Crypto's $200M Election War Chest 🪖

Crypto PACs are spending big on US elections. Are we getting the numbers wrong? FTX and Alameda ordered to pay $12.7B to customers. Binance flop listings of 2024. Solana ETF approved by Brazil SEC.

Hello, y'all. Friday night, what’s on your mind folks? Need help … 👇

Crypto is supporting politics.

Money follows power, and vice versa.

We all know that. Thank you.

Spending millions on the upcoming United States presidential election.

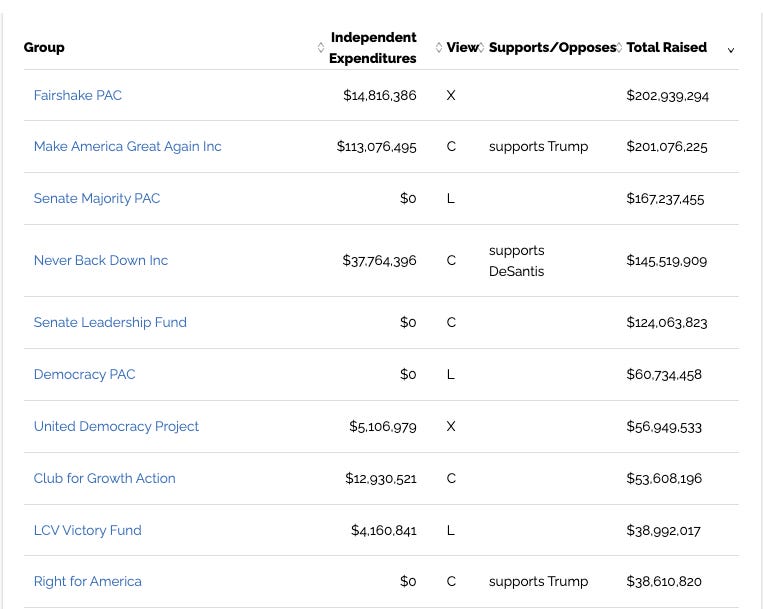

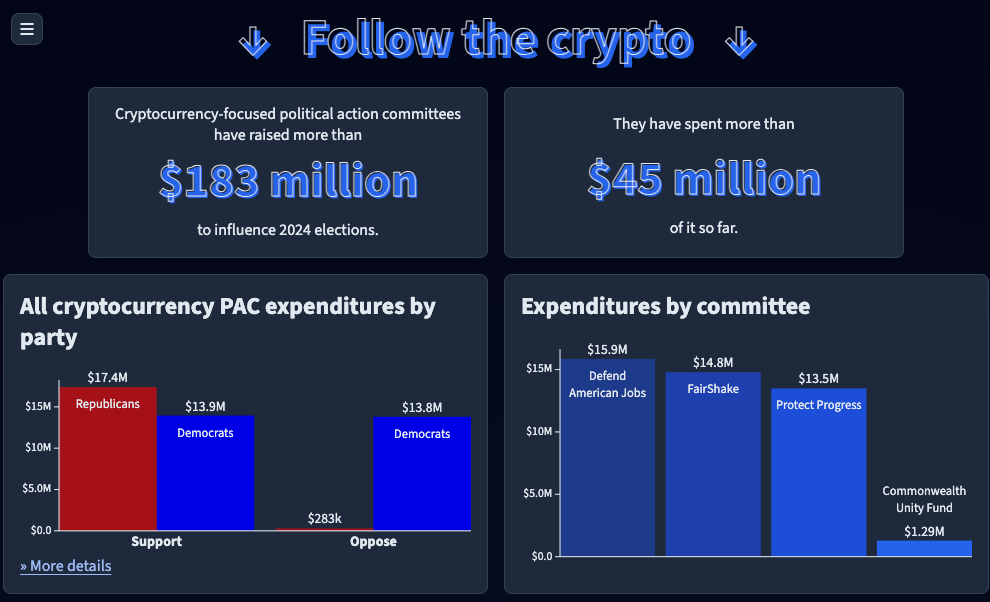

The crypto-centric political action committee (PAC) are running most successful fundraisers in the US political landscape - according to Open Secrets data.

Is it making a difference? Looks like it.

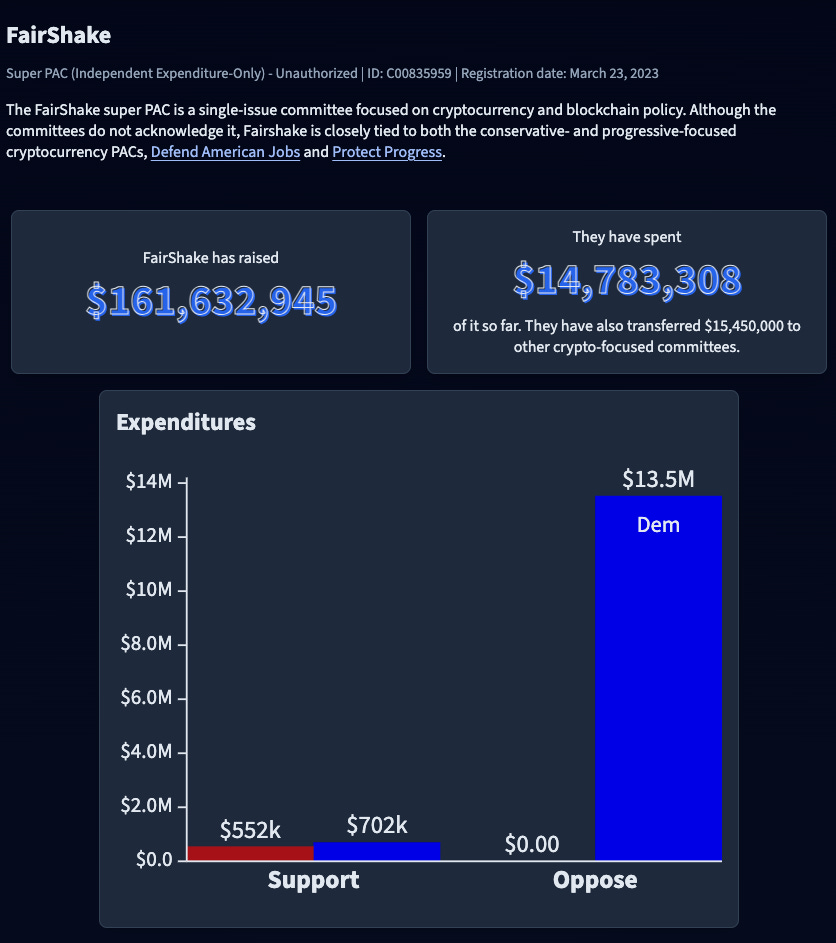

Fairshake Super PAC has raised around $203 million for the 2024 elections.

More money than any other super PACs.

Make America Great Again Inc. follows closely with $201 million, while Senate Majority PAC has raised $167 million.

Major contributions?

~$54 million comes from giants like Coinbase and Ripple.

Read: Did Coinbase violate campaign finance law?

Individual heavyweights

$11 million from Andreessen Horowitz founders.

$5 million from the Winklevoss twins.

$1 million from Coinbase's CEO.

The PAC, so far doing a great job, winning 33 out of 35 contests it participated in.

Fairshake commits $25M

Plans to spend $25 million supporting 18 House candidates—9 Republicans and 9 Democrats—across roughly a dozen states.

Fairshake will purchase approximately $1 million in TV ad time for each candidate's district.

The ads will air in states including Alaska, California, Colorado, Iowa, Illinois, Minnesota, Nevada, New York, Oregon, Texas, and Wisconsin.

Candidate roster?

A closer look at the $203 million

A little confusion here.

Yes, OpenSecrets, the nonprofit that collects data from the Federal Election Commission, says Fairshake raised more than $200 million.

But, Molly White, a crypto researcher reports that the PAC has raised only about $162 million.

The discrepancy is due to the way the FEC records receipts vs actual contributions.

The FEC counts both individual donations and donations from the donors' companies as separate receipts, double counting the money.

Receipts also include refunds and other accounting quirks that aren't real contributions.

For crypto donations, the FEC counts both the initial donation and the value when converted to cash, another double count.

When accounting for these factors, DL News found Fairshake received $40 million less than OpenSecrets reported based on raw FEC data.

Everything else you need to know

The political action committees (PAC) we are talking about?

Fairshake PAC and affiliates—the Defend American Jobs PAC and the Protect Progress PAC.

The aim? Support pro-crypto candidates and oppose candidates favoured by Sen. Elizabeth Warren, the anti-crypto ones.

Then there is Crypto4Harris?

That’s a bunch of people who want to influence Democratic candidate Kamala Harris to like crypto.

Nobody has a clear idea on her crypto stance.

Same thing for her VP pick: Hey Crypto, Let's Walz Now? 🧐️

They are organising a virtual town hall to rally support for Harris among crypto holders.

Billionaire investor Mark Cuban and North Carolina Rep. Wiley Nickel are expected to participate.

Is that gonna work out though?

Crypto goes to the White House

Nearly a dozen crypto executives held a video call with White House officials on Thursday to express concerns over the Biden administration's regulatory approach to the industry. To reset relations with Democrats ahead of the 2024 elections.

The executives discussed the need for clearer regulations and hinted at the potential removal of SEC Chair Gary Gensler, while seeking bipartisan support for crypto initiatives moving forward.

Read: Crypto takes its 2024 political campaign to the White House

The Quiz Game for the Music Lovers

Musicnerd.io - is more than just a platform; it's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

Block That Quote 🎙️

American business man standing by Daddy’s side, Donald Trump Jr.

“We’re about to shake up the crypto world with something HUGE.”

What are presidential candidate Donald Trump’s sons up to?

A major announcement is coming.

Launching a new decentralised finance (DeFi) platform.

Aimed at taking on the banks. Nothing to do with a memecoin.

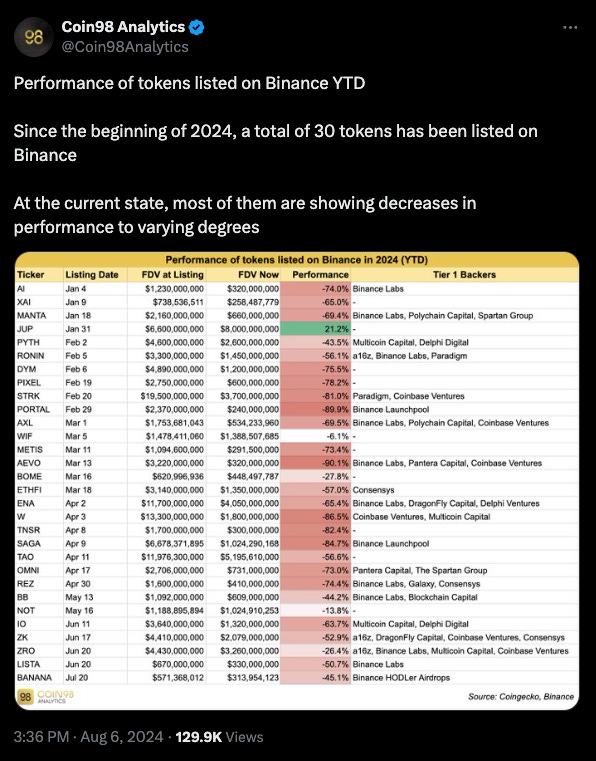

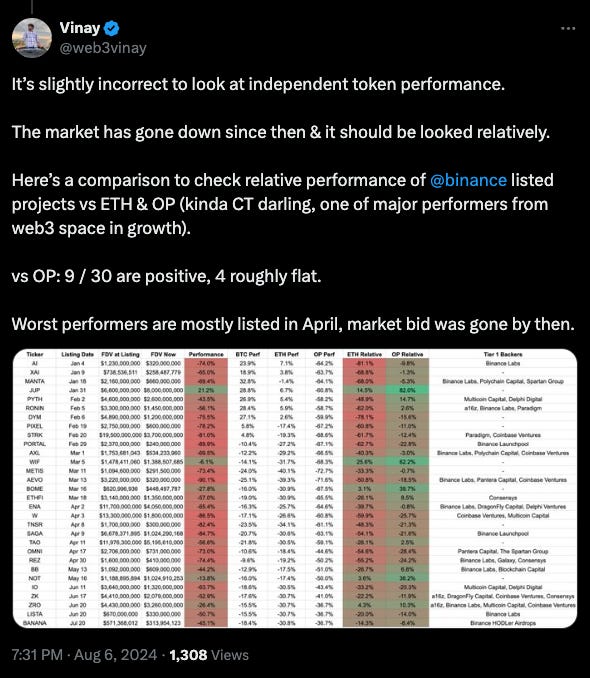

What’s Wrong with Binance Listings in 2024?

Binance listings are a big deal.

Though this year reveals a grim picture for most of its 2024 token listings.

According to Coin98 Analytics, out of 30 tokens added this year, 29 have seen a huge price price drops.

Concerning. You bet.

Given that many of these tokens were backed by high-profile venture capital firms - Binance Labs, a16z, and Paradigm.

But, a comparison to Ethereum and Optimism suggests that a few of Binance's listings have actually performed relatively well in the broader market context.

Why the tumble?

There's speculation that venture capitalists, who often hold large portions of these tokens, might be cashing out, impacting the market.

Research: Why did the token drop sharply after listing on Binance? Who is responsible?

It’s not all bad

Big inflows: While everyone else was drowning in the market downturn, Binance saw an inflow of 1.2 billion on August 5. Read about it here.

Recovers $73M in stolen funds: The exchange's security team has successfully recovered or frozen over $73 million in stolen user funds as of July 31st, a substantial increase from the $55 million recovered in all of 2023.

TON Listing: Binance has officially listed Toncoin (TON) for trading.

Starting August 8th, 2024, you can trade TON on Binance with various trading pairs: TON/BTC, TON/USDT, TON/FDUSD, and TON/TRY.

Deposits for TON are now open, allowing you to prepare for trading.

There's no listing fee for TON.

In The Numbers 🔢

$12.7 billion

US Judge-approved settlement between FTX, its trading arm Alameda Research, and the Commodity Futures Trading Commission (CFTC).

Last day we saw an end to the Ripple vs SEC battle and now?

Read: $2B to $125M. Ripple Victory? ✌️

The FTX saga.

End of a 20-month legal battle.

Where's the money going?

Restitution: $8.7 billion will be returned to those who lost money due to FTX's fraudulent activities.

Disgorgement: FTX and Alameda must cough up an additional $4 billion for profits made illegally.

No payday for the CFTC

Interestingly, the CFTC won't be seeing a dime from this settlement.

The entire amount will go towards compensating FTX's creditors, with the CFTC essentially taking a backseat to prioritise customer refunds.

$1M award: The CFTC announced a $1 million reward for a whistleblower who aided in an enforcement action related to digital asset markets.

The enforcement action was based on information about improper trading provided by the whistleblower, though the specific firm was not disclosed.

Brazil SEC Approves Solana ETF

Brazil is officially one step ahead of the US in the crypto ETF race.

The country's securities regulator, CVM, has given the green light to a spot Solana ETF.

While US-based firms like VanEck and 21Shares are eagerly awaiting SEC approval for their Solana ETF applications, Brazil has stolen the spotlight.

QR Asset, the ETF's creator, positions Brazil as a leader in regulated crypto investments.

Meanwhile, Canadian fund manager 3iQ plans to stake SOL for its Solana ETF, offering investors additional rewards.

The Surfer 🏄

President Vladimir Putin has signed a law legalising cryptocurrency mining in Russia. The law introduces new terms like digital currency mining, mining pool, and mining infrastructure operator.

Tether plans to double its workforce to 200 employees by mid-2025, focusing on compliance. CEO Paolo Ardoino emphasises a lean approach, hiring only senior staff to maintain flexibility.

Franklin Templeton's blockchain-based money market fund, FOBXX, has launched on the Ethereum Layer-2 scaling solution, Arbitrum, to enhance accessibility for investors.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

Binance tokens dropping faster than my Wi-Fi connection during a Zoom call. 📉

How reliable are there fundraising number with all the double counting and accounting quirks?.. 🤨