Hello Dispatchers!

It’s been a crazy last few days with the tariff wars on and off, and US striking a pause with Mexico and Canada, temporarily. Crypto world saw one of the most damaging liquidations early this week, albeit with some correction later on.

Not a bad time for crypto enthusiasts to do with some good news, you’d think. That’s what the crypto community was anticipating from Crypto Czar David Sacks’ first press conference under Donald Trump’s administration.

Tuesday’s line-up gave them that, at least some of it.

The chairs of various committees outlined what Trump’s administration is planning for digital assets and the larger crypto industry.

From dismantling "regulation by enforcement" to fast-tracking stablecoin legislation, the message was clear: Crypto winter's regulatory deep freeze is thawing.

In today’s edition, we help you read in between the lines of the press conference that had a lot of stakes riding on it.

Driving the Next Generation of Wealth

Blockchain applications and digital assets change the fundamentals of how we invest, save, and grow our financial resources. This is the future Nexo is building.

It brings blend cutting-edge blockchain technology with time-tested financial principles, offering a platform where your assets can truly work for you 🫵

DC's Crypto Stance Makeover

When David Sacks stepped up to the podium flanked by the most powerful financial lawmakers in Congress, the crypto industry held its breath. What followed was a 30-minute blueprint for what he called crypto's coming "golden age."

"We want to keep that innovation onshore in the US. Financial assets are destined to become digital, just like every analogue industry has become digital, and we want that value creation to happen in the United States, rather than giving it away to other countries," Sacks said.

The reset included the strategy and approach that multiple governmental bodies and committees will take in coordination with the stakeholders to ensure safety of investors and growth of the industry.

Sacks also said that the Digital Assets Working Group’s number one priority would be to work towards a national Bitcoin reserve, as promised by President Donald Trump.

Although that didn’t drive up crypto markets as much, the conference had quite a few regulatory takeaways from a long-term perspective.

New stablecoin bill dropped in the Senate

Bipartisan working group formed to fast-track legislation

SEC announced scaling down its crypto enforcement unit

CFTC declared an end to "regulation by enforcement"

Let’s take them from the top.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts.

The 100-Day Stablecoin Sprint

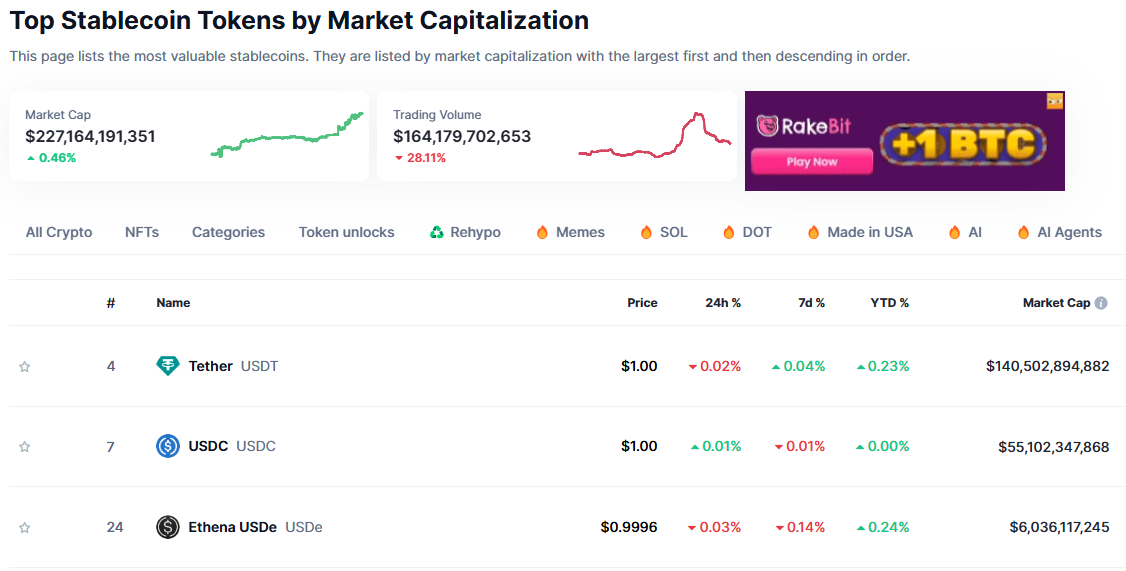

With stablecoin market cap currently at $227 billion and Bitwise projecting it to hit $400 billion by year-end, it’s got regulators' full attention.

Senate Banking Committee Chair Tim Scott didn't mince words about the timeline for the much-awaited stablecoin bill.

Scott expects both - stablecoin bill and the broader market structure legislation (Financial Innovation and Technology for the 21st Century, or FIT21 Bill) - to be cleared by the Senate within Trump's first 100 days.

Ambitious and unprecedented, sure. But with Republicans enjoying a trifecta - control in both chambers and a crypto-friendly White House - the math looks different this time.

On Monday, Senator Bill Hagerty introduced the ‘Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act’ - a comprehensive stablecoin framework.

Split oversight between Fed and states based on a $10 billion market cap threshold

Target giants like Tether and USDC for federal regulation

Mandate monthly audited reserve reports

Introduce criminal penalties for false reporting

🎙 Block That Quote

David Sacks, White House Crypto Czar

"Stablecoins have the potential to ensure American dollar dominance internationally to increase the usage of the US dollar digitally as the world's reserve currency and in the process create potentially trillions of dollars of demand for the US Treasury."

The Bicameral Blueprint

A "bicameral working group" was also announced at the conference with a lineup including top representatives from both the chambers.

Tim Scott (Senate Banking Chair)

John Boozman (Senate Agriculture Chair)

French Hill (House Financial Services Chair)

Glenn Thompson (House Agriculture Chair)

Their mission? Oversee two major pieces of legislation

The GENIUS Act: Sen. Hagerty's stablecoin framework that would

Set $10B threshold for Fed oversight

Require monthly audited reserve reports

Create criminal penalties for false reporting

Allow state regulation below federal threshold

FIT21 2.0: An updated version of last year's market structure bill with what Rep. Hill calls "modest changes" to draw bipartisan support

That’s not all the help the representatives are getting to fast-track the clearance of the bills.

Bipartisan support from the Democratic side has been a rare catalyst and a “pleasant surprise”, Rep. Scott said in the conference.

Hagerty’s GENIUS Act received support from Senator Kirsten Gillibrand (D-NY), besides the backing from Republicans Tim Scott and Cynthia Lummis.

Who else? Industry gets a seat at the table.

The GENIUS Act incorporated recommendations from major stablecoin issuers, while FIT21's revision is expected to reflect extensive industry input.

Agencies Fall in Line

If you were looking for some action beyond the policy plans, regulatory agencies gave the crypto community just that.

Sprang into action and took the first few steps.

After years of aggressive enforcement and unclear guidance, both the SEC and CFTC executed dramatic pivots.

CFTC Acting Chair Caroline Pham completely dismantled the previous enforcement regime. The reorganisation strips away specialised units in favour of two focused task forces.

Complex Fraud Task Force

Led by enforcement veteran Paul Hayeck

Handles sophisticated market manipulation

Cross-asset class jurisdiction

Focus on actual fraud over technical violations

Retail Fraud and General Enforcement Task Force

Under Charles Marvine's leadership

Targets consumer protection

Streamlined enforcement process

Emphasis on market education

"This simplified structure will stop regulation by enforcement and is more efficient," Pham declared.

SEC's Dramatic Pivot

The Securities and Exchange Commission's transformation might be even more striking.

The agency that spent 2023-24 launching enforcement actions against everyone from Coinbase to Ripple is now actively scaling down its crypto enforcement unit.

"The task force will work to classify different types of crypto assets and activities, to identify which would fall under the scope of financial securities. This isn't just about enforcement - it's about creating a framework for innovation," said Hester Peirce, SEC Commissioner, in a statement on Tuesday.

The changes read like a crypto industry wishlist

Over 50 enforcement staff being reassigned

Leading enforcement attorneys moved to other departments

New emphasis on guidance over punishment

Public feedback mechanism established

Fresh look at token offerings and ICOs

Dedicated crypto task force website launched

Acting SEC Chair Mark Uyeda has made what he calls a "slew of appointments" in a top-level restructuring that suggests the changes will outlast any single administration.

Peirce's New Playbook

Under Commissioner Peirce's leadership, the SEC's crypto task force has rewritten the rulebook.

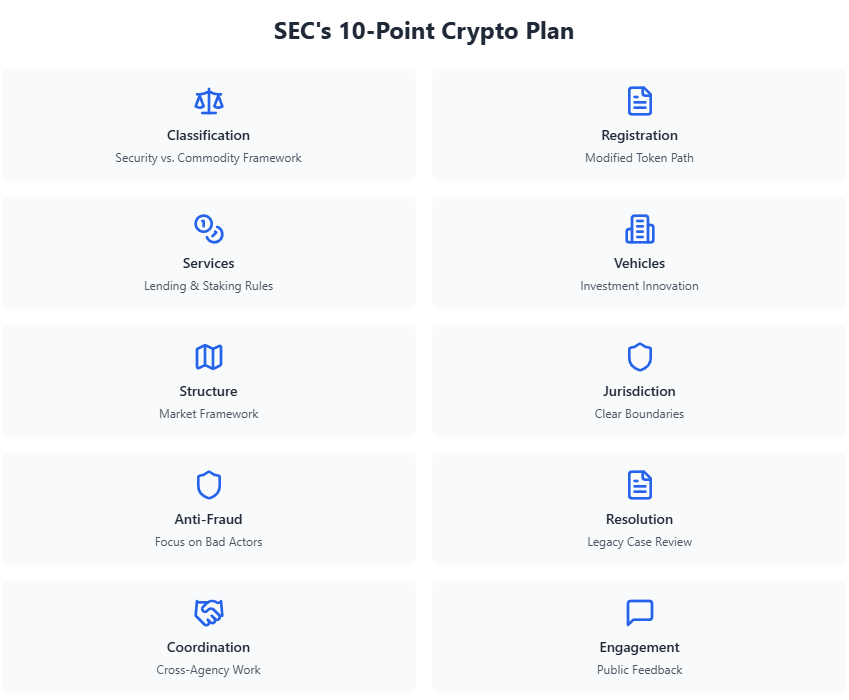

Peirce released a 10-point agenda to tackle the industry's biggest pain points.

The 10-point plan reveals a fundamental shift from the SEC's previous "regulation by enforcement" approach to a structured framework that balances innovation with investor protection.

From clear token classification guidelines to streamlined registration paths, the plan tackles every major friction point that's plagued the industry.

More importantly, there’s no mention of blanket enforcement actions or the previous administration's "everything is a security" stance.

This restructuring isn't happening in isolation. The changes align with Trump's executive order demanding agencies recommend crypto policy changes within 60 days. With Paul Atkins, a noted crypto advocate, nominated as permanent SEC chair, these reforms could be just the beginning.

Token Dispatch View 🔍

The crypto regulatory reset is not merely about getting a strategic Bitcoin reserve passed - it's about redefining America's relationship with digital assets.

Read: Can Bitcoin Reserve Be the Magic Pill? 🏛️

While Sacks' "golden age" proclamation grabbed headlines, the real story lies in the coordinated nature of these changes.

The Speed Paradox: Washington's sudden rush to pass crypto legislation within 100 days seems risky, but it might be exactly what the industry needs. Quick action could prevent the regulatory fragmentation that plagued previous attempts at crypto oversight. Speed without precision could still create new problems we'll spend years untangling.

The Institutional Chess Game: This regulatory revamp is also about positioning the US dollar for the digital age. When Sacks talks about "trillions of dollars of demand for US Treasury," he's revealing a bigger play: using stablecoins to reinforce dollar dominance in an increasingly multi-polar world.

The Enforcement Evolution: The shift from "regulation by enforcement" to "regulation by guidance" signals more than just a friendlier SEC. It suggests that Washington finally understands that crypto innovation can't be controlled through punishment alone. With criminal penalties built into new frameworks like the GENIUS Act, regulators signal that they aren't going soft.

What's more intriguing isn't the individual changes, but how they fit together. From stablecoin oversight to agency restructuring, every move seems designed to create a comprehensive crypto framework that could outlast the Trump administration.

Clear rules mean real accountability, and not everyone who thrived in crypto's regulatory gray zone will survive in its regulated future.

The game is changing. The winners will be those who use this regulatory clarity to build something that lasts.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.