Bitcoin 🆚 Nasdaq

Why is Bitcoin down but Nasdaq making all-time highs? MicroStrategy $700M raise for Bitcoin buying. Bernstein predicts BTC at $200K in 2025. Bitcoin book inspires US bill. El Salvador's Bitcoin Bank?

Hello, y'all … You got a fast car I want to ticket to anywhere | Maybe we make a deal | Maybe together we can get somewhere 🎶

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

The way last few weeks have panned out, there is one question on everyone’s mind.

Why is crypto not keeping pace with Nasdaq?

The tech stocks index has gone up, while crypto has gone down.

Why is Bitcoin down, while Nasdaq is making all-time highs?

How has this deviation come about, adrift from the usual positive correlation between the two markets?

Profit-taking by holders: Investors have been holding onto their Bitcoin since the November 2021 all-time high of nearly $70,000 and are now willing to sell their coins as the price holds near record highs.

Increased Selling by Miners: Data shows that miners have been selling a significant amount of Bitcoin, including 1,400 coins worth $98 million by Marathon Digital this month. Miners receive Bitcoin as a reward for approving blocks on the blockchain and additional revenue from user transaction fees.

Mt. Gox distribution: The upcoming distribution of 142,000 Bitcoin and 143,000 Bitcoin Cash to creditors of the defunct exchange Mt. Gox could also pose a substantial overhang on digital asset prices. The trustees of the exchange have set an October 31, 2024 deadline to reimburse creditors.

Hashrate decline: The decline in the computing power (hashrate) dedicated to the Bitcoin blockchain, from 622 exahashes per second (EH/s) to 599 EH/s this month is a sign of miner capitulation.

Markus Thielen, founder of 10x Research

"When a market continues to sell off at a specific level, it has less to do with events, narratives, or fundamentals. Instead, a large seller perceives prices to be overvalued at that level. The November 2021 all-time high of nearly 70,000 is a level where long-term holders are willing to sell their Bitcoins, as they are the most likely candidates to cash out."

None of this has swayed the long-term view, or stopped the believers

Bernstein analysts have increased their price target for Bitcoin.

They predict that Bitcoin could rally to 1.5 times its marginal cost of production, implying a cycle high of $200,000 by mid-2025.

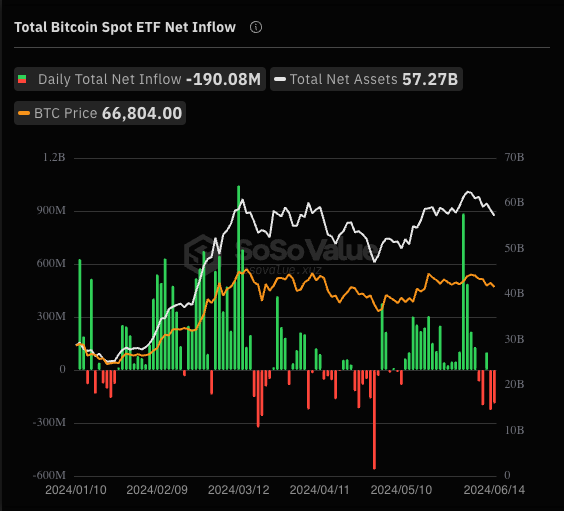

ETF demand: Expect Bitcoin ETFs to reach around $190 billion in assets under management by 2025, increase from the current $60 billion.

Supply constraints: April halving reduced the miners' block reward, resulting in fall of new supply from an average of 900 BTC per day to 450 per day.

New catalysts: Believe that new catalysts for Bitcoin demand will arise, leading to significant price movements.

Bernstein on MicroStrategy: An outperform rating, setting a price target of $2,890 for the stock by the end of 2025, representing an 80% upside.

The analysts forecast that MicroStrategy will own 1.5% of Bitcoin's supply by the end of 2025 and that the company's long-term convertible debt strategy allows it to benefit from Bitcoin upside with limited liquidation risk.

MicroStrategy's $700 million offering

MicroStrategy has set the pricing for its offering of $700 million of 2.25% convertible senior notes, which is expected to close on June 17.

The unsecured notes will mature in 2032 unless repurchased, redeemed, or converted.

The notes will be sold in a private offering to qualified institutional buyers under Rule 144A of the Securities Act of 1933.

The conversion rate will initially be 0.4894 shares of MicroStrategy class A common stock per $1,000 principal amount of notes, equivalent to an initial conversion price of approximately $2,043.32 per share.

Net proceeds: Approximately $687.8 million from the sale of the notes, after deducting underwriting discounts, commissions, and offering expenses.

The company intends to use the net proceeds to acquire additional bitcoin and for general corporate purposes.

Previous offerings: MicroStrategy has previously announced convertible note offerings, including one in March 2024 for $525 million and another in 2023 for $500 million.

Block That Quote 🎙️

Tether CEO Paolo Ardoino

“Bitcoin is about certainty. It’s like a clock keeps ticking, keeps ticking forever [...] When it comes to the concept of unstoppable products, or decentralised — because everyone uses the term ‘decentralised’ — there is only Bitcoin.”

Ardoino emphasises Bitcoin's unparalleled decentralisation at BTC Prague 2024.

And that Bitcoin is unique among the more than 14,000 various cryptocurrencies because it is the only one that is not centralised.

He expressed skepticism about the record-breaking industry of memecoins.

“I like memes, but not memecoins … [Bitcoin and memecoins] are completely at the opposite parts of the spectrum.”

US Bill Inspired by ‘The Bitcoin Standard’

US Congressman Thomas Massie has proposed a bill to eliminate the Federal Reserve, inspired by the book "The Bitcoin Standard" by Saifedean Ammous.

The Bill: “Federal Reserve Board Abolition Act”

The bill aims to address economic problems caused by the Fed's policies, including high inflation and overprinting of money.

Massie believes the Fed's policies disproportionately benefit the wealthy, worsening inequality.

The bill has gained support from the Bitcoin community and Republican co-sponsors.

Previous attempts: Massie has co-sponsored similar bills in the past, including one in 2013 and another in 1999 with former libertarian congressman Ron Paul. These bills attracted little support.

Online support: The Bitcoin community has strongly supported Massie's initiative, with discussions on social media about alternative monetary frameworks.

About the book: The 2018 book proposed that Bitcoin could become the world’s most dominant money.

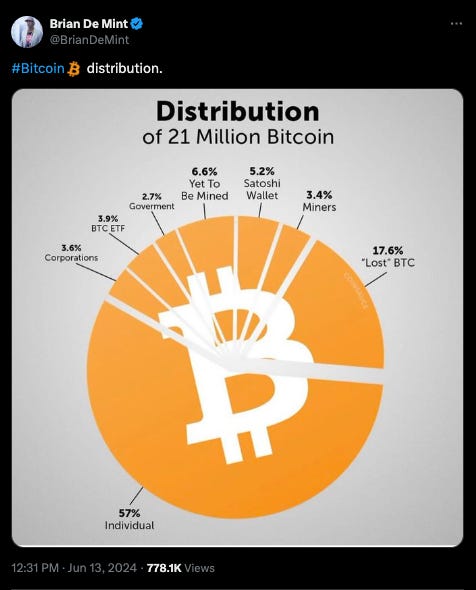

Why? Superior monetary properties, particularly its scarcity, with maximum supply of 21 million coins. Ammous reasons for Bitcoin superiority links to the United States’ abandonment of the gold standard in 1971, including reduced household savings and inflated housing and asset prices.

In The Numbers 🔢

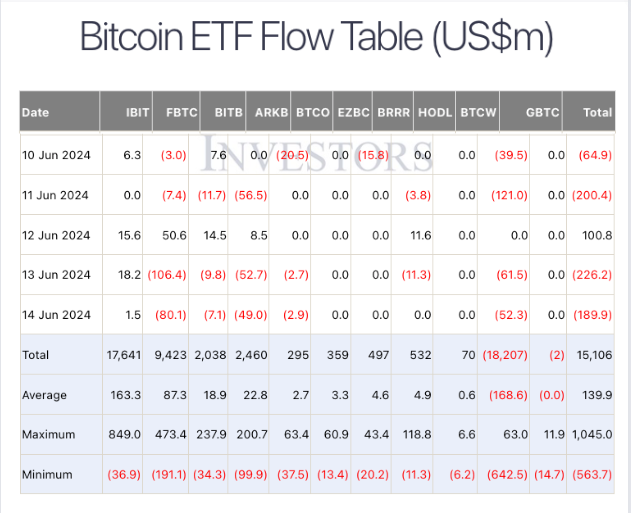

$580 Million

Total outflows for US spot Bitcoin ETFs from the last trading week, June 10-14, 2024.

There were net outflows in four of the past five days.

Bitcoin Banking Proposal in El Salvador

El Salvador's President Nayib Bukele proposes a private investment bank that will offer Bitcoin investors more financial services and fewer restrictions.

Key features

The Bank for Private Investment (BPI) will operate with fewer regulations than traditional banks.

It will be able to handle multiple currencies, including Bitcoin.

Loan restrictions will also be eliminated.

The minimum share capital is $50 million, and at least two shareholders are required.

Milena Mayorga, the Salvadoran Ambassador to the United States.

Current Status: The proposal has not yet been approved by the legislature.

The Surfer 🏄

Bloomberg ETF analyst Eric Balchunas predicts that spot Ethereum ETFs could begin trading in the United States by July 2, citing comments from the SEC and a potential desire to clear the plate before the Independence Day holiday.

The New York Attorney General's office has recovered $50 million from Gemini Trust, which will be returned to investors who were defrauded by the company's Earn program. This settlement is in addition to a $2 billion settlement with Genesis Global Capital, Gemini's partner in the Earn program.

Binance expressed relief after Nigeria's Federal Inland Revenue Service (FIRS) dropped tax charges against its executives Tigran Gambaryan and Nadeem Anjarwalla, leaving Binance as the sole defendant.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋

This was nice, consolidated and curated content. I didn't need to sift through 15 news stories to find the news with bitcoin for the week.