Today’s edition is brought to you by Trezor. The hardware wallet to protect your identity and coins. Get exclusive holiday deals with 30-50% off on select products 👇

It’s Tuesday morning, and we've got a classic story of an “underperforming major” that has managed to break past a psychologically important price mark, for the second time in two weeks.

In today’s dose of crypto, we cover

Ethereum breaks out of $4K, yet again

Also records a three-year high at $4.1K

BlackRock throws its weight behind ETH

Strong ETF flows drive momentum

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 175,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Bitcoin, memecoins and rest of the altcoins - all of them had their moment.

But Ethereum.

Ethereum had to settle for memes and mockery on crypto twitter.

After months of sideways action, and mostly no action - Ethereum has risen.

The world's second-largest cryptocurrency smashed through $4,100, hitting levels not seen since the heady days of 2021.

Sure, Ethereum has crossed $4K mark for the second time this month. But things are different this time.

While crypto twitter was busy dunking on ETH's "modest" performance compared to other Layer-1s, Wall Street giants were quietly building positions.

And they predict better things are to follow.

Block That Quote 🎙

Jay Jacobs, BlackRock's US Head of Thematic ETFs

"We’re really just at the tip of the iceberg with Bitcoin and especially Ethereum. Just a tiny fraction of our clients own ($IBIT and $ETHA) so that’s what we’re focused on (vs launching new alt coin ETFs)"

Tip of the iceberg. It’s BlackRock. Are you listening?

But it's what Jacobs said next that really raises eyebrows: only a tiny fraction of BlackRock's vast client base currently owns their crypto ETFs.

This is a clear message from Wall Street giant: Ethereum, you got our attention.

And things have begun changing for ETH.

While retail traders were chasing meme coins and Solana pumps, someone was methodically accumulating ETH through regulated products. That "someone" turns out to be Wall Street's biggest names.

In the past couple of weeks, BlackRock's iShares Ethereum Trust isn't just seeing inflows – it's witnessing what looks like systematic institutional accumulation.

How do we know? Read on…

Crypto Security Made Easy

Trezor has transformed crypto security from a complex puzzle to a user-friendly playground, so you can be the boss of your financial future? 🫵

In The Numbers 🔢

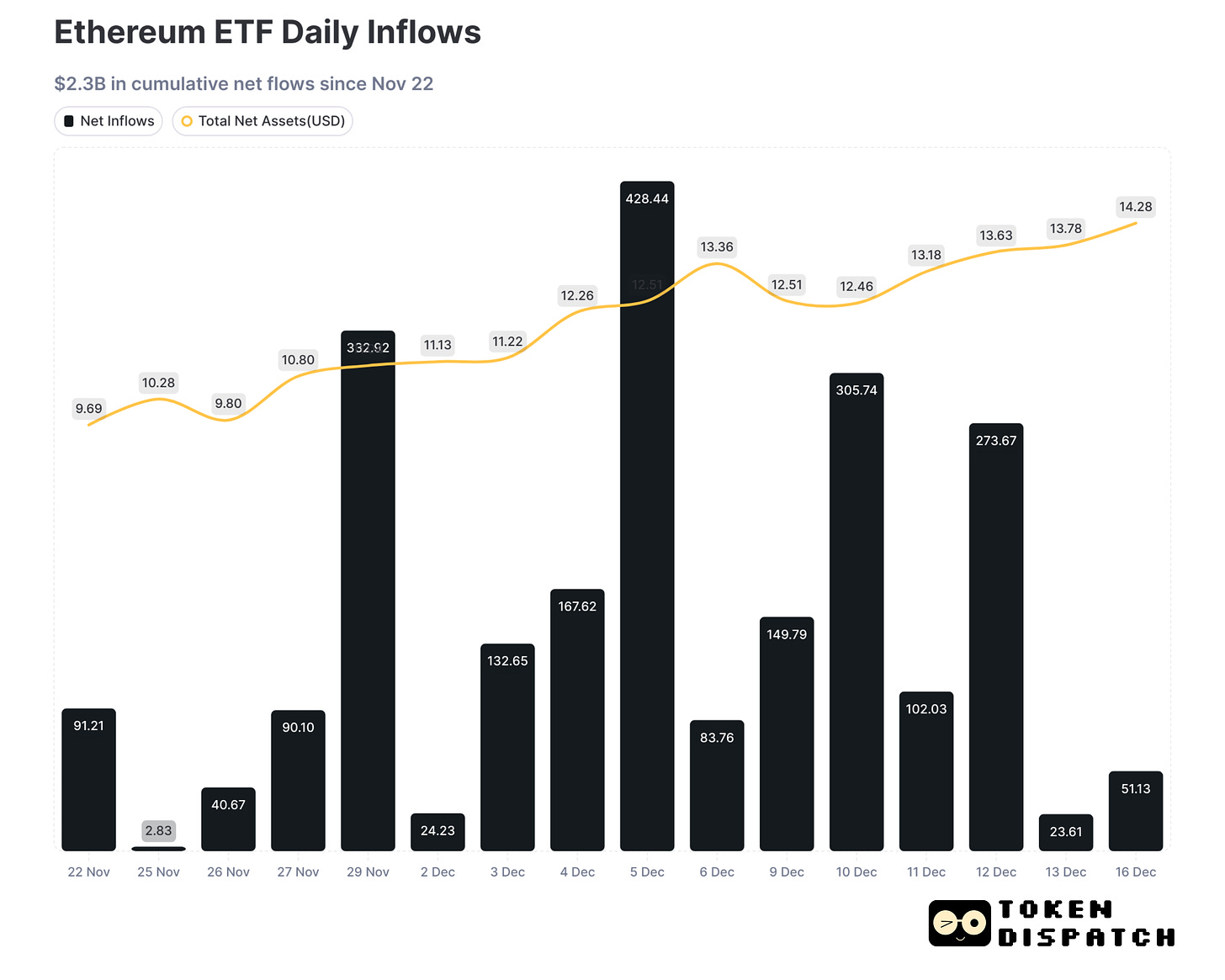

$2.3 billion

Cumulative institutional net inflows Ethereum ETFs raked in 16 consecutive trading days.

Meanwhile, BlackRock Ethereum ETFs just logged its 15th straight day of inflows.

But that’s not even the biggest news.

The cumulative sum that Ethereum ETFs pulled over just 16 trading days since November 22 is 99% of the total $2.32 billion net flows since its launch.

And yet, BlackRock says they're just getting started. Why?

Breaking it down

NAV under ETH ETFs shot up ~60% to $14.28 billion in less than a month

Three of the five highest single-day inflows recorded in December

Worldwide ETH investment products pulled in $3.5 billion since November

So the path ahead is clear for ETH? Not so easy.

Hedge Funds Piling Shorts

Not everyone's buying the Ethereum comeback story.

Even as ETH punched through $4,100, there is serious scepticism from others.

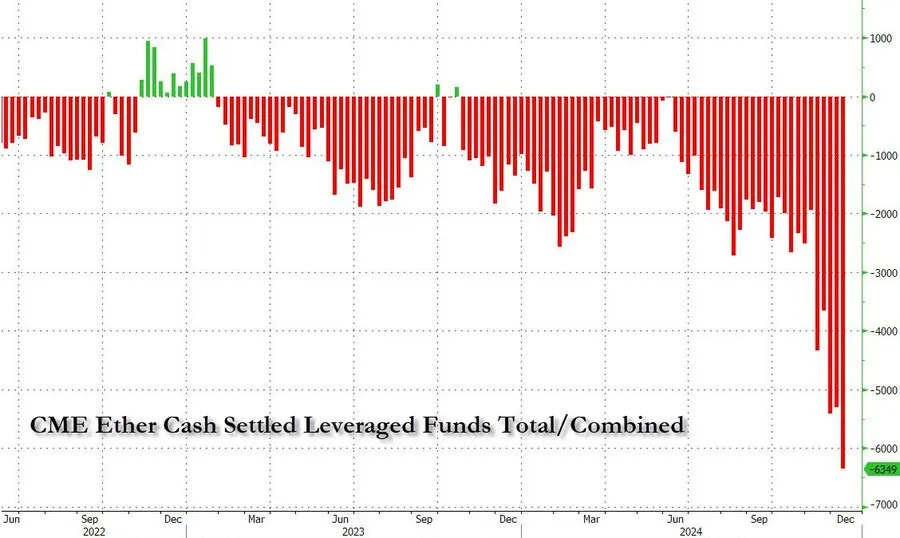

Hedge funds have been quietly building record short positions on CME.

An all-time high of 6,349 contracts betting against Ethereum's rise. Expecting a reversal.

Then there's the Layer-2 dilemma.

Binance Research reports how Ethereum's market dominance has plummeted to 13.1% - a multi-year low. Would've been unthinkable during the last bull run.

The Dencun upgrade, while solving fee issues, has led to a staggering 99% drop in revenue.

It's the kind of statistic that makes you wonder: is Ethereum winning the battle but losing the war?

The Token Dispatch View 🔍

If you're looking for a textbook example of institutional adoption in crypto, this might be it. Unlike the retail-driven mania of 2021, Ethereum's break above $4,100 carries the fingerprints of methodical accumulation.

Consider the context. Bitcoin is setting fresh records above $107,000, Trump's crypto-friendly administration looms on the horizon, and the Fed is expected to cut rates. It's the kind of perfect storm that typically drives crypto higher. But something about this ETH rally feels different.

First, there's the quantity versus quality debate. While critics point to Ethereum's "mere" 223% rise from the lows (compared to Solana's 2,400%), they're missing the quality of flows. Institutional capital through regulated ETFs is sticky money – it doesn't vanish at the first sign of volatility.

Then there's the BlackRock effect. Their decision to focus exclusively on Bitcoin and Ethereum ETFs, rather than expanding to other cryptocurrencies, sends a powerful signal to traditional finance. When the world's largest asset manager picks favourites, Wall Street tends to listen.

However, it's not all smooth sailing. Record short positions at CME suggest serious scepticism from some institutional players. The ongoing debate about Layer-2 solutions potentially siphoning value from Ethereum's base layer remains unresolved.

But perhaps that's exactly what makes this breakout so interesting. Unlike the FOMO-driven peaks of past cycles, this one comes with built-in scepticism. It's climbing a wall of worry, with clear risks visible to everyone.

As Binance Research puts it, Ethereum needs to make a choice: double down on L1 development or fully embrace its role as the foundation for L2 scaling. This "straddling the fence" approach might be contributing to market uncertainty.

Yet despite all these headwinds, institutional money keeps flowing in.

Maybe that's the story here – not that ETH is breaking $4,100, but that it's doing so with both strong tailwinds and serious headwinds in play. It's the kind of conflicted market setup that often precedes major moves.

The Surfer 🏄

Mt. Gox transferred approximately 1,620 Bitcoin (worth $172.5 million) to unknown wallets as BTC hovers around $107K. The transfer included a split of 1,427.9 BTC and 191.7 BTC, with funds moving through various wallets before settling.

CyberKongz, an NFT platform, received a Wells notice from the SEC, indicating potential enforcement action regarding its ERC-20 token linked to a blockchain game. CyberKongz has 30 days to respond to the SEC's notice, which stems from concerns over the sale of Genesis Kongz NFTs in April 2021.

Ethena's new stablecoin, USDtb, achieved $65.4 million in total value locked (TVL) on its first day, December 16. USDtb is backed by cash or cash equivalents at a 1:1 ratio, similar to Tether (USDT) and USD Coin (USDC), providing stability for users.

El Salvador has granted Bitget a Bitcoin Service Provider (BSP) license, allowing the exchange to offer Bitcoin-related services in the country. Bitget can now provide services like fiat currency exchanges, payment solutions, and secure custody for users in El Salvador. The country's Bitcoin portfolio is currently worth over $602 million.

Eliza Labs partners with Stanford University to research autonomous AI bots in the digital asset economy. The study will be part of Stanford's Future of Digital Currency Initiative, led by cryptography experts Dan Boneh and David Mazières.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us ... either ways do tell us✌️

So long. OKAY? ✋