Death of BUSD? SEC is off the leash. Crypto's quest for non-dollar stablecoin

It's SEC v Crypto, sitcom that's painting the town red, Ordinals, the Bitcoin NFTs are marching on regardless, India snatches crypto out of cricket and Siemens brings digital bond on Polygon

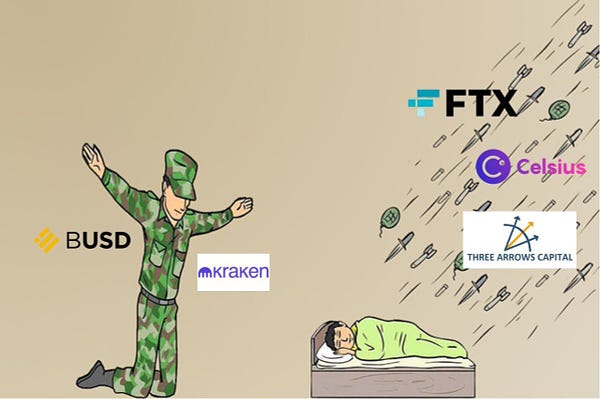

Hello y'all. This is The Token Dispatch. Where do we even start with the crypto adventure? The authorities world over have made it their thing to bring crypto to its knees #JustAskSEC. Dispatched reminding how crypto friends must be dealing the tough times.

If you dig what we do, show us some love on Twitter, Instagram and Telegram #prettyplease

The crypto industry is up in arms after the US Securities and Exchange Commission (SEC) cracked down on the popular crypto exchange Kraken. The SEC accused Kraken of failing to register as a broker-dealer, and the exchange has since been forced to pay a hefty fine. The crypto industry is outraged, claiming that the SEC is overstepping its bounds and extorting the industry. They argue that the SEC is unfairly targeting crypto exchanges and that the agency is not doing enough to protect investors. The crypto industry is calling for more clarity from the SEC and a fairer approach to regulation.

⚰️ The death of BUSD, a stablecoin backed by the US dollar, has caused a surge in the value of Tether’s USDT. USDT is now up to $1 billion in value, as investors flock to the more established stablecoin. This is a sign of the growing demand for stablecoins, as investors look for a safe haven in the volatile crypto markets. USDT has been the go-to stablecoin for many investors, as it is the most widely used and accepted stablecoin. With BUSD gone, USDT is now the only major US dollar-backed stablecoin, and its value is likely to continue to rise. This is good news for investors, as it provides a safe and reliable way to store their funds.

Binance CEO Changpeng Zhao has predicted that the crypto industry will eventually move away from dollar-backed stablecoins and towards non-dollar stablecoins. He believes that this shift will be driven by the increasing demand for stablecoins from countries outside the US, as well as the need for greater decentralisation. Zhao also noted that the current market for dollar-backed stablecoins is already saturated, and that the industry needs to move away from this model in order to remain competitive. He believes that non-dollar stablecoins will be more attractive to users, as they will offer more options and greater decentralisation. Ultimately, Zhao believes that this shift will be beneficial for the industry as a whole, as it will open up new markets and create more opportunities for innovation.

UK FCA to pull up unregistered, illegal cryptocurrency ATMs 🏧

The FCA is cracking down on those sneaky, unregistered crypto ATMs in jolly old England. The FCA and the West Yorkshire Police have taken action against several sites in and around Leeds city suspected of hosting these ATMs. Apparently, no crypto ATM operators in the UK have the FCA stamp of approval, so investors should be careful not to throw all their money into the crypto abyss. The local enforcement officers are handing out warning letters left and right, and anyone caught breaking the rules will be investigated under some serious money-laundering regulations. Luckily, the FCA has given the green light to 41 crypto firms in the UK, so there are still plenty of legit options out there.

Making all the right noise. No stopping Ordinals 🔥

Ordinals, the first NFTs to be built on the Bitcoin blockchain, is showing no signs of slowing down. Why would it? Well, the hype is real and the inscriptions are taking over 50% of the Bitcoin block space. That means good times, as if February 14 - miners have made nearly $600K from NFT transactions, more than 76,000 NFTs have been minted to Bitcoin. If that wasn't enough a Bored Ape Owner Burnt $169K NFT to Move It From Ethereum to Bitcoin. While the community remains divided, the Ordinals protocol has unlocked the potential of tokenising assets on Bitcoin's secure blockchain. It allows permanently storing digital content directly on-chain, an unusual feature in NFT space. This could solve the problem of lost NFTs and create new revenue streams for creators.

Siemens announces digital bond on Polygon 📢

Siemens, a leading technology company, has announced the issuance of its first digital bond on Polygon, a blockchain-based platform. The bond, which has a maturity of three years, will be issued in the form of a tokenised security. This marks the first time a major corporation has issued a digital bond on a blockchain platform. The bond will be available to institutional investors, and the proceeds will be used to finance Siemens' sustainability projects. The issuance of the digital bond is expected to provide greater liquidity and transparency to the bond market, as well as reduce transaction costs. This move is part of Siemens' commitment to sustainability and digitalisation, and it is expected to pave the way for more digital bonds in the future.

Crypto a no-go for cricket in India 🛑

The Board of Control for Cricket in India (BCCI) has announced that it will not allow any crypto-related advertisements or sponsorships in the upcoming Women’s Premier League.

No franchisee shall undertake a partnership or any kind of association with an entity that is in any way connected/related to an entity that is involved/operates, directly or indirectly, in the cryptocurrency sector.

This, after a similar ban for the men’s cricket Premier League, back in 2022. The Indian Premier League (IPL) had been associated with two local crypto exchanges — CoinSwitch Kuber and CoinDCX earlier. With an estimated 115 million cryptocurrency investors, in 2022, India's tax laws on unrealised gains and transactions have been a dampener for the industry.

The BCCI has also stated that it will not allow any players to be associated with any crypto-related activities or investments. This move is seen as a precautionary measure to ensure that the players are not exposed to any potential financial losses. The BCCI has also clarified that it will not be taking any action against any players who are already associated with any crypto-related activities.

TTD Surfer 🏄🏻

NASDAQ-listed Interactive Brokers to offer crypto trading in Hong Kong, which has seen a growing interest from global crypto and fintech players.

Ruairi Donnelly, former FTX Executive created Polaris Ventures and managed to orchestrate mass profits through the FTT token.

A judge banned Sam Bankman-Fried from using a VPN after the former FTX boss said he used a private network to watch the Super Bowl while under house arrest.

Magic Eden Lays Off 22 staff, CEO and co-founder Jack Lu explained the company needed to make changes in order to reach new goals in 2023.

EU Banks told by Regulator to apply Bitcoin caps even before they become law, said crypto should be treated as a risky asset.

If you like us, do tell us. If you don't like us, still tell us. ✌️

Finally, after you done reading and telling, don't forget to share with everyone you love. Each one in your little, big world can sign up here. 🤟

So long. OKAY? ✋