Cantor Fitzgerald’s Tether Powerplay 🏦

Cantor Fitzgerald's $600M stake in Tether, $2B Bitcoin lending program and CEO Howard Lutnick's nomination as Commerce Secretary. Tracking Tether's big $13B minting spree. Regulatory chess game ahead?

Hey degens! Guess who just crashed the crypto party? Wall Street's oldest suit. Buckle up - this Monday's got main character energy.

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

Can you guess the track within 5 seconds to prove your music fandom 🫵

Something big is brewing on Wall Street.

And we mean BIG.

One of America's oldest financial institutions just dropped a bombshell that's got both TradFi and crypto worlds buzzing.

Sometimes, the biggest stories in crypto aren't about the loudest voices or the flashiest projects.

They're about the quiet deals happening in wood-panelled rooms, where traditional finance and crypto are slowly, deliberately intertwining their futures.

This is one of those stories.

What’s happening?

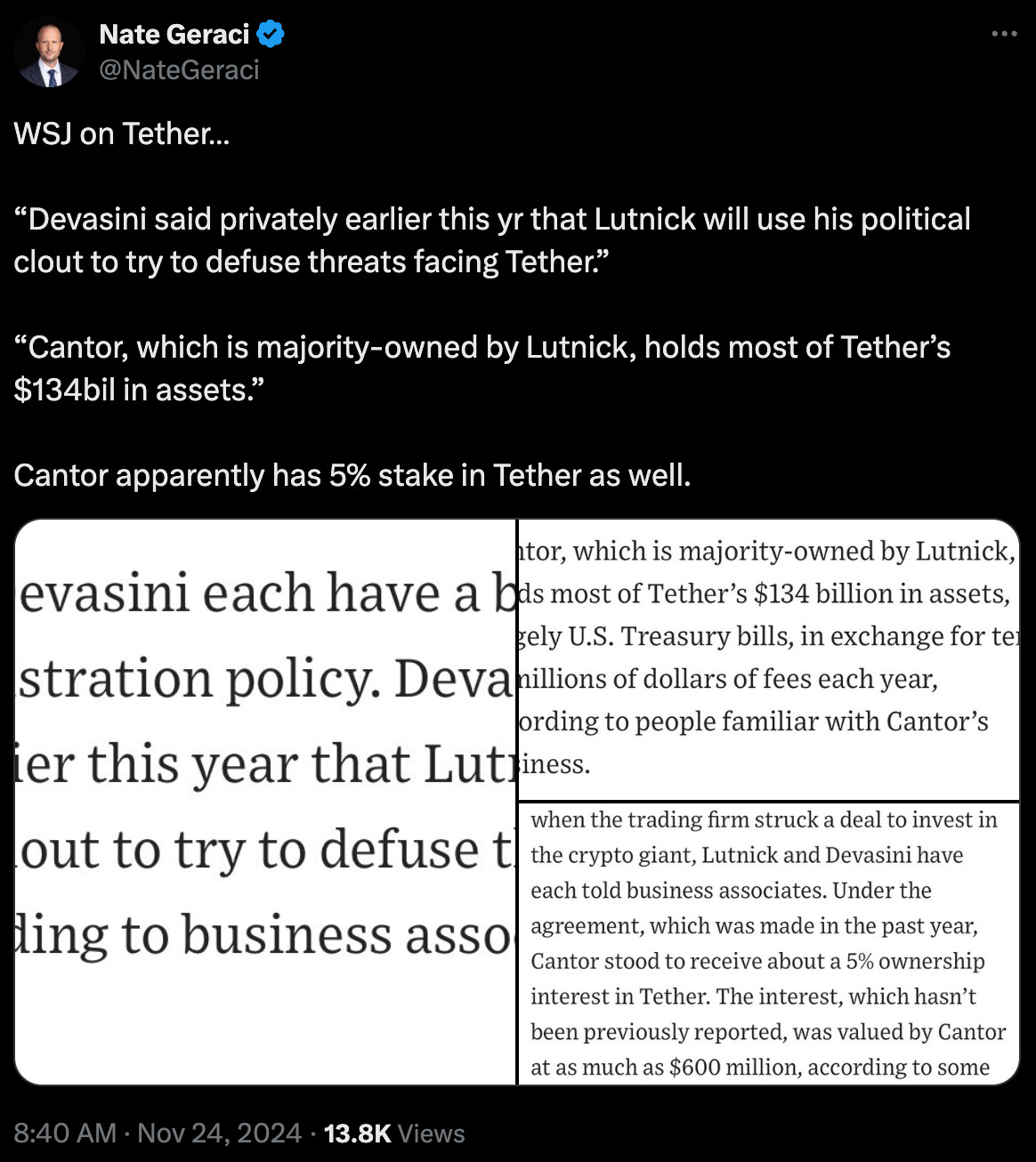

Cantor Fitzgerald, one of Wall Street's oldest and most prestigious firms, has quietly taken a 5% stake in Tether, crypto's largest stablecoin issuer.

The price tag? $600 million. Valuing Tether at $12 billion.

But wait, it gets better.

The Dealmakers

When Cantor's chief, Howard Lutnick met Tether CFO Giancarlo Devasini, he had one message, borrowed straight from Jerry Maguire:

"Show me the money."

And show they did. Every. Single. Penny.

All of Tether's massive $134 billion reserves is accounted for, mostly in US Treasury bills – which, coincidentally or not, Cantor Fitzgerald now manages.

That meeting wasn't just about due diligence. It was the beginning of a partnership that's reshaping the crypto landscape.

How did we get here?

2021: Tether pays $18.5M to settle with NY AG

2022: Most US banks cut ties with Tether

2023: Enter Cantor Fitzgerald

2024: From partners to shareholders

The Political Angle

Here's where things get really interesting.

Howard Lutnick, Cantor's CEO and the architect of this deal, was just nominated as Commerce Secretary by President-elect Donald Trump.

And he's already co-chairing Trump's transition team, helping pick the very regulators who might oversee Tether.

Devasini reportedly told associates that Lutnick would "use his political clout to try to defuse threats facing Tether."

While Tether's spokesperson dismisses this as "laughable," the timing is... intriguing.

“The ratings assigned to Cantor, BGC, and Newmark incorporate key person risk associated with Lutnick given his majority voting control, market relationships, close involvement in many aspects of the businesses, and outsized influence on the firms’ respective strategic directions,” warns Fitch Ratings.

But maybe that's exactly what everyone wanted?

The $2 Billion Bitcoin Play

Remember when Lutnick took the stage at Bitcoin 2024 in Nashville? Between casual movie references and Treasury talk, he dropped a bombshell: a $2 billion Bitcoin-backed lending program.

It's Wall Street's biggest traditional player saying, "We're not just dipping our toes anymore. We're diving in."

The program would allow clients to borrow dollars using Bitcoin as collateral. And guess who's helping power this operation? Tether.

Let's put this in perspective:

Cantor Fitzgerald currently holds around $3.5 billion worth of assets.

Cantor manages most of Tether's $134B assets

Earns tens of millions in annual fees

5% stake valued at $600M

Tether's total valuation: $12B

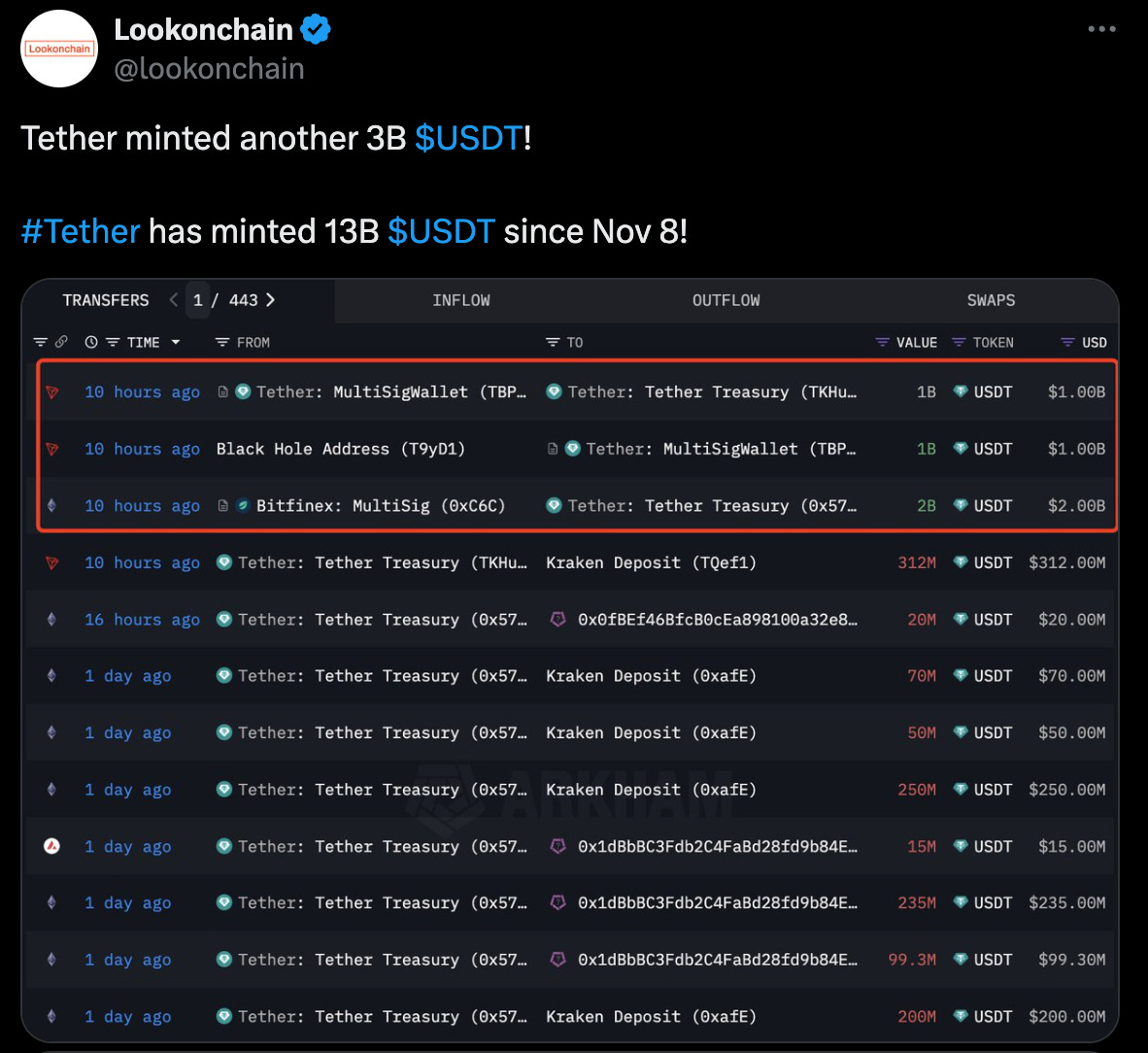

$13B new USDT minted in just two weeks

A Family Affair

The Tether connection runs deeper than just business. Brandon Lutnick, Howard's son, didn't just intern at Tether's Swiss operations – he literally counted the gold bars backing Tether's $660 million gold-backed token in Lugano.

Now at Cantor, Brandon might inherit the Tether relationship as his father prepares to step down for his government role. Talk about keeping it in the family.

The Regulatory Chess Game

This is where it gets complex.

Tether has been facing headwinds.

A UN report flagging USDT as money launderers' "preferred choice"

Treasury Department seeking new powers to block suspicious stablecoin transactions

Proposed legislation targeting offshore stablecoin operations

But with Lutnick potentially heading to Washington, the game is changing.

Let's talk about Tether's numbers

$13 billion in new USDT minted since November 8

Total supply now at $132 billion

$7.7 billion in profit through first nine months of 2024

Managing $134 billion in reserves through Cantor Fitzgerald

Those aren't just numbers. They're signs of a stablecoin empire expanding at breakneck speed.

Token Dispatch View

We're witnessing a masterclass in institutional chess.

While crypto Twitter debates the latest memecoins, Tether and Cantor Fitzgerald are quietly rebuilding the financial system's plumbing. The $600 million stake isn't just an investment – it's a bridge between two worlds.

The timing with Lutnick's Commerce Secretary nomination isn't coincidental. It's a signal that crypto's future might be less about disrupting the system and more about becoming the system.

For better or worse, the lines between TradFi and DeFi are blurring. The real question isn't whether this merger will happen – it's already happening. The question is: who will write the rules of this new financial order?

As Tether mints billions in new USDT and Cantor prepares its Bitcoin lending program, we're getting our answer. The future of finance isn't being written in whitepapers anymore.

It's being written in deal memos on Wall Street and policy papers in Washington.

And Howard Lutnick might just be holding the pen.

The Home for All the Music Lovers

Muzify is a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

In The Numbers 🔢

$13 billion

That's how much USDT Tether has minted since Trump's victory on Nov 8.

Breaking it down

$2B minted on Ethereum

$1B added on Tron

Total USDT supply: $134B

Market dominance: 70%

Paolo Ardoino's take?

"In 2025, Tether will need to reach hyper-productivity to accomplish our grand vision."

Block That Quote 🎙️

Former U.S. Senator, Pat Toomey.

"I think the Fed is fundamentally not friendly to this technology.”

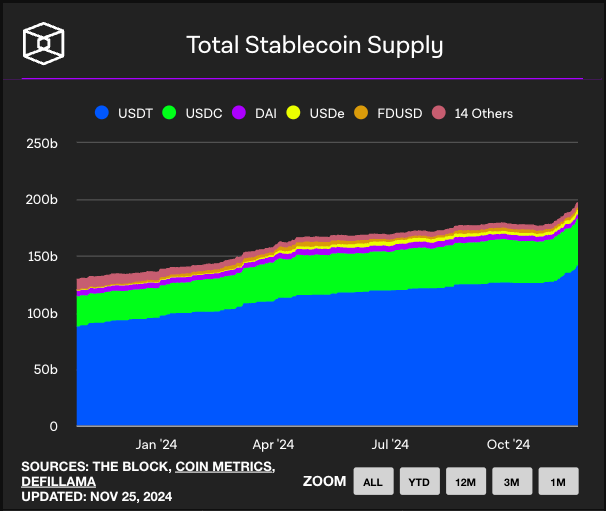

Here's a number that might surprise you: $174 billion.

That's the current market cap of stablecoins.

And yet, we still can't agree on how to regulate them.

Toomey, who's seen his fair share of financial legislation, recently shared some sobering thoughts about why the stablecoin regulation puzzle remains unsolved.

“I believe there was never an imminent opportunity to get a bill done. Understandably, some of these difficult and somewhat complicated issues haven't been fully developed."

Toomey points out four major hurdles

Bankruptcy resolution protocols

Reserve requirements clarity

Bank deposit insurance questions

Regulatory jurisdiction disputes

He's actually optimistic about 2025.

Why? Trump administration.

While lawmakers debate, the stablecoin industry isn't waiting around:

Treasury bills are being gobbled up by stablecoin issuers

The Treasury's own Borrowing Advisory Committee is taking notice

Some are even suggesting a private blockchain for Treasury operations

Senator Hagerty's proposing state-level oversight for smaller players

With Lutnick heading to Commerce and new bills like Hagerty's Clarity for Payment Stablecoins Act in play, maybe the Fed's "unfriendly" stance won't matter as much anymore.

The Surfer 🏄

Wrapped Bitcoin (WBTC) experienced a dramatic flash crash on Binance, plummeting to $5,200 on November 23 before quickly rebounding to around $97,000. The crash was attributed to an electronic error specific to Binance and occurred shortly after Coinbase announced plans to delist WBTC, raising concerns about competition and custody issues surrounding the asset.

The SEC has achieved a record $8.2 billion in enforcement penalties for fiscal year 2024, largely due to a $4.5 billion settlement with Terraform Labs after its blockchain ecosystem collapsed.

US SEC Commissioner Jaime Lizárraga plans to leave the agency in January 2025 to spend more time with his family, following SEC Chair Gary Gensler's announcement of his own departure in January. Lizárraga cited his wife's battle with breast cancer as a key reason for his decision.

Ripple's Chief Legal Officer, Stuart Alderoty, has called for significant reforms at the SEC as Gary Gensler prepares to step down, emphasising the need to end non-fraud crypto litigation and retain pro-crypto commissioners.

President-elect Donald Trump has nominated hedge fund manager Scott Bessent as Treasury Secretary, marking a significant shift towards pro-crypto policies. If confirmed, Bessent will be the first openly gay Treasury Secretary and a strong advocate for digital assets, potentially reshaping US financial policy.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

Saved to look back on the possible impact of some of these things. Or requesting a followup article in a year or so!