Asia takes charge 🔋

What's up in the East? Crypto regulations in Singapore, Japan, South Korea, Hong Kong. Bitcoins, blips, and whale dips. Avalanche $50M initiative. Generative art platform makes debut - Highlight.

Hello, y'all. Make sure you've claimed your collectible on Asset, and don't forget to give your books a »» Muzify «« spin? 🙌

We survive crypto day in and day out. We need this👇 do you?

This is The Token Dispatch, you can hit us on telegram 🤟

A shift in crypto tectonics is underway?

It is said that US regulatory uncertainty might nudge crypto trading eastwards.

Its new playgrounds?

Singapore, Japan, South Korea, and now, Hong Kong, fresh with a brand-new crypto regulatory framework.

Crypto braves China's hard-nosed ban and India's steep taxes.

Institutional investors tag along, lured by Asia's lower regulatory risk and a demographic potential larger than anything seen before.

Now let's have a look at what's actually happening in the East👇🏻

China's Digital Yuan Gains Momentum

An impressive leap: China's Central Bank reports a massive surge in digital yuan transactions, hitting 1.8 trillion yuan ($250 billion) by the end of June. An exponential jump compared to approximately 100 billion in digital yuan transactions in August last year.

The circulation: The bank's official also reveals the circulating digital yuan amounted to 16.5 billion yuan, supporting an impressive 950 million transactions.

The wallets: Over 120 million wallets have been opened, serving as a testament to China's burgeoning embrace of its CBDC.

Expanding use cases: In July, Jinan city integrated digital yuan payments for public transport fares, while Shanghai Clearing House added support for digital yuan settlements. Simultaneously, the Bank of China began testing digital yuan on SIM cards and NFC payments.

Yuan to Hong Kong

e-CNY CBDC is making waves in Hong Kong's retail scene. Through the Bank of China's subsidiary, over 200 merchants from shopping malls to corner stores are now accepting this futuristic form of payment from Mainland Chinese visitors.

Despite Hong Kong's unique political, economic, and social systems, the digital yuan's expansion may herald a new era of money. With calls for a Hong Kong Dollar CBDC to challenge Tether and USD Coin, and President Xi Jinping's endorsement of CBDCs for international trade, Hong Kong may soon see a local digital dollar.

Blockchain into the orbit

For the first time, a blockchain imaging and screening system was launched into orbit by a Chinese satellite.

Chengdu's very own Guoxing Aerospace has successfully launched the world's first in-orbit visual blockchain satellite, the "Tai'an" (Star Era-07). Zipping around in the cosmos, this crafty satellite, powered by the sleek ADASAT-30 platform, will conduct next-level hyperspectral remote sensing and offer the first-ever spaceborne blockchain services.

Binance in Japan

The Big Reveal: Binance will resume operations in Japan next month, rekindling its relationship with the nation after a three-year hiatus.

The Break-Up: Binance retreated from Japan in 2018 following significant regulatory disagreements. A comeback seemed unlikely, until now.

The Preparation: The exchange, planning to operate post-June this year, advised interested customers to re-apply for account opening and fulfill all verification requirements.

The Terra State

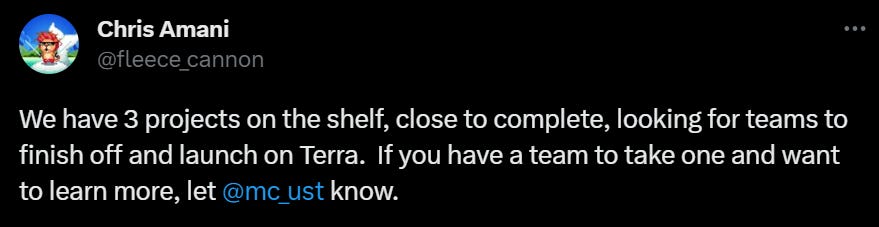

Terraform Labs, the blockchain tech company, is attempting to clamber up a steep incline, with every stride towards progress seemingly tripped up by accusations against co-founder Do Kwon. In a recent Twitter Space conversation titled "A Terra Community Talk", Interim CEO Chris Amani shed light on the company's uphill battle, its plans, and the personal tribulations of Kwon.

Kwon, currently imprisoned in Montenegro, is facing legal issues that have significantly disrupted Terraform's momentum. Amani described the situation as challenging, stating, "Every time we would make a little progress, there would be some accusation or something that would derail us."

McDonald's + Sandbox

McDonald's Hong Kong and The Sandbox introduce "McNuggets Land" in the metaverse.

40 years of McNuggets: McDonald's Hong Kong joins hands with The Sandbox to celebrate 40 years of Chicken McNuggets by creating 'McNuggets Land', an immersive Web3 experience.

Virtual Journey: The virtual world takes users on an adventure through a secret factory and a historical journey of the beloved chicken treat.

Game On: The metaverse offers quests and challenges, where gamers can win The Sandbox utility tokens, used for purchasing virtual goods and personalising avatars.

Golden Ticket: Users from Hong Kong can score exclusive 365-day free Chicken McNuggets coupons, redeemable at any McDonald's restaurant.

To explore the virtual world, users only need an email address.

Indonesia's exchange

Indonesia's brand-new crypto exchange and clearinghouse has flung open its virtual doors! Despite a string of delays, and missing the original 2021 launch deadline, the exchange sprang into action on July 17, according to the country's commodities regulator.

This platform takes a leaf out of traditional securities market playbooks like NYSE, Nasdaq, and Tokyo Stock Exchange, all with the government's thumbs up.

Didid Noordiatmoko, head honcho of Bappebti, Indonesia's Commodity Futures Trading Supervisory Agency, sees the exchange as a crucial step towards a fair and legal crypto trading ecosystem, placing customer protection on the front lines.

Meanwhile in India

A survey conducted by Indian crypto exchange WazirX has found that over half of Indian crypto investors are looking for long-term returns. The survey, which included respondents aged between 18 and 60 years, revealed that 85% of female investors were HODLers (investing for the long term), compared to 53.8% of male investors. The report also highlighted that 40% of respondents aged between 45 and 60 years have invested more than Rs 40,000 in virtual digital assets.

TTD Highlight⚡

Generative art?

The code and algorithms coming to life. On chain.

How about fully open access generative art platform on Ethereum? Free for anyone to create, test, and launch code-based art projects.

There's new tool for them players now. Meet Highlight.

Over 20 of the world's leading generative artists are working with Highlight to drop collections on the platform this summer, including Simon de Mai, Emanuele Pasin, Melissa Weiderrecht, James Merrill, Leander Herzog, Duane King and Holger Lippmann

Got questions? Highlight is hosting a Twitter Spaces today at 16:00 GMT

TTD BTC ₿

Remember when exploring was all about adventure and discovery? Well, the sMiles app says, "Why not make it about Bitcoins too?" Their spanking new feature called Bitcoinverse is the treasure map to every crypto-enthusiast's heart. It leads users on a fun-filled chase to unearth stashes of satoshis (small fragments of Bitcoin), sprinkled across real-world locations.

Treasure Hunt in the Bitcoinverse

The Bitcoin flash crash

If you've got a weak heart, the world of Bitcoin can be a rollercoaster ride. Case in point: the recent Bitcoin flash crash to $29,000. But, the charts suggest that Bitcoin is likely to get its mojo back and reclaim its $30,000 throne in the short term. Traders aren't loosening their grip on leveraged longs, and Bitcoin whales seem to be in a buying frenzy. Some blame this crash on the fickle U.S. dollar. Its predictable monetary policy and autonomy remain untouched.

Whales on the move

Bitcoin whales, those deep-pocketed investors, have been shifting their holdings at a frenetic pace. We're talking nearly $60 million worth of Bitcoin over five short days! These transfers, some as old as from 2010 and 2011, range up to 50 BTC each. This flurry of activity suggests that these whales are either cashing out or diversifying their digital asset portfolio.

The Ripple effect: A Mini Altcoin Rally

Now, let's move away from Bitcoin. Last week's favourable ruling for Ripple has seen trader interest splashing in the direction of altcoins. The Bitcoin dominance index seems to have taken an 8% dip, slinking to a multi-month low of 27%. This shift has ignited a mini altcoin rally, with XRP at the vanguard, followed by the likes of Polygon, Solana, and Stellar Lumens.

TTD Adoption 🫂

Blockchain Diplomas 🎓

High school graduates in North Dakota are getting more than just their diplomas this year. They're getting a high-tech, blockchain-powered digital wallet to store all their educational credentials. All they need to do is flash a QR code for employers or colleges to verify their credentials. They're exploring the possibility of adding career readiness and work-based learning experiences to the digital wallet.

Namibia embraces new law ✍🏻

In Namibia, the government passed the Virtual Assets Act of 2023, embracing rather than banning cryptocurrencies. The law establishes a regulatory authority with powers to license, investigate, and enforce actions against Virtual Asset Service Providers (VASPs). It also introduces a variety of license classifications for different functions like initial token offerings, virtual asset broker-dealers, wallet services, and advisory services.

Avalanche Vista 🎟️

The Avalanche Foundation has launched Avalanche Vista, a $50 million initiative to promote the tokenisation of real-world assets on its blockchain. The initiative demonstrates the potential of converting tangible assets into digital tokens, offering benefits like increased liquidity and transparency. As the world continues to embrace digital technologies, initiatives like these represent exciting steps towards a digitised future.

TTD Microsoft 💻

Microsoft just shattered its own financial records to post its best-ever quarterly sales, and they've got Artificial Intelligence to thank for this triumph.

The deets

Microsoft's overall revenue for the quarter was $56.2 billion, surpassing the projected $55.5 billion.

The company's earnings per share (EPS) for the quarter reached $2.69, exceeding the expected $2.55.

Gross sales and net income ($20.1 billion) both achieved all-time highs.

Microsoft's top line (revenue) increased by 21% over the past year.

The company's bottom line (net income) saw an 8% increase year-over-year.

Compared to the last quarter, profits grew by 10% and sales by 6%.

The Intelligent Cloud segment, which includes Microsoft's AI offerings, saw a 21% increase in operating income year-over-year.

Microsoft's market capitalisation reached $2.6 trillion by the end of trading on the day of the earnings announcement.

But then … 🫣

Microsoft shares fall after earnings report even as AI bet bears fruit

TTD Surfer 🏄

Dogecoin has experienced a surge of 9% after Elon Musk tweeted about it.

KuCoin has denied rumours of mass layoffs, stating that any potential cuts are part of normal business operations.

Italian asset manager Azimut, which manages over $87 billion in assets, has been hit with a ransomware attack by the hacking group BlackCats.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us lovee on Twitter, Instagram & Threads🤞

So long. OKAY? ✋