Ethereum ETFs On July 23 🟢

Cboe exchange confirms July 23 launch for 5 spot Ethereum ETFs in the US. Jefferies’ crypto picks for Donald Trump presidency. Trump flips on El Salvador. Telegram's mini app store to boost crypto?

Hello, y'all. Did you ever want it? Did you want it bad? Did you ever fight it?

Play the 👉 Music Nerd 🎵 quiz game … like now.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

The Chicago Board Options Exchange (Cboe) has confirmed that five spot Ethereum exchange-traded funds (ETFs) will start trading on July 23, 2024.

This announcement comes after the US Securities and Exchange Commission (SEC) approved rule changes for these products in May.

"We are pleased to announce that One (1) Exchange Traded Product ('ETP') will be listed on Cboe and will begin trading as a new issue on July 23, 2024, pending regulatory effectiveness."

The following spot Ethereum ETFs are set to begin trading

21Shares Core Ethereum ETF (CETH)

Fidelity Ethereum Fund (FETH)

Franklin Ethereum ETF (EZET)

Invesco Galaxy Ethereum ETF (QETH)

VanEck Ethereum ETF (ETHV)

SEC approval process: Has been slow.

A complete ball game with speculation and back and forth over months.

These products allow investors to gain exposure to Ethereum through traditional brokerage accounts.

May 13: Fate Of Ethereum ETFs 💊

May 24: Ethereum ETFs Day 🎉

May 25: Approval In. What Now? 🤷♂️

June 05: Ethereum to $5k?🪁

June 14: Ethereum ETFs This Summer 🌞

June 19: Ethereum Survives SEC 🏆

Market expectations: Analysts predict that the new Ethereum ETFs could attract substantial inflows.

Up to $15 billion over the next nine months, with some estimates indicating $1 billion in capital flows per month.

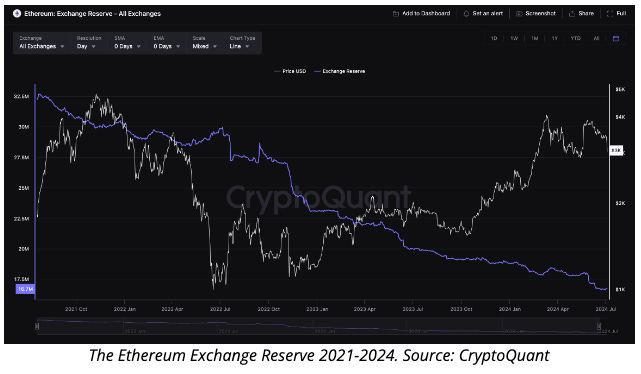

Supply dynamics and price impact: The anticipated demand for Ethereum ETFs may lead to a supply crunch, as the Ethereum Exchange Reserve is at multi-year lows.

Increased institutional interest could drive Ether prices higher, potentially outperforming Bitcoin in percentage terms.

Analysts expect a positive price impact, with predictions of new all-time highs by early Q4.

There is caution though: Into The Cryptoverse founder Benjamin Cowen warns that Ethereum’s price might decline after the initial buzz surrounding spot Ethereum exchange-traded funds (ETF) wears off if its supply continues to increase at the current rate, according to an analyst. Read the thread 👇

Block That Quote 🎙️

Someone who needs no introduction, The Donald Trump

"…they’re sending their murderers to the United States of America."

What? That’s Trump on El Salvador.

That’s crypto-friendly Trump doing a complete flip on a crypto-friendly El Salvador.

“In El Salvador murders are down 70%—why are they down? … He would have you convinced that [it’s] because he trained murderers to be wonderful people. No, they’re down because they’re sending their murderers to the United States of America.”

Rough. Rough. Rough. He ain’t winning crypto friends down that route.

That’s Trump. This is El Salvador’s head of state 👇

Max Keiser, a member of El Salvador’s Bitcoin Office.

Jefferies’ Crypto Picks For Trump Presidency

Jefferies Group, a leading investment banking and capital markets firm, forecasts that cryptocurrency-related stocks could thrive if Donald Trump returns to the presidency.

Why the optimism? Trump's pro-crypto stance and the current economic climate marked by high inflation and a growing fiscal deficit.

Trump's crypto support: Bolsters confidence among stakeholders.

Political pressure on Fed: Could diminish USD's dominance, driving crypto demand.

Economic conditions: High inflation and fiscal deficit prompt investors to seek crypto as an alternative store of value.

Potential Policy Changes: Proposed policies of extending tax cuts and reducing corporate tax rates, could boost consumer spending and corporate profitability.

The economic context? Bloated fiscal deficit and unprecedented government spending, makes Bitcoin an attractive hedge against macroeconomic risks.

Inflation Hedge: Crypto viewed as a hedge against economic instability.

Investor Interest: Growing appeal of crypto assets as a safeguard against macroeconomic risks.

Market Opportunities: Crypto-related stocks offer diversification and growth potential in a politically shifting environment.

In The Numbers 🔢

$7.6 Million

The amount Rho Markets recovers in compromised funds.

The decentralised finance (DeFi) protocol on the Ethereum scaling network Scroll, announced the resolution on X, assuring users that no funds were lost.

What happened? Timeline of events.

July 20, 2024

Rho Markets pauses its platform due to unusual activity and alerts users.

An entity demands Rho Markets address software issues that allowed the siphoning of funds.

A dashboard indicates that $1.1 million and $2.3 million in Tether and USDC, along with $6 million in wstETH, were "borrowed" beyond their listed supply.

Scroll advises users to revoke approvals to prevent further access to their funds.

The entity claims improper implementation of price oracles enabled profitable transactions, leading to the exploit.

Approximately $7.6 million in Ethereum linked to the incident is transferred to another wallet.

July 21, 2024

Rho Markets announces the successful recovery of the stolen funds and begins reassigning them back to borrow pools.

The crypto sleuth ZachXBT had written on Twitter that “there’s a good probability” the funds would get recovered because the entity responsible for the exploit has “a ton of exposure to centralised exchanges.”

Scroll, which launched its public mainnet last October, has seen significant growth, raising $50 million in a funding round led by Polychain Capital.

Telegram Mini App Store and Web3 Browser

Telegram founder Pavel Durov announced that the platform will introduce a Mini App store and an in-app browser with Web3 support by the end of July 2024.

Viral success of TON games: The Open Network (TON) has gained attention with games like Hamster Kombat, which onboarded 239 million users in 81 days.

This success has also attracted scammers using phishing tactics to exploit players.

Rising scams in the TON ecosystem: SlowMist, a blockchain security firm, has warned about increasing scams in the TON ecosystem, largely due to the vulnerabilities in Telegram's chat groups.

Combatting scams: To address scams, Telegram will display the month and country of registration for public-facing accounts and allow Mini Apps to label channels for decentralised verification.

Gaming accelerator program: In response to the popularity of Telegram Mini App games, Notcoin and Helika Gaming have launched a $50 million gaming accelerator program to support game development on the platform.

Token Dispatch view: With nearly 1 billion users globally, Telegram's upcoming Mini App store presents a significant opportunity to introduce cryptocurrency projects to a vast audience.

By leveraging its extensive user base alongside the TON blockchain, Telegram is poised to become a major player in the decentralised app ecosystem.

The Surfer 🏄

Indian crypto exchange WazirX has launched a bounty program to incentivise the recovery of $235 million in stolen assets following a major cyberattack. The exchange is working with over 500 other platforms, forensic experts, and law enforcement to freeze identified addresses, track the perpetrators.

On July 19, a US court approved Binance.US to invest approximately $40 million of customer funds into US Treasury Bills through a third-party investment manager. The ruling mandates that funds must not be reinvested in Binance or its affiliates and requires monthly reporting on associated costs.

Kazakhstan is using its digital tenge CBDC to fund the construction of a rail line to China, marking the second phase of the CBDC rollout. The programmable plans to expand the project to other areas like agriculture and construction.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋