Crypto's Getting Bigger than France? 🌎

Overall market cap touches $3.12T; just a shy away from France's GDP. Bitcoin nears $90K. BTC market cap up at $1.77T. Crypto products see $1.98B inflows in last week. Crypto to peak only in H2 2025.

Hello all, welcome to your Tuesday’s crypto dose. Today's edition we do a reality check - crypto v global economies.

Hello, y'all. FOMO about missing out on Coldplay live? Play Muzify quiz to score the concert ticket👇

$3.12 trillion

That’s the figure crypto’s total market capitalisation touched.

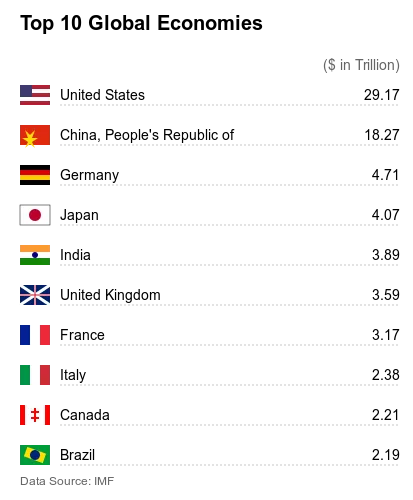

If crypto were a country, it'd be the world's eighth-largest economy. In touching distance to France’s GDP.

Take a moment to wrap your head around that.

We're not just talking about internet money anymore.

We're talking about an asset class bigger than Microsoft, knocking on France's GDP door, and giving Nvidia and Apple a run for their money.

How did we get here?

Bitcoin just casually touched $89,500, pushing its market cap to $1.77 trillion – that's larger than Spain's entire GDP.

Not bad for "magic internet money," eh?

FYI, exactly a week ago, during the US presidential election results, Bitcoin was struggling to get past its then all-time-high of $73K.

In just a week, it has shot up 30% to $89.5K from a low of $68K.

But didn’t crypto touch $3-trillion before too?

Yes it did. Recorded about $3.06 in market cap exactly around this time in 2021.

So, what’s different this time?

Institutional money leading the charge

Bitcoin & Ethereum ETFs becoming mainstream

Real-world use cases emerging

Regulatory clarity on the horizon

10x Research's Markus Thielen told Cointelegraph that he expects Bitcoin to stay dominant and drive crypto market cap towards $4 trillion.

"We anticipate Bitcoin's dominance to remain strong, with the current rally primarily centred on Bitcoin and extending toward Ethereum and Solana."

His target? $100K before the year ends.

But not everyone's betting on Bitcoin dominance.

For BTC Markets' Rachael Lucas, altcoins will be the drivers.

"A crypto market rally toward $4 trillion would likely be driven by a massive surge in altcoins."

And the signs are already there

SOL hitting new milestones

ETH breaking resistance levels

DeFi gaining traction

Layer 2s seeing adoption

Read: Alt Season Incoming? 🎭

Wondering when did all this interest in crypto come? Read on…

In The Numbers 🔢

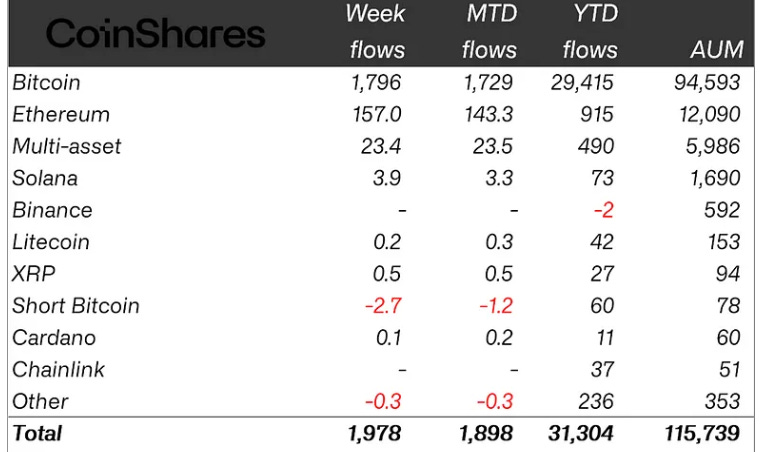

$1.98 billion

Inflows into crypto products in just last week. That’s the fifth straight week of inflows.

$7.7 billion in five weeks

That’s 24% of 2024's total inflows

$116 billion in total assets under management

And yet again, it was Bitcoin ETFs that primarily drove the flows.

What else?

With the bull rally going strong, the crypto bears were rekt.

In just the last two months, $800 billion were added to crypto market cap.

That’s 40% up since September.

So much for thinking that the bull market will kick-in after the post-election volatility, you’d think.

The catalyst? Lots of them

Trump victory boosting sentiment

Rate cuts adding fuel

ETF inflows breaking records

Institutional adoption accelerating

Retail traders joining the party

As if all these weren’t enough, crypto regulations too may finally begin to get clearer.

Says who? Stay with us…

The Home for All the Music Lovers

Muzify - With close to 2 million plays, is more than just a platform.

It's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

Block That Quote 🎙

Venture capital firm a16zcrypto

"We believe this is an incredible opportunity to build on the bipartisan progress from the last Congress."

Andreessen Horowitz’s message to crypto firms was clear.

While it did not speculate the post-election trajectory of crypto, the firm said in its blog that it was very optimistic about the government.

“The government will now foster innovation, accelerate progress, and enable the crypto ecosystem to thrive in the US.”

The firm’s crypto legal and policy experts think now is the time for projects that have held back on using tokens due to regulatory concerns.

OKX's chief legal officer Mauricio Beugelmans sees a paradigm shift.

"Today's all-time high, driven by a Trump election win, signals that we are in the midst of a potential paradigm shift into the next phase of growth for crypto."

But Nansen's Aurelie Barthere adds a note of caution.

"The confirmation of Republicans winning the House could provide an additional boost to the risk rally, but we may see some profit-taking in the coming weeks or months as actual policies are tested."

💫 Crypto Peak Yet to Come

With all that we just said, you think crypto’s peaking?

The whales disagree.

Yeah. They feel there’s more to crypto and that its peak is further away.

MV Global just surveyed 77 major crypto investors (VCs, hedge funds, and high-net-worth individuals), and their predictions are interesting.

Market Timeline

Peak expected: H2 2025

BTC target: $100K-$150K

SOL consensus: $600+

ETH views: Split between $3K-$7K

The Surfer 🏄

About 80% of memecoins listed on Binance in 2024 experienced significant price increases, with Neiro (NEIRO) soaring nearly 7,600%. Out of 15 memecoins listed, 12 saw notable value appreciation, including Moo deng (MOODENG) and Dogwifhat (WIF), both rising over 200%.

Ex-Alameda co-CEO Sam Trabucco agrees to transfer a yacht and two apartments to FTX in a bankruptcy settlement. Trabucco will give up two San Francisco apartments valued at $8.7 million and a 53-foot yacht worth $2.5 million. He will also drop claims against FTX amounting to $70 million, while FTX releases him from any claims.

FTX has filed a lawsuit against Binance and its former CEO Changpeng Zhao, seeking to recover $1.76 billion. FTX alleges that funds were fraudulently transferred during a share repurchase deal in July 2021. The lawsuit claims that Zhao's actions and misleading tweets contributed to FTX's collapse.

Polymarket odds for Bitcoin breaking $100,000 by year's end jumped to 57% after hitting a new all-time high. The price of a "yes" share on Polymarket rose from $0.32 to $0.57, marking a 78% increase within hours.

A Chinese microchip company has announced it will accept Bitcoin as payment for its goods and services via a Coinbase business account. Following the announcement, Nano Labs' shares rose 2.81% to $3.29, although they remain down over 60% from a recent high of $8.33.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

BTC's great, but altcoins like SOL and ETH will drive real adoption through DeFi. If we’re aiming for $4T, we need more than just Bitcoin.

Crypto’s growth is wild! Comparing it to entire national economies shows real legitimacy—but BTC volatility makes me cautious. Altcoins could help stabilize it.