Can Polymarket Whales Sway US Voter Sentiment? 🐋

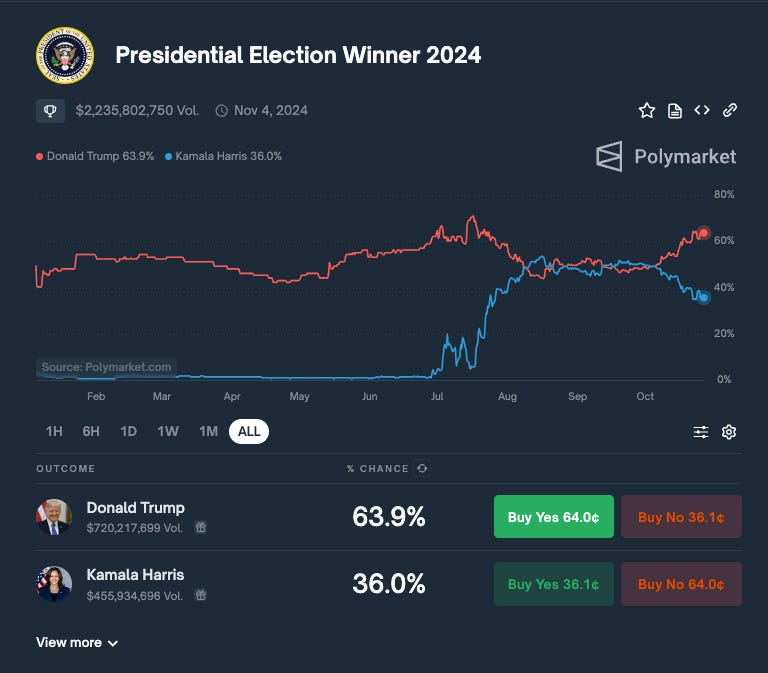

Are dollar prices in prediction markets the same as percentage probabilities? Overall volume of bets on Polymarket is $2.48B, but active traders barely cross 30k. Is manipulation possible?

Hello, y'all. Overwhelmed by prediction markets? Want a simpler betting experience that’s more social, more fun?

Make the Kutt 🚦 Peer-to-peer betting platform with tons of social features: friend groups, chats, leaderboards, H2H history, and user profiles. US only social betting platform that’s legal in 40+ US states 👇

On October 7, a Monday morning, Elon Musk posted on X celebrating Trump’s lead over Harris on prediction markets.

Just a day after he made his first appearance in support of Donald Trump at his rally in Butler, Pennsylvania.

The same place where the former president narrowly survived an assassination attempt.

Musk’s cap read “Make America Great Again”.

This was almost three weeks back.

Trump had just edged out with a 2 to 3 percentage-point lead over Harris on Polymarket.

Since August, the lead between both never crossed 10 percentage points.

But times change.

For more than two weeks now, Trump’s lead has stayed over 10%.

In fact it has shot up close to 30% now.

How reliable are prediction markets?

Musk had also claimed in his X post that betting markets are “more accurate than polls” since involves putting actual money on the line.

Putting money where the mouth is, you’d say, right?

And, he is not the only one who feels so.

“The economic literature suggests that prediction markets are fairly accurate,” Robert Webb, a professor at the University of Virginia who studies speculative markets, told DL News.

Polymarket did get some of its big predictions right in the past.

It predicted a 70% chance of President Joe Biden dropping out of the race as early as July 4.

That was two weeks before he actually bowed out.

Magical stuff?

Well, “Prediction markets are the new source of truth. Free from bias.”

Says who? Tarek Mansour, founder of Kalshi, another prediction platform accepting bets on election winner.

Read: Do Crypto Prediction Markets Matter? 🤔

So, all well with predictions?

Not really.

At least lately, it’s gotten itself into some muddle.

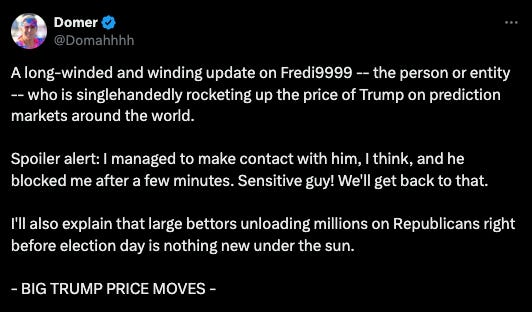

Last week, online sleuths pointed out whales spending millions betting on who will win the US presidential election.

They claimed that this distorted the prediction market in favour of Trump.

Accounts named Fredi9999, Princess Caro, Michie, and Theo4 have collectively spent nearly $24.7 million.

And this was not just done in favour of the Republican presidential candidate.

Whales did pull something similar on the Democrat side too.

On October 23, odds in favour of Trump slightly fell from 66% to 63% after a newly registered Polymarket user backed VP Kamala Harris with $2 million worth of bets.

But how are bets worth few millions swinging $2 billion Polymarket prediction?

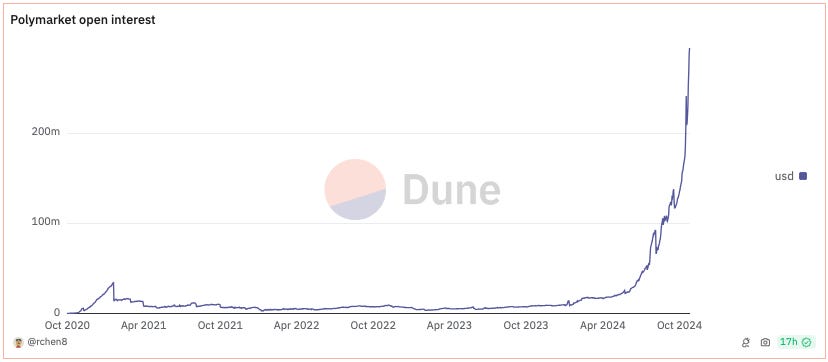

Three words: Low open interest.

Meaning? Although Polymarket got $2 billion in cumulative trades so far on its election winner prediction, that doesn’t mean billions worth of bets in volume are being traded everyday.

The amount of open trades on the market — is just over $200 million, data from Dune Analytics shows.

Put Your Money Where Your Mouth Is

Kutt is a p2p / friend-to-friend social betting platform that's legal in 40+ states

Bet directly against your friends or other fans on sports, politics, pop culture, personal events and more

Unlike prediction markets, Kutt is a community to build relationships with other bettors who have shared interests

Kutt handles the payment side of things, so you never have to chase anyone down for $$

Fully customisable odds and tons of social features: group chats, betting leaderboards, H2H history, and user profiles

Rewards - get cash back just for betting against your friends

Is manipulation possible?

With the kind of bets these whales are putting out, it can’t be ruled out.

That’s because a single entity has been purchasing all Trump related bets on Polymarket.

Says who? Online sleuth @fozzydiablo on X.

Polymarket agrees too. But dismisses manipulation claims.

It said a French national was the one who made large bets on a Trump election victory.

The bettor took a position based on a personal view of the presidential race, Polymarket said in a statement.

Mark Cuban dismissed the relevance of betting on Polymarket.

“From all indications, most of the money coming into Polymarket is foreign money, so I don’t think it’s an indication of anything,” he said in an interview with CNBC Squawk Box earlier this week.

But what does Cuban know?

He is probably just a billionaire investor who wants to support Kamala Harris and is eyeing that SEC chair spot.

Robin Hanson also dismissed concerns of manipulation, or attempts to influence prediction markets through misinformation, while speaking to DL News.

Hanson, a professor at George Mason University, is one of the earliest academic proponents of prediction markets.

“It’s a generic feature of having any information source people might rely on that people might want to try to distort it.”

Read: Market Prices Are Not Probabilities

But why manipulate?

It could be anything. Money? Power?

Maybe the $2.48 billion that’s at stake here?

Or just to sway voter sentiment towards the 2024 US Presidential Elections? Or can they?

If you ask us, it is just the money.

Read: Are dollar prices in prediction markets the same as percentage probabilities?

Token Dispatch View

Whales can swing the voter sentiment towards the candidates.

But what is important to note is the demographics of people betting on prediction markets.

Kalshi, a US-regulated prediction platform, allows US users to place bets on election winner prediction on its platform.

But its cumulative trades total up to $78.5 million. A fraction of the roughly $2.5 billion worth bets on Polymarket.

Meanwhile, US users are not allowed to bet on Polymarket, since it does not operate in the US-regulated market. US users need a VPN workaround to make their bets.

In fact the platform has started hunting for US-based whales.

“Polymarket is in the process of re-checking the details of users of its platform, particularly those making large wagers, to ensure compliance with its rules,” Bloomberg quoted an anonymous source.

So, how can non-US users portray the sentiment of voters when they are not the part of the voting population themselves?

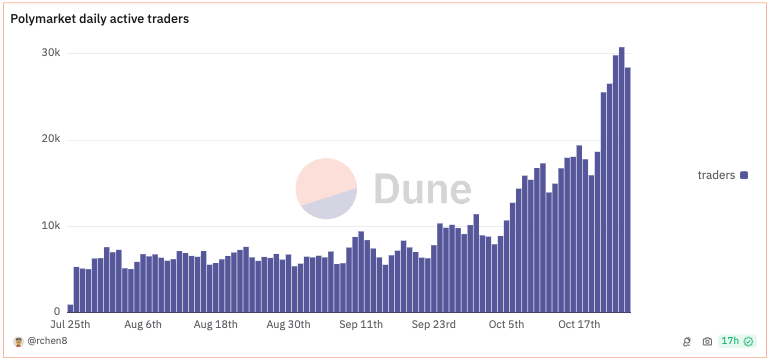

Moreover, while the overall volume of bets on Polymarket are a staggering $2.48 billion, the active traders are a small number.

Barely crossing 30k.

It is unlikely for a fraction of the overall voters to be able sway the sentiment of more than hundred million voters.

We will see that on November 5, 2024.

Week in Funding 💰

BlueSky. $15M. Decentralised social network that’s building AT protocol for developers to build social application

Validation Cloud. $10M. Web3 infrastructure platform for high-performance node and staking infrastructure

Party Icons. $9M. Web3 mobile gaming platform to combine the social elements of party games with the thrill of shooters

STOKR. $7.98M. Digital marketplace for alternative investments, bitcoin mining, real-estate, music royalties and other digital assets

Karpatkey. $7M. Non-custodial, on-chain asset management infrastructure provide financial services to the leading DAOs

Azura. $6.9M. Interfacing layer for on-chain finance for trading DeFi assets while retaining the non-custodial nature of crypto

Hata. $4.2M. Regulated cryptocurrency platform to transact and access cryptocurrencies with fiat currency, including the US dollar

Hana. $4M. Hyper-casual finance for user-driven distribution through existing open social networks

Moonwalk. $3.4M. Fitness accountability app that combines daily step goals with financial incentives.

Borderless. $3M. Global payments infrastructure for money transactions between stablecoins, real-world assets, internet-native currencies and fiat.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

Prediction markets have their merits, but without strict regulation and transparency, they risk becoming tools for disinformation. If Polymarket and similar platforms don’t limit outsized influence, we may end up in a world where 'truth' is just the highest bid. Betting is one thing, but when it impacts democratic processes, it's a slippery slope

Platforms like Kutt highlight how prediction markets could evolve. Making betting more social and less dependent on single, high-stakes players could increase transparency and make them better reflections of general sentiment. Polymarket's approach seems prone to 'echo chamber' effects, where a small, wealthy group dictates the odds.