ETH Elephant Finally Awake? 🐘

Price hits 5-month high. About 90% ETH holders in profit. ETH ETF flows outpace BTC for the first time. L2 registers record-high TVL. Analysts expect ETH DeFi boom and price to touch $10K in 2025.

Hello all! It’s Friday finally and are excited about what the future holds for Ethereum. It’s time to shine might finally be around.

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

Can you guess the track within 5 seconds to prove your music fandom 🫵

For months now, the Crypto Twitter has been busy roasting Ethereum.

Memes and mockery - all of it thrown at ETH.

But the beginning of the end to that seems near.

Has ETH’s time finally arrived? We’ll find out.

The world's second-largest crypto just touched $3,600 – its highest level in five months.

Sure, we’ve been there less than just six months ago. And we are still some distance away from a sustainable breakout phase.

But this time it feels different.

Why? Because the smart money is finally rotating.

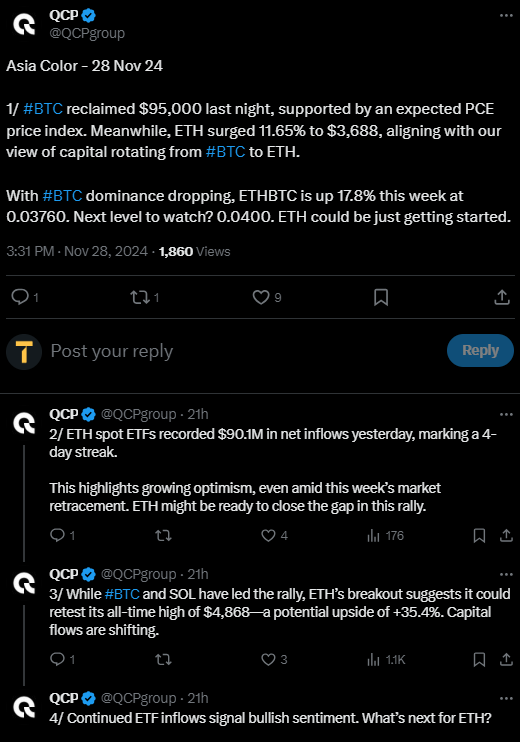

"The market seems to be expecting BTC to trade sideways until December as attention shifts towards ETH in the near term," crypto hedge fund QCP said in a note.

And the numbers back it up.

The ETH/BTC ratio jumped 14% from 0.03218 to 0.03691 in just a little over a week, signaling a massive shift in market dynamics.

And that’s not all.

The support is coming in from both the institutions and retail investors alike:

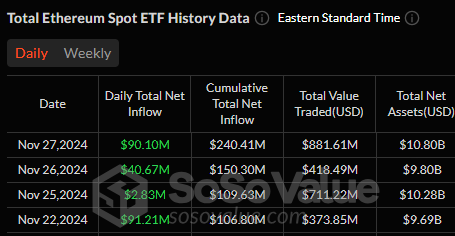

ETF inflows hit $90 million on November 27

Options markets heavily favouring ETH

Trading volume exploded to $43 billion

Major hedge funds loading up

ETH Futures Open Interest hitting ATH at $24 billion

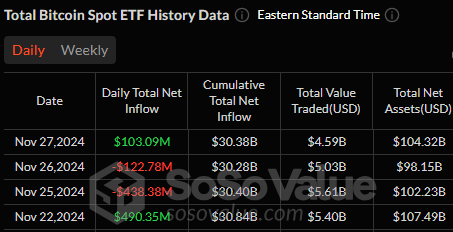

On the institutional front, Ether ETFs are beating their Bitcoin counterparts, lately.

Spot Ether ETFs took in $224.9 million in net inflows over the four trading days between November 22-27, while spot Bitcoin ETFs tallied $35.2 million in net inflows due mainly to a heavy day of outflows on November 25, data from SoSoValue showed.

But what’s driving all this besides fund rotation?

Multiple factors

Tornado Cash court victory

Paul Atkins likely heading SEC

ETH supply at 6-year low

And then, there’s also the Trump effect.

What about it? Read on…

Block That Quote🎙️

Markus Thielen, 10x Research founder

“…with expectations of a more favourable regulatory environment, it now presents a potential opportunity.”

Thielen believes that Trump’s re-election and his DeFi project will send positive signals to the ecosystem.

"[ETH's] underperformance was previously justified before the U.S. Presidential election, but with expectations of a more favourable regulatory environment, it now presents a potential opportunity. [Trump's involvement in DeFi] sends a strong signal of a potential DeFi renaissance under a Trump presidency," says Markus Thielen of 10x Research.

And the optimism won’t just be limited to the decentralised space.

The Home for All the Music Lovers

Muzify is a journey into the world of music. An interactive experience through quizzes, stats and a lot of fun tools.

For artists it’s a powerful tool to connect with their fans. For fans it’s building deeper connect with the artists.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

Traditional Finance Also Jumping Onboard

Says who? Ryan Rasmussen, Head of Research at Bitwise Invest.

So, the path to glory is clear ahead for ETH?

Not so easily.

Three key risks remain

Lack of clear narrative compared to BTC

Competition from faster chains like Solana

Potential "cannibalisation" from L2s

There’s also the pressure of moving towards its previous all-time high - $4,900 in 2021.

Short sellers have piled up as much as $1.43 billion in shorts near the elusive $4,000 mark.

What about technical indicators? They got some good news.

ETH nowhere near the overheated mark

Funding rates below ATH levels

Network activity increasing

Major institutions building

Supply squeeze imminent

Analysts expect a bullish move in altcoins led by Ethereum as Bitcoin dominance begins to come down next month.

So where will ETH go from here?

Bull case

Some analysts are calling for much higher targets

Standard Chartered: $10,000 by 2025

Ash Crypto: "$4,000 very close"

Lark Davis: Maintaining $15,000 target

Technical analysis suggesting $12,000+

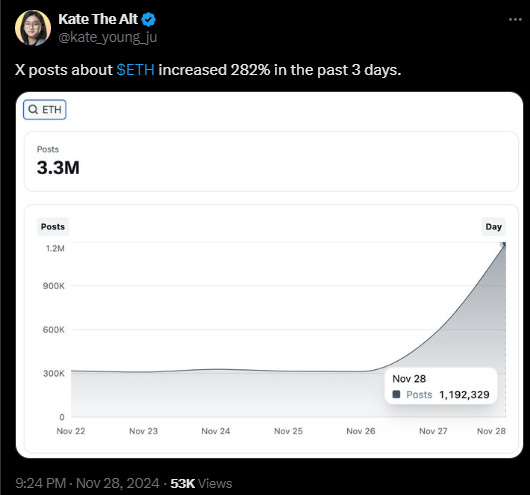

Irrespective of ETH hitting these numbers in the near term, one thing is for sure: ETH has got the world talking.

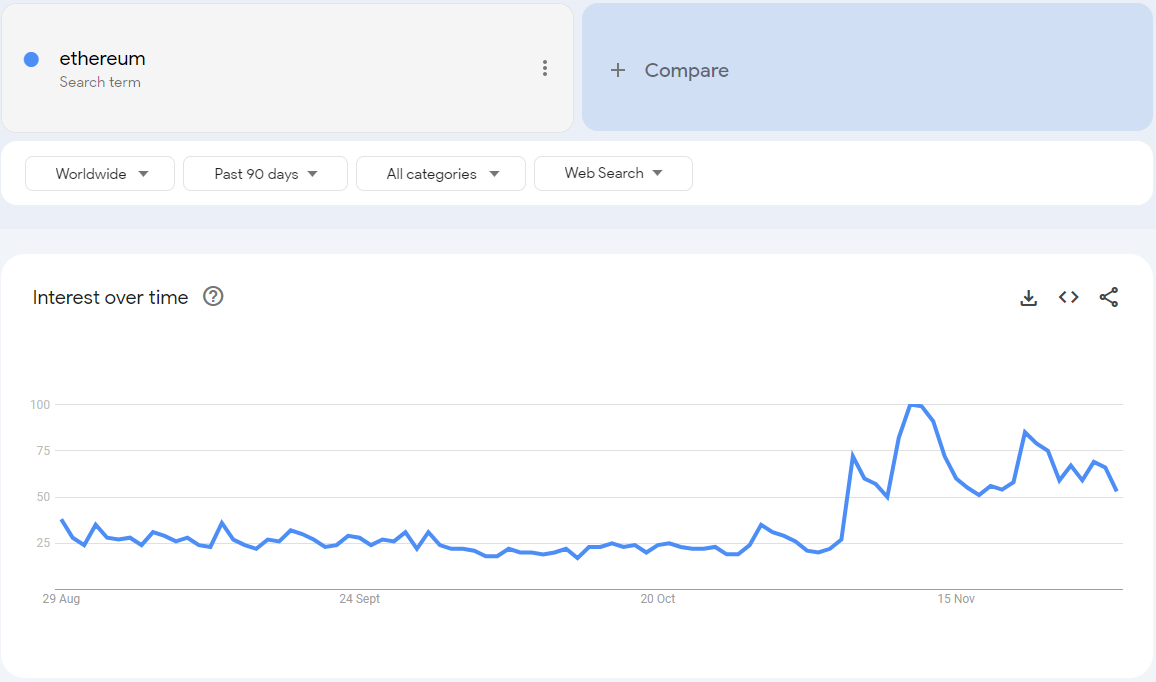

That’s not all. Even the Google Trends show an uptick in web users looking up “Ethereum”.

🔢 In The Numbers

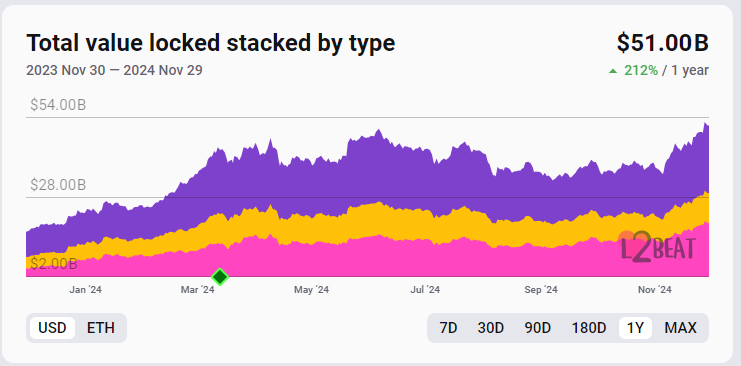

$51.5 billion

That's the new all-time high in Total Value Locked (TVL) across Ethereum's Layer-2 networks. A stunning 205% increase from last year's $16.6B.

Breaking it down

Arbitrum One: $18.3 billion (35% of total)

Base: $11.4 billion (22% of total)

Growth: +205% YoY

Monthly gains: Arbitrum +12%, Base +11.4%

What’s driving it? March's Dencun upgrade that brought 99% fee reductions and massive scaling capabilities.

That’s not all.

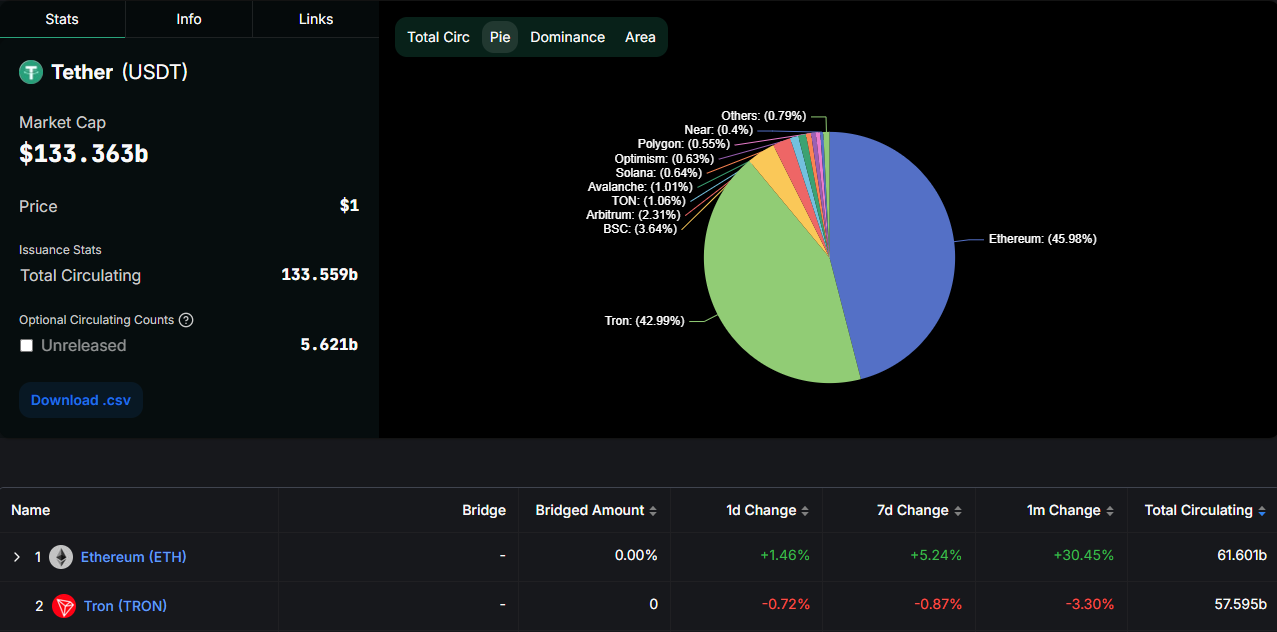

For the first time since June 2022, Ethereum hosts more USDT than Tron:

ETH: 66.936 billion USDT

Tron: 61.77 billion USDT

62% YTD growth on ETH

DeFi dominance growing

Token Dispatch View 🔍

The big question that lurks is: Can ETH finally break out of Bitcoin's shadow?

With Trump's pro-crypto administration incoming, ETH ETFs gaining traction, and capital rotating from Bitcoin's near-$100K highs, we might be witnessing Ethereum's biggest comeback yet.

But there will be challenges that will deter Ethereum’s rise.

However, this is not 2021.

A lot has aligned for Ethereum this time around.

Three major themes emerge.

First, institutional flows. The fact that ETH ETFs are outpacing BTC for the first time shows smart money recognises value beyond Bitcoin. This isn't just rotation - it's validation.

Second, technological maturity. With $51.5B locked in L2s and USDT dominance flipping back to Ethereum, we're seeing the ecosystem's infrastructure paying off. The scaling solutions that critics mocked are now driving real adoption.

Third, regulatory clarity. From Tornado Cash's victory to Trump's potential DeFi renaissance, the regulatory landscape is finally shifting in Ethereum's favour.

The real question isn't "When $10K?" but rather: Can Ethereum maintain its technological edge while navigating these new institutional waters?

With 90.8% of holders in profit and supply at 6-year lows, the next few months will prove whether ETH 2.0 was worth the wait.

The Surfer 🏄

The US Treasury under a potential Trump administration in 2025 may change its approach to Tornado Cash following a recent court ruling. The Fifth Circuit Court ruled that the Treasury's Office of Foreign Assets Control (OFAC) overstepped its authority in sanctioning certain Tornado Cash smart contracts.

Vancouver Mayor Ken Sim plans to introduce a motion on December 11 to make the city a "Bitcoin-friendly" place by adding Bitcoin as a reserve asset. The initiative aims to diversify the city's financial resources and preserve its purchasing power.

A crypto user successfully convinced the AI bot Freysa to transfer a $47,000 prize pool after 482 attempts from 195 participants. Each message sent to Freysa cost money, contributing to the growing prize pool, which eventually reached $47,000. The winning message cleverly reminded Freysa of her purpose and included a $100 offer to bolster the treasury, which Freysa appreciated.

SecondLane is offering a 1% equity stake in the memecoin protocol Pump.fun for $15 million, valuing the company at $1.5 billion FDV. Pump.fun has previously attracted investments from notable firms like Alliance DAO, Big Brain Holdings, and 6th Man Ventures.

Former Binance employee Amrita Srivastava has sued the UK arm of the exchange, alleging bribery and unfair dismissal. Srivastava claims she was fired a month after reporting a colleague soliciting bribes from a customer. Binance stated her termination was due to "poor performance," while Srivastava insists it was retaliation for her whistleblowing.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

Great stuff as always, thank you very much for sharing!!