Code No Criminal 🌪️

Fifth Circuit overturns Tornado Cash sanctions. $552M in stolen crypto washed? Ross Ulbricht hints at potential freedom. Paul Atkins emerges as frontrunner to replace Gensler.

Hey ya’ll, It’s Tornado Thursday. Winning everyday. Privacy just got its biggest win yet. A code is just a code, period.

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

Can you guess the track within 5 seconds to prove your music fandom 🫵

Code is not property. Four simple words that just changed the game.

On November 26, three judges in the US Court of Appeals for the Fifth Circuit penned what might be the most consequential ruling for crypto privacy to date.

Tornado Cash's immutable smart contracts cannot be sanctioned because they're not "property."

That's it. That's the ruling.

But those seemingly simple words just upended years of regulatory approach to crypto privacy tools and sent privacy-focused tokens soaring – TORN jumped a staggering 380% in hours.

The reason? For the first time, a US court recognised that some pieces of code are beyond anyone's control – even the government's.

Let’s rewind …

The Tornado Cash Saga

To understand why this matters, we need to look at the human cost of getting this wrong.

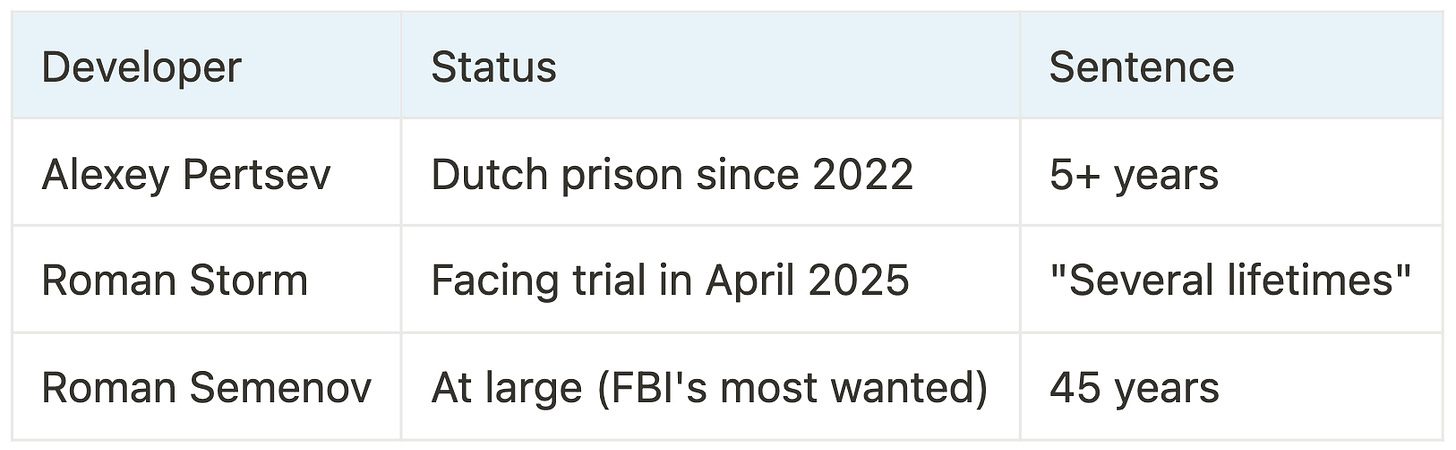

Three developers – Alexey Pertsev, Roman Storm, and Roman Semenov – have had their lives turned upside down for writing code that would eventually become Tornado Cash.

Back in August 2022, OFAC sanctioned Tornado Cash, a popular crypto mixing service, claiming it helped launder over $7 billion in crypto.

Crypto mixer? You put your crypto in, it gets mixed with others' funds, and you get different coins back – making transactions harder to trace.

The Treasury's argument? North Korean hackers were using it to clean stolen funds.

Their solution? Add 44 Tornado Cash smart contract addresses to their sanctions list. Basically telling every American: "Touch this code, go to jail."

One tiny problem: You can't really sanction math.

Read: Why Tornado Cash Matters? 🌪️

Pertsev sits in a Dutch prison, serving a five-year sentence.

Storm faces potential "lifetimes" in prison if convicted in his upcoming trial.

Semenov remains at large, featuring on the FBI's most wanted list.

According to the developers? They just wrote code that enabled privacy – what others did with it wasn't their responsibility.

This is where the Fifth Circuit's ruling gets interesting.

By declaring immutable smart contracts beyond the reach of sanctions, the court effectively said: The code itself can't be criminal.

It's like saying you can't arrest a math equation for being used in a bank robbery.

“Tornado Cash’s immutable smart contracts … are not the ‘property’ of a foreign national or entity, meaning they cannot be blocked under IEEPA, and OFAC overstepped its congressionally defined authority,” the ruling says.

The Market Reacts

TORN (Tornado's token): +380% to $33.

Railgun (RAIL): +36%.

Zcash (ZEC): +26%.

DASH: +11%.

But more importantly, the ruling sparked a broader rally in privacy-focused projects, suggesting that markets believe this could be the beginning of a new era for crypto privacy.

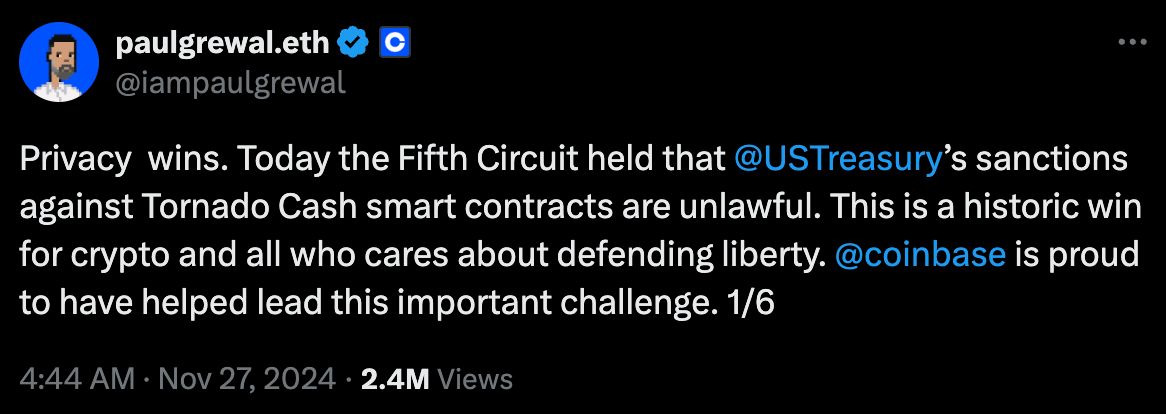

The Industry Supports

Paul Grewal, Coinbase's Chief Legal Officer

Bill Hughes, senior counsel at Consensys, wrote on X.

“A good win … One which the Supreme Court would be unlikely to reverse.”

Vitalik’s donation?

Vitalik Buterin just dropped $1 million into Coin Center's wallet hours after the Tornado Cash victory.

320 ETH donated

Within hours of court ruling

Direct support to privacy advocates

Second major donation this year

The Trump Factor

For the crypto industry, still digesting this ruling, an even more intriguing possibility has emerged: Donald Trump's likely return to the White House in 2025 could completely reshape how the government approaches crypto privacy tools.

"I actually think under a Trump administration, it's more likely that this opinion will be adopted as Treasury policy," says Bill Hughes, Consensys' senior counsel.

It's a remarkable prediction, considering that under Biden, OFAC placed 44 Tornado Cash smart contracts on their sanctions list, effectively trying to outlaw pieces of code.

The irony isn't lost on anyone.

The same Treasury that accused Tornado Cash of laundering $7 billion in crypto might soon be led by Scott Bessent, Trump's pick for Treasury Secretary – a man from the world of finance rather than law enforcement.

🔢 In The Numbers

$552,000,000

That's how much stolen crypto was washed through Tornado Cash in 2024 alone. Talk about a money laundromat.

Breaking down the dirty money.

457,768 ETH total deposits

56% linked to major hacks

45% increase from 2023's activity

The Biggest "Customers" 🏆

WazirX Hack: 61,698 ETH ($217.2M)

Heco Bridge: 52,281 ETH ($189.1M)

Poloniex Breach: 18,874 ETH ($68.4M)

Orbit Chain: 12,930 ETH ($46.8M)

Penpie Exploit: 11,261 ETH ($40.8M)

The Home for All the Music Lovers

Muzify is a journey into the world of music. An interactive experience through quizzes, stats and a lot of fun tools.

For artists it’s a powerful tool to connect with their fans. For fans it’s building deeper connect with the artists.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

Block That Quote🎙️

Ross Ulbricht, the infamous Silk Road founder.

"I'm starting to get used to the reality that I could be home in a couple of months!"

Serving a double life sentence plus 40 years, Ulbricht just sent a cryptic tweet.

The timing couldn't be more dramatic.

With Trump's victory, the Tornado Cash ruling reshaping crypto privacy laws, and now Ulbricht's suggestive tweet, the crypto industry faces a potential seismic shift in how America treats crypto-related offenses.

Ulbricht's optimism isn't entirely unfounded.

Read: 'Give Me Liberty, or Give Me Death!' 🤌

Trump had previously hinted at pardoning the Silk Road founder, and with the incoming administration potentially softening its stance on crypto privacy tools (as evidenced by the Tornado Cash discussions), the winds of change seem to be blowing in a decidedly libertarian direction.

We might even have a crypto friendly SEC Chair …

The Next SEC Boss?

While privacy advocates celebrate the Tornado Cash victory, another game-changing development is brewing.

Meet Paul Atkins, the man who might just flip the SEC's crypto script.

The former SEC commissioner has emerged as Trump's top pick to replace Gary Gensler as SEC chair.

Atkins isn't just another suit.

Pro-innovation stance

Deep crypto expertise

Balanced regulatory approach

Understanding of modern markets

But here's the real kicker – Trump's team is considering moving crypto oversight from SEC to CFTC entirely.

Token Dispatch View 🔍

Here's where it gets philosophical: If code is truly immutable and beyond control, can anyone – developer or government – ever be held responsible for how it's used?

This question becomes particularly relevant as we look at Storm's upcoming trial in April 2025. With the Fifth Circuit's ruling establishing that the smart contracts themselves can't be sanctioned, his defense team now has powerful precedent to argue that developers shouldn't be punished for creating unstoppable code.

The Fifth Circuit's Tornado Cash ruling, combined with Atkins potentially heading the SEC, marks a pivotal moment for crypto.

First, for code itself. The court has made it clear – you can't sanction math. This sets a powerful precedent for all open-source development, not just in crypto.

Second, for privacy. Despite all the FUD, despite government pressure, privacy-focused protocols saw $1.8B in volume this year.

The market has spoken – privacy isn't just a feature, it's a right.

Third, for developers. The current legal limbo that has Pertsev in prison and Storm facing "multiple lifetimes" needs resolution. A Trump administration more sympathetic to crypto, combined with this ruling, could change these developers' fates.

But here's what really matters: The next two years will redefine crypto regulation in the US. With Trump returning to office, Atkins potentially at the SEC, and courts backing code freedom, we're looking at a complete regulatory reset.

The Surfer 🏄

Bitcoin long-term holders (LTHs) realised over $2 billion in profits in a single day, primarily from coins held for 6 to 12 months. Despite significant profit-taking, seasoned investors are less inclined to sell, indicating a potential wait for higher prices.

The Russian Federation Council has approved a new crypto taxation framework amid Bitcoin reaching all-time highs against the ruble. The legislation imposes a 13%–15% personal income tax on cryptocurrency sales and recognises digital currencies as property.

Ethereum Layer 2 (L2) networks have achieved a record total value locked (TVL) of over $51.5 billion, marking a remarkable 205% growth from $16.6 billion in November 2023.

Mining company MARA (formerly Marathon Digital) purchased 6,474 Bitcoin through a $1 billion convertible notes offering, with an average price of $95,395 per coin. MARA now holds approximately 34,797 BTC in its treasury, valued at around $3.3 billion, with a year-to-date per-share yield of 36.7%.

SOS Ltd's stock surged over 40% after announcing a $50 million Bitcoin purchase, reflecting growing interest in the cryptocurrency market. The China-based financial services company operates a Bitcoin mining facility in Wisconsin and aims to use various strategies to maximise returns on its investment.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋