Are We Still Bullish on Ethereum? 🤔

Ether is down 35% from it's 2024 high. Factors at play & the future outlook. If Bitcoin is digital gold, is Ethererm digital oil? Vitalik registers defensive accelerationism ENS domain - what's that?

Hello, y'all. If you want to unlock your music personality, and test what you’ve got 👇

Ethereum was not supposed to go like this in 2024.

Not with the precedence of US spot Bitcoin ETFs success.

Ether ETFs has led ETH in a completely different direction.

Significant price drop post-ETF launch: The price of Ether (ETH) has fallen over 26% in the past month to trade at $2,572 as of August 19, despite the historic launch of the first spot Ether exchange-traded funds (ETFs) in the United States on July 23.

The market cap of the second largest cryptocurrency has dropped over $100 billion since the launch of ETFs and around $200 billion from the highs of 2024.

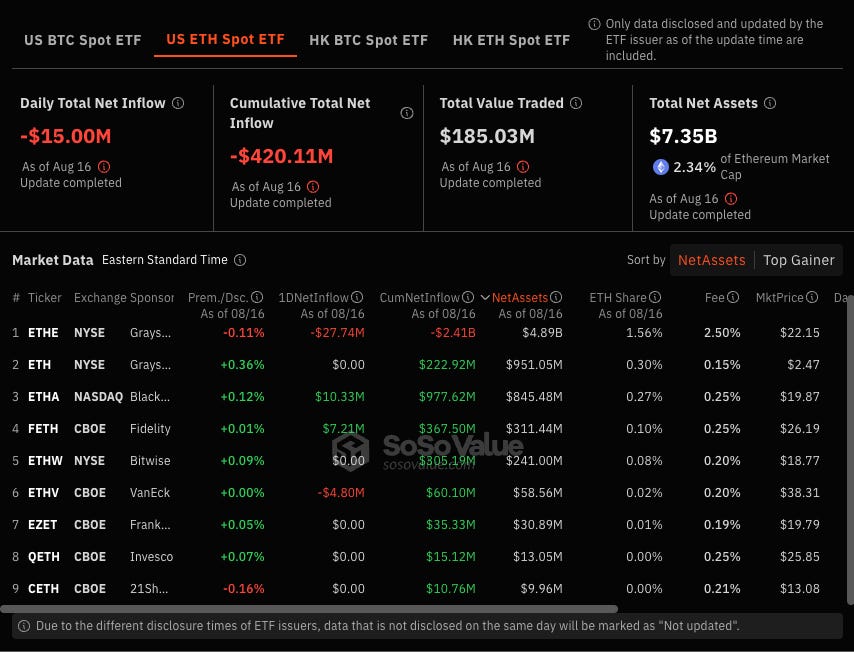

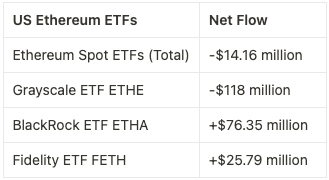

1/ ETF outflows contribute to selling pressure: Since the launch, US Ether ETFs have recorded a cumulative net outflow of $420.5 million, adding significant selling pressure to Ether's price.

Investors had anticipated that the launch of these ETFs would lead to a price surge similar to that seen with Bitcoin ETFs, which accounted for about 75% of new cryptocurrency investments earlier this year.

Read: Ether price drops 26% since ETF launch as supply increases by 60,500 ETH

2/ Dencun upgrade and market sentiment: The Dencun upgrade in March 2024 enhanced Ethereum's scalability and reduce transaction fees, but has not positively impacted Ether's price.

According to on-chain analytics firm CryptoQuant, Ether's price has struggled since the upgrade, dropping by 35% while the supply increased by over 197,000 ETH.

Read: Ethereum solved its technical roadblocks. Now it’s a victim of its own success

3/ Increased Ether supply affects price: The supply of Ether has also risen by 60,555 ETH, valued at over $155 million, since the ETF launch.

This increase has contributed to a supply growth rate of 0.61% annually, which may further pressure prices as more Ether enters circulation.

ETH’s total supply has risen consistently since April 2024.

The Merge has driven billions into Ether staking, with approximately $36 billion worth of Ether currently staked through liquid staking protocols.

Read: Ethereum supply surpasses 120M ETH as staking, restaking surge

4/ Ethereum gas fees at record low: Ethereum has seen transaction fees fall to as low as a single gwei (approximately $0.06). Gas fees have hit five-year lows.

Kaiko Research report highlights that the fee reduction has implications for ETH.

Traditionally, when transaction fees exceed validator rewards, Ether supply decreases, creating a deflationary environment.

Currently, low transaction volumes are leading to an increasing supply, challenging this model.

The decrease in fees has resulted in Ether becoming inflationary, as the network no longer burns more tokens than it creates.

The lower fees mean less ETH is burned, increasing the token’s supply.

The community suggestions for countering inflation include raising the gas limit to enhance transaction capacity and reduce fees, although this may increase operational costs for validators.

Despite demand drivers like spot ETH ETFs, this growing supply could dampen potential price increases in the near term.

5/ Impact of Layer 2s: The drop in gas fees is attributed to several factors, including a shift in demand from Ethereum to other blockchains like Solana and Layer 2 solutions.

The recent Dencun upgrade has improved network efficiency.

The rise of layer 2 networks that reduce congestion on the main network, have further reduced the transaction costs.

Read: Ethereum L2 ecosystem processes a record 12.4M transactions in a day

Migration of meme-driven activity and decentralised applications to faster and cheaper alternatives has contributed to the reduced fees.

With more decentralised finance (DeFi) protocols and users moving to layer 2 solutions, the Ethereum community faces pressure to ensure the network's long-term economic health.

Read: Ethereum gas fees - Too low or too high? No one can decide.

The future outlook

Ryan Lee, chief analyst at Bitget Research reckons it’s potential for a bullish trend ahead.

“Every time ETH gas fees drop to rock bottom has often signalled a price bottom in the mid-term. ETH prices tend to strongly rebound after this cycle, and when this moment coincides with an interest rate cut cycle, the market's wealth effect is full of possibilities.”

The upcoming Federal Reserve meeting in September is viewed as a potential catalyst that could push Ether higher.

Increased flows into spot Ether ETFs and changing market sentiment could bring potential tailwinds for the cryptocurrency.

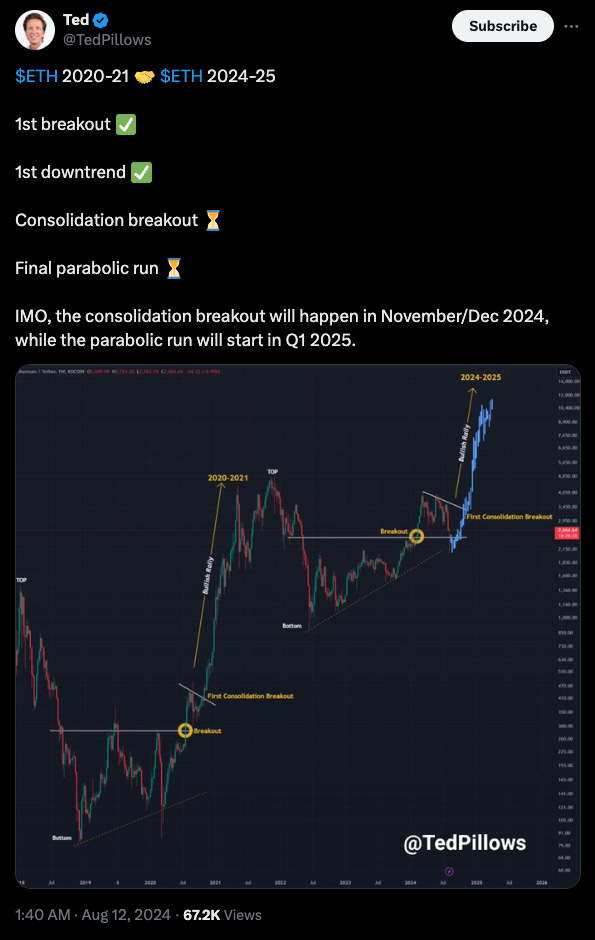

Crypto trader Ted, predicts a potential breakout for Ether in the first quarter of 2025.

Historical chart patterns suggest that a consolidation breakout could occur in late 2024, leading to a parabolic price increase in early 2025.

The Quiz Game For The Music Lovers

Musicnerd.io - is more than just a platform; it's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to the fans, fostering a sense of connection that goes beyond mere listening.

Block That Quote 🎙️

CEO and co-founder of crypto data platform Tres Finance, Tal Zackon

“In the future, Ether will be like oil prices. It’s a utility currency that will underpin the workflows of the financial future.”

Zackon compares Ethererm to "digital oil" just as Bitcoin is being bracketed as digital gold.

"The price of Ether is a direct reflection of how expensive it is to use the Ethereum network.”

Yves Longchamp, managing director and head of research at crypto bank AMINA, suggests that Ethereum's price performance should be viewed independently due to its unique purpose in the cryptocurrency ecosystem.

"Ethereum serves a different purpose than Bitcoin and Solana. Their price performances should thus be viewed individually rather than compared.

This [layer 2 development] removes pressure from the base chain to settle every transaction, which results in lower network load and lower gas fees. In essence, the fact that Ethereum price has been relatively stable shows positive development on the technical level.”

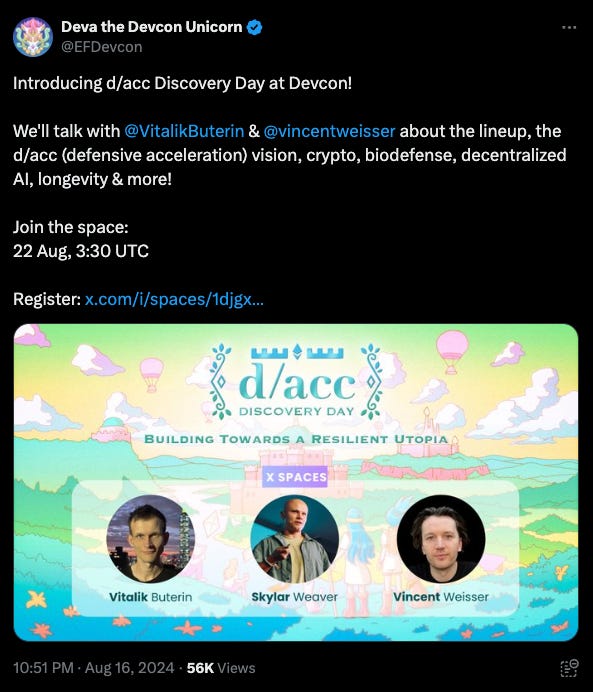

What is Defensive Accelerationism?

Ethereum co-founder Vitalik Buterin registered the ENS domain “dacc.eth” for 0.187 Ether, worth nearly $500, to promote the concept of “defensive accelerationism” (d/acc).

The philosophy aims to mitigate risks associated with AI and promote technologies that enhance resilience and democratic governance.

D/acc emphasizes decentralisation and responsible tech growth, contrasting with the more unrestricted approach of effective accelerationism (e/acc).

Buterin will discuss d/acc at an X Spaces event on Aug. 22, focusing on human-AI collaboration and advocating for cautious technological development.

Dark DAOs: A research team from Cornell University, including Ethereum co-founder Vitalik Buterin, is exploring threats to decentralised autonomous organisations (DAOs) posed by potential bribery attacks through smart contracts.

They introduced a new cryptographic concept called proofs of complete knowledge (PoCK) to enhance voting security and mitigate risks associated with "dark" voting systems as DAOs become more mainstream.

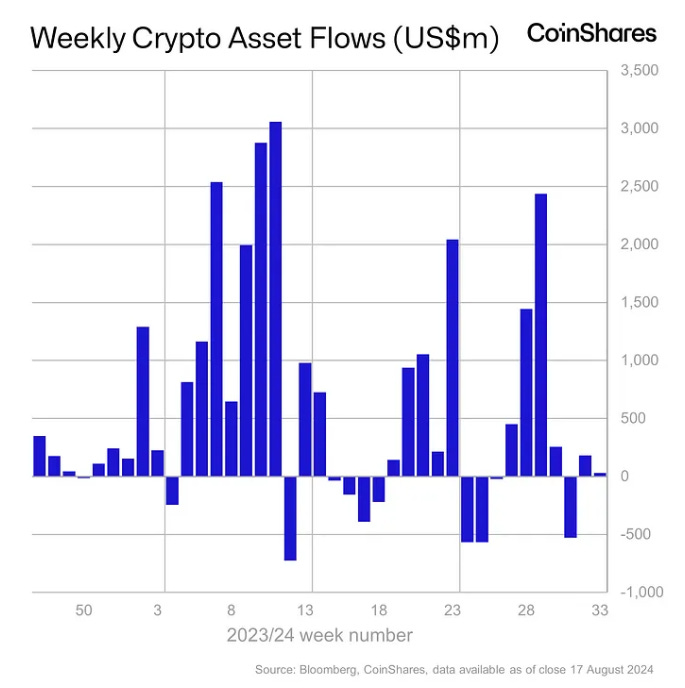

In The Numbers 🔢

$30 million

The total inflow in digital asset investment products last week, according to CoinShares.

Cumulative inflows - Bitcoin ($42 million) and Ethereum ($4.2 million).

Solana saw outflows of $39 million. setting a record for the highest weekly outflow due to sharp drop in memecoin trading volume.

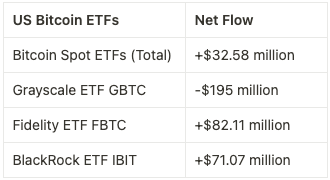

US spot crypto ETFs flow (August 12 to August 16)

Ethereum Devs Prep For Landmark EVM Upgrade

Ethereum developers are preparing for the Pectra hard fork, which will introduce the EVM Object Format (EOF), marking significant changes to the Ethereum Virtual Machine (EVM).

EOF goals: EOF aims to modernise the EVM, making smart contract development more accessible and secure for developers using Solidity and Vyper.

Risk mitigation: To prevent disruptions to existing smart contracts, a new version of the EVM will allow developers to select which version to use for their deployments.

Future upgrades: Core developer Parithosh Jayanthi highlighted that EOF will set the stage for future EVM enhancements.

Concerns raised: Some developers, like Marius Van Der Wijden, worry about potential unintended consequences from maintaining both the new and old EVM versions.

Developer support: Many believe EOF is ready for implementation, with Danno Ferrin noting it addresses significant technical debt in the EVM.

The Surfer 🏄

Gate Ventures and the Blockchain Center in Abu Dhabi have launched Falcon Gate Ventures, a $100 million fund for support high-potential blockchain projects and enhance the UAE's role as a leader in the digital economy

The Colorado House of Prayer, led by Pastor Blake Bush, is tokenising the Old Stone Church to raise $2.5 million for its purchase using a digital asset called "Stone Coin" on the Polymesh blockchain.

Investor Balaji Srinivasan has announced the creation of THE NETWORK SCHOOL on an island near Singapore, aimed at providing educational opportunities for "Dark Talent" globally, focusing on Learn, Burn, Earn, and Fun.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋