Bitcoin’s Graduation? Enter BTC ETF Options 🥁

As the world is lost in the euphoria of BTC nearing $100K, the launch of Bitcoin ETF Options may just be what crypto needed to mature as a sophisticated asset class in the global world of finance.

Hello, y'all. Saturday couplet? 🧱

There once was a trader named Jeff, who cheered for a Bitcoin ETF. Now he has got options so vast, he wondered what he’d amass.

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 160,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Started the year with a bang and ending with one.

How often do we get to say this about our lives?

Losers everyone. Not Bitcoin.

The year has already been filled with many wins for Bitcoin.

In touching distance of the historic $100K.

ETFs? ✅ All-time high? ✅ ETF Options? ✅

It all seems unreal, yet very much happening.

Bitcoin started 2024 on a high with the launch of ETFs and is all set to close the year at a new high.

But, just how big is Bitcoin, really, today?

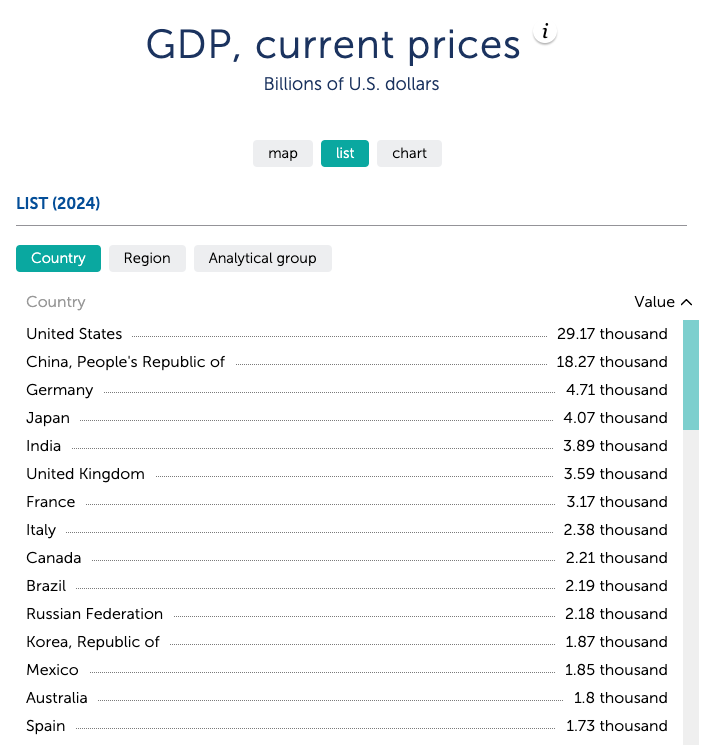

Bitcoin market cap currently stands at $1.95 trillion, up 165% in just one year from $738 billion.

What’s even better? In just last three months, the market cap almost doubled from $1.06 trillion.

So big that if it were a country, it would rank 12th among the top economies of the world. Just behind Russia.

And how did we get here?

Well, there would be a hundred different ways to describe that.

But, in three words: Exchange. Traded. Funds.

What about ETFs?

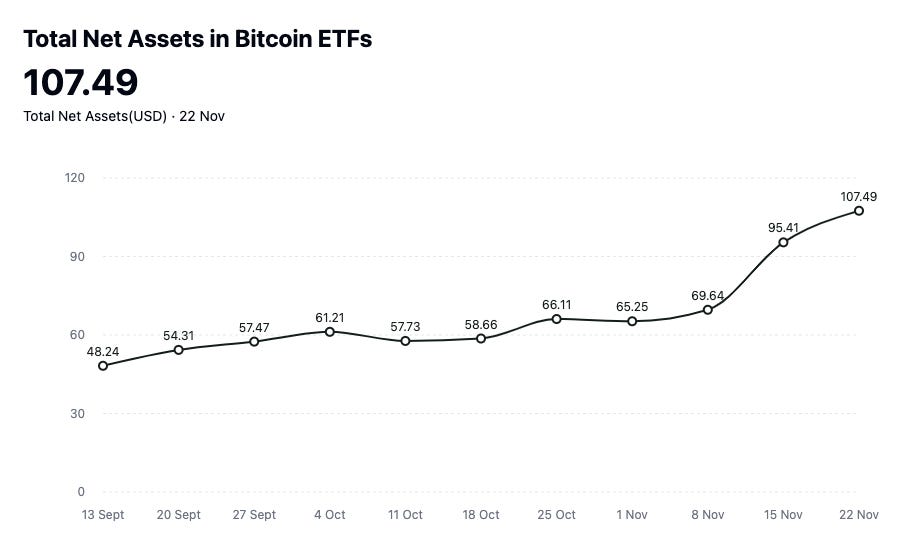

In just the last two months, the total assets value locked in Bitcoin ETFs almost doubled to $107.49 billion.

Throughout this year, ETFs almost single-handedly drove retail and institutional interest by making it easy to have exposure to Bitcoin.

Now, Bitcoin ETF Options are stealing the show.

Just when the post-election BTC price rally seemed to have gotten stuck around $90K for five days, Options came to the party.

The launch of BlackRock's Bitcoin ETF Options - Wall Street’s newest playground - sent Bitcoin price smashing through $93K to register another all-time high.

The financial instruments recorded $1.9 billion in first-day trading volume.

"Unheard of," says Bloomberg's ETF expert Eric Balchunas.

Numbers are staggering

354,000 contracts traded on day one

289,000 calls versus 65,000 puts

Outright bullish sentiment with 4.4:1 ratio

Says who? BlackRock's IBIT data.

For context, the previous record holder managed just $363 million - after four years of trading.

Bitcoin responded accordingly, touching $94,000 and setting a new all-time high.

"These options were almost certainly part of the move," says Bloomberg Intelligence analyst James Seyffart.

Don’t Miss Out on Our Weekly Features

Connecting dots to bridge the narrative that's shaping the crypto world. Saturday analysis written by Prathik Desai 👇

Crypto world can be a maze. Lot of information, not much context. Lot of noise, not much insight. Sunday explainers written by Thejaswini M A👇

But, why do Bitcoin ETF Options matter?

If ETFs brought mainstream acceptance for Bitcoin, ETF Options take it a notch higher by making BTC a more mature asset class for the investor, trader and advisor communities.

What exactly do Options do?

Two words: Risk armour.

Protection from what? Volatility.

Traders can now hedge Bitcoin exposure without selling their precious ETF shares. A put option here, a covered call there - suddenly volatility doesn't look so scary.

Says who?

"Counter to common opinion, options actually reduce volatility. They create natural buyers and sellers on both sides," market structure analyst Dennis Dick told The Block.

What else?

ETF Options are also a great leveller.

Retail traders can now play with the big boys without mortgaging their house. Want exposure to Bitcoin's upside? $0.15 calls are your lottery ticket.

But it's not just about gambling.

Protection against downturns

Less capital needed for positions

Clear regulatory oversight

Tighter spreads incoming

Institutional-grade hedging tools

"With options, we're not just seeing product evolution - we're watching Bitcoin grow up," says Anchorage Digital's Nathan McCauley.

The numbers back him up.

First-hour trading saw 73,000 contracts. That's more volume than some crypto exchanges see in a day.

So, where are the bettors betting?

Everyone’s betting on Bitcoin shooting to the moon.

But how much north?

Look at those December $100 calls - 9,500 contracts traded at just $0.15 each. Lottery tickets betting on Bitcoin hitting $175,824?

Not quite. Smart money is playing a different game.

Take the January $65 calls, priced at $2.40. That's betting on Bitcoin reaching $114,286 - a 22% rise in two months. Suddenly looks more reasonable, doesn't it?

"Professional traders are playing both sides," said Dennis Dick.

The strategies?

Synthetic longs: Selling $50 puts while buying $60 calls for $2.15

Covered calls: Selling $55 calls against IBIT holdings for $5.20 premium

Bull spreads: Buy $53 call, sell $58 call, risk $2.10 to make $5

What does it mean for institutions?

While traders debate strategies, something bigger is happening.

Pension funds and big institutions will also be taking a bite of the options since they drive liquidity.

Says who? Bloomberg’s Eric Balchunas.

Options will also mean that fund houses will get another derivative financial instrument to add to their income.

Others pointed out that the derivative will help in building investor confidence in a relatively young asset class.

"The introduction of options could unlock new credit opportunities. Institutional lenders may feel more confident lending against ETF collateral,” says Binance CEO Richard Teng.

The implications are massive

Price discovery improves

Liquidity deepens

Institutions gain familiar tools

Volatility potentially decreases

And the market's already speaking.

Here are some numbers

Bitcoin Spot Options open interest: $40 billion (all-time high)

Bitcoin Futures open interest: $60 billion

Total ETF inflows: $28.5 billion

IBIT market cap: $44 billion

So, all well with Bitcoin ETF Options?

Ah, there’s a catch.

There’s always one, isn’t it?

There’s currently a 25,000 contract position limit. It’s a dampener and needs to be rethought.

However, the start that BlackRock’s ETF Options saw with 4.4:1 call-to-put ratio, it is clear that Wall Street is voting with its wallet.

Especially when you compare it with Bitcoin CME futures, which allow the equivalent of 175,000 IBIT contracts.

"By industry standards, Bitcoin ETF options should have seen around 400,000 contracts," says Bitwise's Jeff Park.

The math is stark: ETF options represent just 0.5% of IBIT's outstanding shares. Industry standard? 7%.

But this isn’t holding back others from jumping onto the bandwagon.

Grayscale and Bitwise are gearing up to launch their ETF Options tomorrow. Others are lining up.

"Have mentioned before, but I now expect to see uptick in BTC options-based strategy ETF filings," says ETF Store President Nate Geraci.

Already in the pipeline

Covered call ETFs targeting income

Buffer ETFs for downside protection

Tail risk products for hedging

Convexity plays for leverage

Token Dispatch View

What happens when Wall Street decides to go all in on crypto? That's when things get really interesting.

After years of watching from the sidelines, traditional finance is bringing its full arsenal to crypto.

Bitcoin's rise to $100,000 might grab headlines, but the real story is in the infrastructure being built around the asset.

Historically, Options markets dwarf their underlying spot markets. If this is anything to go by, we feel the crypto industry is all set for a major re-consideration by all its erstwhile sceptics.

Especially, with the kind of leverage they will now have access to and anticipated crypto-friendly regulatory environment after the change of guards at the White House.

The game is changing. And we're just seeing the first moves.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋