Banks Get OCC Nod to Play Crypto

The regulatory change lets banks offer crypto services without prior approval, delivering on Trump's promise to stop financial discrimination.

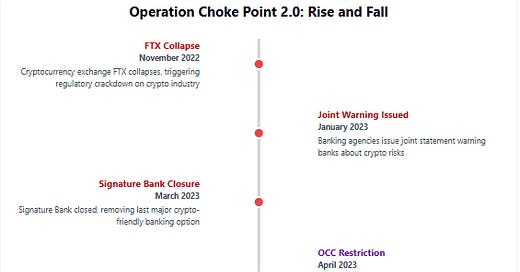

America's top banking regulator shattered the crypto industry's financial chains on Friday. The Office of the Comptroller of the Currency (OCC) released Interpretive Letter 1183, formally ending the "supervisory nonobjection" requirement that had kept bankers away from crypto since 2023.

The announcement came during the first-ever White House Crypto Summit.

"They weaponised government against the entire industry. They strong-armed banks into closing crypto businesses," said President Trump at Friday's Summit.

Rodney Hood's appointment as OCC’s Acting Comptroller appears specifically designed to execute this reversal — a promise kept from Trump's campaign trail.

"Today's action will reduce the burden on banks to engage in crypto-related activities," said OCC’s Acting Comptroller Rodney Hood.

The agency also withdrew its ominous 2023 statement on crypto liquidity risks that had effectively frozen most banks from touching digital assets.

The 2023 guidance served as the primary weapon enabling this financial blockade. Today's reversal yanks away the regulatory justification for the account closures that drove countless crypto firms offshore in search of basic banking services.

What Changes for Industry

Banks earlier needed explicit regulatory blessing before touching crypto. Think of huge piles of paperwork, excessive risk controls and near-impossible approval hurdles.

They can now engage with crypto without any special permission, offering custody services, stablecoin activities, and node verification with the same risk management they apply to traditional banking.

For crypto companies, the change means immediate access to banking services without regulatory roadblocks.

The change was desperately needed.

When Anchorage Digital's CEO asked, at the crypto summit, ‘how many founders had experienced banking problems’ - every single hand went up.

The path is now clear for repatriation of crypto businesses that fled offshore, bringing billions in economic activity back to American shores.

Battle’s Not Won Yet

Custodia Bank CEO Caitlin Long cautioned: "Operation Chokepoint 2.0 isn't over until the Fed and FDIC also rescind their anti-crypto guidance."

The existing restrictive guidance leaves some crypto firms still struggling to access payment systems. Full normalisation will require coordinated action across all regulators.

The crypto banking revolution has begun, but it's not yet complete.