Today’s edition is brought to you by Uphold - The easiest way to buy and sell cryptocurrency and earn rewards. Simple, one-step trading 👇

Monday blues + Christmas week … how can we possibly cheer you up today? Perhaps take you away from the news and the crypto volatility.

Let’s talk about people.

The crypto industry has got its dream regulator. And he's got the keys to the US Securities and Exchange Commission (SEC).

Paul Atkins, the "Godfather of Republican capital markets policy," is set to replace Gary Gensler as SEC chair. Let’s get to know him better.

First up, show us some love on X 🤞

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 190,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

When President-elect Donald Trump announced Paul Atkins as his pick for SEC chair, crypto markets responded with historic enthusiasm — and for good reason.

Trump's pick isn't just another suit – he's been quietly shaping crypto's future from the sidelines.

Think about it.

Co-chair of Token Alliance

Digital Chamber advisor

Fintech startup consultant

Former SEC commissioner

To understand why this appointment matters so much, we need to look at where Atkins came from and where he might take us.

Read: 5,815 Days 💯

Before that, all the happenings from Trump's vision to make America the "crypto capital of the planet" and usher in a "Golden Age of American Innovation."

Trump and Co. Go Picking

Donald Trump has been making so many announcements and appointments that it is difficult to keep track. There are committees and councils and advisories.

These include Trump administration veterans and tech industry experts.

The latest what we’ve managed to put together from President-elect Trump’s key appointments to his technology team, focusing on AI and cryptocurrency.

Office of Science and Technology Policy (OSTP)

Michael Kratsios: Nominated as director of the White House OSTP

Previously served as Trump's chief technology officer

Will advise David Sacks, the "AI and Crypto Czar"

Presidential Council of Advisors for Science and Technology (PCAST)

Dr. Lynne Parker: Appointed as executive director of PCAST

Former deputy CTO under Trump and founding director of the National Artificial Intelligence Initiative Office

Will advise Kratsios and work under David Sacks, who will chair PCAST

AI Policy

Sriram Krishnan: Named senior policy advisor for AI at OSTP

General partner at Andreessen Horowitz, with experience at Microsoft, X, Meta, and Snap

Crypto Council (Presidential Council of Advisers for Digital Assets)

Bo Hines: Appointed as executive director

Former college football player and unsuccessful Republican congressional candidate

Other Notable Appointments

Stephen Miran: Named chairman of the Council of Economic Advisers

Scott Kupor (Andreessen Horowitz managing partner): Appointed director of the Office of Personnel Management

David Sacks: Initially expected to serve as "AI and Crypto Czar," but Sacks' role has been adjusted to a general advisory position, and there are reasons … it isn’t easy ride in the Trump camp.

Lest we forget, Trump has nominated Cantor Fitzgerald CEO Howard Lutnick to be the next Secretary of Commerce.

Now, let’s get back to Atkins.

From Tampa to the Token Alliance

Born in Lillington, North Carolina and raised in Tampa, Florida, Atkins isn't your typical crypto advocate.

His path to becoming the potential architect of American crypto policy started conventionally enough — Wofford College, Vanderbilt Law, and a stint at Davis Polk & Wardwell working on securities and mergers.

But it was his first tour at the SEC, serving under chairmen Richard Breeden and Arthur Levitt in the 1990s, that shaped his regulatory philosophy.

While there, he focused on something that would later become crucial to crypto: reducing barriers for small and medium-sized companies to access capital markets.

This wasn't just bureaucratic tinkering.

Atkins was laying the groundwork for what he'd later advocate in the crypto space — the idea that excessive regulation often hurts the very investors it's meant to protect.

The Gensler Reset

To appreciate what Atkins might do at the SEC, we need to understand what he's inheriting.

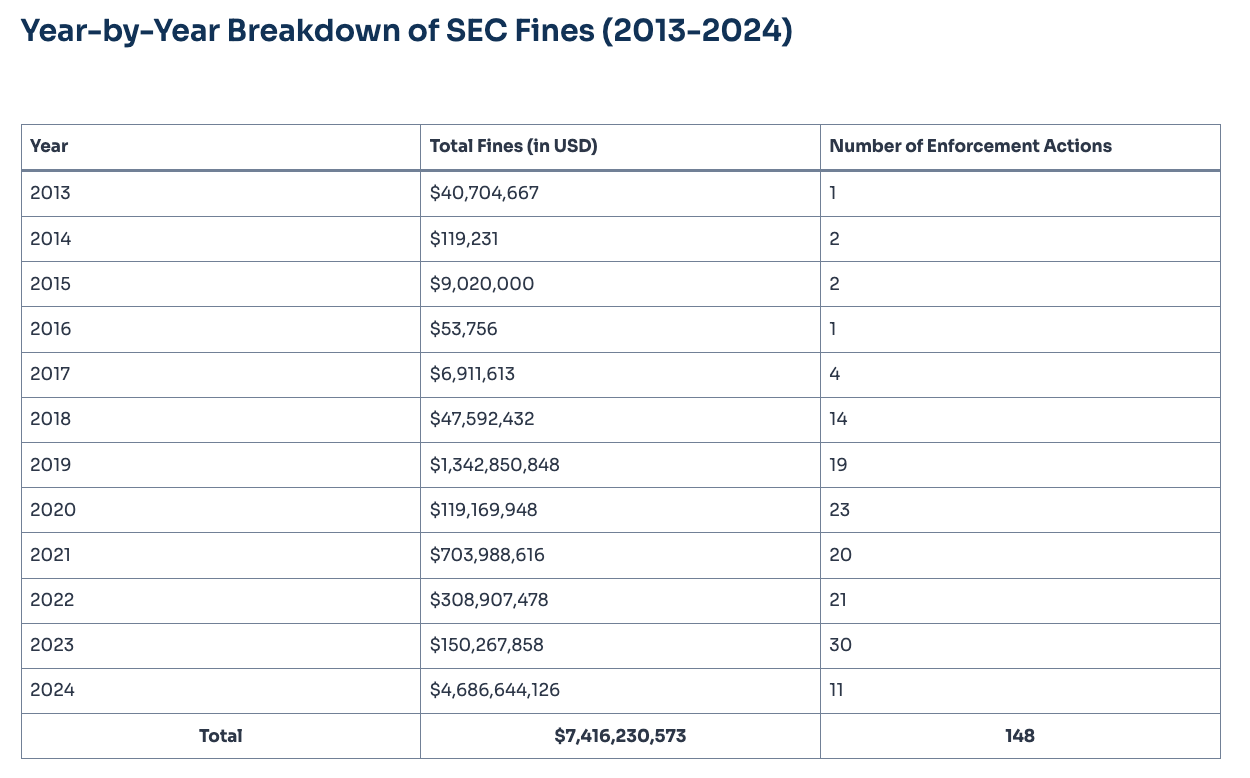

Under Gary Gensler's leadership, the SEC took unprecedented action against crypto companies.

During his three-year tenure, he was responsible for more than half of all SEC enforcement actions against the crypto industry since 2015.

This "regulation by enforcement" approach has been criticised for creating uncertainty and pushing innovation offshore.

Atkins isn't just anti-Gensler — he brings his own vision for crypto regulation.

The FTX Factor

Perhaps the most intriguing chapter in Atkins' crypto story is his firm's connection to FTX.

His consultancy, Patomak Global Partners, advised the now-defunct exchange in early 2022, months before its collapse.

Rather than distance himself from this association, Atkins has used it to make a broader point about US crypto regulation.

He argues that the FTX debacle became an "international debacle" precisely because the US lacked clear rules for digital assets.

This perspective — that clarity, not restriction, prevents disaster — could define his approach as SEC chair.

What Changes (and When)?

The crypto industry shouldn't expect an overnight revolution.

While Atkins will likely have a Republican majority at the SEC, several practical constraints will shape his early days.

Existing cases can't simply vanish. The SEC's ongoing lawsuits against Coinbase, Kraken, and others will need proper resolution.

Legal precedents set under Gensler can't be instantly reversed without justification.

Many changes will require formal rule-making processes, which take time and public comment.

However, certain shifts could come quickly.

A move away from "regulation by enforcement" toward clear guidance

Support for Hester Peirce's Token Safe Harbour proposal

Streamlined processes for crypto companies seeking regulatory compliance

Block That Quote 🎙

Brian Quintenz, Policy Head at a16z

"If the SEC had any doubt about the regulatory treatment of ETH, it wouldn't have approved the ETF."

And now he might be running the Commodity Futures Trading Commission (CFTC).

Trump's reportedly eyeing the former CFTC commissioner to lead the agency.

Why's that spicy?

Led policy at crypto's biggest VC (a16z)

Previously served at CFTC (2017-2021)

Called out SEC's Ether confusion

Backed crypto innovation while regulating

The result? We might see the first-ever crypto-native CFTC chair.

Actually understands digital assets

Has regulated them before

Knows the industry inside out

Has skin in the game

Between Atkins at SEC and Quintenz at CFTC, 2025's shaping up to be regulation's redemption arc.

Discover Crypto Better

Uphold is a multi-asset platform for retail traders and businesses to discover, trade, and secure a wide range of cryptocurrencies, stablecoins, precious metals, and foreign fiat currencies. The user-friendly platform offers cross-asset trades and custody vault storage 🫵

The Trump Factor

Atkins' nomination fits perfectly with Trump's broader crypto agenda.

The president-elect has promised to make the US "the crypto capital of the planet," even floating the idea of a Bitcoin strategic reserve.

With Trump's backing, Atkins could have unprecedented latitude to reshape crypto regulation.

His experience at the Token Alliance and the Chamber of Digital Commerce suggests he'll push for frameworks that encourage innovation while maintaining basic investor protections.

The Inside Game

The most intriguing aspect of Atkins' nomination isn't just his pro-crypto stance — it's his existing relationships within the SEC.

Both current Republican commissioners, Hester "Crypto Mom" Peirce and Mark Uyeda, were once his staffers during his previous SEC stint.

"When we look at how the commission is going to work moving forward, they have familiarity. They've already rolled up their sleeves and been in the war together," says Digital Chamber President Cody Carbone.

This internal alignment could prove crucial, especially with the SEC's upcoming Republican majority.

The Power Balance

The SEC's five-person commission is about to see its biggest shakeup in years.

With both Gensler and Democratic Commissioner Jaime Lizarraga announcing their January departures, and Caroline Crenshaw's renomination in limbo, the balance of power is shifting dramatically.

Some speculate Trump might even break with protocol and nominate a fourth Republican commissioner — though that remains purely speculative.

The Token Dispatch View 🔍

Paul Atkins' appointment could mark the beginning of a new era in American crypto regulation.

His background suggests he'll favour clarity over restriction, innovation over enforcement, and market access over regulatory barriers.

But the real test will come when theory meets practice.

Can Atkins transform the SEC from crypto's biggest obstacle into its greatest enabler?

Will his vision of proportional regulation survive contact with market realities?

The crypto industry has never had a more influential ally at the helm of the SEC.

What he does with that influence could determine whether America becomes the crypto capital Trump envisions or remains stuck in regulatory limbo.

The next few months will show us whether Atkins can turn his decades of regulatory philosophy into practical policy.

For now, though, both the markets and the industry seem to believe he can.

The Surfer 🏄

Tether has announced a $775 million strategic investment in Rumble - $250 million cash commitment and support for Rumble’s tender offer to purchase up to 70 million shares at $7.50 per share. The transaction is expected to close in the first quarter of 2025, with Rumble CEO Chris Pavlovski retaining control

Several marked North Korean hacker addresses have recently been trading on Hyperliquid, with a total loss of more than $700,000, according to @tayvano_. Some community members are concerned that these trading activities may mean that North Korean hackers have identified Hyperliquid as a potential target and are testing the stability of the system by executing transactions.

The US SEC has charged Jump Trading subsidiary Tai Mo Shan Limited with misleading investors about the stability of Terra USD (UST) and acting as a legal underwriter in unregistered transactions in the LUNA crypto asset. As part of the settlement, Tai Mo Shan agreed to pay $123 million, including disgorgement of profits, interest, and penalties.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us ... either ways do tell us✌️

So long. OKAY? ✋

Real talk - can one guy really flip years of crypto regulation? Feels like we've heard the "crypto-friendly regulator" story before. Just saying...

So Atkins might run the SEC... but hold up - wasn't this the same guy who advised FTX right before it blew up? 🤔 Sure, he's pro-crypto, but maybe check his track record first