Happy Sunday dispatchers!

Here's a riddle: What has made some crypto traders both filthy rich and incredibly angry at the same time? It’s about bears and billions on the blockchain?

No, it's not another memecoin – though in 2025, you'd be forgiven for guessing that.

Today, we're diving into Berachain, one of the most anticipated blockchain launches of the year that started as a collection of cartoon bears smoking bongs and somehow attracted $1.7 billion before it even went live.

If that sentence alone doesn't capture the beautiful absurdity of crypto, we don't know what does. So here’s today’s exploration.

How a bear-themed NFT project evolved into crypto's hottest Layer-1

Why traditional investors poured $142 million into something called "Bong Bears"

What happens when you split blockchain governance and value

Roses Are Red, Security Is Key

Trezor has transformed crypto security from a complex puzzle to a user-friendly playground, so you can be the boss of your financial future?

This Valentine’s Day, help your audience give a gift that lasts. Get discounts of up to 50% on Trezor’s bundled best-selling hardware wallets.

From NFTs to Network Effects

In 2021, during the height of the NFT boom, a small collection of 107 smoking bear NFTs called Bong Bears launched on Ethereum.

Just another quirky NFT project? We thought the same.

Who knew it would eventually evolve into one of crypto's most ambitious blockchain protocols?

At its core, Berachain is an EVM-identical Layer 1 blockchain with a twist. While most new chains pitch themselves as "Ethereum killers" or "faster and cheaper alternatives," Berachain is trying something different: reimagining how blockchain security and liquidity work together.

While other chains claim Ethereum compatibility, Berachain takes it further. Any smart contract that works on Ethereum works here, unchanged.

Think of it as building a perfect mirror of Manhattan – every street exactly where Ethereum developers expect it to be.

The project's journey has been anything but conventional. After starting as an NFT collection, it caught the attention of serious investors, raising $142 million across two rounds.

April 2023: $42 million at a $420.69 million valuation (led by Polychain Capital)

April 2024: $100 million Series B (led by Framework Ventures and BH Digital)

What makes Berachain different from the countless other Layer-1 blockchains?

Traditional proof-of-stake networks face a fundamental challenge: they require validators to lock away tokens, effectively removing liquidity from the ecosystem.

The more successful a network becomes, the more liquidity gets locked up – creating a paradox where success can actually hinder usability.

For Berachain, the answer lies in its novel "Proof of Liquidity" (PoL) consensus mechanism – a system that's already attracted $3.1 billion in pre-launch liquidity through its Boyco platform.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts.

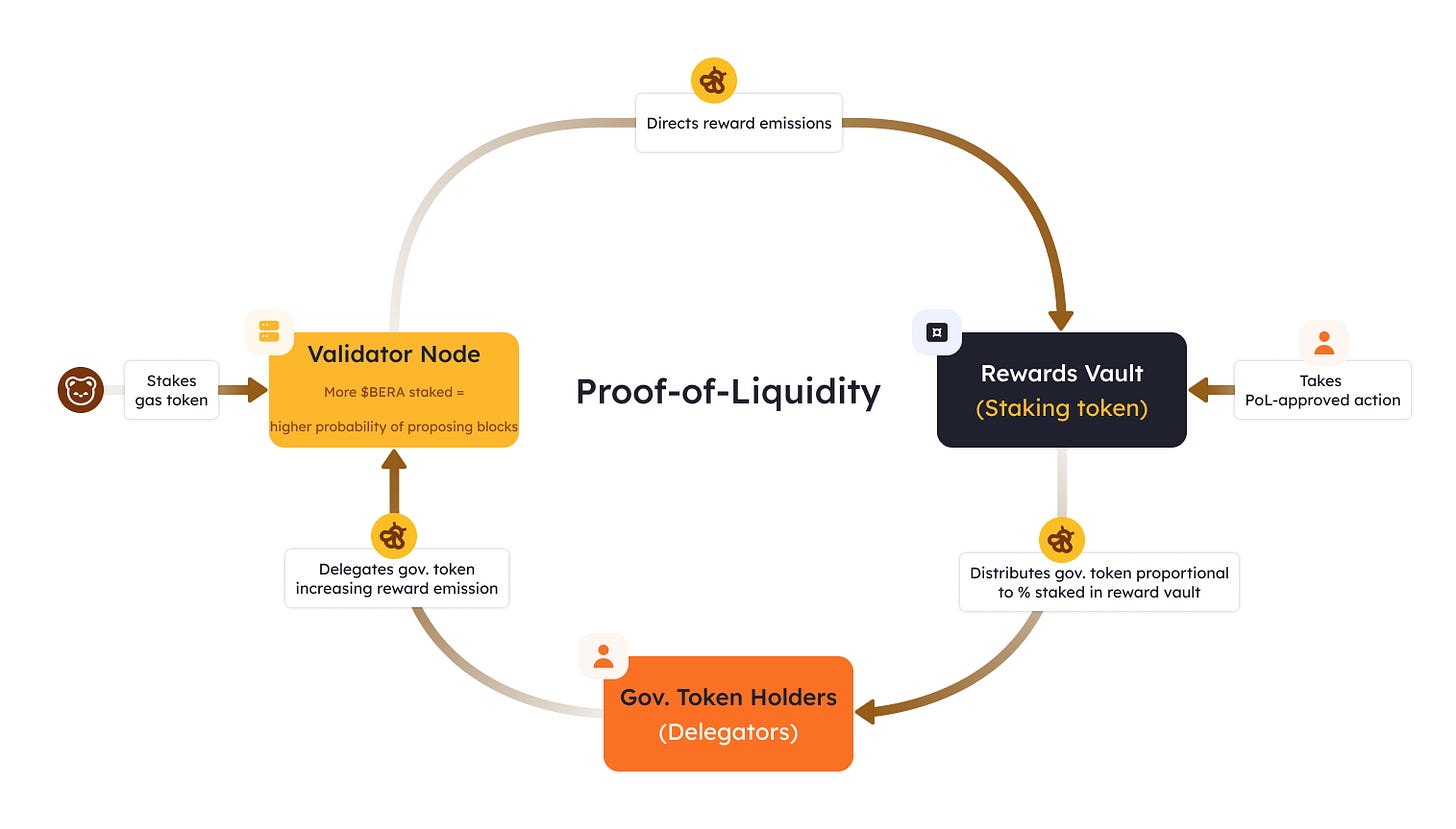

Proof of Liquidity

A novel consensus mechanism that attempts to solve one of crypto's biggest problems: fragmented liquidity.

Here's the issue: When you stake tokens in a Proof of Stake system, those tokens are effectively locked away, reducing the available liquidity for DeFi applications.

PoL tries to solve this by allowing users to stake their assets while simultaneously using them in DeFi protocols.

The Three-Token Tango

Unlike traditional blockchain architectures, Berachain operates on a tri-token system.

BERA - Serves as the network's native token for gas fees, launching with a genesis supply of 500 million tokens. What makes it unique is its relationship with the other two tokens in the ecosystem.

BGT (Berachain Governance Token) - A non-transferable "soulbound" token – meaning once you earn it, it's yours alone until you decide to burn it. Users earn BGT by providing liquidity to the network, and it can be used for governance or burned at a 1:1 ratio for BERA tokens.

HONEY - The ecosystem's native stablecoin, completes the trinity. It's designed to be minted against collateral like USDC and PYUSD, with new collateral types subject to governance decisions.

This three-token model isn't just clever tokenomics – it's an entirely new way of thinking about blockchain economics.

The real magic of Berachain is in the technical architecture that few are talking about. At its core sits BeaconKit, a framework that achieves something remarkable: true EVM-identical functionality.

When Ethereum upgrades, Berachain upgrades. When new features roll out, they roll out here too. It's a technical achievement that's easy to overlook but hard to overstate.

With roughly $80 billion locked across various DeFi protocols, most projects struggle with limited liquidity pools. Berachain's solution? Build DeFi directly into the blockchain's DNA.

Instead of waiting for third-party protocols to emerge, Berachain launches with core DeFi primitives baked in: BEX for trading, BEND for lending, and BERP for perpetuals. It's a complete DeFi ecosystem on day one.

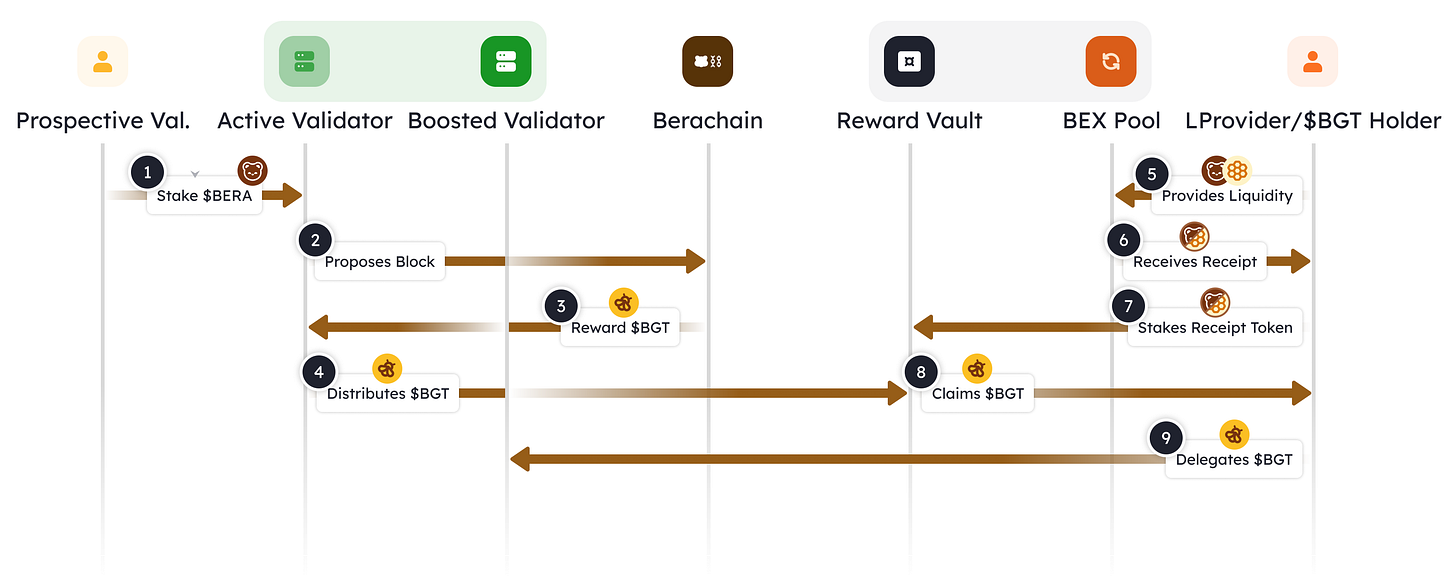

The Validator Value Loop

In traditional proof-of-stake networks, validators simply process transactions. In Berachain's system, they play a much more dynamic role.

Validators direct BGT emissions to liquidity providers based on incentives offered by protocols. A protocol might offer, for example, 30 USDC for every 1 BGT emitted to its vault, while another might offer 10 of its native tokens.

This creates a fascinating economic loop.

Users provide liquidity to earn BGT

They can delegate their BGT to validators

Validators direct BGT emissions based on protocol incentives

Protocols compete for liquidity by offering better incentives

It's a self-reinforcing system where everyone's incentives align toward the same goal: deeper liquidity across the entire ecosystem.

The Distribution Drama

No launch this significant comes without controversy.

The token distribution has sparked heated debate within the crypto community.

34.3% to investors

16.8% to initial core contributors

15.8% to airdrops

13.1% for community initiatives

20% for ecosystem research and development

The controversy centres particularly around the testnet users' allocation – a mere 1.65% of the total supply. For context, Binance users received 2%, and NFT holders received 6.9%.

This disparity became even more stark when the numbers were revealed: while some NFT holders received allocations worth up to $55.77 million, testnet users received as little as $60 worth of tokens according to a report.

The Rich-Poor Divide

The six largest NFT holders were allocated 19.78 million tokens – worth approximately $306 million at peak prices. This amount alone exceeds the total allocation for millions of testnet users.

This disparity has led to accusations of favouring whales over actual network participants. The Berachain team defended the decision, stating that "NFT holders have always been one of the oldest and most supportive members of the Berachain community."

But the difference between the highest and lowest airdrop amounts represents one of the largest wealth gaps in recent crypto launches.

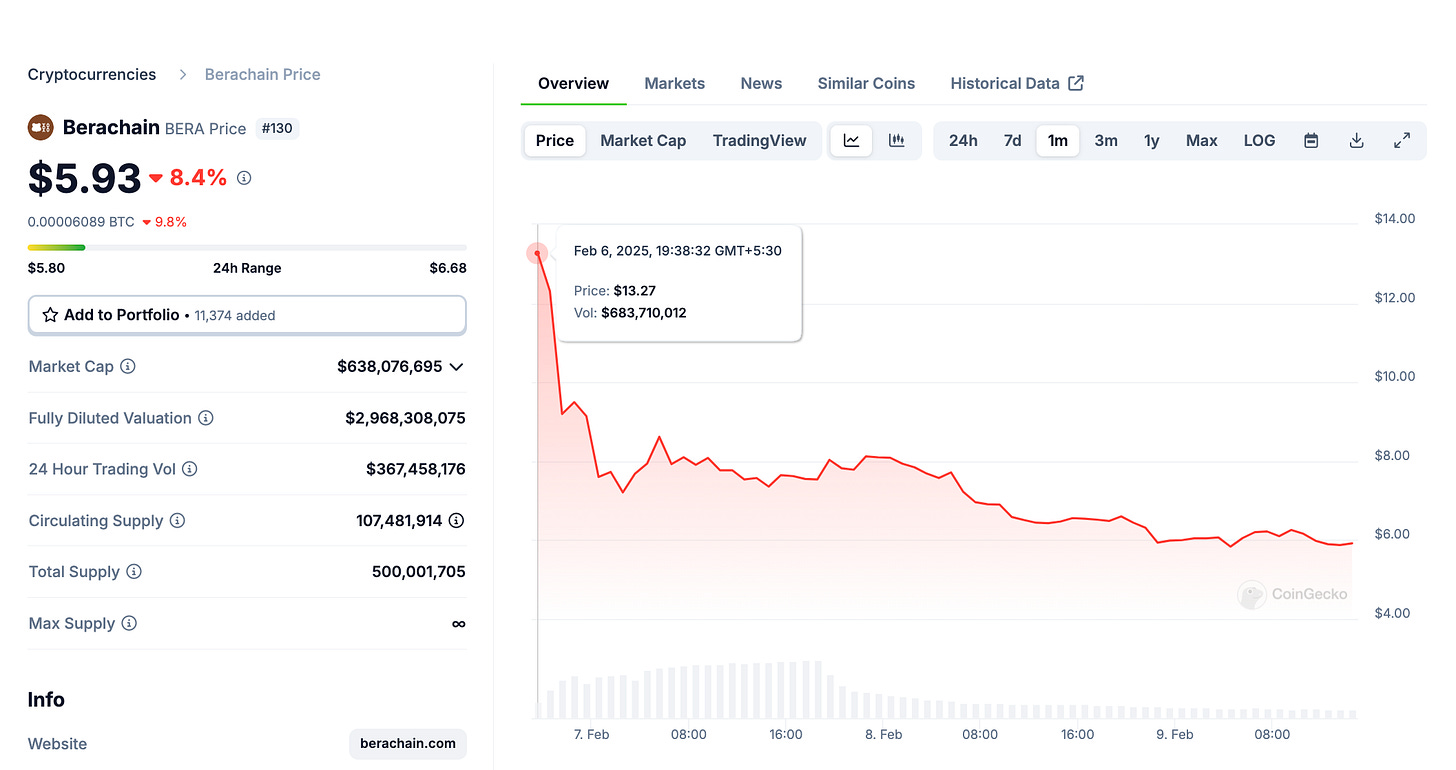

The Launch, The Crash, and What's Next

When Berachain's mainnet finally went live on February 6, few could have predicted the chaos that would unfold in the first 24 hours.

Launch Day Drama

BERA tokens hit exchanges at 1 PM UTC, quickly surging to $15.5 before dramatically plunging more than 50% to $6.7. Trading volume exploded to $2.77 billion as traders rushed to either capitalise on or escape from the volatility.

The carnage was particularly severe in the derivatives markets. A massive long squeeze triggered $25 million in liquidations, with long positions taking the majority of the damage. It seems many traders had positioned themselves for a sustained upward move, only to be caught in the downdraft.

Beyond the price action, something more significant was happening.

Network Activity Explosion

More than 140,000 independent addresses active

Total Value Locked (TVL) $1.8 billion - surpassing many established chains

These numbers would be impressive for an established blockchain. For a day-one launch, they're extraordinary.

The VC Question

With 34.3% of tokens allocated to VCs at an average entry price of $0.82, questions loom about potential selling pressure.

Some analysts, like DYθR founder hitesh.eth, suggest BERA's fair value lies between $10-15 in bull markets and $5-10 in bear markets.

The controversy deepened when it was revealed that locked tokens could be pledged for rewards – effectively creating a backdoor unlocking mechanism that wasn't initially disclosed.

The NFT DNA

While most are focused on Berachain's DeFi innovations, there's another crucial element to this story: NFTs aren't just part of Berachain's past – they're central to its future.

The "Big Four" anticipated chain launches of 2025 (Abstract, Berachain, MegaETH, and Monad) all promise DeFi innovation, but Berachain stands apart in how it's woven NFTs into its core identity.

It's not just about the Bong Bears origin story; it's about creating a blockchain that serves both DeFi degens and NFT collectors equally well.

This dual focus is reflected in the numbers: 6.9% of BERA's total supply (34.5 million tokens) was allocated to holders of Bong Bears and subsequent rebase NFT collections.

Unlike many airdrops that feel like afterthoughts, this one acknowledges a simple truth: culture and technology need to evolve together.

The ecosystem is already buzzing with NFT activity. Projects like Bullas, Steady Teddys, and Junky Ursas are ready to launch, while established players like Magic Eden and Sudoswap are building Berachain support.

LayerZero's day-one bridge support means these NFTs won't exist in isolation – they'll be part of a broader, multi-chain NFT landscape.

But perhaps most intriguingly, Berachain has pioneered an NFT rebasing mechanism that helped grow its ecosystem well before launch. It's a reminder that in crypto, sometimes the best technical innovations come from cultural experiments.

Token Dispatch View 🔍

The crypto industry has seen its fair share of ambitious Layer-1 launches, each promising to solve blockchain's fundamental challenges.

Berachain's approach feels different – not because of its technology alone, but because of what it represents.

In splitting governance from value, making liquidity a core protocol feature rather than an afterthought, and building DeFi primitives directly into the chain, Berachain isn't just launching a new blockchain.

It's proposing a new model for how crypto networks might evolve.

Can this model create sustainable network effects that outlast the initial hype. Can a blockchain designed around liquidity incentives avoid the fate of previous DeFi summers? Can governance mechanisms that privilege early whales still create an ecosystem that benefits all participants?

Not just for Berachain – they're questions for the entire industry.

As we move into an era where Layer-1 competition intensifies and liquidity becomes increasingly scarce, Berachain's experiment might offer valuable lessons, regardless of its ultimate outcome.

The bears have made their move. Now it's up to the market to decide if this new model of blockchain economics is truly the future, or just another chapter in crypto's endless search for sustainable growth.

Week That Was 📆

Saturday: Why States May Beat Nation in BTC Reserve Race?🏃🏾♀️➡️

Thursday: MicroStrategy Drops the ‘Micro’ 🎤

Wednesday: Crypto Czar Hits Regulatory Reset 🔄

Tuesday: Too Big to Ban 🚫

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.