Regulators Need Good Faith: Clear and consistent rules are essential for fostering a healthy crypto ecosystem.

The SEC would agree?

Most probably not.

The SEC, led by Gary Gensler, isn't exactly on the same page.

They keep saying crypto folks aren't playing by the current rules.

This has led them to label big-name tokens like Solana and Cardano as securities and even sue companies like Coinbase, Consensys and Binance for their crypto offerings.

Read: SEC Can't Stop Suing 👨⚖️

The new target?

Silvergate, a now-defunct crypto-friendly bank.

Allegation: Silvergate, along with its former CEO, COO, and CFO, made false statements about their compliance programs.

The goal? To downplay concerns about FTX using Silvergate for potentially fraudulent activity.

The lawsuit claims Silvergate failed to properly monitor a staggering $1 trillion worth of transactions, including $9 billion linked to FTX.

The settlement: Silvergate agreed to a $50 million penalty. The former CEO and COO paid $1 million and $250,000 respectively, all without admitting guilt.

Read: SEC Sues Consensys 👨⚖️

But, crypto wins sometimes.

US Supreme Court dropped not one, but two decisions.

Big chill for the SEC.

SEC on Trial: In a 6-3 decision (SEC v Jarksey), the court ruled that defendants in SEC enforcement actions involving securities fraud have the right to a jury trial, not just an administrative judge. This could make it harder for the SEC to win cases.

Curbing Agency Power: Another 6-3 decision (Loper Bright Enterprises v. Raimondo) overturned the Chevron deference doctrine. This doctrine gave agencies more power to interpret laws.

This could be a big win for crypto companies battling the SEC in court.

Why?

Less power to the SEC: With the Chevron doctrine out, courts will have more freedom to interpret laws, potentially limiting the SEC's reach.

Clearer Rules? The hope is that this ruling will push Congress to step up and write clearer laws for crypto, instead of relying on the SEC's interpretations.

"This ruling means that executive agencies, like the SEC and CFTC, will need to be more cautious in extending their regulatory reach without clear statutory authorisation, especially in novel and rapidly evolving fields like crypto and AI," - Amanda Tuminelli, chief legal officer at the DeFi Education Fund.

Everyone is not thrilled

Investment bank TD Cowen thinks it could complicate things.

"It [Chevron decision] takes off the table the most common tactic to find a bipartisan compromise, which is to keep the language ambiguous in order to leave the final decision to the regulator ... This offers political benefits as lawmakers can later criticise the regulator for not following the intent of Congress, even if Congress failed to clearly articulate what should happen."

Block That Quote 🎙️

Ethereum co-founder Vitalik Buterin.

"Every poll I make confirms the same thing: the #1 thing in becoming more home staking friendly is to reduce the 32 ETH requirement."

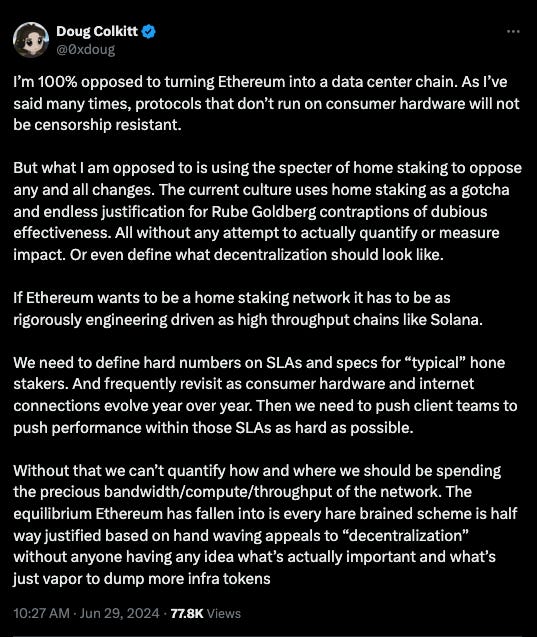

Buterin's facing off against concerns that Ethereum might turn into a giant data centre party, leaving regular folks out in the cold.

The drama started with Doug Colkitt, crypto dude and founder of Ambient Finance.

He wants Ethereum to stay accessible to anyone with a computer at home, not just tech giants with server farms.

Buterin’s mission: Turn Ethereum into your friendly neighbourhood staking platform.

The 32 ETH Wall

Buterin believes reducing the current 32 ETH requirement (roughly $111,000) is crucial.

He points to community feedback and argues a lower barrier will make staking more accessible, strengthening decentralisation.

Finding common ground

Innovation for Home Staking: Solutions like Orbit and Solo Staking Friendly (SSF) make solo staking more manageable for individual users.

Long-term scalability: Hyper-aggregation as a future possibility for increased scalability while maintaining security against quantum computing threats.

What else is Vitalik right about?

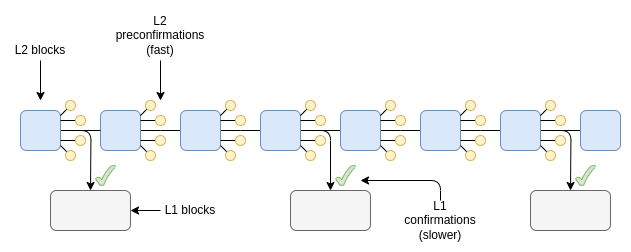

Proposes a new system to speed up transactions on the Ethereum network.

Why? Current system uses epochs and slots, with confirmations taking 5-20 seconds.

Moving to a single-slot finality (SSF) system, similar to Tendermint consensus.

This could reduce confirmations to milliseconds.

More options could benefit both L1 and L2 users and simplify L2 development.

Backs MegaLabs

MegaLabs raises $20 million for "real-time blockchain" MegaETH.

Backed by Buterin, Dragonfly, Consensys CEO Joseph Lubin, and others.

Aims for 100,000 transactions per second with millisecond response time.

Testnet launch planned for Fall 2024.

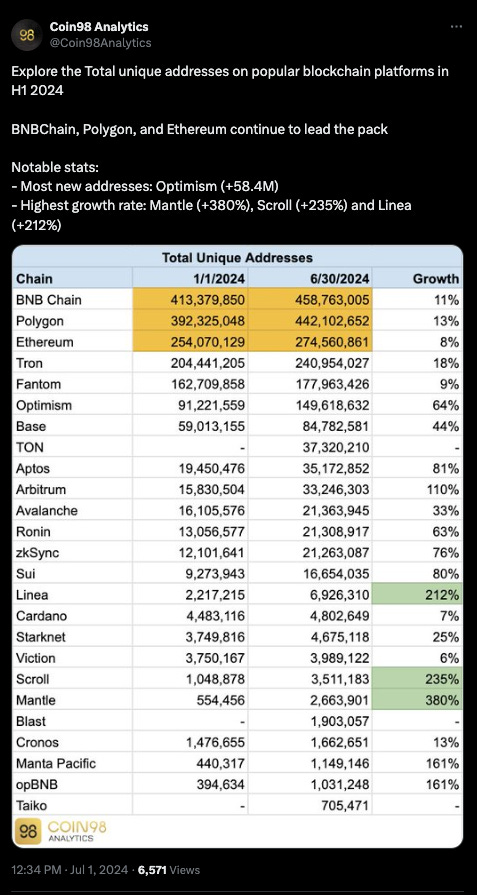

Crypto's Layer-2 Explosion

Layer-2 blockchains have had a bumper 2024.

Driven by fee reductions and governance changes, unique addresses have notched up record numbers in the first half of 2024.

Significant increase in unique addresses during the first half of 2024.

Optimism Leads the Charge

Recorded the most new L2 addresses (over 58.4 million) since January, a 64% increase.

Coincides with the launch of Optimism Governance Season 6, focusing on decentralisation and developer growth.

Other Notable Mentions: Mantle, Scroll, and Linea saw significant increases in unique addresses (over 200% each).

BNB, Ethereum, Polygon hold top spots

BNB Smart Chain leads with 458.7 million new addresses, driven by the opBNB L2 solution and a 90% transaction fee reduction.

Ethereum's reduced fees through EIP-4844 (Proto-Danksharding) also benefit L2 networks on Ethereum.

Polygon's multi-chain scaling solution attracts DApps and smart contracts.

In The Numbers 🔢

$850 million

Vitalik Buterin’s net worth as of June 2024.

In January he was looking at a net worth of around $552 million.

What’s the secret? Well, it all boils down to good ol' ETH.

Back in 2021, when ETH hit its peak, Buterin's net worth briefly surpassed $2 billion.

Then the market nosedived, so did his net worth - 75% down.

Buterin never held more than 0.9% of the total ETH supply (peaked at 0.91% in 2015).

Yet, he remains the largest individual ETH holder, though some pre-sale investors may hold more (inaccessible funds).

Food for thought

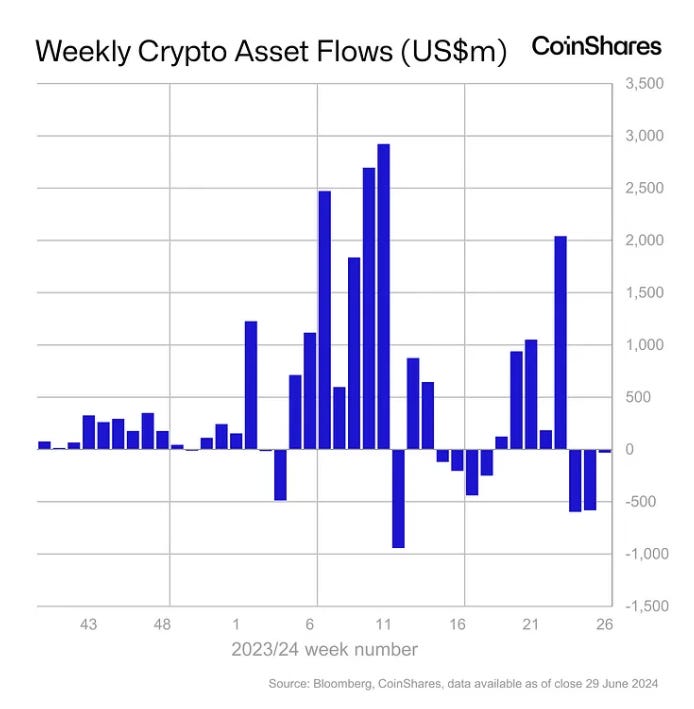

Ether Records Largest Outflow Since 2022

Digital asset investment products saw a third consecutive week of outflows - $30m, Coinshare digital asset flow report.

Ethereum Leads Outflows: Saw the largest outflows since August 2022 - US$61 million, making it the worst performing asset year-to-date.

Bitcoin and Multi-Asset Products See Inflows: Bitcoin ETPs and multi-asset products led inflows with US$10 million and US$18 million, respectively.

Trading Volume Picks Up: Trading volumes increased by 43% to US$6.2 billion but remain below the year-to-date average.

Mixed Performance by Region: US, Brazil, and Australia saw inflows, while Germany, Hong Kong, Canada, and Switzerland saw outflows.

Short-Bitcoin Outflows: Short-bitcoin products experienced outflows of US$4.2 million.

Altcoin Inflows: Some altcoins like Solana (US$1.6 million) and Litecoin (US$1.4 million) witnessed inflows.

Blockchain Equity Outflows:

Blockchain equities faced outflows of US$545 million year-to-date - 19% of Assets Under Management (AuM).

The Surfer 🏄

The number of cryptocurrency ATMs installed worldwide is nearing its all-time record of 39,541 set in December 2022. 2,564 new cryptocurrency ATMs have been installed in 2024, compared to the net loss of 2,861 machines in 2023.

The Philippines has adopted Tether's USDT stablecoin for social security payments. Tether has partnered with Uquid to allow citizens to pay their Social Security System contributions in USDT.

Crypto hacks decreased by 54.2% in June compared to May. Approximately $176 million was lost in crypto hacks in June.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋