Happy Sunday dispatchers!

One tweet. 69 minutes. $17 million. Then chaos. What happened next on Base's official account has the entire crypto community questioning everything about "content coins," insider trading, and the responsibilities of major platforms.

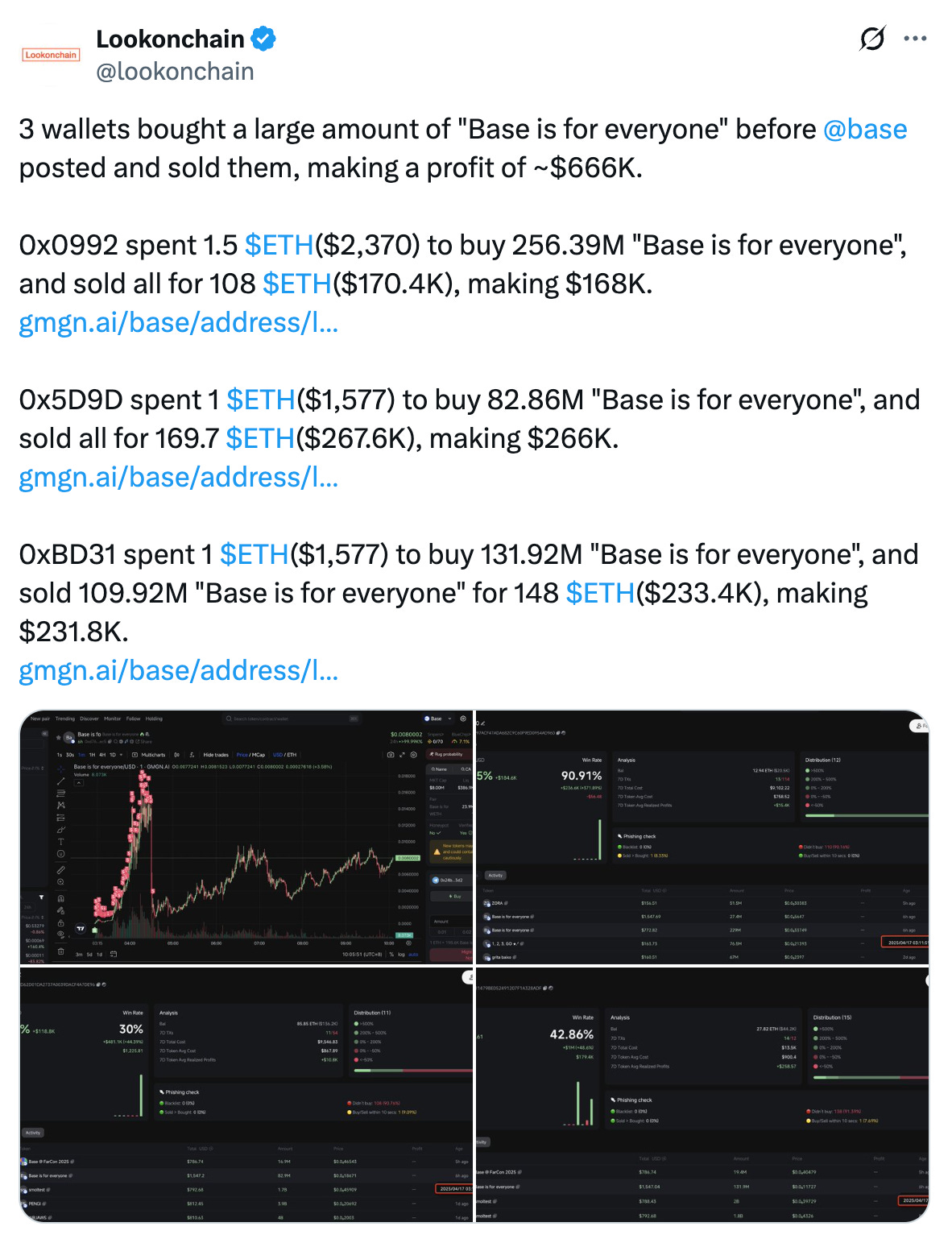

Three mystery wallets somehow knew exactly when to buy, walking away with $666K in profit while thousands of retail traders got absolutely wrecked.

Base claims it was all just an innocent experiment in "onchain culture" - but the onchain evidence tells a much murkier story. Was this a new frontier for creator monetisation or a pump-and-dump with a fancy new name?

In today's deep dive, we're pulling apart every angle of crypto's most controversial "non-token token" launch.

Earn, Swap, Borrow - All at One Place!

“Wait, so I don’t need three tabs open just to trade tokens?”

Exactly. Kamino just made swapping crypto super simple.

You open the app, pick what you want to swap, and done. No bouncing between platforms, no weird buttons, no wondering if you did it right.

It’s like if your wallet, trading app, and DeFi dashboard all got together and said: “Let’s make this make sense.”

Why’s this a big deal?

You can swap tokens without leaving Kamino

No shady popups or confusing steps

It’s fast (like, Solana-fast)

It’s built for people who don’t live on Crypto Twitter

Just clear, easy swaps that work - check it out.

On a perfectly ordinary Wednesday afternoon, Base – Coinbase's Ethereum Layer 2 network – tweeted four innocent words: "Base is for everyone."

What happened next serves as a perfect case-study in crypto's still-evolving etiquette, where the line between experimentation and irresponsibility remains frustratingly blurry.

Sixty seconds after that initial tweet, Base dropped a link in the comments to a Zora post with the exact same phrase. For the uninitiated, Zora is an "onchain social protocol" that automatically turns any content posted on its network into tradable tokens. Post something clever, and people can buy and sell shares of your brilliance.

Base's leadership likely saw this as a harmless experiment in "onchain culture." The crypto community saw something else entirely: a $17 million memecoin spontaneously materialising out of thin air, bearing the name of one of crypto's most recognised brands.

This is where the story gets interesting – and messy.

The market reaction was exactly what you'd expect when a major L2 "launches" a token.

Market cap ripped from $0 to $17 million in just 69 minutes

Then crashed nearly 90% shortly after (down to under $2 million)

Recovered over the next few hours, reaching as high as $20 million

Finally settled around $8-10 million as of this writing

Get 17% discount on our annual plans and access our weekly premium features (Mempool, Game On, News Rollups, HashedIn, Wormhole and Rabbit hole) and subscribers only posts. Also, show us some love on Twitter and Telegram.

For onlookers, this looked suspiciously like a classic pump-and-dump. For Base, it was an object lesson in the law of unintended consequences.

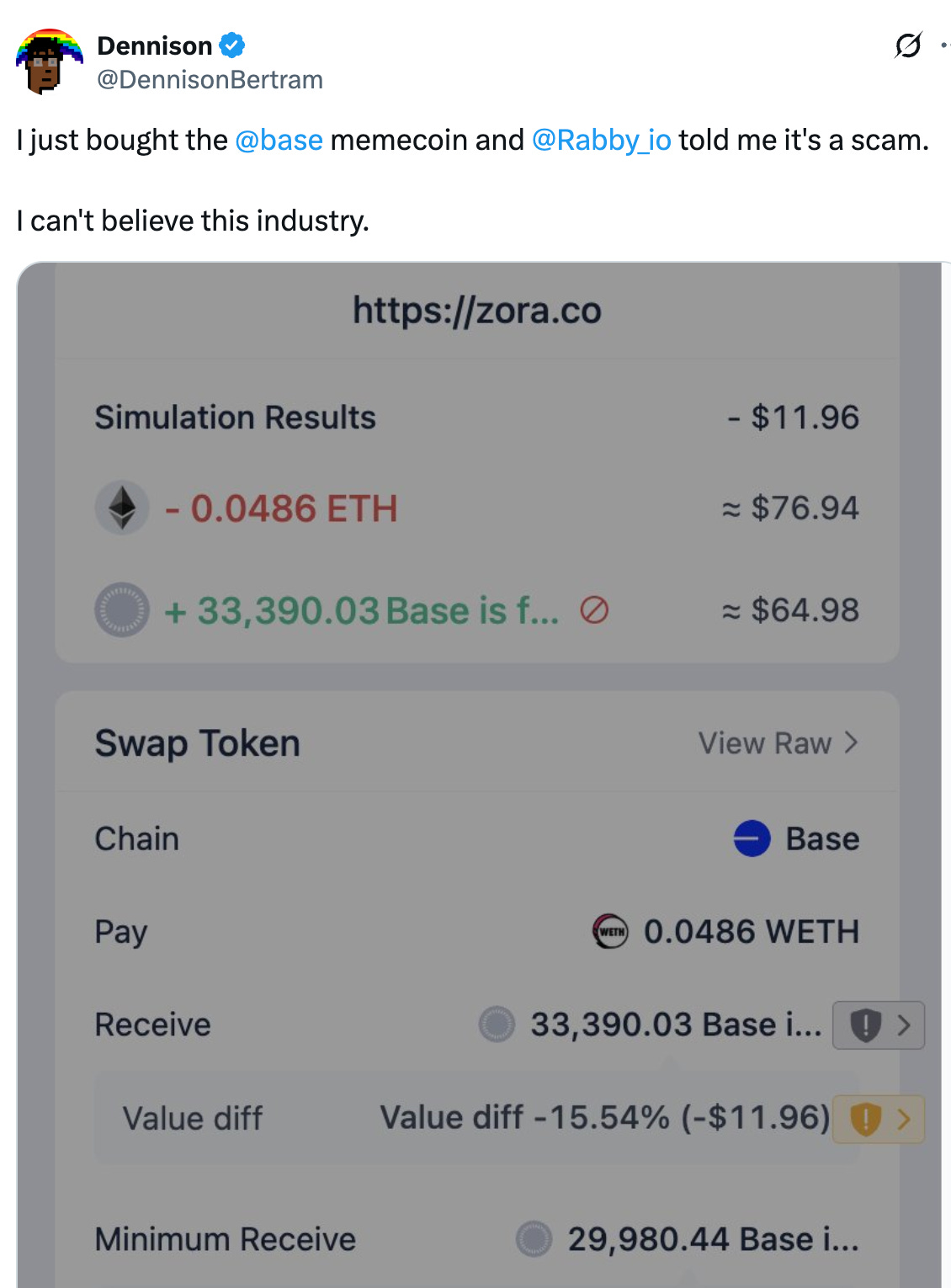

For the thousands of retail traders who bought in near the top, it was an expensive education in the difference between a "content coin" and a "memecoin" – a distinction that matters precisely to no one who just lost money.

Base creator Jesse Pollack tweeted.

The Anatomy of a Controversy

What made this incident particularly eyebrow-raising wasn't just the price action but what onchain sleuths discovered afterward.

Three wallets bought large amounts of the token before Base's official announcement, then sold at the peak for a combined profit of around $666,000, blockchain analytics platform Lookonchain showed. These wallets collectively held 47% of the token's supply.

Meanwhile, Base itself received 10 million tokens (1% of the total supply) as the content creator, earning approximately $81,000 from trading fees. Though Base pledged never to sell these tokens, the optics weren't great.

So we have three wallets that:

Somehow knew to buy before the public announcement

Collectively held almost half the supply

Sold near the peak, making over $666K in profit

And the community was not happy with the chaos.

So while Base claims they never sold their 1% allocation, they still profited from the trading fees generated by the frenzy they created.

And the timing of those pre-announcement purchases raises serious questions about whether someone had advance knowledge of Base's post.

Sure, maybe three random wallets just happened to buy massive amounts of this specific token right before it was promoted by one of crypto's biggest brands. And maybe I'll win the Powerball tomorrow.

As if the "Base is for everyone" saga wasn't chaotic enough, Base followed it up by launching a second token the same day: "Base @ FarCon 2025."

This token, also created on Zora, was meant to promote Base's presence at FarCon, an annual conference for the decentralised social media platform Farcaster.

FarCon also had to experience a downfall just like it’s brother.

Semantic Gymnastics

In response to the backlash, Base and its supporters employed a defence that felt reminiscent of Mark Zuckerberg insisting Facebook isn't a media company: “This wasn't a memecoin, it was a "content coin."

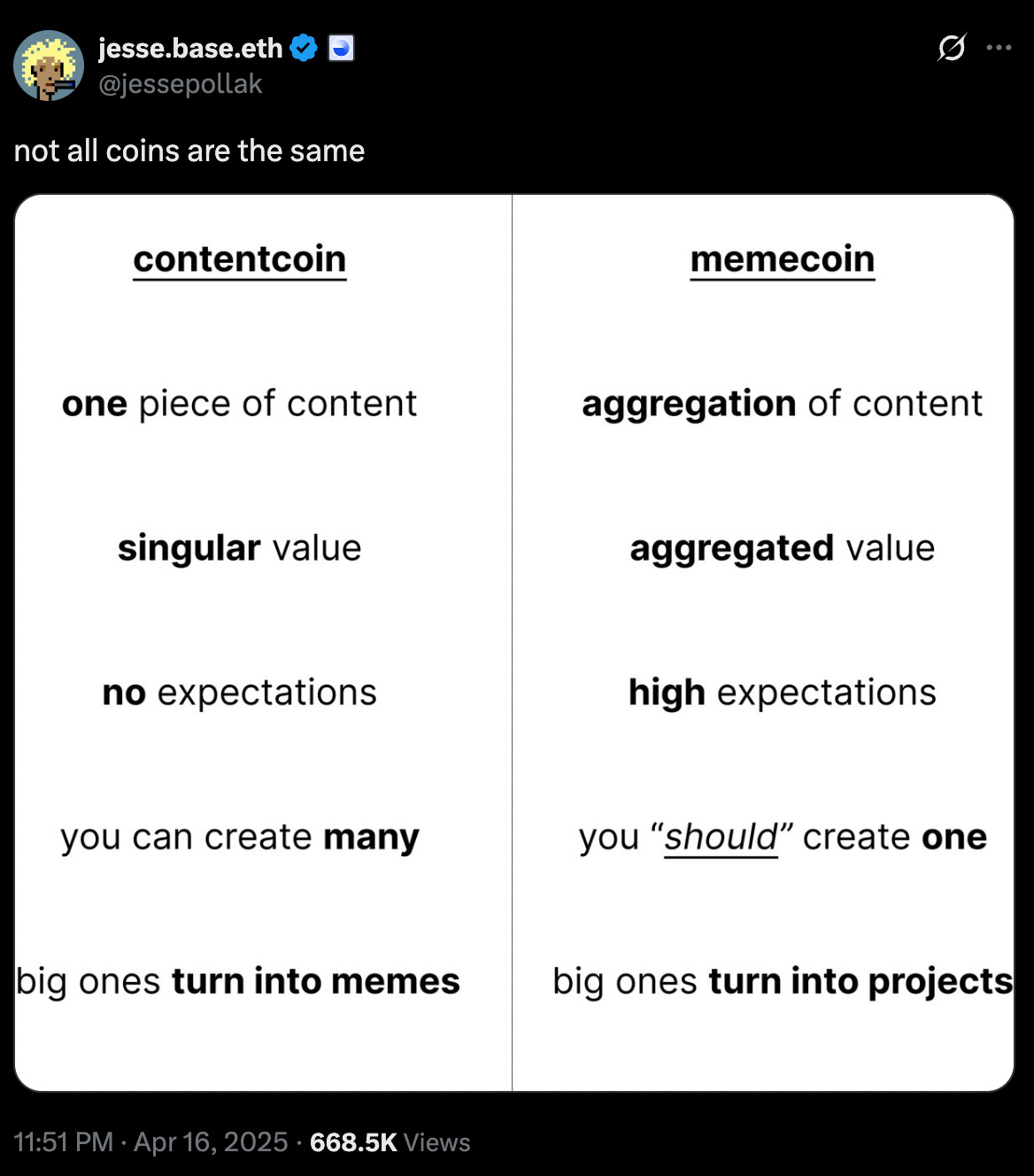

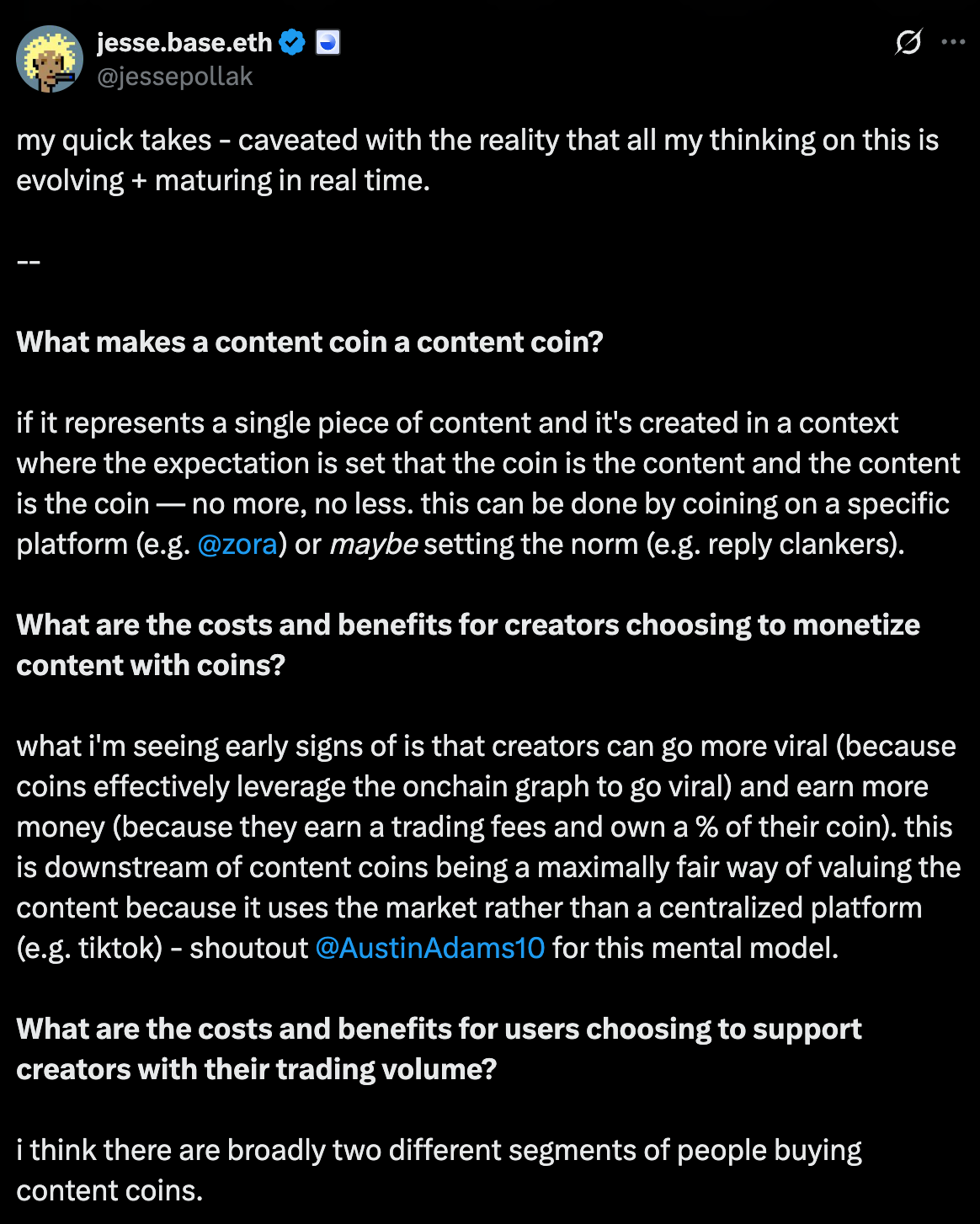

Jesse Pollak, Base's creator, offered this distinction: content coins represent "one piece of content" with "singular value" and "no expectations," contrasting with meme coins that aggregate content and carry high expectations.

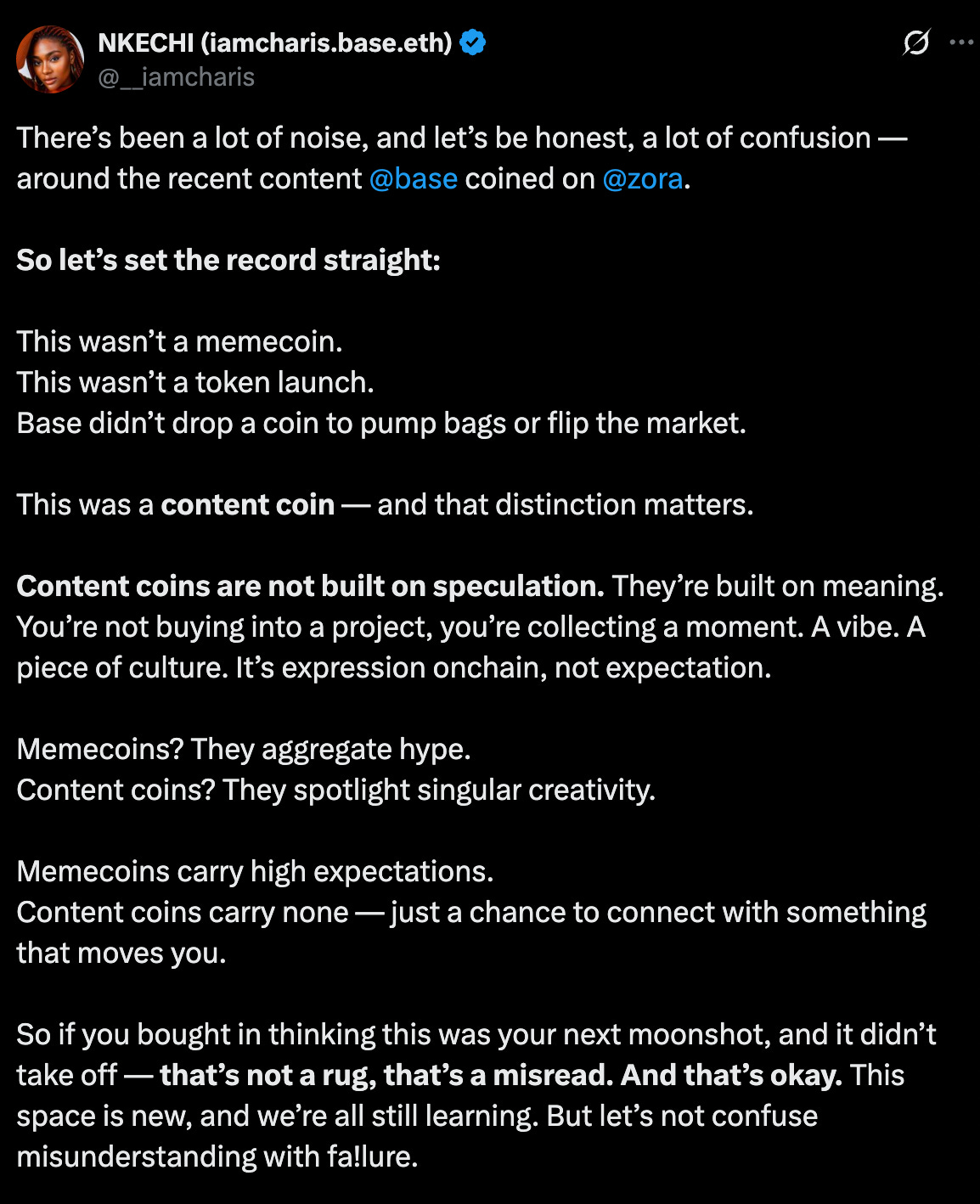

Another Base developer named Charis was more direct: "This wasn't a meme coin. This wasn't a token launch. Base didn't drop a coin to pump bags or flip the market. This was a content coin — and that distinction matters."

To which most crypto traders responded with the digital equivalent of an eye-roll.

Got questions about a hot crypto topic that you want help understanding? Ask your question using the form and our crypto experts may answer it along with your name in the next Thursday’s News Rollups.

Content Coins Vs. Memecoins: What's the Difference?

Let's break down this whole "content coin" vs. "memecoin" debate, because it's central to Base's defence.

Jesse Pollak said a content coin gets its designation "if it represents a single piece of content and it's created in a context where the expectation is set that the coin is the content and the content is the coin — no more, no less."

He argues that content coins can be a way for creators to go viral and that explicit financialisation isn't inherently bad.

Jacob Horne, co-founder of Zora, in February wrote an essay arguing that content coins can resolve the tension between information wanting to be free and the expense of producing it. In his vision, content coins create open markets that reward creators, distributors, and consumers while keeping information freely accessible.

In theory, this sounds nice. In practice, what happened with the "Base is for everyone" token looks a lot like a pump and dump:

Token launches with implicit backing of major brand

Price skyrockets

Early buyers (with mysterious foresight) sell

Late buyers get wrecked

Everyone argues about semantics after the fact

Zora's post retweeted a pseudonymous user named Larp von Trier who provided this pithy summary: "Solana manlets had no idea about how Zora works and got rekt."

That's not exactly the empathetic response you'd expect from a platform that claims to be about helping creators.

Token Dispatch View 🔍

The "Base is for everyone" incident reveals a critical gap in how we think about responsibility in crypto. Traditional finance has clear lines of accountability – if a bank promotes an investment that blows up, there are consequences. In crypto, those lines remain blurry at best.

When Base tweets a link that creates a token that pumps to $17 million then crashes 90%, who bears responsibility? Is it Base for posting the link? Zora for automatically tokenising the post? The traders who bought in without understanding what they were buying? The wallets that front-ran the announcement?

The answer, frustratingly, seems to be "it's complicated."

This ambiguity is both crypto's greatest strength and its most persistent weakness. The space moves quickly precisely because the barriers to experimentation are so low. But that same freedom creates an environment where things like this "content coin" debacle can happen with alarming regularity.

The mere association with Base/Coinbase was enough to drive millions of dollars into a token with no utility, no roadmap, and no future.

This isn't unique to Base – we've seen similar phenomena with tokens purportedly associated with Solana, Bitcoin, and virtually every other major crypto project.

This power comes with responsibility. Base's core mission – "to build a global onchain economy that increases innovation, creativity, and freedom" – is laudable. Their technical innovations are impressive. Their growth metrics (900,000 daily active addresses, $2.4 billion in TVL) show legitimate traction.

All of which makes this memecoin misadventure so puzzling. Base doesn't need to chase quick wins or social media hype. They're building something that could genuinely matter in the long run.

The "content coin" defence feels particularly hollow considering that the entire incident occurred just as Base published its ambitious Q2 roadmap. The plan outlines impressive technical innovations like Flashblocks (reducing block times to 200ms), Base Appchains (Layer-3 chains for specialised applications), and enhanced privacy features.

It's hard not to see the jarring contrast between Base's serious technical aspirations and this seemingly cavalier foray into tokenised social posts.

The line between innovation and irresponsibility may be thin, but navigating it successfully is what separates truly transformative projects from interesting but ultimately failed experiments.

In crypto, as in life, good intentions aren't enough. "Base is for everyone" is a fine slogan – but only if "everyone" includes the retail traders who don't understand the difference between a memecoin and a content coin, and who deserve better than to be collateral damage in an experiment in "onchain culture."

Week That Was 📆

Thursday: The Fartcoin Phenomenon 💨

Wednesday: Trump Rolls Dice on Crypto Monopoly 🎲

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.