Coinbase Wants To Wrap Your Bitcoins 🌯

Coinbase launches cbBTC. Wrapped Bitcoin, an ERC-20 token. BitGo WBTC controversy and concern of concentrated custody. Was Bukele's BTC adoption a PR move? US election result won’t matter for Bitcoin?

Hello, y'all. We are going to be at Token 2049, are you?👇

Please DM us on X with a link to your project. We are going to publish friends of Token Dispatch at Token 2049 list starting tomorrow until September 20, 2024.

That’s you and your project landing in over 130,000 inboxes. Seven days in a row - September 14-20, 2024. Limited to five people and projects each day.

America's largest cryptocurrency exchange has officially launched its wrapped Bitcoin token, Coinbase Wrapped BTC (cbBTC).

Allows traders to use their Bitcoin on the Ethereum network.

Why it matters? Without a wrapped Bitcoin, Coinbase users holding Bitcoin cannot use their assets on various decentralised finance (DeFi) activities built on the Ethereum network.

The cbBTC token allows them do just that.

Each cbBTC is an ERC-20 token backed 1:1 by Bitcoin held in Coinbase's custody. It will initially be available on both the Ethereum mainnet and Coinbase's layer-2 network, Base.

Coinbase's new cbBTC token offers Bitcoin holders expanded opportunities in the Ethereum ecosystem, allowing them to leverage their BTC for loans, yield farming, and trading on decentralised exchanges while maintaining exposure to Bitcoin's price movements.

BitGo's wrapped Bitcoin (wBTC) has been the dominant player in this space, and it’s not without controversy. Why would it be different?

Trust: As one of the world's largest Bitcoin custodians, Coinbase leverages its reputation for security and reliability.

Ease: Coinbase has streamlined the wrapping process for its users. When sending BTC from Coinbase to an Ethereum or Base address, it's automatically converted to cbBTC, eliminating the need for manual bridging steps.

By making it easier for Bitcoin holders to participate in the Ethereum ecosystem, Coinbase may help unlock a significant portion of Bitcoin's $1.14 trillion market cap for use in DeFi.

This comes at a time when wBTC faces scrutiny due to potential changes in its custody structure.

Concern of concentrated custody

Wrapped Bitcoins (wBTC) are enabling, true. But handling them is not all that easy.

Each of the wBTC, or in this case - cbBTC, is backed by one underlying Bitcoin that’s held in the reserves of centralised custodians.

Think of BitGo and Coinbase.

These custodians act as honeypots for attackers and create single points of failure.

Meaning, if the custodian faces regulatory scrutiny or security issues, it could jeopardise users' assets.

BitGo’s wrapped Bitcoin controversy

The launch also coincides with ongoing controversies and uncertainty around the security of the custody of WBTC with BitGo.

BitGo held custody of wrapped BTCs in a single location.

So, BitGo announced its plan to diversify the custodial centres of its Wrapped Bitcoin (WBTC) across Hong Kong and Singapore.

This would help beef up the security.

Problem solved, then, right? Nope.

Community criticised the involvement of TRON blockchain founder Justin Sun, a joint venture partner in the initiative.

He has faced charges from the SEC for fraud and other securities law violations. Critics have also called out his centralised management of the TRON network.

Risk management firm Block Analitica proposed restricting all WBTC positions—calling Sun’s involvement in the diversified jurisdiction plan an “unacceptable level of risk.”

Centralised in a decentralised ecosystem? Goes against the ethos of the blockchain community, doesn’t it?

Perhaps, Coinbase’s cbBTC will be a good alternative to WBTC?

Achorage Digital, BitGo join Coinbase in ETF Custody

Were we talking about risk of concentrated custody?

Well, 21Shares heard you. Among the first US spot crypto ETF issuers to expand its custodians beyond Coinbase.

Anchorage Digital Bank and BitGo will now join Coinbase in providing custody services for 21Shares' ARK 21Shares Bitcoin ETF (ARKB) and 21Shares Core Ethereum ETF (CETH).

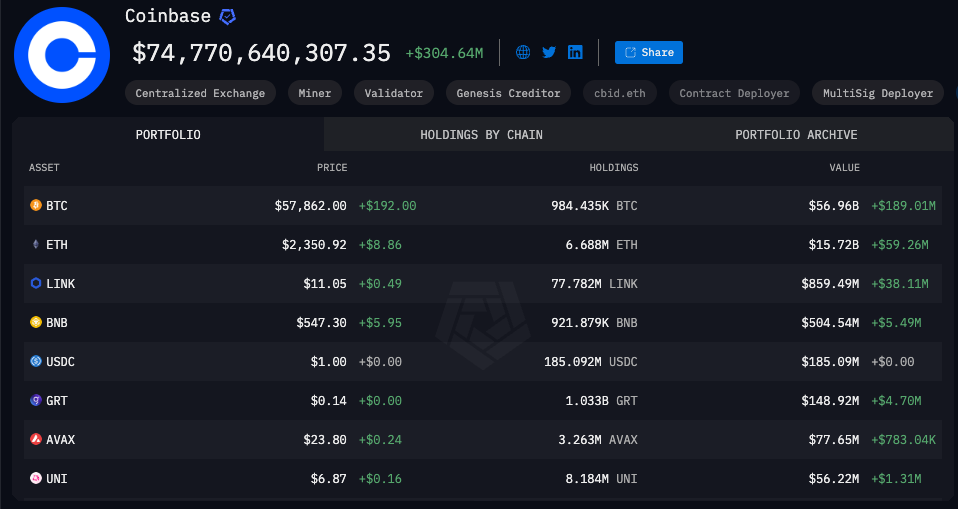

Currently, eight of the 11 US Bitcoin ETFs use Coinbase as their custodian. That’s about $54 billion worth ETFs in custody of one single player.

Diversifying custodians adds to the safety and security of funds.

More fund issuers expected to diversify? That’s what the president of investment adviser The ETF Store, Nate Geraci, feels.

Read more: Is $50B+ in US Bitcoin ETFs Safe? 🚨

The Quiz Game For The Music Lovers

Musicnerd.io - is more than just a platform; it's a journey into the world of music.

The music quiz game that’s got over million plays. Who are you playing with then 👇

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Block That Quote 🎙️

TIME Magazine reporter Vera Bergengruen

“Everything he does he’s kind of image first, results later oriented.”

That’s about Bukele. The first president to to adopt Bitcoin as a legal tender.

El Salvador. September 2021.

Now he is serving the second term as President. The story is still the same, but is the narratve still strong?

Bergengruen interviewed Bukele for the TIME magazine cover.

An interview that unpacked El Salavador’s Bitcoin story. Bergengruen reflecting on the story said that Bukele’s advisers referred to Bitcoin adoption in El Salvador as a “great rebranding” and “complete PR [public relations] move.”

“I think the most important thing [...] is his past as a publicist … It’s important to understand from Bitcoin to the war on the gangs, everything he does he’s kind of image first, results later oriented.”

Bukele led his family’s PR firm before moving into politics

Starting November 18, 2022, El Salvador would buy one Bitcoin everyday to build up its reserves, Bukele had posted on X.

Not without troubles and struggles with adoption, El Salvador’s Bukele Bitcoin pot is sitting alright.

Hell of PR move, you’d think?

US Election Result Won’t Matter for Bitcoin?

Worrying about impact of US election results on Bitcoin? Don’t.

Standard Chartered's head of forex and digital assets research Geoff Kendrick says that it won’t matter.

Kamala or Trump, Bitcoin will still hit record high price by year-end regardless.

"I think bitcoin ends the year higher, at new all-time highs, no matter who wins the U.S. election, with a Trump win taking it to $125,000 and $75,000 if it’s Harris."

What drives the optimism?

Favourable regulatory changes.

Relaxing regulations: The repeal of SAB 121 - which imposes stringent accounting rules on banks' digital asset holdings - to continue in 2025 no matter who is in the White House.

Election outcome: Trump's administration is expected to push for pro-crypto policies. A victory for Kamala Harris could be bearish for Bitcoin, but only for some time.

Democrat victory might delay some of the progress expected under a Trump administration.

Might trigger an initial price decline. But dips will likely be bought as the market recognises that progress on the regulatory front will still be forthcoming.

What about spot Bitcoin ETFs? Expect a seasonal rebound in October.

Meanwhile, for the first time on the betting platform Polymarket, Harris has overtaken Trump (49%) with a 50% chance of winning the election.

In The Numbers 🔢

$20 million

Amount decentralised crypto exchange Uniswap allegedly demanded for protocol deployments.

Claims who? A user on X, Alexander.

Another one: Millicent Labs cofounder Kene Ezeji-Okoye claimed that Uniswap charged $10 million for a deployment plus an additional $10 million in user incentives focused on trading carbon credits.

Uniswap denies it. CEO himself.

For the context: Uniswap settled a suit with the United States Commodity Futures Trading Commission (CFTC) by paying a $175,000 civil penalty and agreeing to cease violating the Commodity Exchange Act.

Republicans Have a Beef with SEC Chair

US Securities and Exchange Commission (SEC) Chair Gary Gensler is facing a probe by Republican lawmakers over allegations of political favouritism in hiring civil servants.

Who is investigating? House Judiciary, Financial Services and Oversight Committees sent a joint letter to Gensler outlining their concerns.

What do they claim? SEC may be violating a federal law by "unlawfully considering an applicant's political ideology when hiring bureaucrats.

The letter points to Gensler’s email exchange with Dr. Haoxiang Zhu and his appointment as SEC Director of Trading and Markets.

In the email, Dr. Zhu allegedly reassured Gensler about his political alignment while discussing his potential employment.

"I believe I'm in the right place on the political spectrum, and I'm happy [to] provide as many details as needed so you feel comfortable."

He was hired by the SEC on November 19, 2021.

Probe demands: Documents and communications related to hiring directors, associate directors, and staff in the Chair's office since April 2021.

Gensler has until September 24 to comply with the document requests.

Context: Gensler is already facing scrutiny from the crypto industry for his aggressive crackdown. Critics say his stance is driven by a partisan agenda.

The Surfer 🏄

Solana's Pump.fun has struggled to maintain its summer peak as only 89 of its nearly 2 million meme coins have a $1 million market cap. At its peak, Pump.fun was deploying up to 20,000 tokens a day. It has come down to 4,500-8,000 recently.

Grayscale has launched the its XRP Trust, providing investors with exposure to XRP, the seventh-largest cryptocurrency. The trust will track XRP's price and follows Grayscale's successful SEC approvals for Bitcoin and Ethereum ETFs earlier this year. XRP price shot up 6% following the launch.

An attacker exploited a vulnerability in the CUT token's liquidity pool on September 10, draining over $1.4 million worth of Binance-Pegged Tether (BSC-USD) using a mysterious unverified contract. The attacker used an unreadable function to withdraw funds without possessing the necessary liquidity provider tokens.

The Central Bank of the United Arab Emirates has approved custodial risk insurance for digital assets, allowing OneDegree and Dubai Insurance to offer coverage to local clients. Against losses from hacking, fraud, or physical damage, enhancing consumer confidence in the UAE's digital asset market.

eToro will pay a $1.5 million penalty as part of the settlement with US SEC, and restrict crypto trading for US customers to Bitcoin, Ethereum, and Bitcoin Cash. Users outside the US will continue to have access to over 100 crypto assets.

If you want to make a splash with us, check out sponsorship opportunities 🤟

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋