Curve Balls 🪩

Spotlight on Curve Finance as DeFi goes through a liquidation drama. Wall Street is greedy, more ETFs will come - Tether co-founder. In 10 years, crypto startup funding over $100B. CZ owns 64% BNB.

Hello, y'all … Why do you have to go and make things so complicated? 🎶

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

Just when you think that DeFi (decentralised finance) is back in the play with a push for wider adoption. It gets a push back.

What happened? Curve, a major DeFi player, is reeling after its founder took a massive gamble.

Curve, what? A decentralised exchange liquidity pool launched in January 2020. It is built on Ethereum and designed for efficient trading of stablecoins and Bitcoin.

Name the man? Curve founder Michael Egorov.

A Russian scientist. CEO of Curve Finance and co-founder of NuCypher.

What did he do? Egorov borrowed heavily against his CRV holding.

Took out $95.7 million in stablecoins backed by his $141 million worth of CRV tokens.

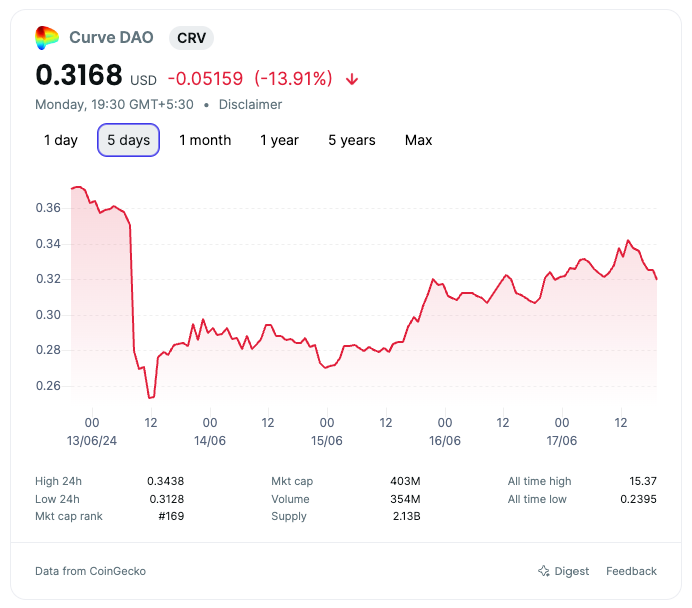

On June 13, when the price of CRV dropped 20% in a single day, Egorov's position got liquidated - Lookonchain data.

Meaning? His CRV tokens were automatically sold to cover his loan.

The liquidation caused a 30% price crash.

Big losses for investors.

To stabilise the token, a proposal to burn 10% of the circulating supply gained traction.

This positive outlook sparked a 15% price surge, offering hope for further recovery.

Egorov acknowledged the issue and claims to have repaid most of the loan.

But, the rumours about Curve burning CRV tokens?

FAKE NEWS. Impersonator account.

Current Market Status: Market Cap: ~$400 million

The dodged hack

Why CRV plummeted in the first place? Curve Finance's built-in safety net, LLAMMA, successfully fended off a recent hacking attempt.

But the victory came at a cost - CRV went down.

This was triggered by the exploit of UwU Lend, which caused a cascade of liquidations across DeFi protocols.

What is LLAMMA? Lending-Liquidating Automated Market Maker Algorithm, a fancy term for Curve's built-in safety net.

LLAMMA aims to prevent "bad debt" by automatically selling off collateral (borrowed funds) before losses become unrecoverable.

Unlike traditional liquidations with a single trigger point, LLAMMA uses multiple "bands" to gradually sell off collateral as the price drops - prevents a fire sale but can still rack up losses for the borrower, which in this case was Egorov himself.

Curve's "soft liquidations" were praised for their performance in handling the situation.

Even though LLAMMA did its job, the market panicked.

Millions made, Millions lost.

Lookonchain revealed Egorov cashed out a significant amount of his CRV holdings before the crash, using the funds for a fancy new mansion (allegedly).

While the liquidation looks bad on paper, some believe he came out ahead.

Some crypto enthusiasts argue Egorov simply "shifted the risk" to the community by selling his CRV during the crash.

Others defend him, saying selling on the open market would have had a similar impact.

Deja Vu for Curve?

This isn't Egorov's first rodeo.

Back in 2023, a similar borrowing mishap caused CRV prices to tumble. Back then, crypto heavyweights like Justin Sun (Tron founder) stepped in to buy the dip and prevent a wider DeFi meltdown.

UwU Lend hack drama

Curve itself is safe. The exploit happened on a separate platform called UwU Lend.

The DeFi lending protocol, was hacked twice, with the first hack occurring on June 10 and the second on June 13.

The hacks resulted in the theft of nearly $23.7 million in tokens.

The hacks were caused by price manipulation, where the attacker used flash loans to manipulate the price of certain tokens, including SUSDE and CRV, and then deposited them into UwU Lend to borrow more tokens than expected.

UwU Lend offers a hefty $5 million bounty in ETH to anyone who identifies the attacker.

UwU Lend initially offered the attacker 20% of the stolen funds if they returned the remaining 80%.

The exploit led to $10 million in bad debt on Curve.

Egorov, taking responsibility, has already fully repaid this debt.

Now Egorov talks about the importance of proper liquidation risk management:

“For non-major crypto (eg - not BTC or ETH as collateral), one should likely provide borrow caps; data shows that Curve-specific markets can be well-parametrised to withstand even these conditions.

It appears industry heavyweights did not fully know how to deal with liquidations; they did not attempt to do partial hard liquidations for my position on Curve. Eventually, I had to do it myself.”

Panic across the DeFi ecosystem

The event put pressure on other DeFi protocols, as CRV is used as a trading pair and in trading pools.

Importance of risk management in DeFi for high-leverage positions held by prominent figures like Egorov.

Increased market volatility, with CRV experiencing significant price fluctuations in a short period.

Block That Quote 🎙️

Tether WAX co-founder, William Quigley

“Wall Street is greedy.”

Not just Ethereum and Bitcoin ETFs. There’s much more to come.

Wall Street's insatiable appetite for profit, as Quigley puts it, will drive the creation of ETFs for everything from Solana to Cardano.

Wall Street loves “the next hot thing.”

“Every time Wall Street packages a new product to sell to consumers, if that product is successful, you can guarantee there will be copycats. There would be no ETFs if the Bitcoin ETF had failed.”

This ETF explosion won't last forever.

“We will continue to see new ETFs launching until there's a big pullback … Then, you’ll see some of those ETFs shut down by the firms who launched them due to lack of demand.”

Reservations about the growing influence.

"I was happy with crypto without Wall Street. Would it be smaller? Of course. But I didn't feel the need to keep growing the size of crypto now. If you want a massive amount of capital, then yes, you have to do things like ETFs."

Bitcoin's long-term prospects.

Quigley believes the price is primed for a significant surge as the effects of the recent halving event kick in.

"It can't go higher because it's not the right time."

Joe Biden’s Campaign Eyes Crypto Donations

Platform of choice? Coinbase Commerce

The irony here? The SEC, under Biden's watch, sued the same Coinbase last year for operating as an unregistered broker and offering unauthorised services.

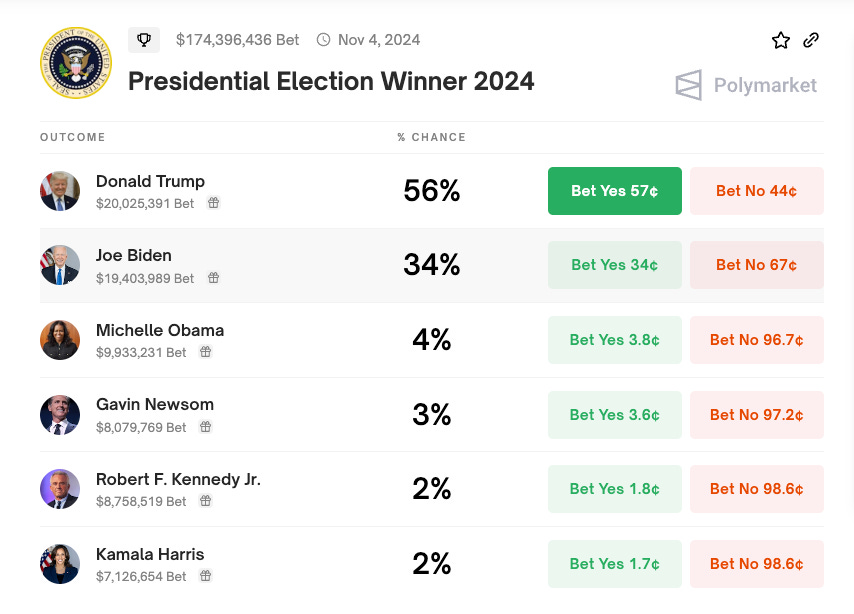

“People in [Biden’s] outer inner circle are now specifically telling the Biden team, ‘if you're quiet on this crypto thing and you don't get up to speed, you could lose the election,’” - source close to the matter.

Another sign: Rep. Ro Khanna plans a July roundtable with Biden administration officials and Mark Cuban to discuss U.S. crypto policy. The focus is to bolster Bitcoin and blockchain innovation stateside.

Donald Trump turned 78 years old.

On the occasion, down in sunny West Palm Beach, Florida, he promised to end Joe Biden’s ‘war on crypto.’

Called out Biden for letting crypto suffer a “slow and painful death.”

Made a clarion call, "if you're pro-crypto, vote for Trump."

Trump has promised crypto a lot of things, and has started accepting crypto donations.

Crypto wants Trump.

Brian Armstrong, Coinbase: “Both parties are recognising that they need to address this issue … crypto’s arrived.”

Rep. Wiley Nickel: “Frankly, passing FIT21 would prevent the next FTX, and that was really the place we focused … And for Democrats, it was a simple message: love crypto or hate it, we should want to have regulation.”

Billionaire, Mark Cuban: SEC chain Gary Gensler could “literally cost Joe Biden the election.”

Crypto-backed super PACs have amassed a $100 million war chest.

Why? Crypto is important for politics.

In The Numbers 🔢

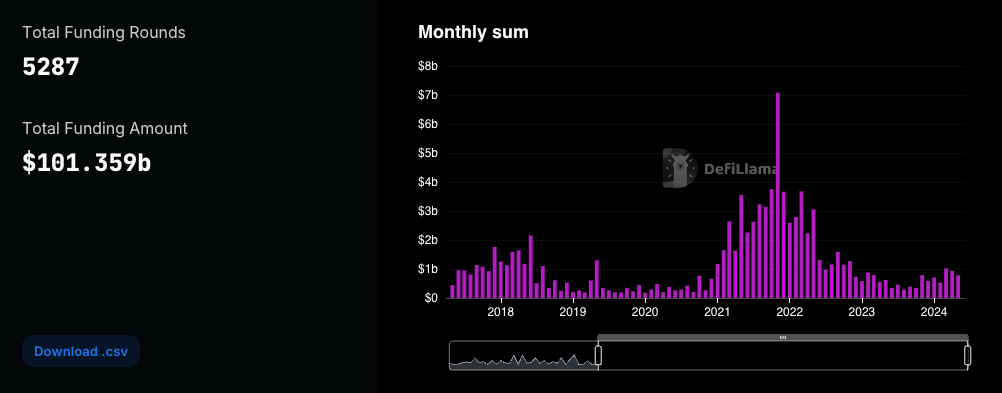

$100 Billion

That’s how much crypto startups have raised since the end of May 2014.

It's been a rollercoaster ride.

Ups and downs along the way, regulations, bankruptcies, and fluctuations.

Despite the bumps, the overall trend is clear: venture capital funding is on the rise.

Ten years ago, crypto startup funding was a mere $17 million in a single month.

Fast forward to today, and May 2024 saw $280 million invested.

$777 million raised in April 2024.

Nearly half of all crypto funding comes from American investors.

The UK (7.7%) and Singapore (5.7%) follow closely behind according to a 2023 report.

Venture Capital activity in has increased in early 2024.

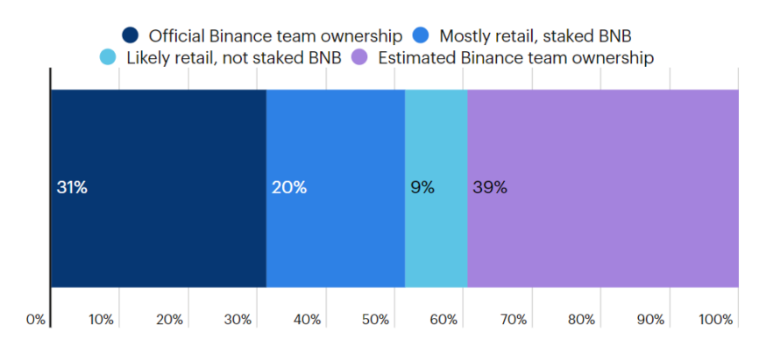

CZ Owns A Massive Chunk Of BNB?

We are talking ~ 94 million.

Binance Coin (BNB), the exchange's native token.

Binance co-founder Changpeng Zhao holds 64% of circulating supply.

Who said? A new report by Forbes.

How'd he get so many? Two sources.

As part of the founding team, CZ received a chunk of tokens during the initial coin offering (ICO).

Binance's ICO didn't sell out completely. CZ, through his majority ownership of Binance, likely controls most of those unsold tokens.

Binance + CZ control even more.

Combine CZ's holdings with those directly owned by Binance = 71% of all circulating BNB.

Thanks to his hefty BNB holdings and 90% stake in Binance, CZ is estimated to be worth $61 billion.

The 24th richest person in the world.

What Does This Mean? Potentially influence on the price of BNB, raising questions about market manipulation.

The Backstory: Remember the 2023 indictments against Binance and CZ for alleged money laundering and sanctions violations? CZ stepped down as CEO, Binance paid a hefty $4.3 billion fine, and CZ received a 4-month prison sentence (much lighter than the 3 years prosecutors requested). Jailed in a low-security federal prison in Lompoc, California. He is the richest inmate in the US.

The Surfer 🏄

Tokenisation platform Holograph was hacked, resulting in a loss of $14.4 million. The price of Holograph's native token, HLG, plummeted by 80% after the hack. Attacker exploited a vulnerability in a smart contract and issued 1 billion HLG tokens.

T-Mobile owner Deutsche Telekom will soon start mining Bitcoin in addition to running nodes. Deutsche Telekom is the largest telecommunication provider in Europe. The company has been running Bitcoin and Bitcoin Lightning nodes since 2023.

94% of central banks are exploring CBDC, according to a BIS survey. The survey also found that stablecoins are rarely used for payments outside the crypto ecosystem.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋