Corporates Opt Debt To Buy Bitcoin 🛒

More companies mimic MicroStrategy's Bitcoin financing template: Raise funds via debt issue and use them to buy BTC. MSTR buys record BTC in a day. More than 40 listed corporates now hold Bitcoin.

Welcome to your Tuesday’s dose of crypto. Today’s edition looks at the route listed companies are taking to build Bitcoin treasuries.

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

Hello, y'all. FOMO about missing out on Coldplay live? Play Muzify quiz to score the concert ticket👇

Can’t wait for the Bitcoin surge from sub-$70K to $91K to resume its rally?

But the corporates aren’t waiting. They are out and buying, buying and buying a bit more.

How and what?

Heard of zero-interest debt to buy Bitcoin?

That’s the playbook the corporates have turned to to stack up their Bitcoin shopping cart.

And this week, the floodgates opened.

In a series of announcements, three major players revealed their Bitcoin accumulation strategies, all using the same playbook: cheap debt.

It started with the biggest corporate champion of Bitcoin.

MicroStrategy announced they would be raising $1.75 billion through 0% interest convertible notes to buy more Bitcoin. And they're not alone in this debt-fueled Bitcoin shopping spree.

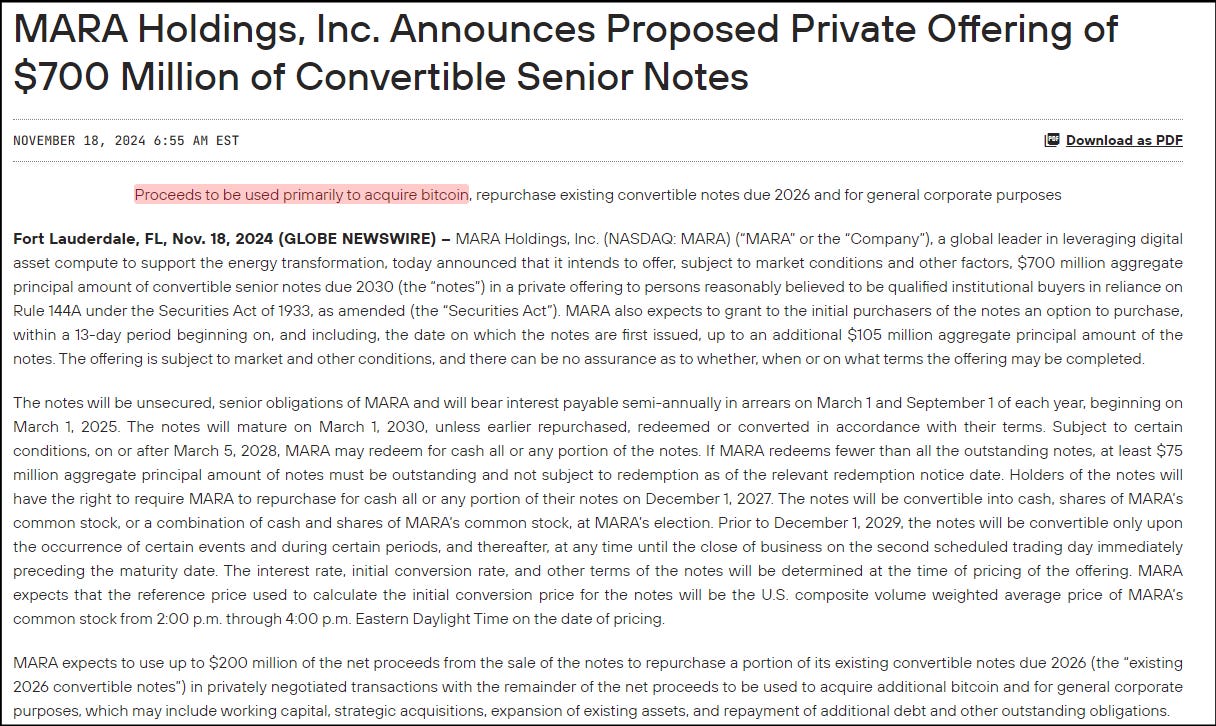

MARA also kicked things off with a $700M convertible note sale, complete with an option for an additional $105M.

What do they want to do with all this money?

Clear intentions – a big chunk is going straight into Bitcoin, with the rest marked for expansion and strategic acquisitions.

And MARA’s got company from across the Pacific.

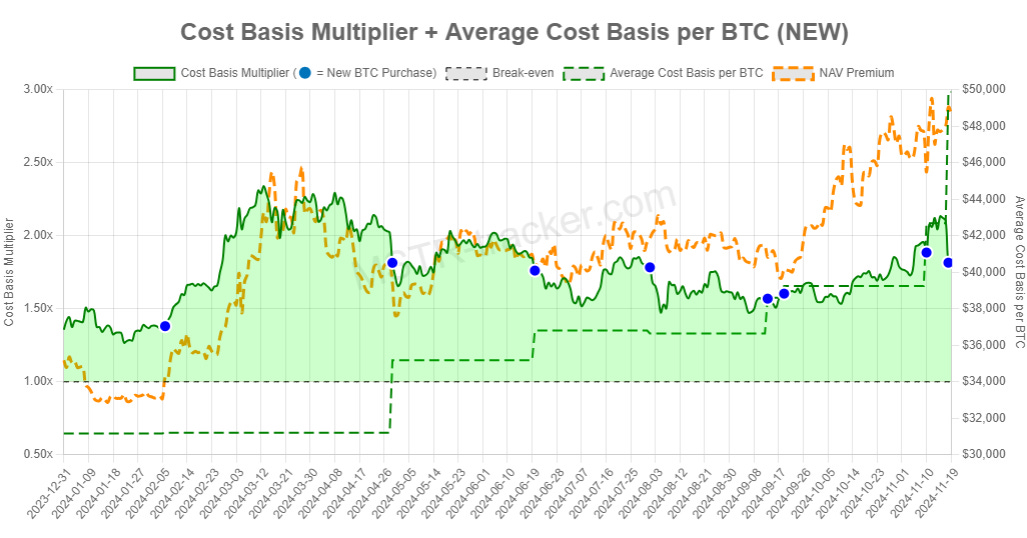

Tokyo-based Metaplanet, already sitting on 1,018 BTC, announced a bond issue at a microscopic 0.36% interest rate.

Their strategy? Use options alongside direct purchases to maximise their Bitcoin position.

The template is clear

Issue convertible notes or bonds

Secure incredibly low interest rates

Deploy capital directly into Bitcoin

Use excess for strategic growth

Rinse and repeat

But why take this route?

Convertible notes get the best of both worlds – zero or low interest rates with long maturity dates. Bond issues offer a more traditional approach, appealing to conservative investors while still getting the job done.

Want to understand it even better?

Read: Should You Invest in MicroStrategy’s Bitcoin Bet? 🍔 🤔

Market analyst John Doe sums it up

"With Bitcoin hitting new historic records, companies are racing to find innovative ways to add BTC to their treasuries. What we're seeing is just the beginning.”

Wall Street's definitely paying attention. As Bitcoin continues its post-election rally, more corporates are jumping on to this bandwagon.

How big is this corporate treasury today? Read on…

The Home for All the Music Lovers

Muzify - With close to 2 million plays, is more than just a platform.

It's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

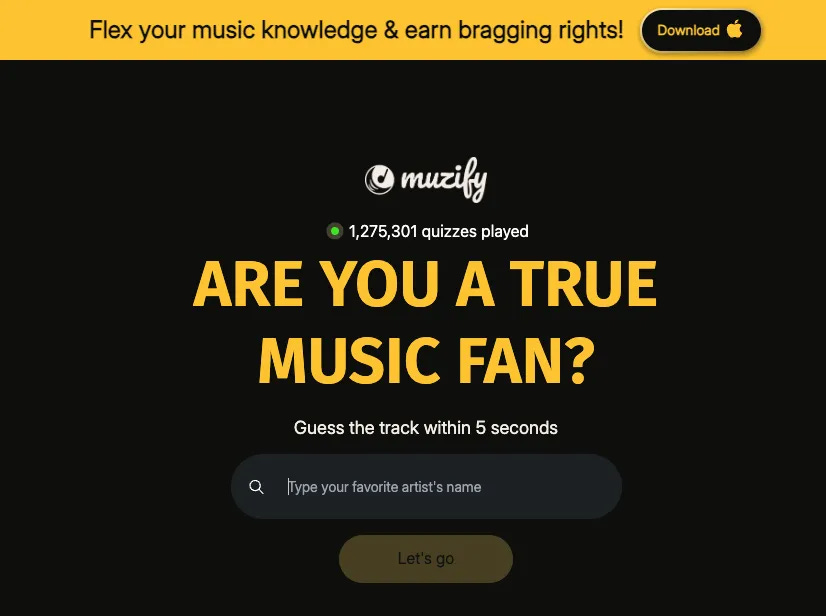

In The Numbers 🔢

444,207

That's how much Bitcoin sits in corporate treasuries right now.

But a majority of it is concentrated among five players.

Together, just these five companies control 88% of all corporate Bitcoin holdings.

Collectively, corporate treasuries hold about 2.1% of Bitcoin's total supply.

Number Game

40+ public companies now hold Bitcoin

Total market value of BTC holdings ~$41B

Average return: 2.12x investment

Small caps joining the race

Meanwhile, what’s the leader of the pack up to?

Michael Saylor, founder of MicroStrategy, casually added another $4.6 billion to MSTR’s Bitcoin kitty – the largest single-day crypto shopping spree in corporate history.

Numbers Are Wild

MicroStrategy now holds 331,200 BTC

Average purchase price: $49,874

Current value: $30.3B

Up 133% on their strategy

Stock up 450% year-to-date

The corporate treasury race might just be getting started and MicroStrategy is beginning to see good company (and competition, soon?).

Bitcoin Treasury Club Keeps Growing 🎯

Meet the newest members of the Bitcoin treasury club.

Artificial intelligence firm Genius Group took baby steps towards building Bitcoin treasury.

They just dropped $10 million to buy 110 BTC, targeting a whopping 90% of their reserves for Bitcoin.

But that’s not where they want to stop.

They also are launching a podcast.

Why? To help other companies follow suit and make it easier for them.

"When we decided to adopt MicroStrategy's Bitcoin treasury plan, there was no clear guidelines available. We want to change that," says CEO Roger Hamilton.

They're not alone.

Healthcare giant Cosmos Health is eyeing both Bitcoin and Ethereum, while Nano Labs called Bitcoin "a reliable store of value." Even Solidion Technology pledged 60% of their excess cash to Bitcoin purchases.

The reason?

"Not only as potential hedges against inflation and currency devaluation but also as diversification tools offering substantial upside potential," says Cosmos Health CEO Greg Siokas.

With Microsoft shareholders now voting on Bitcoin treasury proposals, one thing's clear – the corporate Bitcoin playbook isn't just for crypto companies anymore.

The Surfer 🏄

Goldman Sachs is set to spin out its cryptocurrency platform to form a new company focused on blockchain financial instruments. The investment bank is in talks with potential partners, including Tradeweb Markets, to enhance the platform's capabilities. The spinout is expected to be completed within 12 to 18 months, pending regulatory approvals.

Coinbase CEO Brian Armstrong is set to meet with President-elect Donald Trump to discuss key "personnel appointments." Trump has not yet nominated candidates for Treasury Secretary and SEC chair, both critical roles for the crypto industry.

Russia's government proposes a 15% tax on income from crypto trading and mining. Draft amendments classify cryptocurrencies as property for tax purposes. Miners can deduct expenses related to their operations from taxable income.

Bakkt’s shares soared 162% on November 18 after reports of Trump Media's advanced talks to acquire the struggling crypto exchange surfaced. Bakkt Holdings Inc (BKKT) closed at $29.71, with an after-hours increase to $34.59, while Trump Media's stock rose 16.65% but fell 3.5% after hours.

Binance clarifies that its upcoming BFUSD asset is not a stablecoin and has not yet launched, addressing user concerns about high yields. BFUSD is described as a reward-bearing margin trading product for futures trading.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋