TGIF Dispatchers.

He graduated high school at 14.

Finished university at 17.

Had professors call him the brightest student they'd ever seen.

What happens when a mathematical genius decides the crypto world is just another puzzle to be solved – not by building, but by breaking?

Meet Andean Medjedovic, the prodigy who could have been crypto's next wunderkind.

Instead, he allegedly orchestrated two of the most sophisticated DeFi hacks in history, wrote a manual on how to launder crypto millions, and disappeared to an undisclosed island – all before reaching an age when most people finish college.

How thin is the line between genius and threat?

The answer might make you rethink everything you know about crypto security.

Let's dive in.

Roses Are Red, Security Is Key

Trezor has transformed crypto security from a complex puzzle to a user-friendly playground, so you can be the boss of your financial future?

This Valentine’s Day, help your audience give a gift that lasts. Get discounts of up to 50% on Trezor’s bundled best-selling hardware wallets.

Crypto hackers typically remain shadowy figures behind clever pseudonyms.

Occasionally, one emerges from the shadows – not with a mask, but with a master's degree: Andean Medjedovic.

A teenage genius who graduated high school at 14, blazed through university in record time, and eventually found himself at the centre of a $65 million crypto scandal.

Before he became cryptocurrency's newest alleged super-villain, Medjedovic was turning heads for entirely different reasons.

At the University of Waterloo, Canada – the same institution that produced Ethereum's Vitalik Buterin – Medjedovic was more than another bright student.

While most teenagers were wrestling with high school algebra, he was completing an undergraduate degree in mathematics in just three years.

His intellectual prowess was matched only by his intensity. Fellow students recall a young man who carried himself with confidence "to the point of arrogance," often condescending to those he deemed less intelligent.

This combination of brilliance and social friction would become a recurring theme in his story.

The signs of his future path were already visible during his university years.

Between classes, Medjedovic developed a particular interest in automated market makers (AMMs) and DeFi protocols.

First, Medjedovic honed his skills in legitimate ways.

The bounty hunter turned hunter?

Perhaps the most telling detail in Medjedovic's story is his transition from bug bounty hunter to alleged exploiter. He won multiple prizes on Code4rena for finding vulnerabilities in protocols – the crypto equivalent of a security guard learning every weakness in a building's defense.

It's a path that should have led to a lucrative career protecting DeFi protocols. Instead, he allegedly used that same knowledge to drain them.

By the time he was preparing to apply for PhD programmes, having completed his master's degree in just one year, Medjedovic had developed a deep understanding of both the mathematical principles underlying cryptocurrency protocols and their potential weaknesses.

What no one knew then was that this extraordinary academic career was about to veer into territory that would make him not just a mathematical outlier, but one of the most wanted figures in crypto.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts.

Code is Crime

In October 2021, while most of the crypto world was riding the bull market high, a relatively unknown liquidity protocol called Indexed Finance was about to become the testing ground for one of the most sophisticated DeFi exploits in history.

The perpetrator? Our mathematical wunderkind, Andean Medjedovic.

The attack was brazen. The crypto address used in the hack included "1488" – a known neo-Nazi reference – and the code was peppered with racial slurs. This wasn't just a hack; it was a calling card.

The mechanics of the exploit revealed Medjedovic's mathematical genius turned malicious. He had discovered what he called a "mispricing opportunity" in Indexed Finance's code after reading about it on a forum.

Most would have dismissed it as too complex to exploit.

For someone with Medjedovic’s brains, it was an irresistible puzzle.

The result? A $16.5 million heist that worked by manipulating the protocol's "reindexing" process – the mechanism by which it added new tokens to liquidity pools.

Using millions in borrowed tokens, Medjedovic allegedly distorted the platform's smart contract calculations, effectively turning its own mathematics against it.

When confronted, his defense was simple: "Code is law." The protocol had been "out-traded," he claimed.

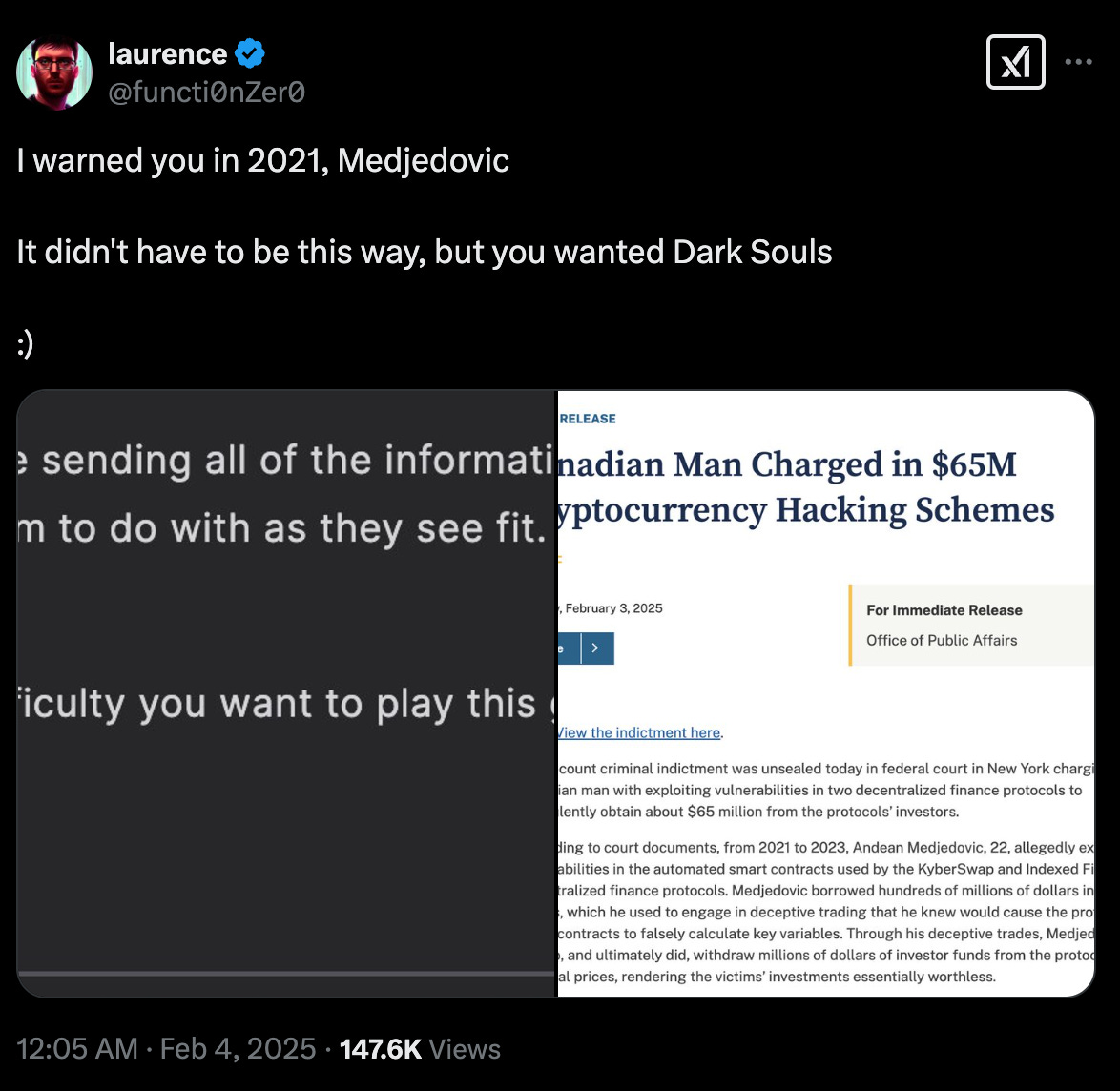

But Canadian Superior Court Justice Fred Myers disagreed. A court order was issued to freeze the tokens, along with a warrant to search Medjedovic's belongings.

His response? He simply disappeared.

Indexed Finance's owners Laurence Day’s recent tweet.

Most hackers would have laid low after such a heist. Not Medjedovic.

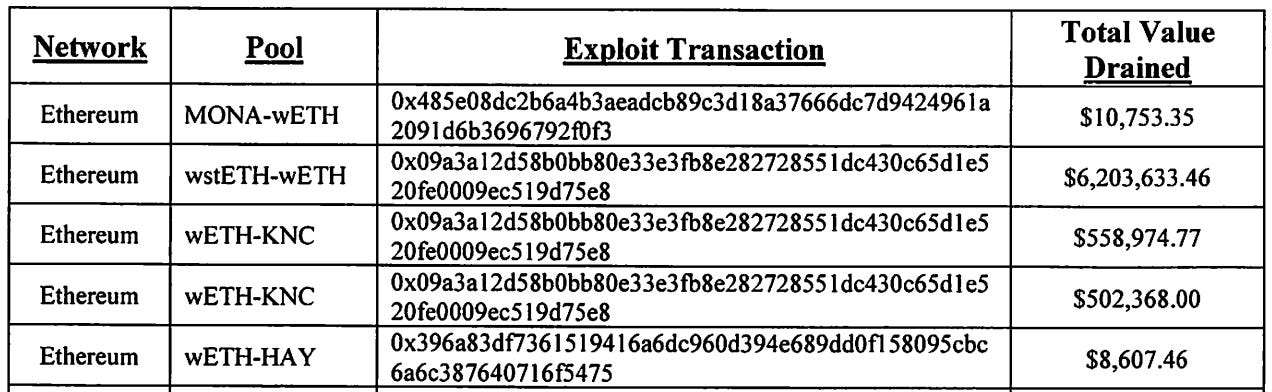

Two years later, in November 2023, he allegedly orchestrated an even more ambitious attack on KyberSwap.

This time, the target was bigger: $48.8 million.

The method was similar – exploiting automated market makers, his longtime area of interest – but the execution was even more sophisticated. The attack involved hundreds of millions in borrowed crypto, creating artificial prices in liquidity pools that caused KyberSwap's AMMs to "glitch."

It was what came next that truly set this hack apart.

He made an audacious demand: complete control of KyberSwap's protocol and DAO in exchange for returning just half of the stolen funds.

Even more bizarrely, he threatened to "alert authorities" if his gains were frozen, apparently missing the irony of a criminal threatening legal action.

The final act of this crypto crime drama has an unexpected twist: an attempt to launder the combined $65 million through cryptocurrency mixers would lead him straight into the arms of an undercover agent.

The Ghost in the Machine

As February 2025 dawned, the US Department of Justice dropped a bombshell: they were formally charging the elusive math prodigy with wire fraud, computer hacking, and attempted extortion.

Medjedovic was nowhere to be found.

The indictment revealed a fascinating detail: the young hacker had created what amounts to a "how-to guide" for moving large amounts of cryptocurrency through mixers. He had even developed strategies for using false KYC information for "hacks and cashing out" – essentially writing his own playbook for crypto crime.

According to DL News, which managed to track him down for an interview in 2023, Medjedovic had been island-hopping across Europe and South America. He was speaking from an undisclosed island, still maintaining his defiant stance that what he did was perfectly legal – just clever use of code.

The DOJ's case tells a different story. While Medjedovic claims he simply "out-traded" these protocols, prosecutors paint a picture of deliberate deception. The indictment describes how he allegedly agreed to pay an undercover agent $80,000 to help circumvent restrictions and release $500,000 in stolen cryptocurrency – hardly the actions of someone convinced of their legal standing.

Token Dispatch View 🔍

The case of Andean Medjedovic has become a flashpoint in the ongoing debate between "Code is Law" advocates and traditional legal frameworks. Like the Mango Markets case before it, where Avi Eisenberg's similar defense crumbled, the message from courts is becoming increasingly clear: just because something is technically possible within a smart contract doesn't make it legal.

Yet this case represents something far more unsettling than just another legal precedent. When brilliant minds choose to become digital pirates, we're forced to ask uncomfortable questions about how we nurture exceptional talent in the digital age.

Think about it: here's a mathematician who could have been working on climate models or advancing artificial intelligence. Instead, he chose to spend months crafting exploits to drain liquidity pools – essentially using a Ferrari to rob convenience stores.

The implications stretch far beyond one brilliant mathematician gone rogue. When a protocol is exploited, who gets to decide what constitutes a hack versus a clever trade? How binding are the "settlements" often negotiated between DAOs and their attackers? And perhaps most importantly, how can decentralised systems protect themselves against individuals whose mathematical brilliance matches or exceeds that of their creators?

The crypto industry has created an environment where technical brilliance is often celebrated regardless of its ethical application. We've seen this before with traditional finance – quants using their physics PhDs to create ever more complex derivatives – but crypto has accelerated and democratized this process.

For now, Medjedovic remains at large, a ghost in the machine, while the crypto world grapples with the implications of his actions. The mathematical prodigy who could have been crypto's next Vitalik Buterin instead became its latest cautionary tale – a reminder that in the world of DeFi, the greatest threats often come from those who understand it best.

Perhaps most ironically, Medjedovic's legacy might be exactly what he didn't intend: strengthening the case for more robust regulation in the crypto space, and forcing us to ask ourselves a crucial question: Are we creating an environment that channels brilliant minds toward meaningful innovation, or are we just building ever more elaborate puzzles for them to break?

That choice matters far more than any single hack ever could.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.