Crypto Whiplash 📿

Bitcoin ATH and down. Ethereum aiming for ATH. Winners of Bitcoin surge. ETFs hit $10 billion trading volume. Crypto bull emotions run high on Twitter. DeFi trading volume hits $100 billion.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

March 5 was the day we had all been dreaming about for the past two years.

What happened?

Bitcoin finally hit its ATH.

After 846 long days.

A 4% 24-hour rise.

Starting 2023 at less than $17,000, Bitcoin has now surged more than 300% since then.

But then came the flash crash.

BTC again Plummeted 14% all the way to $60k

Traders using options and futures to amplify their gains faced $1 billion in losses.

What happened? The hodlers (long-term holders) decided to cash in on their profits. This included a dormant whale who woke up after 14 years to sell 1,000 BTC, raking in a cool $68 million.

Over $1 billion in liquidated positions were recorded due to the volatility, making it the worst day since the last market peak.

But then again Bitcoin traces its way back to $67k.

Such a rollercoaster.

But the liquidations? Still high.

But its all healthy

Ethereum Eyes $4K

Ethereum (ETH) setting its sights on $4,000.

Here's why it might moon soon:

Shrinking supply: Investors are holding onto their ETH, reducing selling pressure and potentially driving up the price.

Whales accumulating: Big investors are buying in, signalling their belief in ETH's future potential, adding further upward pressure.

Staking boom: Increased ETH staking reduces circulating supply and can also boost the price.

Bonus: Surging open interest in ETH futures suggests increased demand, potentially leading to a price rise.

Winners of Bitcoin Surge

Bitcoin's price is soaring, nearing its all-time high, and big-time holders are celebrating.

MicroStrategy (OG Believer): Doubling their money with a $12.8 billion Bitcoin stash (bought for $6 billion), their stock is up a crazy 90% this year.

Marathon (Mining Millions): This top miner's Bitcoin holdings jumped to $1 billion, but face challenges due to an upcoming profit-halving event. Still, their stock rose 22%.

Tesla (Silent Holder): Despite staying quiet, their $647 million Bitcoin stash has seen a 230% gain, with an average purchase price of $20,109.

El Salvador (Bold Adopter): The first nation to adopt Bitcoin holds $160 million and plans to hold on tight, even launching Bitcoin-backed bonds.

US Government (Unintentional Collector): Holding the second-largest stash ($14.3 billion) from law enforcement seizures, they're not active buyers.

Crypto Record Trading Volume

On March 5th, the crypto market witnessed a massive surge in trading volume, according to data from Kaiko.

Bitcoin (BTC) saw its spot trading volume across all centralised exchanges (CEXs) skyrocket to $46.25 billion, marking the highest level since 2021.

Binance dominated the BTC trading scene, processing a staggering $23.84 billion in volume, followed by Coinbase, Bybit, OKX, and others.

Ethereum (ETH) wasn't left behind either, with its spot trading volume exceeding $20 billion on the same day. Similar to BTC, Binance led the pack with $10.04 billion in ETH volume, followed by Bybit, OKX, and Coinbase.

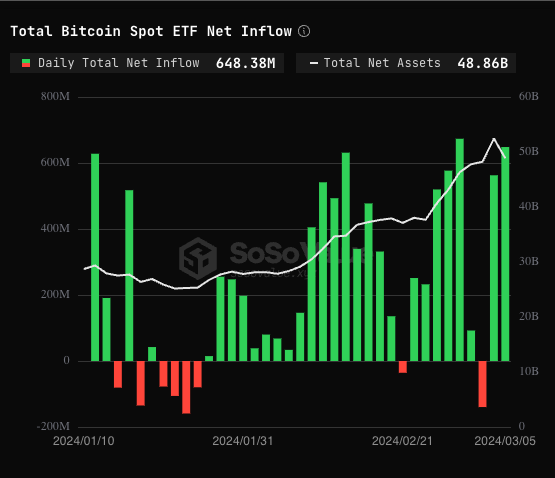

Where’s ETF?🚨

On March 5th, the total net inflow to Bitcoin spot ETFs was $648 million. Grayscale ETF GBTC experienced a net outflow of $332 million.

Highest net inflow was BlackRock ETF IBIT, $788 million.

Total historical net inflow to IBIT has reached $9.167 billion👇

ATH Emotions Run High

Crypto Twitter is a rollercoaster of emotions as BTC surpassed $69,000 for the first time since 2021.

Tears of joy? Check. Gloating galore? You bet. Poetry and philosophical musings? Believe it or not.

DeFi Trading Volume Hits $100 Billion

Current TVL: As of March 5, we're looking at $101.36 billion parked in DeFi.

Leading Categories: Lending leads the pack with $32.62 billion, followed by decentralized exchanges ($19.97 billion), collateralized debt positions ($12.22 billion), and restaking activities ($10.06 billion).

Flashback: The last time DeFi TVL crossed the $100 billion mark was back on May 11, 2022, peaking at $112.67 billion.

What's driving this surge?

Crypto prices are on the rise, making DeFi services more attractive in dollar terms.

New DeFi features are grabbing attention, like re-staking (earning rewards on staked tokens) and real-world assets (RWAs) (bringing traditional assets like stocks and bonds into the DeFi space).

The Surfer 🏄

Fetch.ai allocates $100 million to an infrastructure program that will provide GPU credits to its users.

Court in Montenegro overturns decision to extradite Terra founder Do Kwon to the United States.

Binance is exiting the Nigerian market due to regulatory scrutiny, cease all Nigerian Naira transactions by March 8.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋