Crypto On One-Way Highway 🆙

Crypto $2T. BTC $61000. ETH $3350. US-listed spot Bitcoin ETFs traded over $2B, clock $576M inflows, ETFs hold 300000 BTC. IRS ropes in crypto veterans for taxes. Crypto in extreme greed territory.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

The crypto market just clawed its way back to the $2 trillion mark.

Why? Bitcoin just hit $61K and there's a huge surge of positive sentiment.

This rally isn't limited to Bitcoin - Ethereum is in, so are the other ALT coins. Stablecoins going strong. Everyone has joined the party.

Look at these TradingView Crypto Charts

Reaching new heights

The combined market cap of all crypto skyrocketed by 7.7% - surpassed both Amazon and Google's parent company in size.

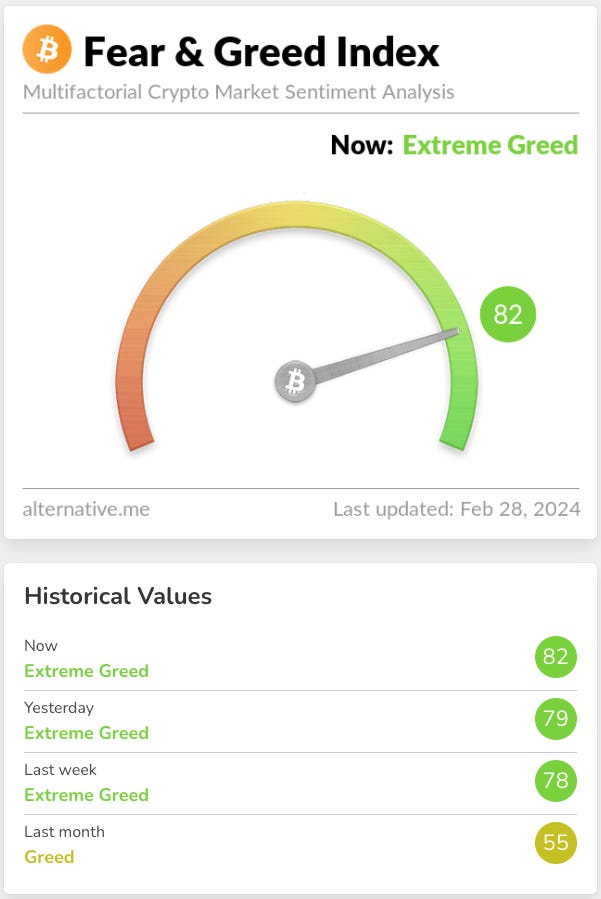

Bullish vibes fuel the fire: It is back in "extreme greed" territory, reflecting the euphoria surrounding the market.

Fuelling the fire

Spot Bitcoin ETFs are attracting significant inflows.

Outflows from the Grayscale Bitcoin Trust are at record lows.

Read this: Liquidations 🫗

2 signs point to a mature bull market

1. Short-term holders are buying: The "Realized Cap HODL Waves" indicator shows an influx of short-term investors.

2. Long-term holders are taking profits: The "Hodler Net Position Change" indicator reveals the largest sell-off of long-term holders since the 2022 bear market bottom.

This doesn't necessarily signal a drop, but could be them locking in profits before a potential price explosion.

Ethereum's bullish sentiment

Ethereum (ETH) is on a roll, trading around $3350.

Highest price since April 2022.

Extends a 7-day winning streak - 9.9% gain.

Institutions are increasingly favoring ETH over Bitcoin, allocating 40% of their crypto portfolios to ETH compared to 40% for Bitcoin. This shift might be driven by ETH's recent outperformance.

Read: ETH Leads Institutional Bets But Retail Still Favour BTC

Block That Quote 🎙️

Bitcoin bull Anthony Scaramucci, SkyBridge Capital founder.

"“I would just ask him [Jamie Dimon] to please do more homework"

Scaramucci is back in the ring, this time trading jabs with JP Morgan CEO Jamie Dimon.

Why? Dimon recently expressed concerns about the economy and scepticism towards Bitcoin.

Scaramucci highlights the upcoming Bitcoin halving as a reason for increased investor interest and potential price growth.

“If you look at the last 14 years, you usually get a quadruple after the halving. Bitcoin right now is trading at $57,000 … when the halving takes place, but let's say it's at $50,000. That would imply over 18 months from the halving a $200,000 Bitcoin price. The price is going up, primarily because there's not a lot of supply out there.

Gold [is] a $16 trillion asset, and Bitcoin has a lot of the same properties as gold. I would make a case that it's better than gold because it's easier to move around. It should trade to at least half of that. It's at a trillion dollars right now.”

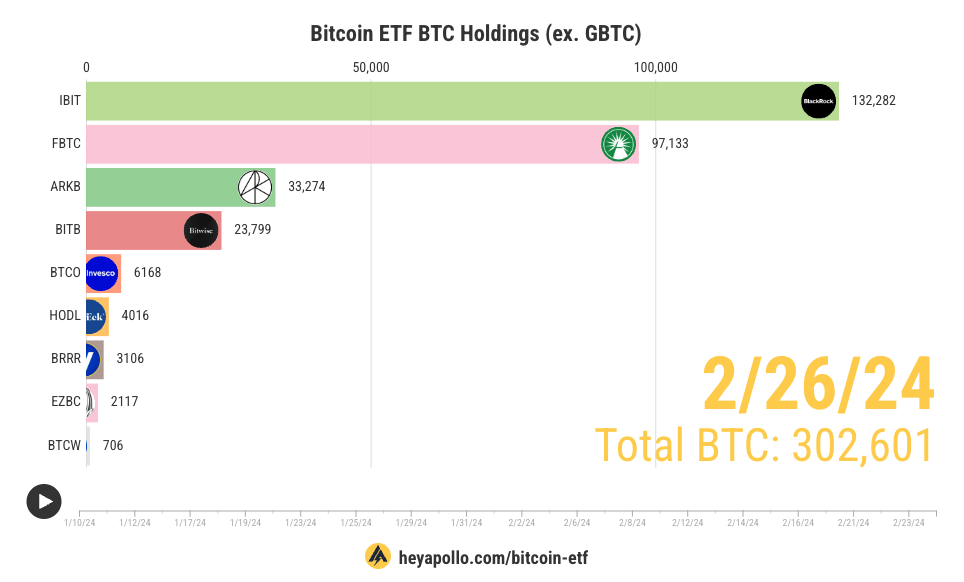

300,000 BTC for Bitcoin ETFs

The 9 new Bitcoin ETFs already hoard massive 300,000 Bitcoin.

Worth over $17 billion.

This is 1.5% of all Bitcoin in circulation.

That's not even counting the Bitcoin giant Grayscale, which holds even more.

BlackRock, the investment giant, is leading the pack with over $7 billion worth of Bitcoin in their ETF.

Grayscale, the OG Bitcoin holder, still reigns with 444,037 BTC.

Worth $25.3 billion.

Combined, new and old players hold almost $43 billion worth of Bitcoin.

Where’s ETF?🚨

Bitcoin Spot ETF numbers on February 27.

US-listed spot bitcoin ETFs traded over $2 billion.

Total net inflows for Bitcoin spot ETFs reached $576 million.

The Grayscale ETF net outflow of $125 million in a single day.

BlackRock's ETF IBIT net inflow of approximately $520 million.

IBIT's total historical net inflow has reached $6.54 billion👇

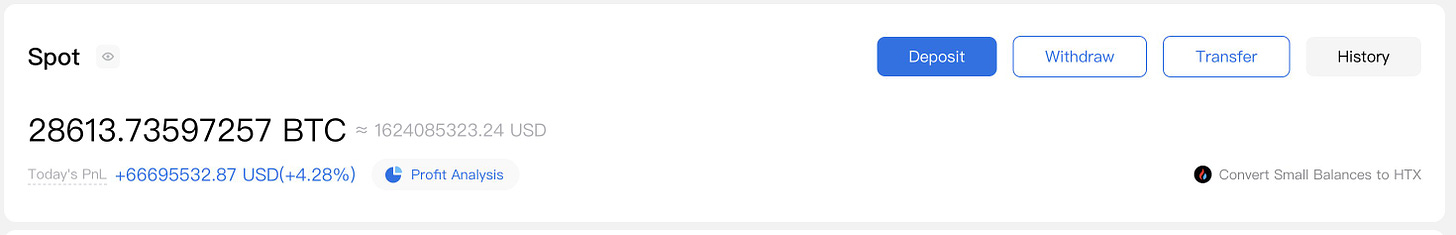

Justin Sun's Crypto Dosh

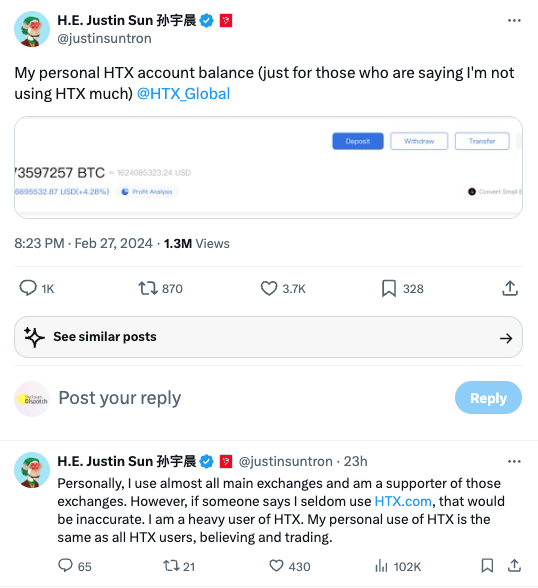

Justin Sun, the founder of TRON, went online to prove his loyalty to the cryptocurrency exchange HTX, where he's an advisor.

How'd he do it? By posting a screenshot of his alleged HTX wallet containing $1.6 billion in crypto.

Why's this bizarre?

Sun faces SEC allegations: He's been accused of fraud and selling unregistered securities by the US watchdog.

Questionable timing: Flaunting his wealth amidst legal troubles raises eyebrows.

Suspicious "proof": Sharing a screenshot lacks transparency and raises security concerns.

The move likely aims to silence rumors of him not using HTX frequently.

However, it backfires by drawing more attention to his controversial past and questionable methods.

IRS Ropes in Crypto Folks

The IRS just brought in two heavy hitters from the private sector to beef up their crypto tax enforcement game.

Meet the new team

Sulolit "Raj" Mukherjee: A blockchain expert with over 10 years of experience in tax compliance for financial institutions.

Seth Wilks: A seasoned tax pro with 6 years in the digital asset space, previously tackling complex tax issues for multinational corporations.

Why the big guns? The IRS is serious about getting a grip on crypto taxes. They see this as a complex and evolving area with major implications for tax administration.

Remember the Kraken case? The IRS isn't afraid to get tough. They're leveraging their John Doe summons power to gather information from crypto exchanges.

The Surfer 🏄

Hut 8 has started building a 63MW crypto mining site in Texas.

DWF Labs, a digital asset market maker, will invest $10 million in meme coin Floki Inu (FLOKI).

Bitcoin-focused payments app Strike is expanding its services to Africa.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋