Crypto Firms Get Rekt? 📉

Coinbase & Robinhood miss Q3 earning estimates. Share prices slump. Riot Platforms' revenue jumps 65%. Tether registers $2.5B in Q3 profit. MicroStrategy's share price up despite share dilution.

Happy Friday, y'all. Today’s crypto dose of Token Dispatch takes you through how crypto firms performed in the 2024 Q3 earnings.

FOMO about missing out on Coldplay live? Play Muzify quiz to score the concert ticket. It’s got over 2 million plays, are you on the board yet?👇

Times change quickly in crypto.

How quick? Very.

Just less than 48 hours ago, the world over was talking about Bitcoin knocking on ATH's door.

Now? Bitcoin is down more than 5% from the record-high of $73K it set just two days ago.

And Bitcoin’s got company.

Whose? Multiple leading crypto firms.

Double-digit stock drops. Missed revenue estimates. Slashed projections.

What's happening?

Earnings season drama.

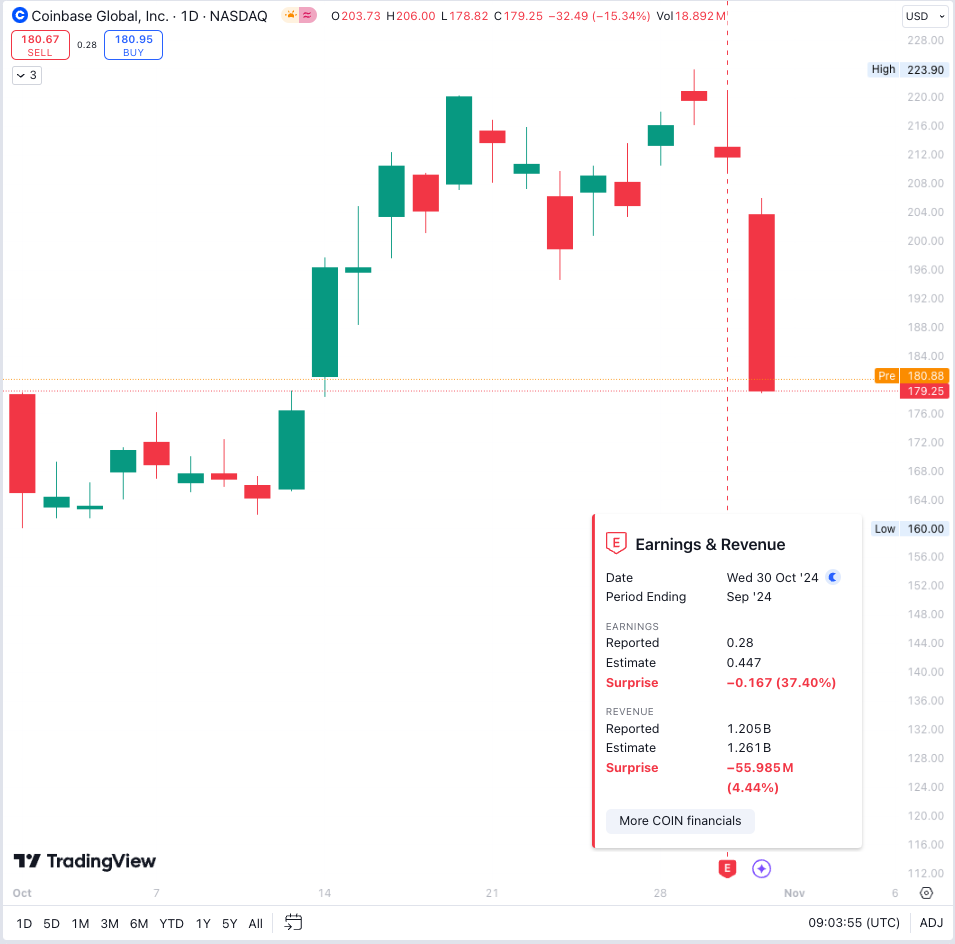

First up: Coinbase's reality check

Shares tumbled more than 15%

Revenue missed by 5%

Earnings miss estimates by 37%

Transaction revenues down

Subscription services? Also down

Coinbase had some consolation, though.

Its L2 network, Base, saw a 55% increase in transactions and a doubling of deployed smart contracts.

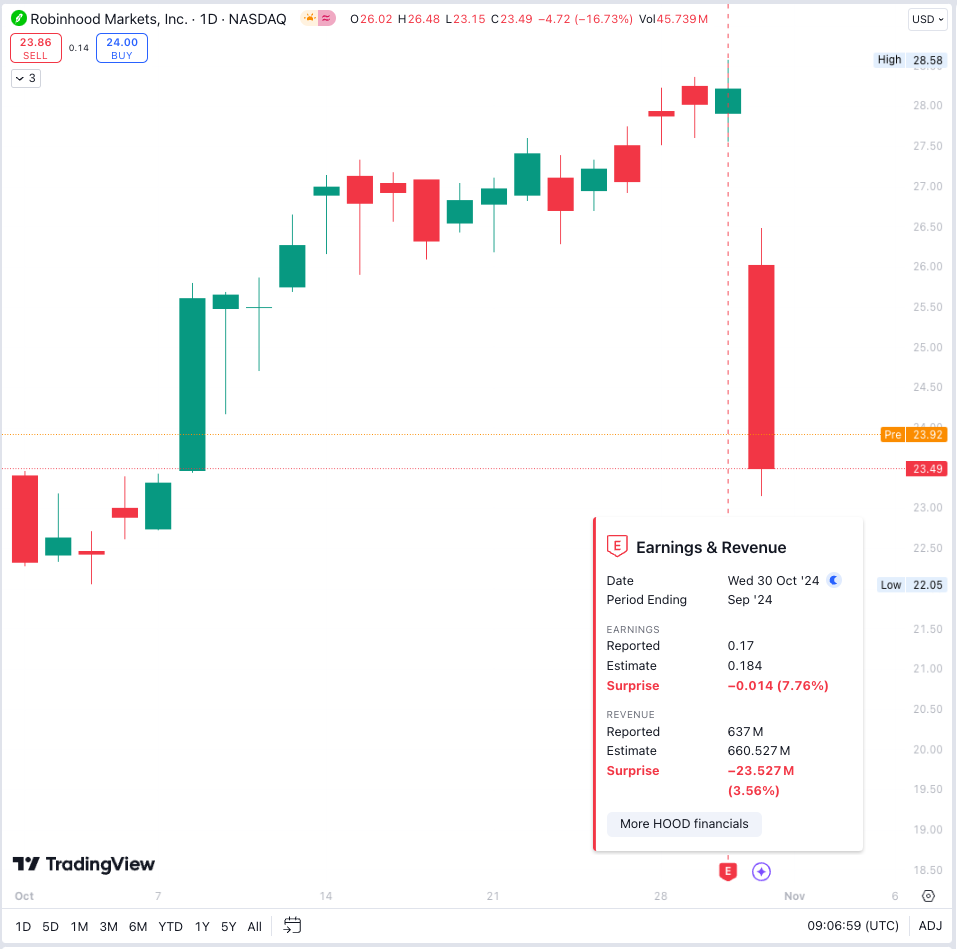

Next up: Robinhood. How’d it do? Even worse.

Stock plunged 15%

Lowest quarterly net deposits this year ($10B)

Missed account growth targets

Trade pricing disappoints

Bad days ahead for crypto firms?

Not really. At least, analysts tracking Coinbase don’t want you to panic, yet.

Why?

They feel the share price movement was a “knee-jerk” reaction.

What next then?

Two words: Election catalyst.

Election will drive greater clarity and building consensus among legislators on both sides of the aisle in coming months.

Says who? Wall Street broker JMP, while keeping a healthy $320 target on Coinbase.

JMP believes institutional interest in the Coinbase stock is growing as it becomes a more important component of various equity indices.

And then, there are mining giants such as Riot Platforms.

Revenue up 65% YoY

1,104 Bitcoin mined post-halving

Average mining cost: $35,376 (half of current BTC price)

Net loss: $154M

Share price slumps over 10%

What’s behind these missed results?

Probably the summer crypto slump is hitting the Q3 numbers.

But, what about Bitcoin's recent surge? Why isn’t it reflecting?

Most likely the companies will see the impact only in the next quarter.

JPMorgan called it a "seasonal deceleration in the business after a robust 1H24 with record net deposit growth."

So what next?

All eyes on election impact.

Analysts at Canaccord feel regulatory regime change could be massive.

But has it been this bad for all crypto firms?

USDT issuer Tether: Hold my beer …

In The Numbers 🔢

$2.5 billion

That's how much Tether made in Q3 profit.

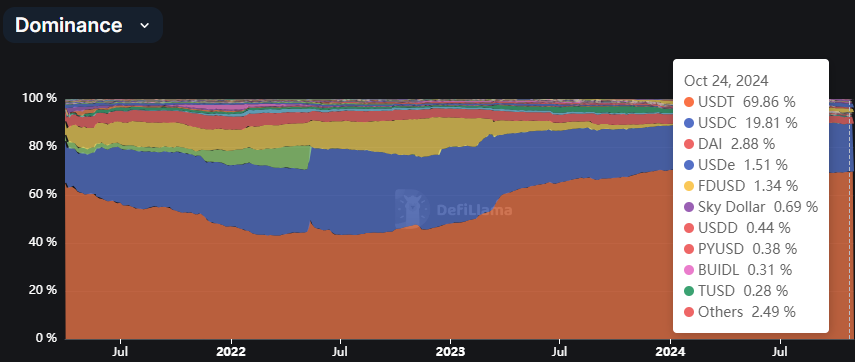

Read: Stablecoin That Conquered Crypto 👑

Here’s a breakdown

$1.3 billion from Treasury yields

$1.1 billion from gold appreciation

With this, the total profit for 2024 goes up to $7.7 billion.

The most dominant stablecoin issuer now holds about $134.4 billion in total assets and has $120 billion USDT in circulation.

About 70% dominance.

And that’s not all.

Tether's now among the top 18 global holders of US debt.

Bigger than Germany, Australia and UAE.

Yeah, take a moment and let that sink in.

Read: Stablecoins: Too Big To Ignore?

The Home for All the Music Lovers

Muzify - With over 2 million plays, is more than just a platform.

It's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

Saylor's $21B Magic Trick 🎩

What follows earnings that missed estimates and a massive stock dilution?

Slump in share price. Right? Wrong.

How? Ask Michael Saylor.

MicroStrategy announced on October 30, their plan to sell $21 billion in new shares.

(No prizes for guessing why: Buy more Bitcoin)

Ideally, announcing share sale leads to dilution of ownership for shareholders.

That would tank the share price.

Did it? No.

Instead, MSTR

Rose 1% after the announcement

Overtook Coinbase as biggest crypto stock

Tripled in value this year

Hit $50 billion market cap

But how’s this happening?

Are MSTR’s shareholders cracked?

Not really. But unique in a way.

CoinDesk's James Van Straten

"MicroStrategy shareholders are a unique cohort. I celebrate being diluted as I know MicroStrategy are going out and buying bitcoin."

So much belief in the company’s strategy?

Well, it’s like, when Saylor says "jump", his shareholders ask "how high?" 🚀

Read: Should You Invest in MicroStrategy’s Bitcoin Bet? 🍔 🤔

Block That Quote

Adam Morgan McCarthy, Kaiko analyst

"This year in particular, there was a lot of negative sentiment which likely deterred traders."

Major selling events — from the German government and bankrupt crypto firms like Mt Gox — added to the pessimism.

The muted retail interest in crypto is changing the market make-up.

What’s causing disinterest in traders?

Muted volatility + falling crypto prices = Fewer investors at the exchanges, says Coinbase.

What else?

Numbers story

Bitcoin volatility down 40% since 2020

PayPal's crypto holdings dropped 11% in Q3

Institutional demand 2x of retail demand

Looks like the whales are swimming, but retail is still watching from the beach 🏖️

Token Dispatch View

The volatility and uncertainty about crypto’s trajectory is discouraging retail participation.

The retail disinterest will persist until the volatility induced by the US elections doesn’t settle down. Until then, institutions will continue to dominate Bitcoin investments through ETFs and corporate treasuries.

The crypto stocks have not seen that kind of participation or euphoria, and hence results missing estimates.

All of this could change if crypto gets a favourable outcome in US elections.

The next quarter will likely reflect which model of crypto business will reap dividends.

The Surfer 🏄

JPMorgan analysts predict that a Trump victory could boost retail demand for bitcoin and gold, enhancing their prices. Retail investors are increasingly engaging in the "debasement trade," purchasing bitcoin and gold ETFs as a hedge against currency devaluation.

Crypto losses from hacks and scams in 2024 have exceeded $1.4 billion, despite a monthly decrease. In October, the industry lost $55.1 million, a 56.6% drop from September's $126.9 million. A total of 179 hacks and scams have contributed to the significant losses this year, according to Immunefi.

Asia has surpassed North America, becoming the top region for cryptocurrency and blockchain developers, with a share of 32% in 2024. North America's share of crypto developers has halved from 44% in 2015 to 24% in 2024. Despite the decline, the US still has the highest total number of crypto developers globally, accounting for 18.8% of all developers.

Russia is set to ban cryptocurrency mining in certain regions due to electricity shortages. President Vladimir Putin legalised crypto mining in August 2024, allowing registered entities to mine. The ban affects regions like the Far East, southwest Siberia, and the South, with limitations expected until 2030.

The Blockchain Association claims the SEC has cost crypto firms $426 million in litigation since Gary Gensler became chair in 2021. The SEC has initiated 104 cases against the crypto industry during this period, according to the advocacy group.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

Great information!! Thank you very much for sharing openly!! ♥️☀️☮️🌈🏁

Tether’s dominance is remarkable and a little concerning. With $134.4 billion in assets and a large portion of its revenue tied to U.S. Treasuries, Tether is now deeply embedded in traditional finance. If any instability were to hit Tether, it could send ripples far beyond the crypto space, impacting debt markets globally. This could make regulators uncomfortable and could result in more stringent stablecoin regulations.