Chinese Checkers 🧲

Will China learn to love Bitcoin? Professor Yang Wang suggests some tweaks. BitForex is back after vanishing. US Ethereum ETFs debut with 1.1 Billion. Japan to be the global crypto hub?

Hello, y'all. Remember the “Gangnam Style”? 🐎

If not, then just play the 👉 Music Nerd quiz game 🎵

This is The Token Dispatch 🙌 find all about us here 🤟

The next stop: China?

China might finally let people buy Bitcoin again?

The Bitcoin ban? Might be lifted by the end of the year?

Could be rumour, could be truth, definitely bullish?

Reasons for speculation?

Justin Sun's legal win in China.

Bybit allowing Chinese expatriates to trade crypto.

Hong Kong approving Bitcoin and Ethereum ETFs.

The hope is sparked by Galaxy Digital CEO Mike Novogratz.

What’s the history?

2017: China starts restricting crypto trading.

May 2021: The People's Bank outlaws all crypto transactions.

But, China has never actually placed a blanket ban on Bitcoin—it’s more about certain activities like exchanges and mining.

While cryptocurrencies are not recognised as legal tender and are classified as virtual commodities, private possession and circulation of Bitcoin are not explicitly illegal.

But, the government does not allow cryptocurrencies to be used as a medium of exchange.

The Chinese government is actively developing its own central bank digital currency (CBDC) - digital yuan or e-CNY.

Would love to be in control, eh?

Justin Sun, founder of TRON, scored a win in a Chinese court recently.

After a two-year legal battle, Sun was cleared of false accusations published by the Chongqing Business Media Group.

The media group published articles and videos accusing Sun of insider trading, fraud, and money laundering, without evidence. The court ruled in favour of Sun, ordering the media group to remove the false content and issue a public apology.

Crypto exchange Bybit is making moves too, tweaking its services for Chinese expats, hinting at a softer stance from China on crypto. The exchange now enables overseas Chinese users to trade cryptocurrencies despite the strict ban on crypto trading in mainland China.

What happened in Hong Kong? ETFs.

Hong Kong approved spot Bitcoin and Ethereum ETFs this April, but mainland investors are still out of the loop. The city’s aiming to be a crypto hub, possibly signaling a broader change in China’s strict crypto policies.

Have the Chinese sold?

In November 2020, Chinese authorities seized about 194,775 bitcoins from the operators of the PlusToken Ponzi scheme.

Some of the crypto was directly seized from the fraudsters.

A defendant managed to get permission to legally sell the seized digital currencies through Beijing Zhifan Technology Co. Ltd., aiming to compensate the victims.

Remaining proceeds were turned over to the state treasury.

WuBlockchain report suggests that a large portion of these bitcoins were sold between late 2019 and mid-2020 when prices were lower.

There’s speculation that about 15,000 bitcoins might still be unsold.

Is Trump right to worry about China?

Donald Trump recently shared his thoughts on the US needing to step up its game in the crypto world.

He told Bloomberg that if the U.S. doesn't get serious about crypto, China might just swoop in and dominate the space.

“If we don’t do it, China is going to pick it up and China’s going to have it—or somebody else, but most likely China.”

Read: Trump Picks VP ✅

Read: Crypto Rides Black Swan Event 🕊️

This isn’t very surprising.

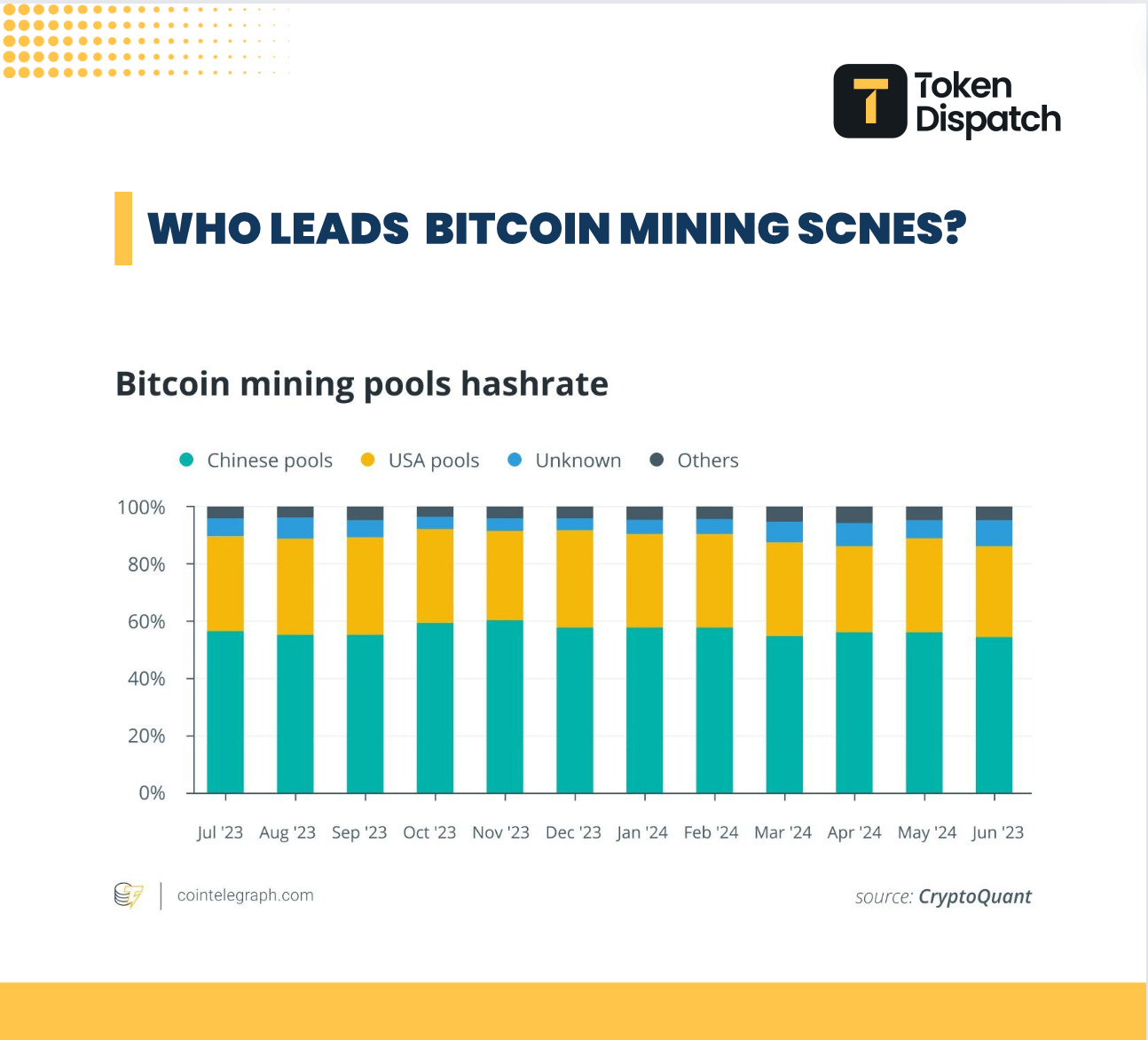

Historically, China was a major player, hosting up to 75% of the world’s Bitcoin mining.

China has access to cheap hardware and energy, which could help it regain some level of dominance in the crypto space.

Bitcoin mining is not high-tech but relies heavily on capital and infrastructure, areas where China has a comparative advantage.

Despite bans, Chinese influence persists. Mining equipment and know-how are still predominantly Chinese.

CryptoQuant's insights reveal that Chinese mining pools hold a significant market share, which means some operations might still run covertly within China.

Trump might have a point after all!

Block That Quote 🎙️

Vice President of the Hong Kong University of Science and Technology (HKUST), Professor Yang Wang

“… if Trump comes to power, China will need to re-evaluate all these policies in a very short time.”

Renowned mathematician, and Hong Kong's leading scholar, Professor Wang is critical of China and Hong Kong's cryptocurrency policies.

He presented his perspectives on the development prospects of Hong Kong's virtual asset market at the HashKey New Horizons event.

He said Hong Kong has been too slow in promoting cryptocurrencies and that China needed to lift its ban on Bitcoin mining, especially after Trump's election, and that China needed to reassess its policy of banning cryptocurrencies.

Back After Vanishing With $57m

Five months ago, the Hong Kong cryptocurrency exchange BitForex vanished, leaving behind $57 million in user funds that were transferred to a new wallet.

The exchange announced its re-emergence on July 19.

Re-emergence: BitForex announced it was absent due to a police investigation in Jiangsu province, China, where several staff members were reportedly detained.

User withdrawals: The exchange stated that users would soon be able to withdraw their assets, but it will not resume trading or accept new registrations or deposits.

Initial claims: BitForex initially attributed its downtime to “unscheduled maintenance,” contradicting later revelations about police detentions.

Detained staff: Former CEO Jason Luo claimed that employees were working from Singapore and were detained upon returning to China for the New Year holidays.

Mystery: Luo connection to BitForex is unclear after he stepped down shortly before the exchange's disappearance.

Lack of Transparency: The investigation raises questions about BitForex's operations, as the exchange had not disclosed any links to Jiangsu and has not specified the number or roles of detained staff.

Headquarters discrepancy: BitForex claims to be headquartered in Hong Kong but appears to lack a physical office, with business registry documents pointing to virtual address services.

Regulatory issues: In March, the Hong Kong Securities and Futures Commission labeled BitForex as a suspicious platform, suspecting it of fraudulent activities, and Hong Kong police are still investigating.

Despite the risks associated with operating cryptocurrency projects in China, many companies continue to do so, often utilising affordable staff based in the country.

The case of BitForex mirrors other incidents in the crypto space, such as the arrest of Multichain's CEO, highlighting ongoing concerns about the intersection of cryptocurrency and regulatory scrutiny in the region.

In The Numbers 🔢

$1.1 billion

The total trading volume for US Ethereum ETFs on debut.

Nine US spot Ether ETFs went live on July 23 - Ethereum ETFs ▶️

On the first day of trading, the ETFs clocked $106.78 million in net flow.

The US Bitcoin ETFs had $4.5 billion in trading volume on their first day, and $600 million in net flow, earlier in January 2024.

Read: The Bitcoin ETFs were a huge success. Can Ethereum do the same?

Crypto Companies Flocking to Japan?

Japan’s potential to become a global crypto hub, is attracting international crypto firms to establish a presence in the country.

Favourable regulatory environment: Clear and sophisticated regulatory framework for cryptocurrencies, providing stability and clarity for businesses.

Large, tech-savvy population: A digitally native, educated, and affluent population, makes it an attractive market for crypto and digital finance companies.

Government support: Actively promotes crypto and blockchain as part of its national strategy, with initiatives led by the ruling Liberal Democratic Party.

Relaxed token policies: Self-regulating bodies in Japan are easing requirements for token listings, for easier access for crypto projects to gain market exposure.

Tax reforms: Revisions to restrictive crypto tax laws aim to attract more businesses to the Japanese market.

Maturity after past hacks: Japan has weathered major crypto hacks like Mt. Gox in 2014, reducing some of the fear around the industry. The country is now positioned as a stable environment for crypto growth.

More about Mt. Gox: Fire Sale 📉

The Surfer 🏄

Decentralised exchange dYdX is in talks to sell its v3 derivatives trading software to a consortium including Wintermute Trading and Selini Capital, with Perella Weinberg Partners advising the sale. It revealed its v3 front-end had been compromised, less than an hour after the news of the sale discussions broke.

ApeCoin DAO is voting on a proposal to establish an APE-themed hotel in Bangkok, with over $3.6 million in APE votes supporting the initiative, representing over 90% approval. The proposal, known as AIP-448, aims to enhance the ApeCoin ecosystem and will conclude voting on July 31.

Igloo, Inc., the parent company of the NFT brand Pudgy Penguins, has raised over $11 million in funding. To develop a new Ethereum layer-2 scaling network called Abstract to improving decentralissed app creation through zero-knowledge cryptography.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋