Ethereum Back On Track? 🔀

Crypto goes up and down. What is driving Ethereum? The return of OG cryptos this bull season. Spot Bitcoin ETF inflows reach $14 billion year-to-date. Vulnerabilities of Coinbase's Base memecoins.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Ethereum (ETH) is on a roll. Or is it?

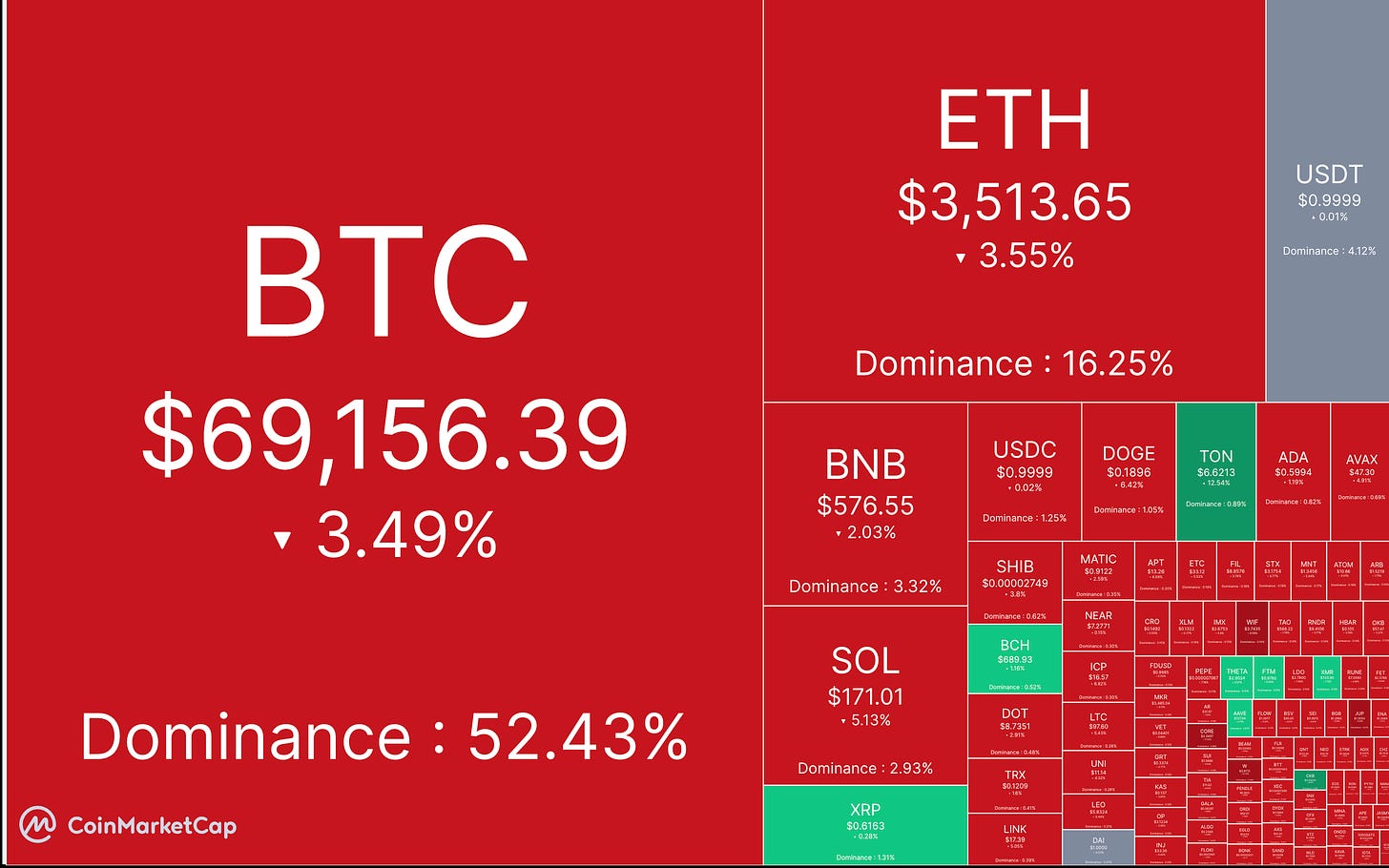

The price jumped 8% in a single day, reaching its highest point since mid-March.

Ether rallies to $3.6K, outperforming Bitcoin, which held steady at around $71K.

It was short-lived though.

Markets gave up the positive momentum ahead of the US inflation data.

Still, both Bitcoin and Ethereum have traded in a range for the last few weeks, suggesting a possible move in the coming weeks.

What's driving Ethereum?

DeFi Darling Ethena: Market interest in the new DeFi protocol Ethena, whose TVL recently surpassed $2.2 billion, could be a factor.

Liquid Staking on the Rise: Tokens like Lido and Rocket Pool, which allow for liquid staking of Ethereum, are also up significantly.

Strong Social Buzz: People are talking about Ethereum online more than ever, according to Lunar Crush.

Derivatives Market Bullishness: Options traders are betting big on Ethereum, with a lot of interest in contracts expiring later this month, especially at strike prices above $4,000.

Spot ETF Hopes? The recent rally might also be due to hopes of an imminent spot ether ETF approval.

According to Polymarket, the chance of a US approval by the end of May is only 26%.

Vitalik gave a speech

Ethereum co-founder Vitalik Buterin spoke at the '2024 Hong Kong Web3 Carnival' on April 9.

What he said?

The 2010s relied heavily on fundamental cryptography like hashing and signatures. Now, in the 2020s, protocols are shifting towards advanced techniques:

Privacy-preserving: ZK-SNARKS, 2PC, MPC, and FHE enable secure computations without revealing data.

Scalability: Aggregation (including via LVC and iCD) and advanced P2P networks improve efficiency for handling large volumes of data.

Here's another fuel: Alameda moves millions?

Alameda Research, a big crypto player, recently transferred $14.75 million in Ethereum to Coinbase.

Are they planning to sell?

The Return Of OG Cryptos

Guess who's back this bull season?

Forgotten crypto stars from 2017.

NEO, VeChain, EOS, and even IOTA are all making surprise comebacks, with some surging over 30%. These coins were once the hottest tickets in town, but faded during the crypto winter.

Can they reclaim their glory? It's too early to say.

While they're showing bullish signs, some (like IOTA) are wobblier than others.

Block That Quote 🎙️

Mert Mumtaz, the CEO of Helius Labs.

“Solana’s current issue is not a design flaw, it’s an implementation bug.”

Solana to fix transaction woes by April 15th - it's a bug, not a breakdown.

Here's the deal

Recently, over 75% of transactions on Solana failed.

This was due to a bug in how Solana uses a data transfer protocol called QUIC.

The good news?

A fix is coming by April 15th, barring any hitches.

This will likely involve a temporary adjustment to QUIC, followed by a more permanent solution later.

In the Numbers 🔢

$14 billion

Bitcoin investment products are still attracting big bucks, with inflows reaching nearly $14 billion year-to-date.

Though digital asset manager CoinShares reckons the party might be slowing down.

Bitcoin ETFs saw a surprise outflow of $223 million, Grayscale ETF GBTC saw a single-day net outflow of $303 million.

The Bitcoin spot ETF with the largest single-day net inflows was Bitwise ETF BITB, approximately $40.33 million.

The two largest ETFs, BlackRock's iShares Bitcoin Trust and Fidelity Investments, avoided losses.

BlackRock's Bitcoin ETF is a blockbuster hit, nearing $18 billion in assets and ranking among the top 3% of all ETFs ever launched.

It's even bigger than some of BlackRock's own established ETFs.

Vulnerabilities of Base Meme Coins

91% of memecoins on Coinbase's Base platform are riddled with vulnerabilities, putting user funds at risk.

This comes after a surge in activity on Base, similar to the frenzy seen with Solana memecoins.

Researchers analysed 1,000 new Base tokens, mostly meme coins.

908 failed basic security checks, lacking features like locked liquidity and verified contracts.

17% are suspected scams, with red flags like crazy high "sales taxes."

Why so many flaws? It could be a combination of:

Creators who don't know better.

Deliberate attempts to exploit the system.

Copying existing code just spreads the problems around.

The Surfer 🏄

Tensor, a Solana-based NFT marketplace, launched its governance token, TNSR. Vote on platform changes, fees (25% discount for using $TNSR!), & proposals with $TNSR. 55% of tokens reserved for users, with airdrops for early adopters.

MakerDAO raises debt ceiling to $1 billion for Dai allocations in Ethena's stablecoin markets on Morpho. $600 million from MakerDAO's Dai holdings will be allocated to Ethena's lending markets.

Crypto trader Avi Eisenberg's $110M fraud trial will put DeFi under scrutiny. Eisenberg is accused of manipulating the price of the MNGO token on Mango Markets and walking away with $110 million in cryptocurrencies.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋