Today’s edition is brought to you by Coin Ledger. December is here and it's time to lock in tax savings and reduce your 2024 tax bill.

Use the 10% discount coupon - CRYPTOTAX10 👇

Hello, y’all, It’s been quite an eventful year and an even more interesting week, this one. Bull runs are dizzy 🫵

Most of us were busy riding the crazy rollercoaster ride called Bitcoin for the past 72 hours: $100K to $92K, and all the way back to $100K. Ethereum has also joined in.

But elsewhere, something fascinating was happening in the Layer-1 (L1) ecosystem.

Sui and Aptos are the new two L1s being dubbed as Solana-killers.

In today’s Wormhole, we discuss if the failed children of Meta's crypto dreams will be able to disrupt proven giants Solana and Ethereum have been.

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 175,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

The ETH and SOL Challenge

These chains are looking to address what Ethereum and Solana failed to do - the Trilemma challenge.

What’s that?

Every rose has its thorn. And in blockchain, that thorn is called the trilemma - speed, security, decentralisation.

Pick two, they said.

Sui and Aptos said, "Why two?"

They decided to pack all of them together at even faster speeds.

Sui can theoretically process 297,000 transactions per second.

Solana, the current speed champion? About 65,000.

And fees? Consistently under $0.02.

Aptos is not too far behind. It can achieve 160,000 TPS with parallel processing.

Meaning? Contrary to sequential processing as in Ethereum and similar blockchains, Aptos uses parallel processing where simultaneous transactions are executed first and validated later.

This allows it to decongest the chain and charge lesser fees, making it more scalable than Ethereum and Solana.

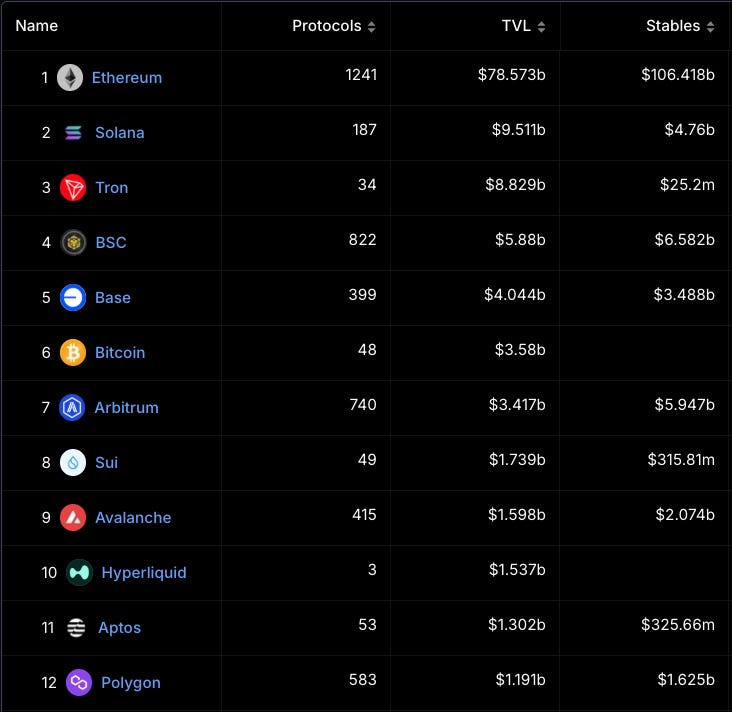

The Numbers Story

Sui: 9.4M active addresses monthly, 7.2B total transactions

Aptos: 8.67M monthly active users, 1.99B total transactions

Combined TVL growth: Over 200% in Q4 2024.

Translation? Sui and Aptos aren't just experiments anymore. They're becoming real contenders.

But how? It all starts with four letters: M-O-V-E.

The Move Advantage

Picture this: You're a developer trying to build the next big DeFi protocol using Solidity, the statically-typed programming language used for developing smart contracts on blockchain platforms.

That's like trying to build a rocket with Lego - it works, but you might want to double-check those pieces.

Move, on the other hand? It's like having a pre-built safety system. Those pesky hacks that keep making headlines? Move just doesn't let them happen.

What makes Move so special? First off, it treats your assets like they're actual objects. Can't accidentally delete them, can't magically duplicate them. Just like in the real world - when you give someone your coffee cup, you don't suddenly have two cups. Simple, right?

And developers are flocking to it.

Electric Capital's developer dashboard shows a 257% and 103% jump in the last two years in the total developer count on Move-based chains, as of July 2024.

Industry agrees.

"The interesting thing about Sui was the founders are not as visible, but they are doing something right because developers are talking about them. A ton of developers are talking about how Sui is great," says Ramani Ramachandran, Router Protocol's CEO.

But how are they competing alongside giants such as ETH and SOL?

Lock in Tax Savings: 2024 Checklist

Tired of tracking your profits and losses across multiple different wallets? Unsure of your cost basis or how much unrealised gain you're sitting on? Need a single dashboard to track your holdings and file your taxes?

Sign up on CoinLedger for free to get started with a preview tax report and a portfolio tracker. Use the 10% discount coupon - CRYPTOTAX10 👇

Simply connect your centralised exchanges and paste your public wallet addresses. CoinLedger pulls in all of your historical transactions and auto-calculates your gains, losses, and holdings across your entire portfolio—CeFi, DeFi, or anywhere else.

CoinLedger will make filing your crypto taxes a breeze.

Big money

Sui came from Mysten Labs, led by Evan Cheng - the same guy who won an award for making Apple's devices run smoother. They've raised $336 million, with backers including a16z and Binance Labs.

Aptos team is led by former Meta employees Mo Shaikh and Avery Ching, snagged $400 million in funding.

When you've got that kind of backing, you're not just building another blockchain - you're building for the long haul.

Steep Challenge Ahead

But beating Solana and Ethereum is not a walk in the park.

Simply because they have gone through the worst of market cycles, have borne the brunt of the community in such times and are battle tested.

And solving the problem of trilemma, while desirable, is not easy to achieve.

Remember those early days when Solana kept taking naps? Just last month, Sui had its own two-hour siesta. A humbling reminder that even the most promising tech needs battle testing.

But they're not backing down. Quite the opposite.

Both chains are throwing everything at the wall. Sui's cooking up a blockchain gaming device called SuiPlay0X1, partnering with gaming giants like Netmarble and NCSoft.

Aptos? They're going after emerging markets with JamboPhone, while also catching BlackRock's eye for institutional adoption.

They have also gone live on the mainnet with their most recent emojicoin.fun platform, which allows users to launch and trade digital assets with emoji symbols.

And DeFi? It's booming. DEX volumes between the chains hover between $20-50M daily. Lending protocols like NAVI Protocol and Scallop are pushing the boundaries of what's possible with Move.

But here's the billion-dollar question: Can they actually challenge Solana's dominance?

Token Dispatch View 🔍

Well, Solana wasn't built in a day. Its ecosystem took years of developer love, community building, and yes, those occasional outages we all love to joke about.

Sui and Aptos are playing a different game. They're not just trying to be faster - they're trying to be safer. Move's security-first approach means developers can sleep better at night. No more waking up to "we've been hacked" tweets.

Here's the thing about blockchain revolutions - they rarely announce themselves with a bang. Instead, they creep up on you, one developer at a time, one successful project at a time.

For bulls, Sui and Aptos represent the next evolution in blockchain architecture - faster, safer, more scalable. For bears, they're just another set of "Solana killers" that'll fade into crypto history.

Both views miss the point. The real story here isn't about killing anything. It's about evolution.

Move brings something new to the table - a way to prioritise security without sacrificing speed. Whether that's enough to reshape the landscape? Well, that's what makes crypto interesting.

Remember folks: in crypto, the most successful projects aren't always the ones making the most noise. Sometimes, they're the ones quietly solving real problems.

Keep your eyes on these two. They might just surprise us all.

Week in Funding 💰

Union. $12M. Hyper-efficient interoperability protocol connects all blockchains and rollups, across any ecosystem.

Haven1. $4.6M. Proof of Authority (PoA) blockchain that provides a secure environment for on-chain financial transactions.

Suilend. $4M. An autonomous lending and borrowing platform on Sui.

Fiamma. $4M. Zero-knowledge (ZK) proofs verification network for economically efficient solution for universal blockchain integration.

Sekai. $3.1M. Platform for creating, sharing and monetising interactive narratives, in partnership with Story Protocol.

DeFi.app. $2M. Simplify DeFi trading while maintaining full self-custody of crypto assets.

OpenPad. $2M. Decentralised AI analytics platform to deliver data-driven investment strategies

Scrypted. $1.5M. Decentralised, self-owning, autonomous agents and games, including ArtemisML and Inori Network.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋