Ethereum ETF Countdown⏱️

Ethereum ETF decision from the SEC is nearing, possible watershed moment? Uniswap fires back at the SEC. Coinbase is expanding its horizons. Grayscale gets new CEO. Gala Games gets some money back.

Hello, y'all. It's the final countdown.

We're heading for Venus | And still we stand tall … 🎶

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

Ethereum ETF decisions are nearing.

The price is acting accordingly - 26% up in the past 7 days.

What does Ethereum co-founder (and the Consensys CEO) Joe Lubin say?

"This (ETF approvals) could be a pretty profound watershed moment for Ethereum and the entire crypto industry.”

Here's why

Demand Surge: Institutional investors, already exposed to Bitcoin via ETFs, will likely jump into Ethereum ETFs, creating a surge in demand.

Limited Supply: Unlike Bitcoin, a significant portion of Ether is locked in staking, DeFi projects, and DAOs, making it less readily available.

Burning Mechanism: Ethereum's burning mechanism further reduces the available supply over time.

The Result? A potential supply crunch for Ether, pushing prices higher.

This could be even more dramatic than the impact of Bitcoin ETFs due to Ethereum's already limited available supply.

The first deadline for ETF applications is May 23rd, with VanEck's proposal at the front of the line.

The clock is ticking.

Here’s the latest on Ethereum spot ETFs

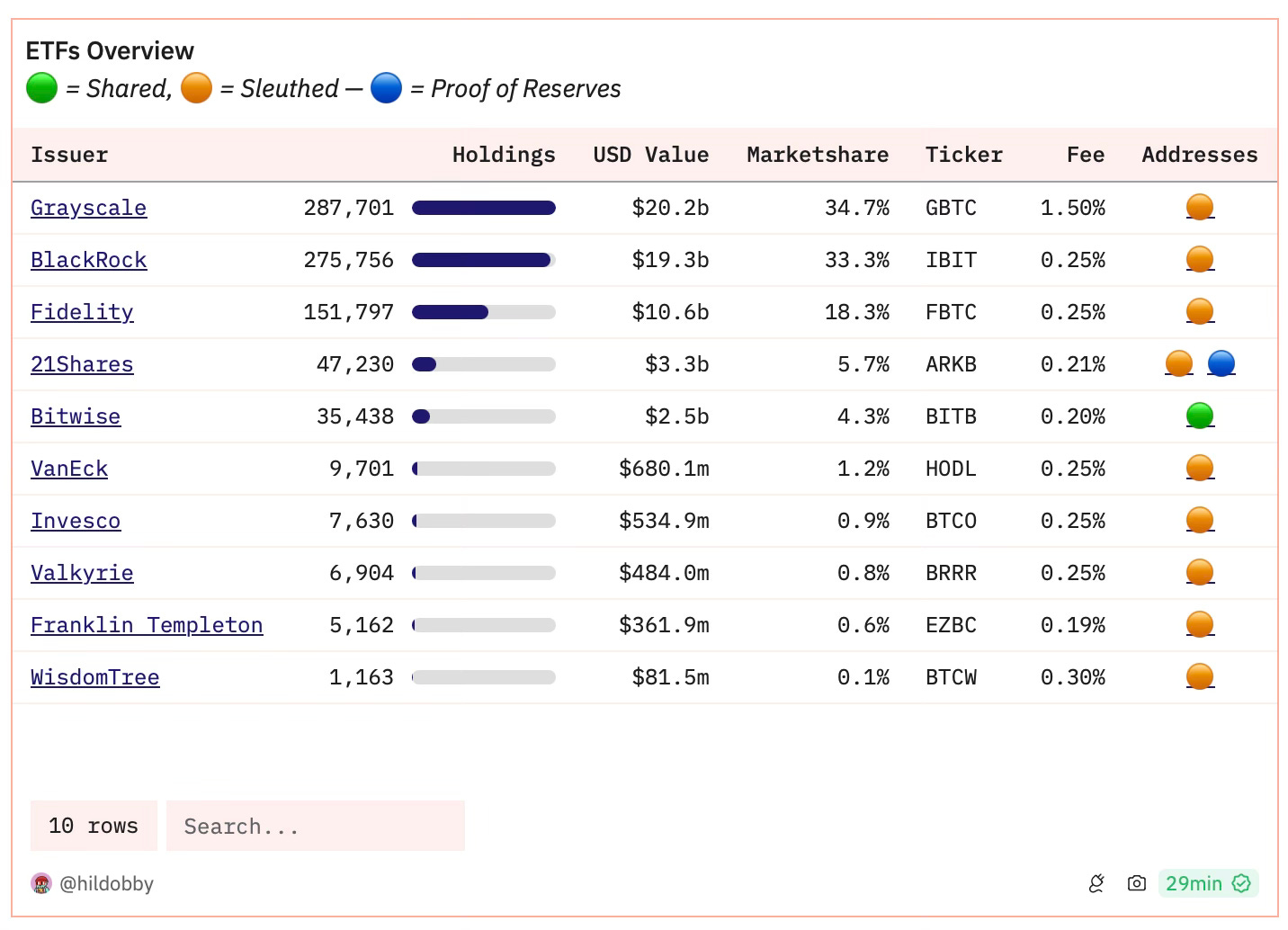

The SEC has requested revisions to spot Ethereum ETF proposals from Nasdaq and Cboe. This is positive news for the nine firms waiting on a decision, including Grayscale, BlackRock, and Fidelity.

Fidelity has removed the staking feature from its Ethereum ETF proposal. This could be a strategic move to appease the SEC's concerns about staking and securities.

VanEck's Ether ETF (ticker symbol: ETHV) is now listed on the DTCC website. This usually happens before a fund launch, but doesn't guarantee approval. The DTCC website even clarifies that "pre launch" ETFs aren't actively processed.

SEC staff told exchanges it is leaning towards approving spot ether ETFs, according to a report in Barron’s.

The discount on the Grayscale Ethereum Trust (ETHE) has significantly narrowed, reaching its lowest point in over two months at around 10%. Investors are interpreting this as a sign too.

Standard Chartered is now "80% to 90% certain" about the go-ahead. Estimates suggest inflows of $15 billion to $45 billion in the first year, similar to Bitcoin ETFs.

Bernstein reckons that approval of a spot Ethereum ETF will lead 75% surge in the price of Ethereum, to $6,600. SEC's approval of a similar Bitcoin product in January spurred a 75% rise in Bitcoin prices, and expect similar changes in ETH's price action.

And politics? A bit softened?

If the SEC’s change of heart was politically motivated, “that’s a seismic shift,” Galaxy Digital CEO Mike Novogratz.

““It almost became a purity test — Republican good for crypto, Democrat bad for crypto. And the Democratic regime woke up and said ‘This is crazy.’ If that’s what actually happened, prices are going to be much higher than here.”

Maybe it’s election season politics. Former President Donald Trump has been courting the crypto crowd, possibly pushing the Biden administration to reposition.

Read this: The Biden Administration Is Easing Up on Crypto (a Vibes Analysis)

Block That Quote 🎙️

“We are ready to fight, and we’ll keep building”

The company behind the popular crypto exchange Uniswap is firing back at the SEC's recent Wells notice, which hinted at a potential lawsuit.

Uniswap's Argument

The SEC's case is "weak and wrong."

Uniswap's tokens aren't securities.

The SEC shouldn't waste resources on this fight.

“The SEC should not devote its taxpayer-funded resources to bringing a case against us.”

Uniswap's got a legal team with a winning track record against the SEC.

“Our lawyers are 2-0 in high-profile SEC cases. Andrew Ceresney, a former head of enforcement at the SEC, represented Ripple in their victory over the SEC. Don Verrilli, a former US solicitor general, has argued more than 50 cases before the US Supreme Court and represented Grayscale in its successful case against the SEC.”

Meanwhile, congress is voting on a new law (Financial Innovation and Technology Act) that could reshape crypto regulation by the SEC and CFTC.

Uniswap suggests this law might render the SEC's case irrelevant, giving the CFTC the power to handle crypto enforcement.

Grayscale CEO Steps Down

Grayscale CEO Michael Sonnenshein is leaving to pursue other interests, with a Goldman Sachs veteran, Peter Mintzberg, taking the helm in August.

After 10 years, Sonnenshein is stepping down.

The reasons are unclear, but Grayscale's flagship Bitcoin fund (GBTC) has seen investor outflows despite a recent uptick.

Goldman Sachs veteran takes over: Mintzberg brings over 20 years of experience from major financial firms like Goldman Sachs and BlackRock.

The Grayscale Bitcoin Trust (GBTC) has had a rough year.

Despite the approval of spot Bitcoin ETFs in January, GBTC saw outflows that outweighed inflows from the new products.

There were signs of a turnaround in May with some inflows, but it's unclear how this will play out.

Grayscale is also hitting the brakes on staking for its proposed spot Ethereum ETF.

In an updated filing, Grayscale removed all language related to staking Ether through the trust.

In the Numbers 🔢

$23 million

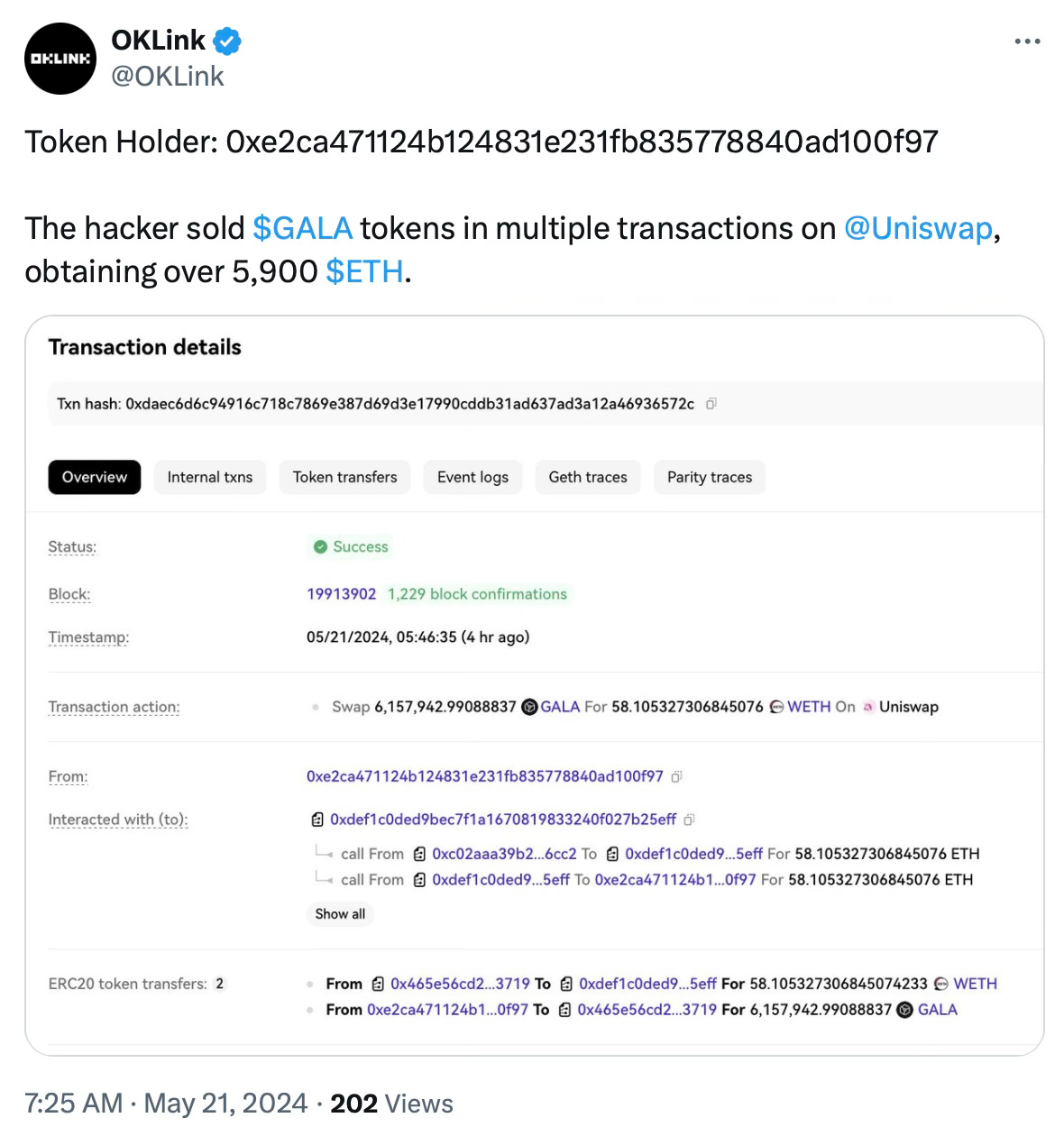

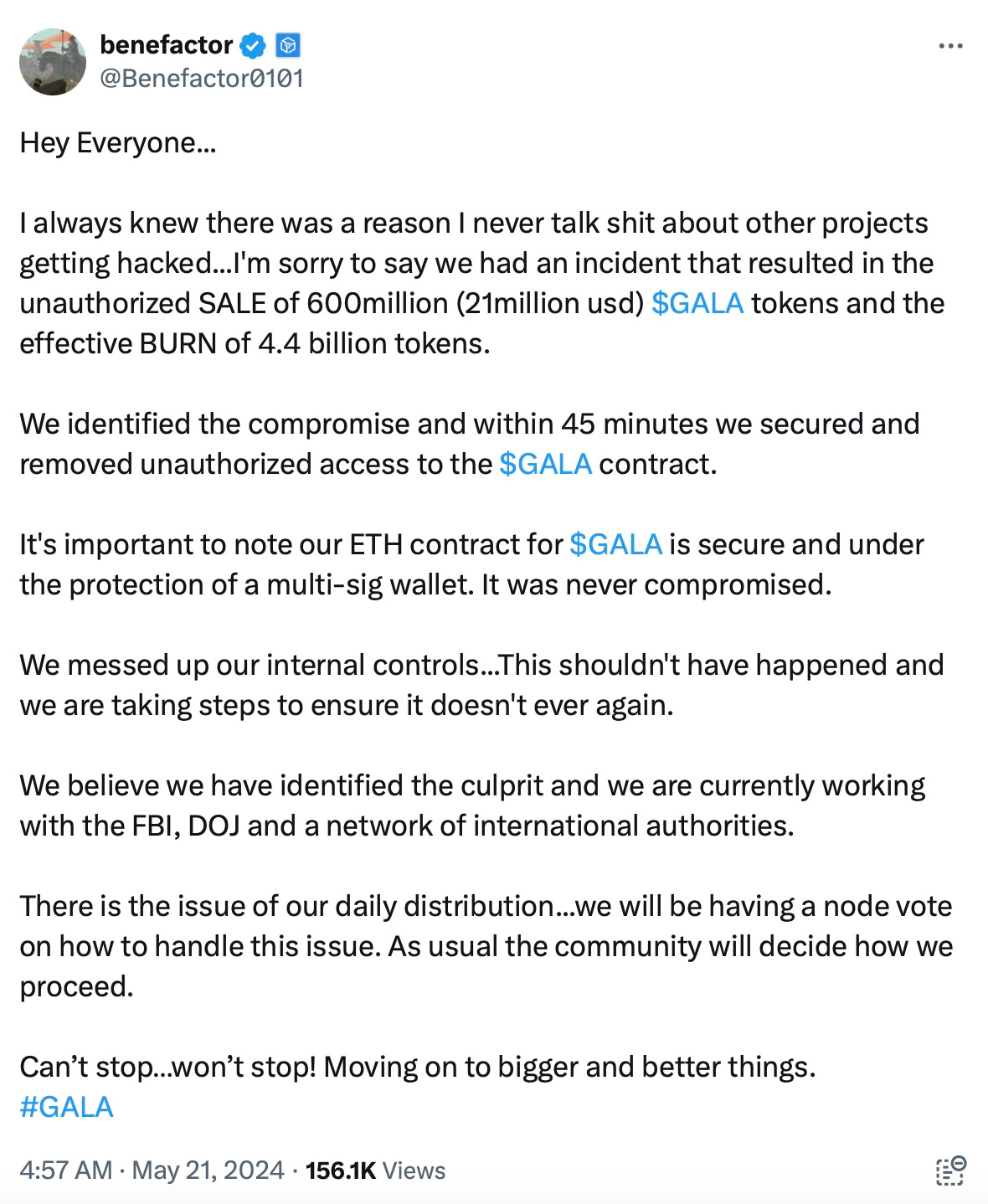

Gala Games got hacked for 5 billion GALA tokens.

Hacker returned nearly $23 million worth of stolen Ethereum (ETH) to the platform.

Hackers Minted Billions: An attacker exploited the Gala smart contract to mint 5 billion GALA tokens (around $240 million at the time).

Fire Sale on Uniswap: The attacker sold 600 million tokens ($29 million) on Uniswap, crashing the GALA price by 20%.

After nearly two hours, Gala Games CEO admitted the hack and assured the remaining tokens were "burned" (destroyed).

Gala managed to freeze the remaining 4.4 billion stolen tokens (almost 9% of total supply).

Gala's community will decide whether to permanently "burn" the frozen tokens, effectively removing them from circulation.

The fund that returned

About 5,913 ETH, valued at approximately $23 million, was transferred from the attacker's wallet back to a Gala wallet.

This money is some of the proceeds from selling 600 million GALA tokens on the decentralised exchange Uniswap, following Monday's exploit.

Gala investor DWF Labs also stepped in, buying 28 million GALA tokens to stabilise the market.

Coinbase Goes Beyond Crypto

Coinbase is launching gold and oil futures contracts on their Coinbase Derivatives exchange starting June 3rd.

Offering traditional assets alongside crypto and going mainstream could be a winning formula?

Why the move? Coinbase says there's a growing demand for these products among their users. Analysts believe it's also a strategic move to:

This could bring in investors interested in traditional markets alongside crypto.

Sophisticated investors can use these futures to manage risk in their crypto holdings.

More trading options could keep users glued to the Coinbase platform.

Not the First: Coinbase isn't the only crypto exchange venturing into commodities. FTX (before its bankruptcy) also offered futures contracts for oil and other commodities.

The Surfer 🏄

Bitcoin and Ethereum investment vehicles called ETPs got the green light from UK regulators and will start trading on the London Stock Exchange on May 28th. These are for institutional investors only, as retail trading of crypto derivatives is banned.

Vitalik Buterin, co-founder of Ethereum, sent another $300,000 (80 ETH) through Railgun, a privacy protocol. This follows his previous support for Railgun, which uses tech to anonymise transactions and differs from mixing services.

Decentralised social media Farcaster announced the completion of $150 million funding round led by Paradigm with participation from a16z crypto, Haun, USV, Variant, Standard Crypto and others. Farcaster has had 350,000 paid signups since October and has hundreds of developers building on the protocol.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋

Just a quick note to say Token Dispatch ROCKS. Quick summaries, not too "clickbaity" or sleazy, but direct and to the point. Seems like good reporting to me. Thank you for your quality and credibility.

Rudi Hoffman

The pivot from no-go to high probability has been surprising. Just the amount of capital that moved around in this turn around would be huge.