Hello dispatchers! Happy Tuesday!

Today’s story: A token appears for one second in a tutorial video. The founder says "don't buy it." People buy it anyway. It hits a peak market cap of $489 million. The founder criticises his own exchange for listing it. The price crashes.

Welcome to crypto in 2025, where even the test tokens go viral and the world's largest exchange gets called out by its own creator.

We're diving into this beautiful mess.

Founder's warnings making tokens more viral

Four-hour window that's breaking the market

Test token that refused to stay in its tutorial

A $489 million lesson in "what not to do" that nobody asked for

Roses Are Red, Security Is Key

Trezor has transformed crypto security from a complex puzzle to a user-friendly playground, so you can be the boss of your financial future?

This Valentine’s Day, help your audience give a gift that lasts. Get discounts of up to 50% on Trezor’s bundled best-selling hardware wallets.

The Tutorial Tragedy

When Changpeng Zhao (CZ), Binance's founder, calls out his own creation as "broken," you know something's seriously wrong with the system.

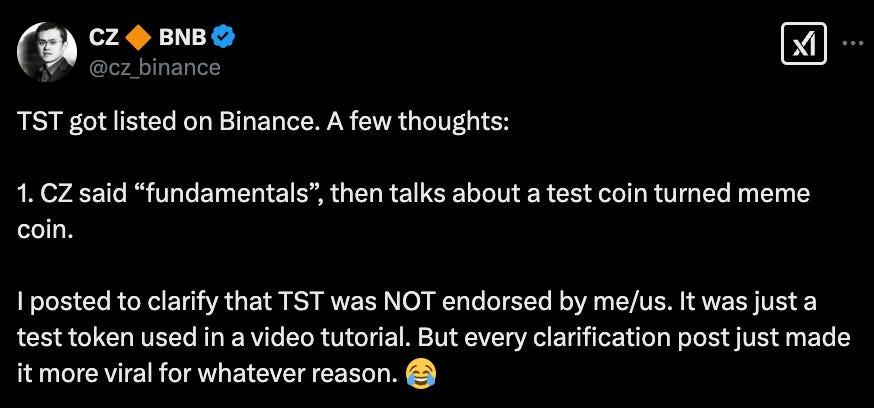

A test token (TST) appeared for barely a second in a BNB Chain tutorial video - that's all it took to expose fundamental problems in how the world's largest crypto exchange handles listings.

What started as a simple educational video transformed into a wild market experiment that nobody asked for. Chinese influencer communities spotted the token, and despite CZ's attempts to clarify its test nature, each explanation only amplified its virality. The more he tried to downplay it, the more attention it received.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts.

🎙 Block That Quote

Changpeng Zhao, Binance Founder

"As an observer, I think the Binance listing process is a bit broken. They announce, then list 4 hours later. The notice period is necessary, but in those 4 hours, the token prices go high on DEXes (Decentralised Exchange), and then people sell on CEX (Centralised Exchange)."

What exactly is broken about the listing process?

The problematic four-hour window between listing announcement and actual trading - perfectly conducive for market manipulation.

When Binance announces a new listing, experienced traders immediately rush to decentralised exchanges, accumulating positions at lower prices. As word spreads, retail investors pile in, driving prices higher through pure FOMO.

By the time the token actually lists on Binance, early buyers are primed to dump their holdings, leaving new investors holding bags at inflated prices. It's a predictable cycle that plays out with almost every new listing.

The TST case perfectly illustrates this broken system. The token's price started at a modest $0.12 on decentralised exchanges before the announcement.

During the four-hour window, it skyrocketed to $0.89, pushing the market cap to an astounding $489 million.

Post-listing, reality hit hard - the price crashed over 50%, settling around $0.19 with a market cap of $185.9 million.

CZ's Radical Proposal

The founder's suggestion challenges the foundation of CEXes: make them work more like their decentralised counterparts.

"I think CEX should list (almost) everything automatically, just like DEX," he proposed.

This radical proposition raises fundamental questions about the future of token listings.

How DEXes Work?

The TST saga isn't happening in isolation. It's a symptom of a broader shift in how crypto markets function in 2025.

While Binance deliberates over listing criteria and four-hour windows, a parallel universe of token creation has exploded on Solana.

Platforms like pump.fun have transformed token launches from complex technical endeavours into something as simple as creating a social media account. The platform churns out nearly 100,000 new tokens daily - a volume that traditional exchange listing processes were never designed to handle.

Even though 95% of these tokens are "rugged" within 24 hours, the survivors can achieve mind-boggling valuations. Peanut (PNUT) reached a $2.4 billion market cap, while Dogwifhat (WIF) secured a coveted Coinbase listing. These aren't outliers anymore - they're becoming the norm.

This new reality poses multiple questions for centralised exchanges.

When tokens derive value from Twitter memes and Discord engagement rather than fundamentals, how do you maintain a meaningful listing process? When a test token from a tutorial video can hit half a billion in market cap, what does due diligence even mean?

How would CEXes maintain their strict quality control with automatic listings? What happens to regulatory compliance in an automated system? The answers aren't clear, but one thing is: the current system isn't working.

And the Binance team has a response.

Binance co-founder Yi He offered a more nuanced perspective on the exchange's listing challenges.

She revealed the complex balancing act major exchanges face in today's evolving crypto landscape.

"A pressing concern may be that listing on Binance no longer delivers the same wealth effects it once did. For many projects, listing on Binance has become their ultimate goal, akin to going public on Nasdaq. But how can we address this issue and restore the wealth effect for users?" Yi admitted in a recent interview.

The Institutional Dilemma

Despite increasing its listing team size, Binance faces a paradox: slower response times amid faster-moving markets. The exchange that once prided itself on agility now struggles with the weight of its own institutional processes.

This sluggishness isn't merely about bureaucracy. With each passing month, the stakes get higher. A wrong listing decision could trigger regulatory scrutiny or expose millions of users to potential losses besides risking the exchange's reputation.

The Metrics Mess

Yi He revealed that Binance's listing criteria still revolves around three core metrics.

Return on investment performance

Market performance on other exchanges

Ability to attract new users to the crypto space

These traditional metrics might be part of the problem. In a market where memecoins can outperform "serious" projects and social media mentions often matter more than technical fundamentals, how relevant are conventional success metrics?

The New Rules of the Game

Yi's comments suggest Binance is grappling with a fundamental shift in the crypto landscape. The exchange needs to evolve beyond being just a trading platform - it needs to become an ecosystem that can adapt to rapidly changing market dynamics.

"If we don't face problems head-on and work on improvements, burying our heads in the sand will only erode confidence in the entire industry," said Yi He.

The DEX Factor

CZ's suggestion about automating listings like DEXes might seem radical, but it addresses a crucial reality: the crypto market has outgrown traditional listing processes. DEXes have shown that markets can self-regulate through mechanisms like liquidity pools and automated market makers.

Yet the DEX model isn't perfect either. Without proper vetting, automated listings can become breeding grounds for scams and manipulation. The challenge isn't just technical - it's about finding the right balance between accessibility and protection.

Token Dispatch View 🔍

The TST saga is more than just a listing gone wrong. It’s about an industry in the midst of an identity crisis. We're watching traditional crypto infrastructure struggle to adapt to a new reality where memes move markets and social sentiment trumps sophisticated metrics.

Three critical insights emerge from this situation.

First, the broken listing process CZ describes isn't just inefficient - it's becoming actively harmful to the ecosystem. That four-hour window has transformed from a well-intentioned transparency measure into a predictable manipulation mechanism. When even a test token can hit half a billion in market cap through this process, something fundamentally needs to change.

Second, Binance's internal tension - between CZ's call for automation and Yi He's focus on traditional metrics - mirrors a larger industry divide. The old guard wants to maintain control and quality standards, while new platforms like pump.fun show that the market has already voted for speed and accessibility over careful vetting.

Most fascinating is what this reveals about the future of centralised exchanges. They're caught in a paradox: maintain strict controls and risk becoming irrelevant, or embrace automation and risk becoming indistinguishable from DEXs. The challenge isn't technical - it's philosophical. Can centralised exchanges evolve without losing their identity?

The solution likely lies not in choosing between CZ's automation vision or Yi He's measured approach, but in reimagining what an exchange should be in 2025.

Maybe it's time to stop treating every token like it's aiming for a Nasdaq listing and start building infrastructure that can handle both serious projects and meme tokens with equal efficiency.

Until then, we're stuck in a world where warning people not to buy a token makes them want it more, and where even test tokens can become viral sensations. Welcome to crypto in 2025 - where the memes are made up, but the money is very, very real.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.