Today’s edition is brought to you by Trezor. The hardware wallet to protect your identity and coins. Get exclusive holiday deals with 30-50% off on select products 👇

Rise & shine! It's another Monday in the land of perpetual numbers...

BTC smashes $106K, corporates rush to stack sats.

Trump effect drives markets higher.

MicroStrategy joins Nasdaq 100.

MARA and Riot load up treasuries.

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 175,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

$106,554.

That's no prediction.

That's Bitcoin's new all-time high.

But the price isn't even the biggest story today.

While retail traders celebrate their gains, there’s something else happening.

MicroStrategy just crashed the Nasdaq 100 party.

States are racing to hoard Bitcoin.

And miners? They're transforming into Bitcoin banks.

Oh, and the President-elect? He's got plans. Big ones.

The market's been on fire since Trump's November victory. Why?

Campaign promises are turning into action.

Crypto Advisory Council formation

Meeting with industry heavyweights

David Sacks as "White House AI & Crypto Czar"

Pro-crypto appointments across the board

"Campaign promises to make the US 'the crypto capital of the planet' might be viewed as political posturing. But the Crypto Advisory Council proposal, along with rumors of Trump meeting several heavyweights of the crypto industry, sends a signal that the new administration will pay more serious attention," says Lucas Schweiger, Digital Asset Research Manager at Sygnum.

But Trump isn't the only force driving Bitcoin higher.

The Federal Reserve's expected 25-basis-point rate cut this week — bringing rates to between 425 and 450 basis points — is providing additional rocket fuel.

As borrowing becomes cheaper, risk assets like Bitcoin typically benefit from increased investment flows.

Block That Quote 🎙

Matthew Hougan, Bitwise CIO

”When bitcoin hits $1 million, investors are going to look back and wonder how they missed such obvious signs”

The Bitwise chief just dropped a reality bomb about where Bitcoin's headed.

His recipe for seven figures?

BlackRock's 2% portfolio mandate

Record-shattering ETF performance

Ray Dalio's Bitcoin endorsement

Trump's crypto conference keynote

State-level adoption wave

The Institutional Tsunami

MicroStrategy just made history - becoming the first Bitcoin-heavy company to join the Nasdaq 100. We're talking about joining the ranks of Apple, Tesla, and Microsoft. The implications are staggering.

Through funds tracking the Nasdaq 100, millions of Americans will now have indirect exposure to Bitcoin whether they realise it or not.

The Invesco QQQ Trust alone manages over $300 billion. That's a lot of passive investment flowing into the Bitcoin ecosystem.

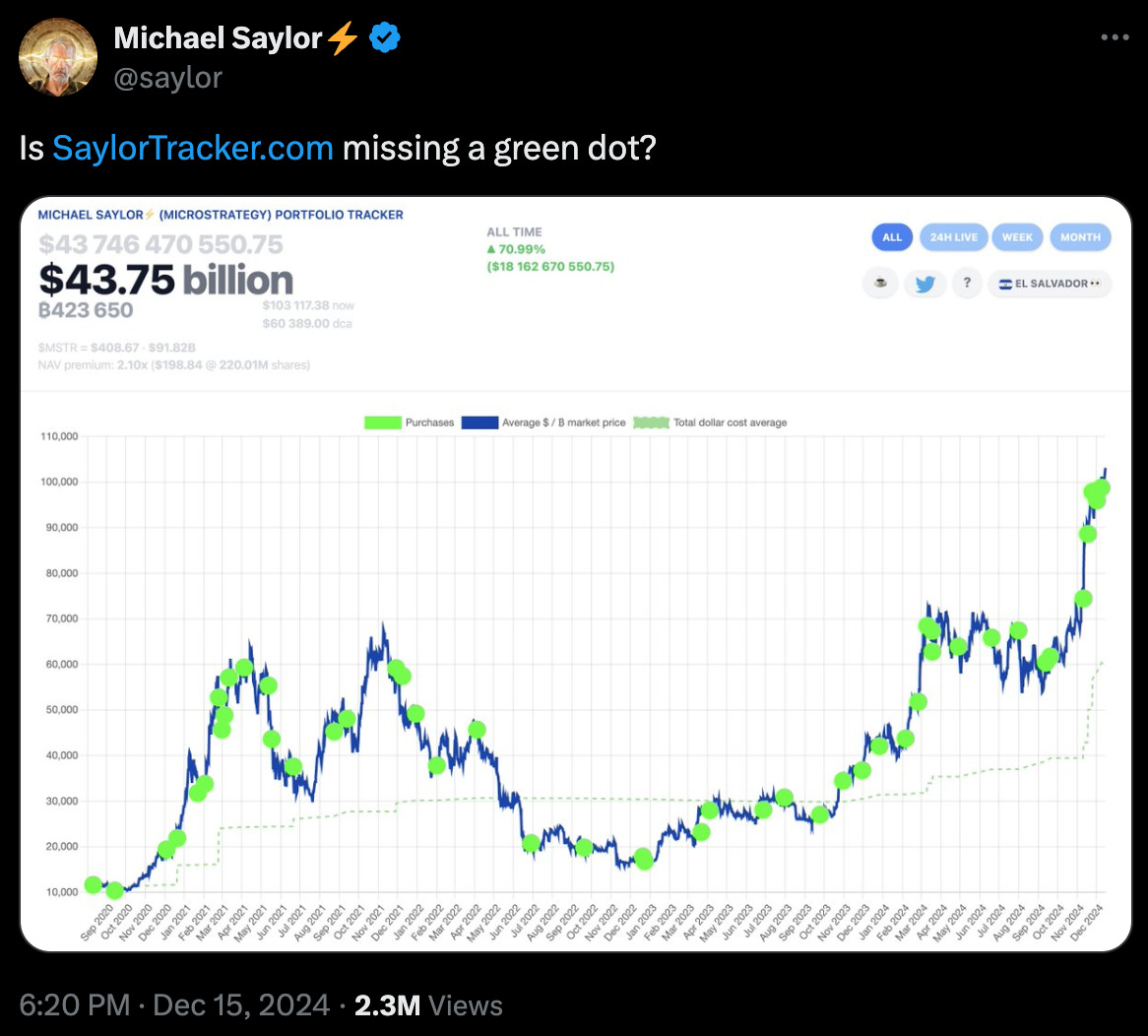

The story of corporate America's Bitcoin addiction starts and ends with Michael Saylor, the CEO who transformed his business intelligence company MicroStrategy into what he calls a "Bitcoin bank."

The company holds 423,650 BTC

Worth $43.75 billion

Latest batch potentially above $100K

As Bitcoin touched new highs, MicroStrategy was busy accumulating more, likely marking its first purchase above the $100,000 mark.

Michael Saylor's been posting the same Bitcoin chart for five consecutive Sundays.

Each time, they announced a purchase the next day. Guess what he just posted again?

Crypto Security Made Easy

Trezor has transformed crypto security from a complex puzzle to a user-friendly playground, so you can be the boss of your financial future? 🫵

Miners’ Big Bet

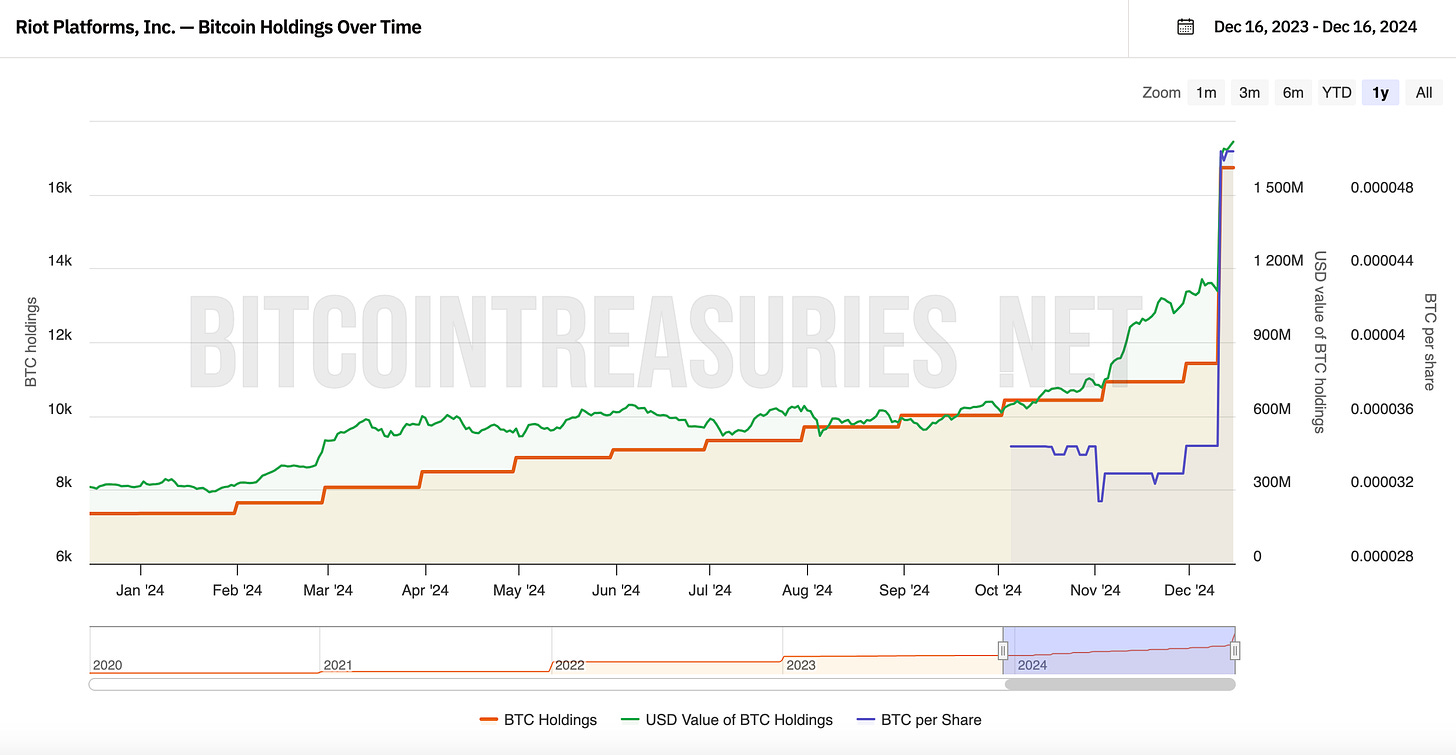

Bitcoin miners, traditionally sellers of the asset, are now becoming major accumulators.

The Half-Billion Dollar Shopping Spree

Riot Platforms dropped $510 million on Bitcoin in a mere three days. The purchase pushed their treasury to nearly $1.7 billion, marking one of the most aggressive moves in corporate Bitcoin history.

MARA's Moonshot

Not to be outdone, MARA Holdings has poured over $600 million into Bitcoin in just two months. With 40,435 BTC in their treasury, they're stockpiling Bitcoin. Their chairman, Fred Thiel, is already eyeing a spot in the Nasdaq 100, following MicroStrategy's playbook to institutional legitimacy.

The CleanSpark Curve

While others splurge on Bitcoin, CleanSpark is taking a more nuanced approach. Their $550 million convertible note offering, set to close December 17, signals big ambitions. But unlike their peers, they're not rushing to convert it all to Bitcoin. With 9,297 BTC already in their treasury, they're balancing growth with accumulation.

Wall Street's Change of Heart

JPMorgan, once skeptical of Bitcoin, is now pricing in what they call a "HODL premium" for mining stocks. The bank's analysts have raised price targets for four major miners, explicitly valuing their Bitcoin treasuries like they do MicroStrategy's. It's a remarkable shift in Wall Street's perception of the mining industry.

State-Level Momentum

Florida's move

$1.857B from pension funds (1% allocation)

$1.165B from budget surplus

Early 2025 target launch

Already invested via hedge funds

Texas and Pennsylvania blazed the trail. Now, according to Satoshi Action Fund CEO Dennis Porter, a third state's jumping in.

"We had Pennsylvania, and we had Texas. And now we have another state coming on board. And they sent me the draft. So I know it's real."

His prediction? At least 10 states will introduce Bitcoin reserve bills.

In The Numbers 🔢

73%

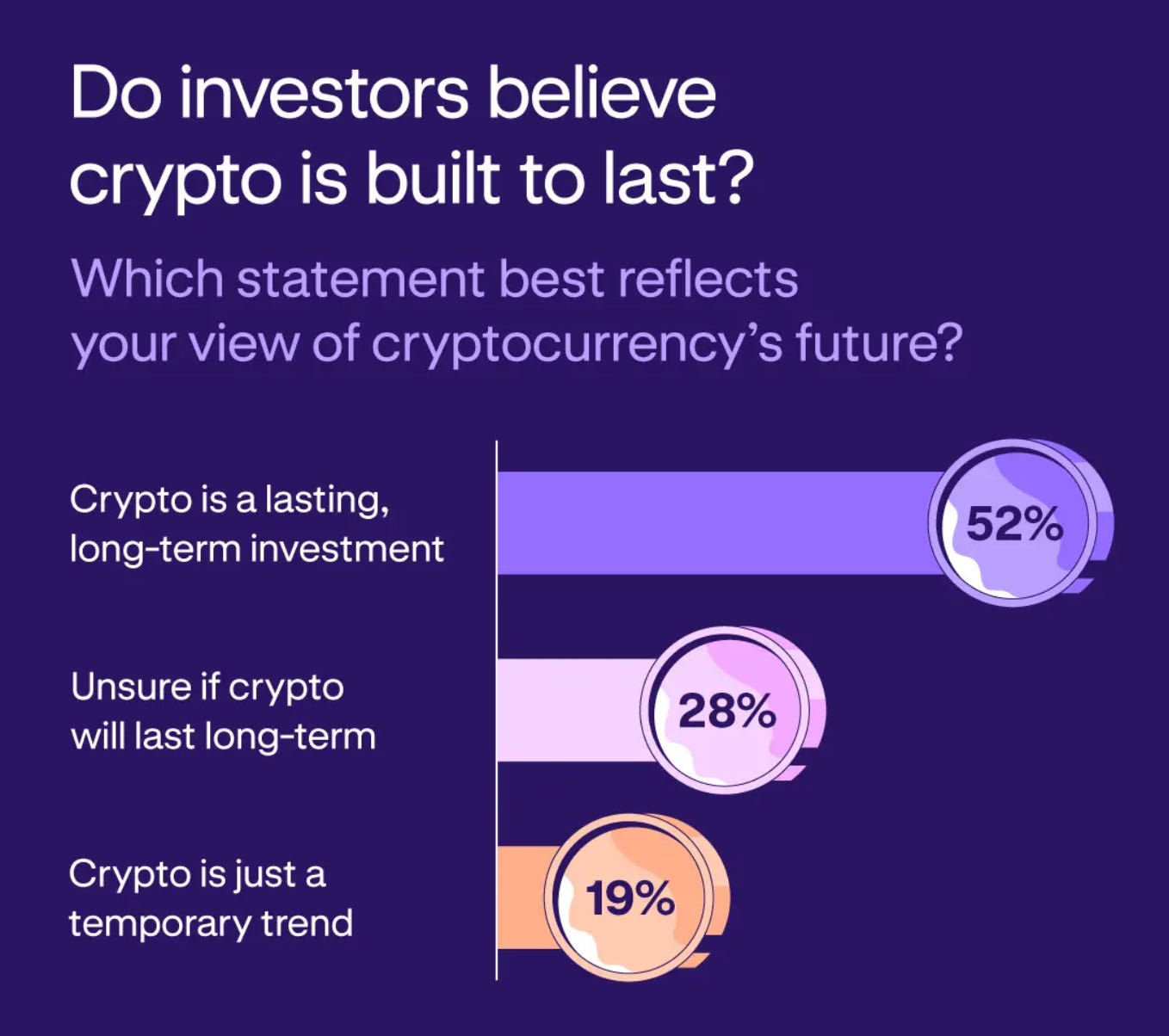

That's how many American crypto holders are ready to double down in 2025, according to Kraken's latest survey.

Breaking it down

Sample size: 2,537 Americans

Trust in crypto > traditional banking: 43%

Long-term believers: 52%

Real-world utility believers: 55%

The Generation Game

Gen X: Most bullish (Battle-tested by '08 crash & COVID)

Gen Z: Most skeptical (Only 32% see daily use case)

Overall crypto ownership: 7M+ adults (UK data)

But here's the plot twist...

While 73% are loading up for 2025:

29% still uncertain about crypto's future

60% think it's mainly for illegal stuff

Yet 55% see real-world value

The Token Dispatch View 🔍

What's particularly striking about this rally is its relative stability. Unlike previous bull runs characterised by extreme volatility, this move above $100,000 has been methodical, driven by institutional buying rather than retail speculation.

The entrance of major players like BlackRock, recommending a 2% Bitcoin allocation in portfolios, signals a maturing market. When combined with potential government adoption and continued corporate accumulation, we might be witnessing the early stages of Bitcoin's transformation from a speculative asset to a legitimate institutional reserve.

Of course, no rally is without risks.

The market's current "Extreme Greed" score of 80 out of 100 suggests some froth. There's also the question of how much of the Trump administration's potential crypto policies are already priced in.

For now, though, Bitcoin's ascent continues. At $105,000, it's no longer a question of if institutions will embrace Bitcoin, but rather how much of it they'll be able to acquire. In this new reality, yesterday's all-time highs might just be tomorrow's support levels.

The Surfer 🏄

Coinbase is facing a $1 billion lawsuit from BiT Global Digital Limited over its decision to delist Wrapped Bitcoin (wBTC), which the lawsuit claims was an anti-competitive move to promote Coinbase's own competing product, cbBTC.

U.S. authorities have seized over $4.6 million in cryptocurrency linked to a "pig butchering" scam, where victims are lured into fake crypto investments through deceptive relationships.

Frank Richard Ahlgren III, a Texas resident, has been sentenced to two years in prison for failing to report $4 million in cryptocurrency profits and evading over $1 million in taxes. This case marks the first criminal tax evasion prosecution in the US focused solely on cryptocurrency.

Polygon DAO is considering a proposal to deploy over $1 billion in idle stablecoin reserves, aiming for a conservative annual yield of $70 million through Morpho Labs' vaults.

Binance Research reports that Ethereum's market dominance has plummeted to a multi-year low of 13.1%, from 16.74 at the start of 2024, despite recent bullish momentum and significant inflows into Ethereum ETFs.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us ... either ways do tell us✌️

So long. OKAY? ✋