Bitcoin Plays Election 🗳️

Trump's odds tumble, Harris gains ground. Bitcoin shivers with two days to go for US elections. Prediction markets are in chaos. Mt. Gox spooks the market. JPMorgan favours both Gold and Bitcoin.

Happy Monday, y'all. Today’s crypto dose of Token Dispatch takes you through the crypto euphoria building up to the election day.

FOMO about missing out on Coldplay live? Play Muzify quiz to score the concert ticket. It’s got over 2 million plays, are you on the board yet?👇

A day till the US votes.

Two days till results (hopefully).

And a whole lot of volatility around it.

Remember last week's euphoria? When we were just $175 away from an all-time high?

Well, things change fast in crypto. Especially when there's an election around the corner.

Now we are back at $68K.

The correlation is so tight that crypto traders are starting to joke about using Polymarket as their primary technical indicator.

This correlation isn't entirely surprising. The former president has, after all, undergone quite the crypto evolution.

Let's talk promises.

Read: If Trump Wins …🗳️

The Trump transformation

Pledged to make US the "world capital of crypto"

Promised to fire SEC's Gensler "on day one"

Backed DeFi project World Liberty

Multiple NFT collection launches

Strong stance against CBDCs

Support for Bitcoin mining

Plans for crypto advisory council

Read: Trump's WLF: Triumph or Fiasco? ⚠️

Harris, meanwhile, played it subtle until October

Promised pro-crypto regulatory framework

Commitment to blockchain innovation

More open stance than Biden administration

Reaching out to crypto leaders like Mark Cuban

Focus on retail investor protection

Support for emerging technologies

Plans for inclusive crypto policies

Read: Who Will Win the Crypto Game? 🏹

The Trump effect is fading

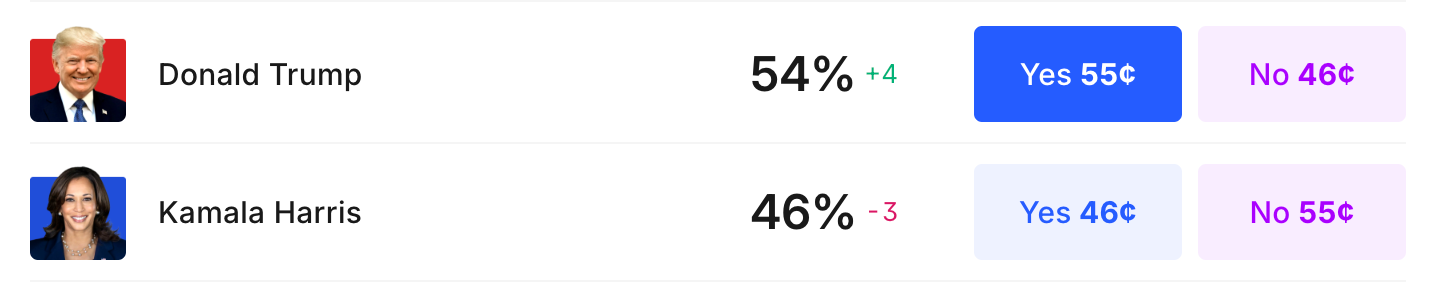

Kalshi showing a similar trend.

Until last week, prediction markets were painting a clear picture: a comfortable Trump lead that had crypto traders feeling optimistic enough to push Bitcoin within striking distance of its all-time high.

Then came the Ann Selzer poll

If you're not familiar with Selzer, she's the polling equivalent of a crypto oracle – one of the few who saw Trump's 2016 victory coming.

When her latest numbers showed Harris leading in Iowa – a state Trump won twice – the crypto market's confidence cracked.

On Polymarket, Trump's odds tumbled 13 percentage points in just a few days. Over at Kalshi, a CFTC-regulated prediction market that just added USDC support, Harris briefly took the lead.

The platform has now handled over $3 billion in election-related trading volume.

Read: Can Polymarket Whales Sway US Voter Sentiment? 🐋

The manipulation question

In 2008, an institutional investor dumped hundreds of thousands into prediction markets to boost John McCain's apparent chances.

In 2012, someone lost $4 million trying the same trick for Mitt Romney.

This time around, a French trader named Théo has placed $30 million in bets on Trump's victory.

Théo, who stands to make $80 million if Trump wins, insists his massive positions are purely financial plays, not political ones.

He claims his analysis shows the polls are underestimating Trump, putting his odds of victory at 80-90%. It's either brilliant trading or the most expensive political statement since Sam Bankman-Fried's campaign donations.

The Volatility Vortex

As prediction markets gyrate, Bitcoin's implied volatility has shot up to its highest level since July - 3-month high. 74.4% implied volatility for election week.

The Deribit volatility index suggests traders are pricing in potential swings of nearly 10% in either direction following Tuesday's results.

This anxiety isn't confined to crypto.

The US Treasury's MOVE index has jumped to levels not seen since October 2023, and EUR/USD implied volatility is testing highs last seen during the March 2023 banking crisis.

When traditional markets get nervous, crypto tends to get absolutely jittery.

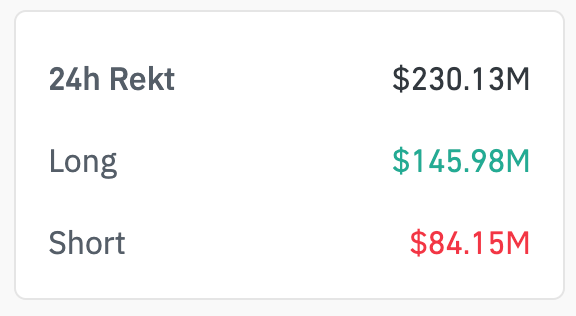

On November 3, over $315 million in crypto positions were liquidated in just 24 hours as traders scrambled to recalibrate their election bets.

Of that, $250 million were long positions – suggesting many traders were caught off guard by the market's sudden bearish turn.

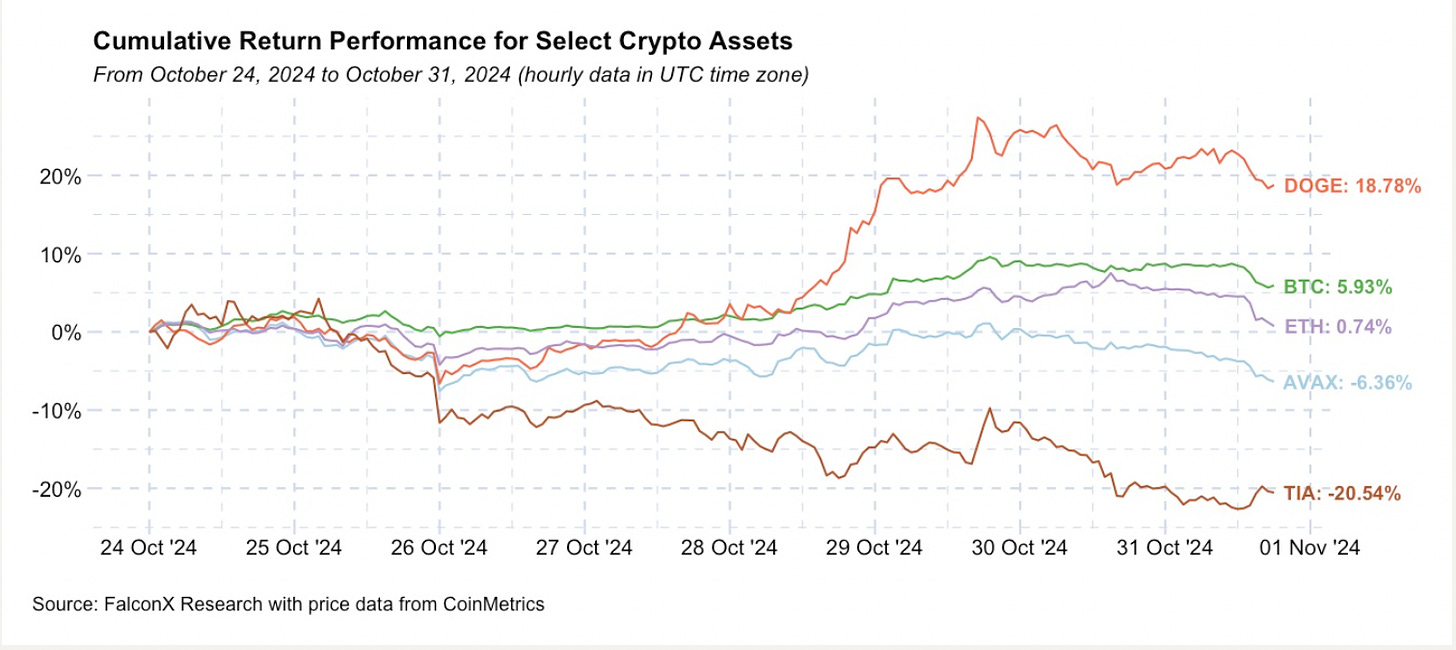

How’s it looking at the moment?

What are the experts saying?

David Lawant, FalconX Head of Research.

"After six months of directionless trading, markets appear eager to move past election uncertainty toward firmer ground."

On potential chaos: "Additional volatility could emerge if results are too close to call and it takes too much time to reach an outcome."

Nick Forster, Derive.xyz Founder.

"This escalation reflects traders are bracing for the election results, which could sway market prices substantially."

Daan Crypto Trades.

"There's a good possibility of at least a 10% move to either direction depending on who ends up winning the election this week."

Alan Santana, Trading Expert.

"Two instances earlier this year produced 5 days red ... This can signal that a sudden surprise reversal will happen ... Or, we will witness the biggest crash in years. The latter is the most likely scenario."

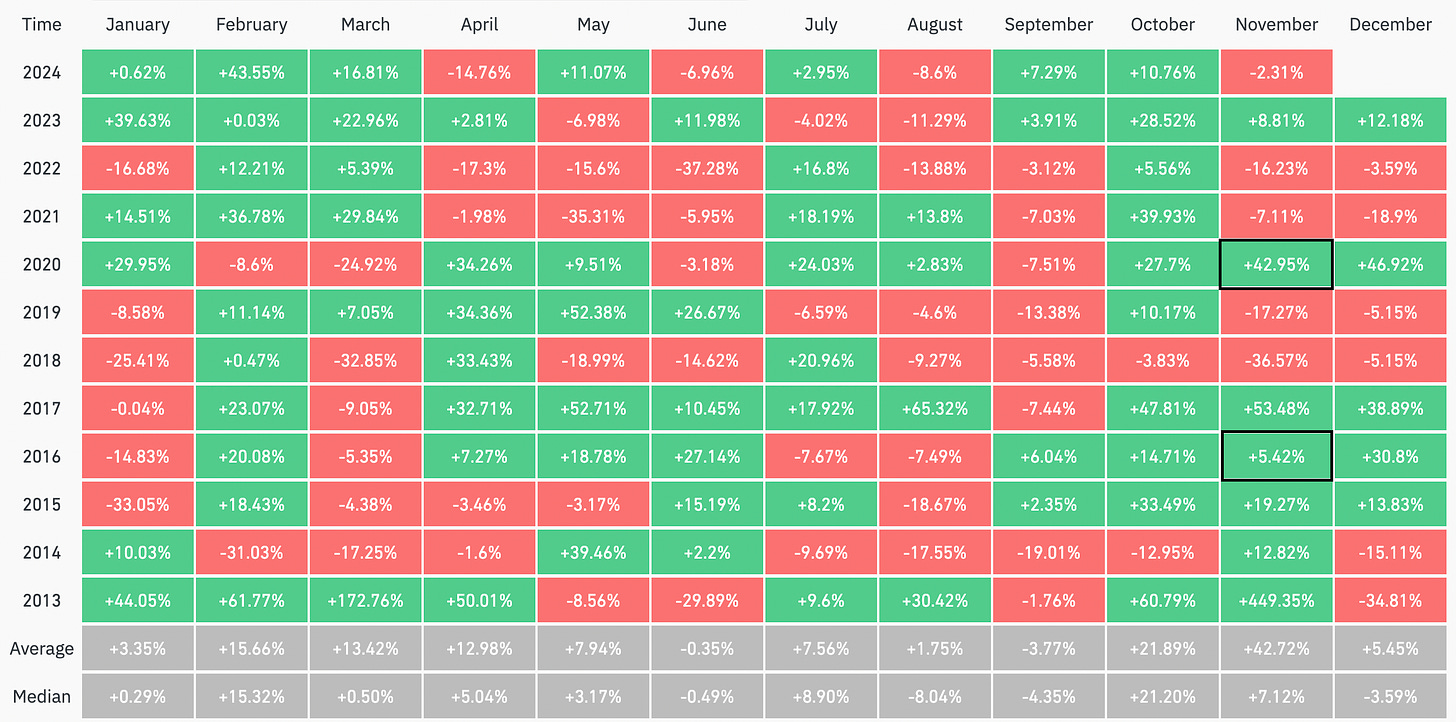

Before we enter the panic mode, election months (November) usually give crypto green. And let’s hope the same happens this month, regardless of the results.

The Home for All the Music Lovers

Muzify - With over 2 million plays, is more than just a platform.

It's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

Block That Quote 🎙️

JP Morgan Analysts

"Rising geopolitical tensions and the coming US election are likely to reinforce what some investors call the 'debasement trade' thus favouring both gold and Bitcoin."

Why this matters?

Traders hedging against weakening currencies

Gold hitting new ATH at $2,483

Bitcoin just 5% away from its peak

Geopolitical uncertainty driving both assets

Trump victory could amplify the trend

Debasement trade? It's when investors protect themselves against:

Weakening currencies

Geopolitical headwinds

Growing government deficits

And guess what? Both digital and physical gold are winning.

In The Numbers 🔢

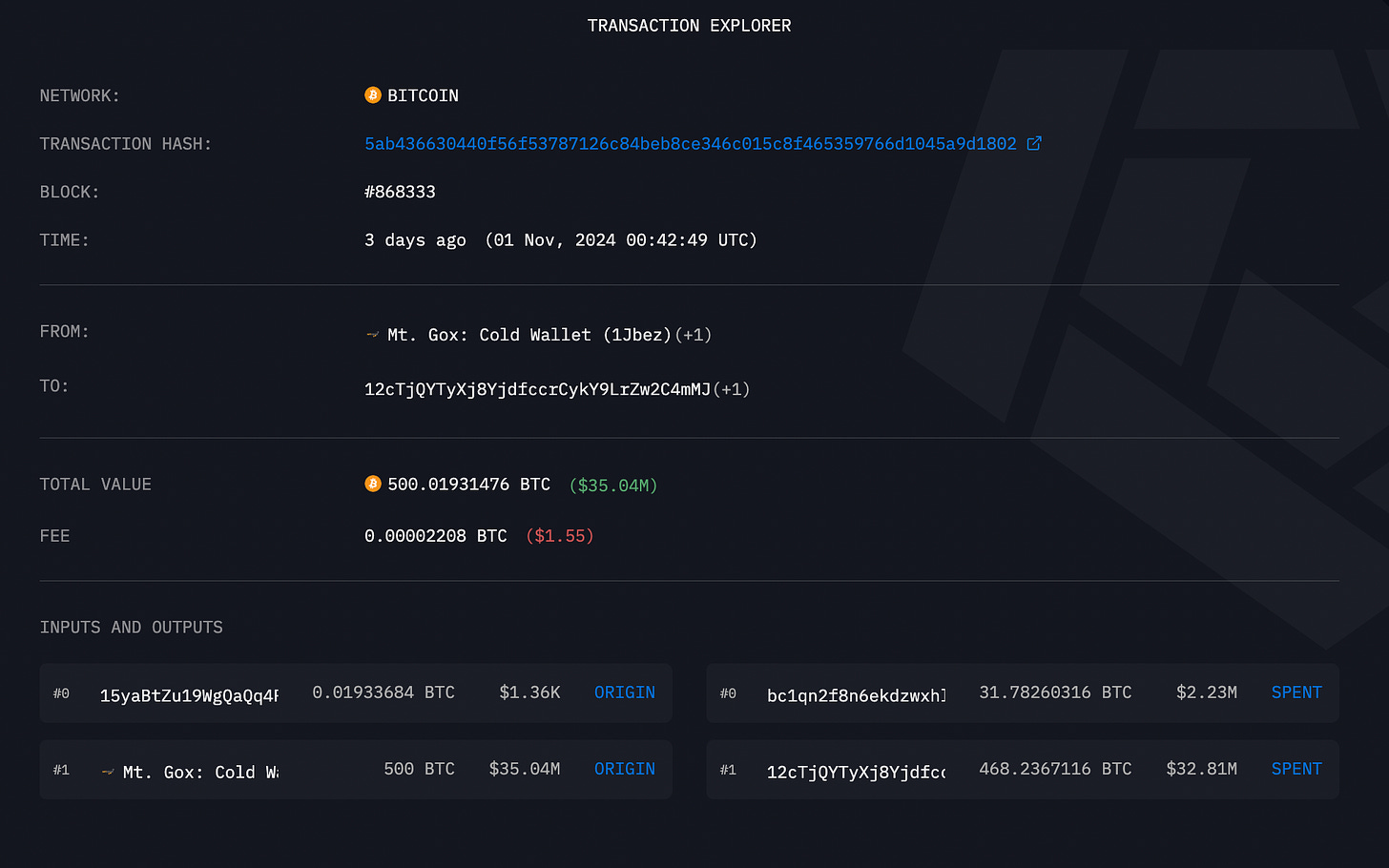

500 BTC

That's how much Mt. Gox just moved in the dead of night.

Breaking it down.

31.78 BTC to one wallet

468.24 BTC to another

Worth $35.04M total

First move since September

But here's the real number to watch: 44,905 BTC.

That's what Mt. Gox still holds. Current value? $3.1 billion.

Remember Mt. Gox's glory days?

World's largest exchange in 2010

Lost 850,000 BTC in 2014

Thousands still waiting for refunds

Repayment deadline? Extended to Oct 2025

Ten years later, and those ghost wallets are still moving markets.

The Surfer 🏄

Vivek Ramaswamy, a Trump advisor, is integrating Bitcoin into his $1.7 billion asset management firm, Strive Asset Management, as part of a new wealth management initiative. The firm aims to make Bitcoin a standard part of investment portfolios for everyday Americans, citing economic factors like rising debt and inflation as reasons for its inclusion.

In October 2024, cryptocurrency losses from hacks and exit scams totalled $129.6 million, primarily driven by significant incidents including a $50 million hack of Radiant Capital and a $36 million phishing attack targeting a crypto user.

In November 2024, crypto projects are set to unlock about $2.68 billion in tokens, with significant releases from Memecoin, Aptos, Arbitrum, Avalanche, and Optimism. Memecoin will unlock 3.45 billion coins for airdrops, while Aptos will release 11.31 million tokens valued at $93 million.

The US has tightened restrictions on foreign-owned crypto mining operations by expanding the Committee on Foreign Investment in the United States' (CFIUS) authority to review transactions near military installations.

UBS has joined BlackRock and Franklin Templeton in tokenisation by launching its first tokenised investment fund, the UBS USD Money Market Investment Fund Token (uMINT), built on Ethereum.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

Mt. Gox's moves are a reminder of crypto’s wild past and how it still influences today’s market.

Crypto’s reaction to election drama and economic trends highlights its role as a hedge. It’s maturing beyond just being a 'risky asset.