Ethereum ETF In Circles 🕳️ 🙆

SEC unlikely to approve spot ETH ETFs in May. Satoshi Nakamoto's last email message. Bitcoin outperforms Tesla, gets a film festival and heating homes in Finland. Fidelity's Bitcoin ETF's $40M catch.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Bitcoin ETFs approval? Check.

Bitcoin Halving? Check.

The next stop? Ethereum ETFs approval.

But that's not happening anytime soon, definitely not in May.

Who wants Ethereum spot ETF?

BlackRock

VanEck

ARK Invest

Grayscale Investments

Fidelity Investments

Invesco (joint proposal with Galaxy Digital)

Galaxy Digital

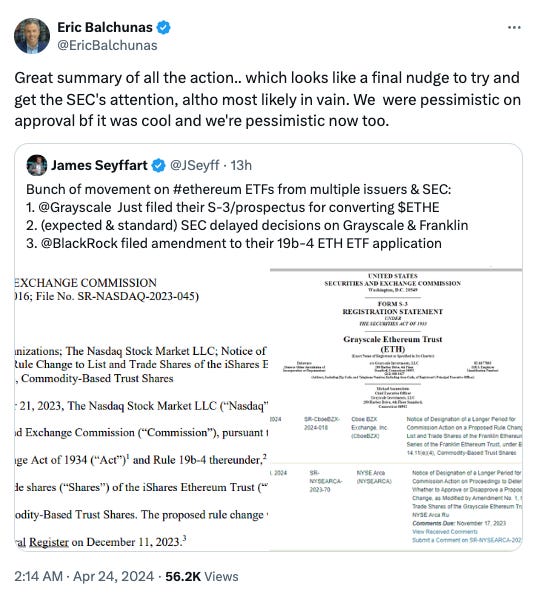

But the SEC has postponed its decisions on approving Ethereum ETFs.

Franklin Templeton ETF - June 11th, 2024

Grayscale Ethereum Trust - June 23rd, 2024

BlackRock ETF - delayed twice

SEC cites needing more time to consider the proposals.

"The Commission finds it appropriate to designate a longer period within which to take action on the proposed rule change so that it has sufficient time to consider the proposed rule change and the issues raised therein," the SEC said in its Franklin Templeton filing.

BlackRock Gets Tweaked

The SEC is asking for public comment on changes made to BlackRock's proposal, including a switch to a cash-based redemption process.

BlackRock originally filed for a spot Ethereum ETF in November 2023.

The SEC delayed a decision in January, again in March.

Nasdaq, on behalf of BlackRock, amended the proposal on April 19th.

The key change: the ETF will now redeem shares for cash, not Ethereum itself.

This aligns with the SEC's approach to recently approved Bitcoin ETFs.

Public comment is open for 21 days. The SEC will review public comments and make a final decision.

Standard Chartered Bank is throwing cold water: They originally expected the SEC to follow a similar path as with Bitcoin ETFs. However, a lack of communication between the SEC and ETF applicants suggests a May approval is unlikely.

Bloomberg and Galaxy Digital also lowered their expectations for May approval in recent weeks.

But, here's three things to calm you down now.

1. SEC is being sued: The Blockchain Association and Crypto Freedom Alliance of Texas are suing the SEC, claiming the newly adopted dealer rule harms the industry.

The Complaint: SEC overstepped its authority by defining dealers and ignoring industry concerns during the rule-making process.

The Rule: Requires certain market participants to comply with securities laws, potentially impacting crypto trading and DeFi.

The Goal: The lawsuit seeks to overturn the rule to prevent its application to the crypto industry.

2. SEC is also being rejected: Ripple rejects SEC's $1.95 Billion fine. Ripple argues the court should impose a maximum penalty of just $10 million.

3. SEC lawyers ousted: Two SEC lawyers resigned after a judge slammed the agency for "gross abuse" of power in a crypto case against DEBT Box. Michael Welsh and Joseph Watkins led the SEC's case against DEBT Box, accused of a $50 million crypto fraud.

Block That Quote 🎙️

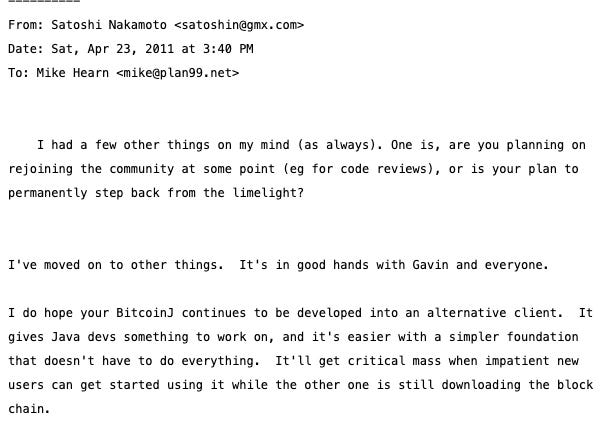

Satoshi Nakamoto, pseudonymous creator of Bitcoin.

“I’ve moved on to other things"

It's been 13 years since Satoshi Nakamoto, the mysterious creator of Bitcoin, vanished.

His last email, sent in April 2011, offers a glimpse into his decision to step away.

Bitcoin core developer Mike Hearn revealed the final instructions as part of an email exchange with Nakamoto.

Despite speculation and lawsuits, no one has conclusively proven to be Nakamoto.

His legacy? Bitcoin, now a $1.3 trillion asset, continues to revolutionise finance.

Today's Five Things Bitcoin

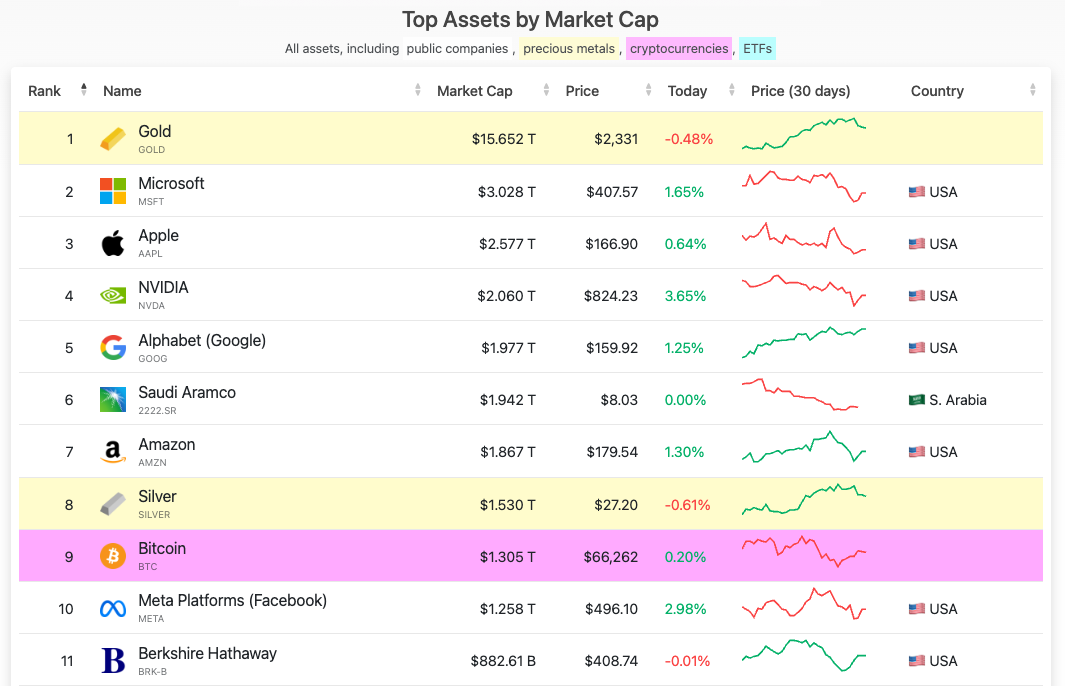

1. Outperforms Tesla: Bitcoin's price has outperformed Tesla's stock for the first time since 2019.

Over the past five years, Bitcoin's price has risen over 1,180%, while Tesla's stock price has risen over 806%.

Bitcoin is now the world's ninth-largest asset with a $1.3 trillion market capitalisation, while Tesla is the 21st largest asset with a $455 billion market capitalisation.

2. Eyes higher ground: Standard Chartered analysts believe Bitcoin can climb higher thanks to a recent de-leveraging event.

Before the halving, a lot of risky leveraged bets on Bitcoin were liquidated (sold).

This means less speculation and potentially more room for the price to increase.

Standard Chartered maintains their bullish year-end target of $150,000 for Bitcoin.

3. A film fest in Warsaw: Bitcoin enthusiasts descended on Warsaw, Poland for the second Bitcoin FilmFest.

Biopics about Bitcoin's history

Dystopian tales exploring a world without Bitcoin

Documentaries tackling Bitcoin's misconceptions

Short films showcasing Bitcoin's positive impact

Beyond the screen, attendees networked, with educational "Amondo Mornings" for kids, "Sats4Flats" for real estate pros, and a late-night "European Halving Party." (99 words)

4. Heating homes in Finland? Bitcoin enthusiasts in Finland are using Bitcoin mining to heat their homes during the cold winter.

Hashlabs Mining has introduced a project that combines heat production from Bitcoin mining devices with the Finnish district heating system.

5. Jack develops Bitcoin Mining System: Jack Dorsey's Block has developed a complete Bitcoin mining system, aiming to decentralise the mining landscape.

They'll offer this chip separately and also as part of a complete mining system they designed.

In the Numbers 🔢

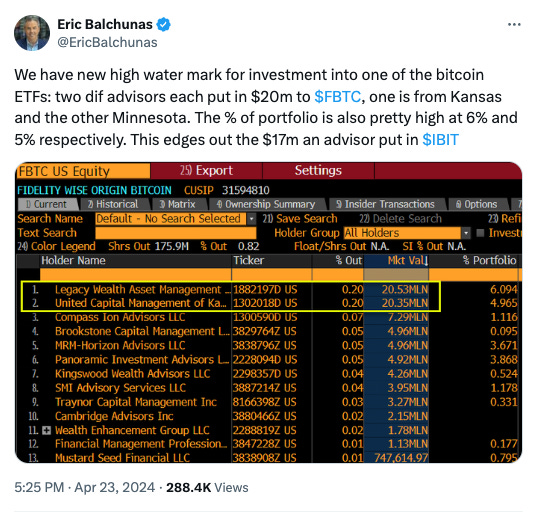

$40 million

Fidelity's Bitcoin ETF just landed its biggest fish yet.

Two financial advisors, Legacy Wealth Management and United Capital Management of Kansas, each put $20 million into the Fidelity Wise Origin Bitcoin Fund (FBTC).

These advisors manage billions in assets.

Bitcoin represents a significant portion (5-6%) of their portfolios.

Fidelity thinks Bitcoin's rally may be cooling off

They recently changed their medium-term view from "positive" to "neutral."

Also, there were “zero days on Q1 where Bitcoin was considered 'cheap.'”

Read the report.

US Government Wants 3 years for CZ

Binance founder faces to go to prison for money laundering. US prosecutors are seeking 36 months jail time for Changpeng Zhao (CZ).

This news comes just days before CZ's sentencing on April 30th.

"Given the magnitude of Zhao's wilful violation of U.S. law and its consequences, an above-guidelines sentence of 36 months is warranted," US prosecutors told the US district court for the western district of Washington.

CZ pleaded guilty to violating money laundering laws.

Prosecutors allege Binance failed to report suspicious transactions with terrorist groups.

Binance platform also reportedly enabled sales of child abuse material and received ransomware proceeds.

DOJ says CZ should spend 3 years in jail.

The defense documents claim.

CZ was not aware of and was never explicitly informed of the specific transactions involving criminal funds conducted on Binance.

He was not at risk of re-offending because he should have been sentenced to probation rather than prison.

The Surfer 🏄

Crypto heavyweights have millions of dollars stuck on DeFi bridges, according to Arkham Intelligence. Vitalik Buterin has over $1 million stuck for 7 months. A wallet linked to Coinbase has $75,000 stuck for nearly 6 months. Other wallets have funds forgotten for over 2 years.

Binance executive Tigran Gambaryan will remain in Nigerian custody until a bail hearing on May 17. Gambaryan was detained in Nigeria since February over allegations of tax evasion and money laundering.

El Salvador's bitcoin wallet, Chivo Wallet, has suffered a security breach. Cybercriminal group CiberInteligenciaSV leaked snippets of the wallet's source code and VPN access information.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋