Hello dispatchers! Welcome to Friday's crypto dose.

We know we are a bit too late to do a wrapped series on what 2024 was like.

Bare with us (maybe for just a bit?) and you’ll know why we think today’s dispatch couldn’t have come at a better time.

Ten days into 2025, and crypto Twitter is already having a meltdown over Bitcoin's slide to $92,000. Yes, the same Bitcoin that shot up to $108,000 less than a month ago. "The bull run is over," they cry. "Institution dump incoming," others warn.

We get your pain.

Here's one thing common about life and Bitcoin - sometimes you need to zoom out to see the forest for the trees.

When Others React, Our Readers Prepare💡

Monday's Mempool Edition: "Bitcoin needs to hold above $100K before the next rally"

Tuesday: BTC drops from $100K

Wednesday: Continues sliding

Thursday: BTC hits $92K

While crypto Twitter was posting rocket emojis, our premium subscribers knew what was really happening with

Institutional flow analysis

Support/resistance level breakdowns

ETF impact assessment

Don't chase the market. Get ahead of it.

2025 New Year special limited time offer - 38% off on our annual subscription.

We're taking a step back from the noise. Away from the leverage liquidations and Twitter hysteria.

Instead, we'll look at how Bitcoin rewrote the rules of institutional finance in 2024, and what this new reality means for 2025.

The Bitcoin ETF wars

MicroStrategy's relentless accumulation and more

Trump's vision of a "Bitcoin superpower"

Mining industry overhauls

Get. Set. Go?

Just a year ago, sceptics were questioning if Bitcoin would ever see $50,000 again. Today, they're panicking about a dip to $92,000. Let that sink in.

While the crypto community obsesses over hourly candles, something far more profound has happened: Bitcoin has evolved from a speculative digital token into a legitimate institutional asset class.

A transformation so complete that BlackRock's Bitcoin ETF now holds more assets than their flagship gold fund - a feat that would have seemed impossible just twelve months ago.

For some perspective, if you had bought Bitcoin in January 2023 (at $17,500), congratulations - you've seen a 500%+ return.

Bought this time last year? Still a 100%+ return.

The asset that critics once dismissed as "rat poison squared" now sits comfortably above $90,000, having touched an all-time high of $108,268 in December 2024.

Bitcoin's dominance

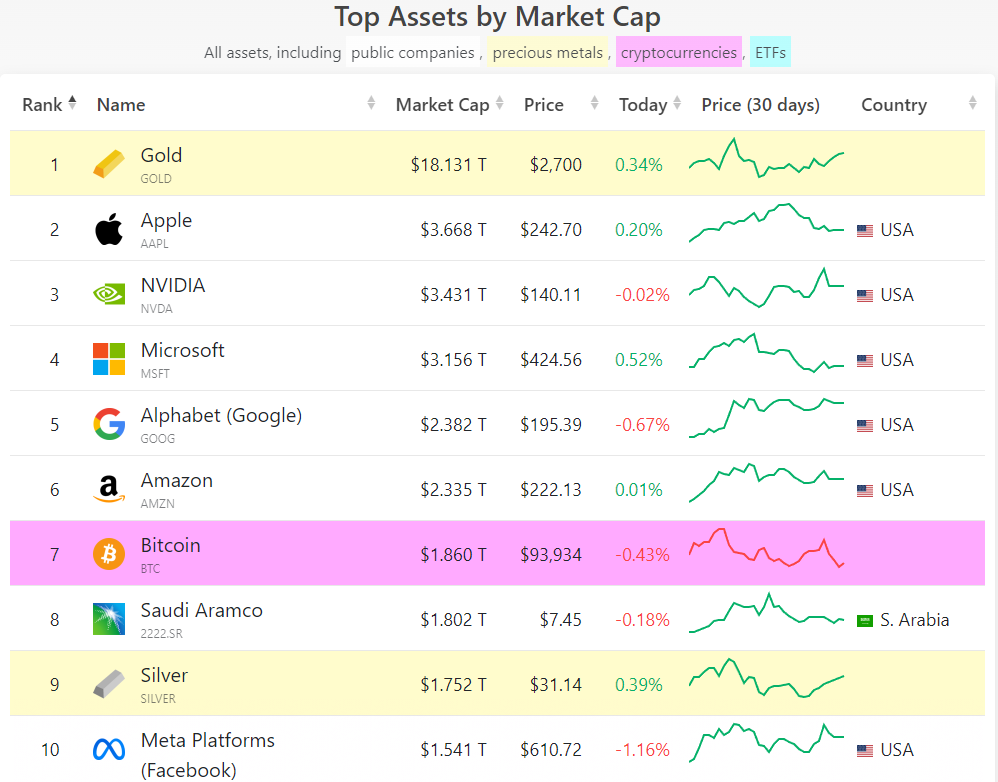

Market cap grew from $840 billion to $1.9 trillion in 2024

Added $1.1 trillion in value

Accounted for approximately two-thirds of total crypto market growth

Became the 7th most valuable asset globally, by market cap

Where is Bitcoin headed from here?

Ask the industry for price predictions and all you will hear is bullish sentiment. Although with varying degrees of optimism.

Noelle Acheson, a crypto analyst, expects it to breeze past $125,000

Sandy Carter: $500,000

Cathie Wood (ARK Invest): $500,000 by 2026

What’s driving these predictions?

The ETF Elephant

$100K or $90K - institutions are not backing down. Persistently pumping in into Bitcoin.

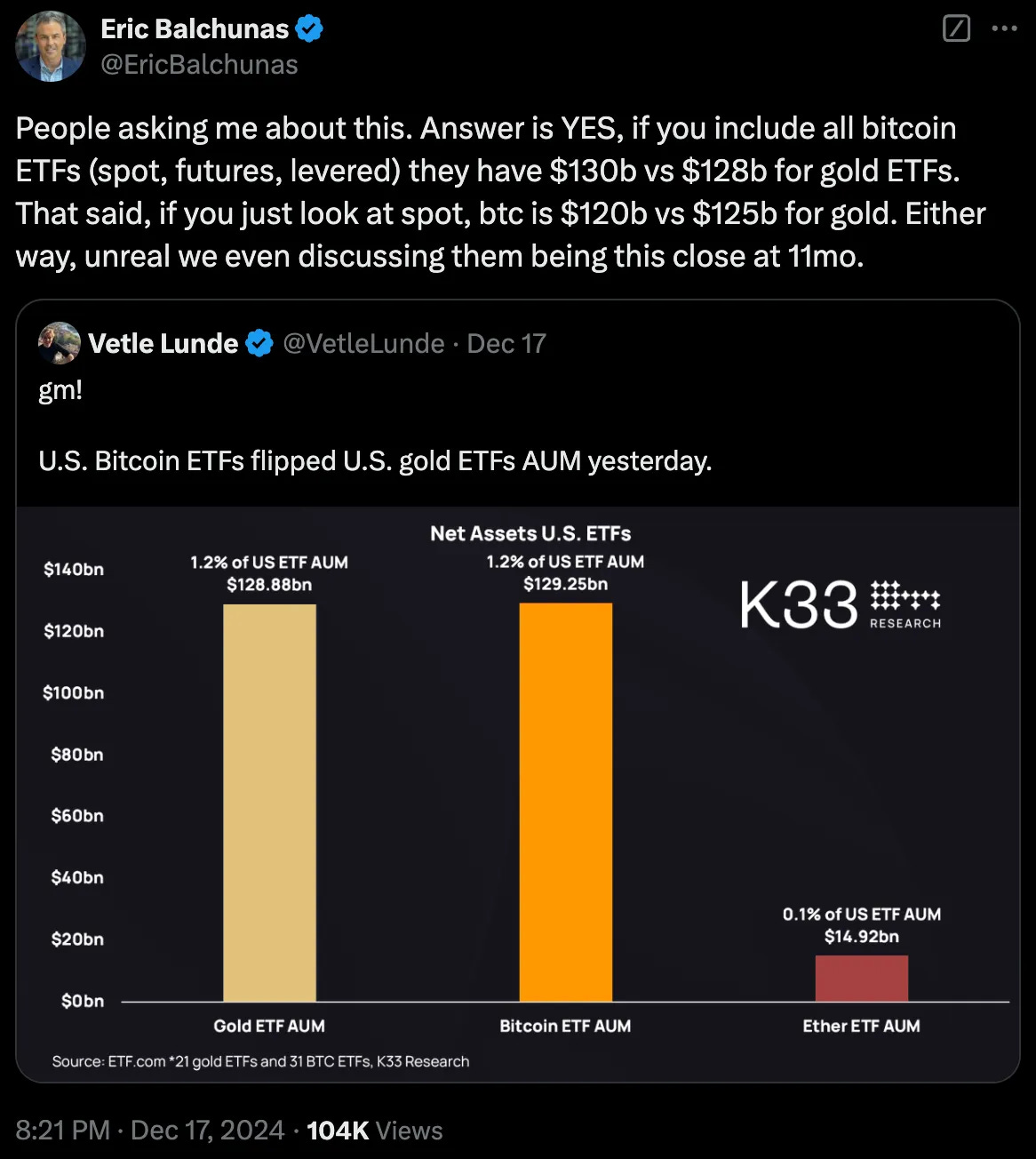

Look at how it all started on January 10, 2024. After a series of rejections, the US Securities and Exchange Commission (SEC) finally approved spot Bitcoin ETFs. BlackRock, the world's largest asset manager, led the charge alongside nine other firms.

The impact was seismic. BlackRock's iShares Bitcoin Trust (IBIT) quickly emerged as the dominant force, accumulating over $58 billion in assets under management and capturing 48% of the total Bitcoin ETF market.

Within months, total Bitcoin ETF assets surpassed gold ETF holdings - a milestone that took gold ETFs nearly 20 years to build.

Read: The Day Bitcoin Flipped Gold 🤸🏼♀️

How will all this flow into 2025?

"We’re really just at the tip of the iceberg with Bitcoin and especially Ethereum. Just a tiny fraction of our clients own ($IBIT and $ETHA) so that’s what we’re focused on (vs launching new alt coin ETFs)," said Jay Jacobs, BlackRock's US Head of Thematic ETFs.

When the world’s largest asset manager says they are going to double down on Bitcoin ETFs, that means just one thing - ETFs are going up!

BlackRock's influence extended beyond just market share.

The firm's recommendation of a 2% Bitcoin allocation in portfolios and release of educational content signals its deeper and long-term commitment to Bitcoin as a legitimate asset class.

Regulatory Tailwinds: Enter ‘Trump Effect’

We don’t know if the promised strategic Bitcoin Reserve is coming anytime soon. Let’s save that topic for another day.

But one thing has surely happened post the re-election of Donald Trump to the White House - favourable regulatory sentiment.

November 5 changed everything.

Donald Trump's victory, campaigned partly on making America "the crypto capital of the planet," sent Bitcoin soaring past $100,000. His promise to make the US a "Bitcoin superpower" resonated with markets - the asset hit $105,004 within weeks of his election.

The anticipation of the incoming administration’s crypto-friendly policies is moving the markets and likely to continue dictating the direction of the crypto space post Trump’s swearing-in.

And even before entering the White House, Trump’s got the ball rolling with pro-crypto nominations, appointment of a crypto and AI czar and his own crypto projects.

The incoming administration reads like a Who's Who of crypto advocates.

Vice President-elect JD Vance: Significant Bitcoin holder

HHS Secretary Robert F Kennedy Jr: Advocates for Bitcoin backing the dollar

National Security Adviser Michael Waltz: Consistent pro-crypto voting record

Upgrade to paid to get full access

For our weekly premium features and subscriber-only posts.

Wormhole: Connecting dots to bridge the narrative that's shaping the crypto world. Saturday analysis written

Rabbit hole: Crypto world can be a maze. Lot of information, not much context. Lot of noise, not much insight. Sunday explainers by

Mempool: Weekly Bitcoin perspective on the most significant developments and data-backed insights. Monday feature by

2025 New Year special limited time offer - 38% off on our annual subscription.

Corporate Treasuries Getting Bigger

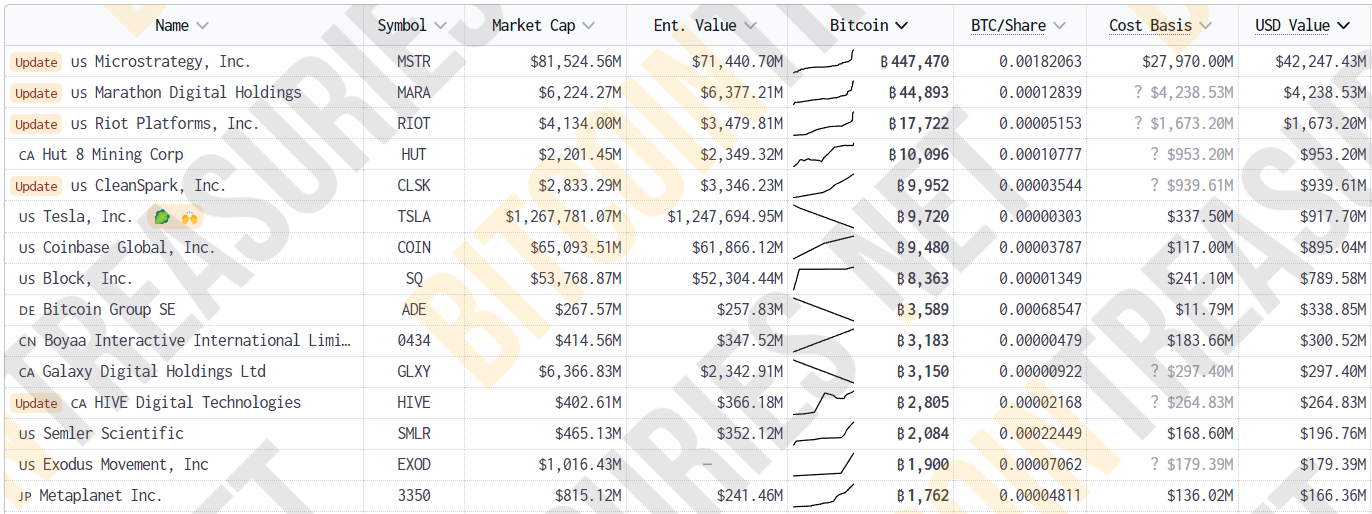

Michael Saylor's company didn't just buy Bitcoin in 2024 - they went all in. By December, MicroStrategy held 447,470 BTC (valued at $42 billion), making them the largest corporate holder of Bitcoin globally.

Bonus? MicroStrategy just kicked off what now seems like a tested playbook for many listed corporates - stacking Bitcoins to pump up the premium on their shares by riding on Bitcoin’s price surge.

Read: Corporates Opt Debt To Buy Bitcoin 🛒

Need more validation? Well, the year 2024 also saw MicroStrategy being included in the Nasdaq 100 index.

And others are queuing up, too.

Innovation on Bitcoin

2024 wasn't just about price action.

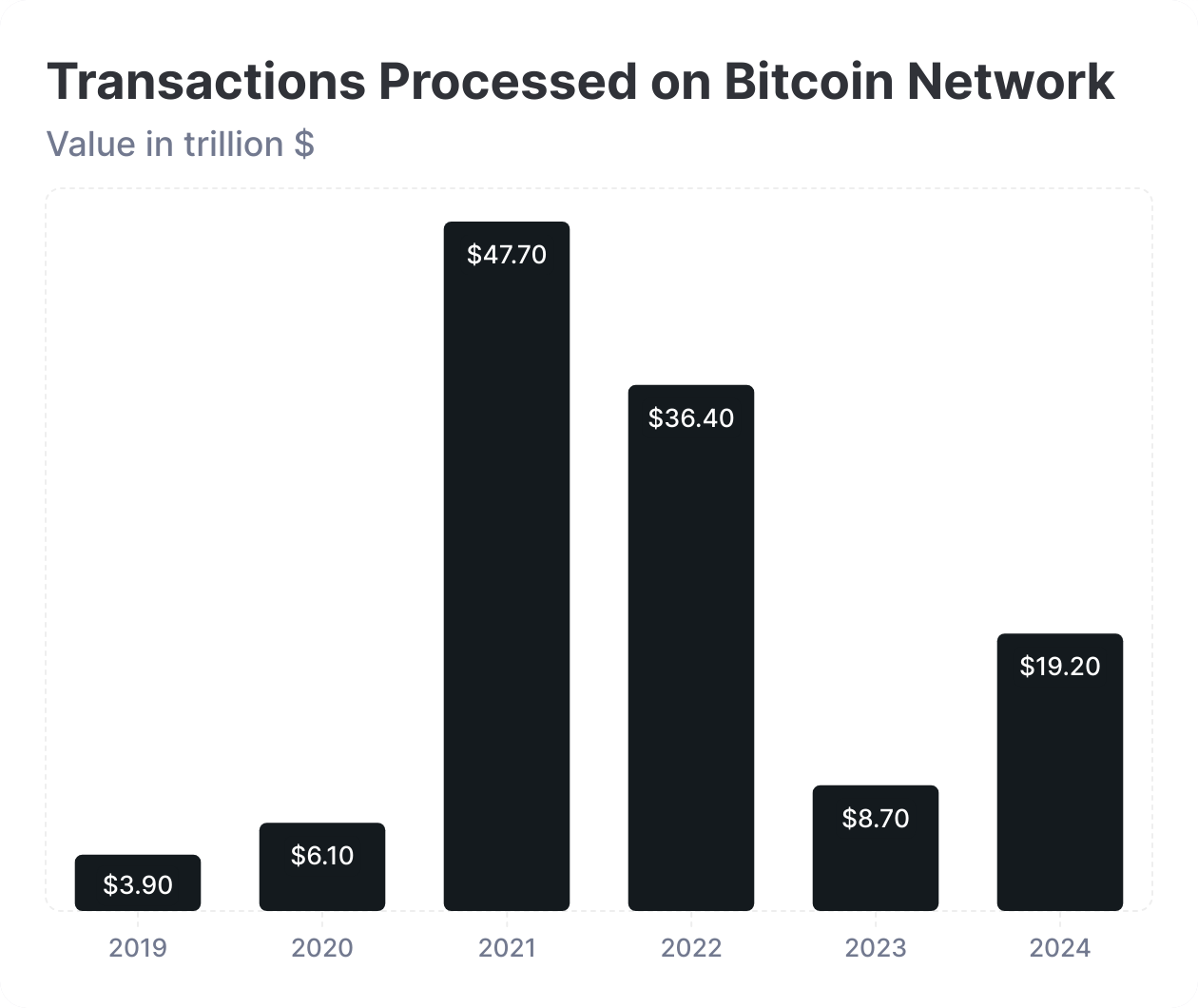

More than $19 trillion in transactions settled over the Bitcoin network in 2024 — more than double the $8.7 trillion settled in 2023 — reversing two years of declining transaction volume since 2021.

The network saw significant technical advancement.

Runes protocol launched alongside the halving, bringing new token capabilities to Bitcoin

BitVM bridges development progressed, promising trust-minimised BTC bridging solutions

Growing integration with AI and high-performance computing

Continued evolution of layer-2 scaling solutions

Mining's Evolution: From Crisis to Reinvention

The Bitcoin miners, who seemed all but out, underwent a dramatic transformation in 2024 and have placed themselves in a solid position for 2025.

When the industry was busy speculating their demise last year, they not only turned around their fate but also managed to reinvent themselves.

Three key events - the halving event, declining profitability, and industry consolidation.

April's halving slashed block rewards from 6.25 BTC to 3.125 BTC, while mining difficulty continued to rise. This squeeze on profitability forced miners to adapt or exit. Many smaller operations shuttered, while larger players emerged stronger through strategic pivots.

Several major mining companies found a lifeline in artificial intelligence.

Core Scientific led the way with a landmark $4.7 billion AI hosting deal with CoreWeave, while Hut 8 secured $150 million to develop AI infrastructure.

Some others like Cathedra Mining adopted the MicroStrategy playbook.

Read: The Bitcoin Mining Dilemma ⛏️

Token Dispatch View 🔍

The current pullback to $92,000 might be grabbing headlines, but it's just noise in Bitcoin's larger institutional transformation story.

While retail traders obsess over short-term price movements, the fundamental shifts that occurred in 2024 have permanently altered Bitcoin's position in the global financial system.

Consider this: In just one year, Bitcoin has gained more institutional validation than in all its previous years combined.

BlackRock isn't just offering a Bitcoin ETF - they're actively educating their massive client base about it.

MicroStrategy isn't just buying Bitcoin - they've earned a spot in the Nasdaq 100 doing it.

Miners aren't just mining - they're evolving into sophisticated AI infrastructure players.

The incoming Trump administration's crypto-friendly stance might be the headline catalyst, but remember how Bitcoin has matured beyond needing any single catalyst.

With $19 trillion in network transactions (more than double 2023's figure), Bitcoin is no longer just a speculative asset - it's becoming financial infrastructure.

What's particularly striking about this evolution is its comprehensiveness.

From ETFs outpacing gold to miners pivoting to AI, from corporate treasury adoption to layer-2 scaling solutions - Bitcoin's maturation is happening across multiple fronts simultaneously.

This multi-dimensional growth suggests that even as prices fluctuate, the foundation for long-term institutional adoption grows stronger.

As we move deeper into 2025, the key question will be how the asset's role will evolve as it becomes increasingly embedded in traditional finance.

With BlackRock suggesting we're just at "the tip of the iceberg" with institutional adoption, this current dip might well be remembered as just another buying opportunity in Bitcoin's journey from alternative asset to financial cornerstone.

After all, when a drop to $92,000 is considered bearish, perhaps it's time to zoom out and appreciate just how far we've come.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.