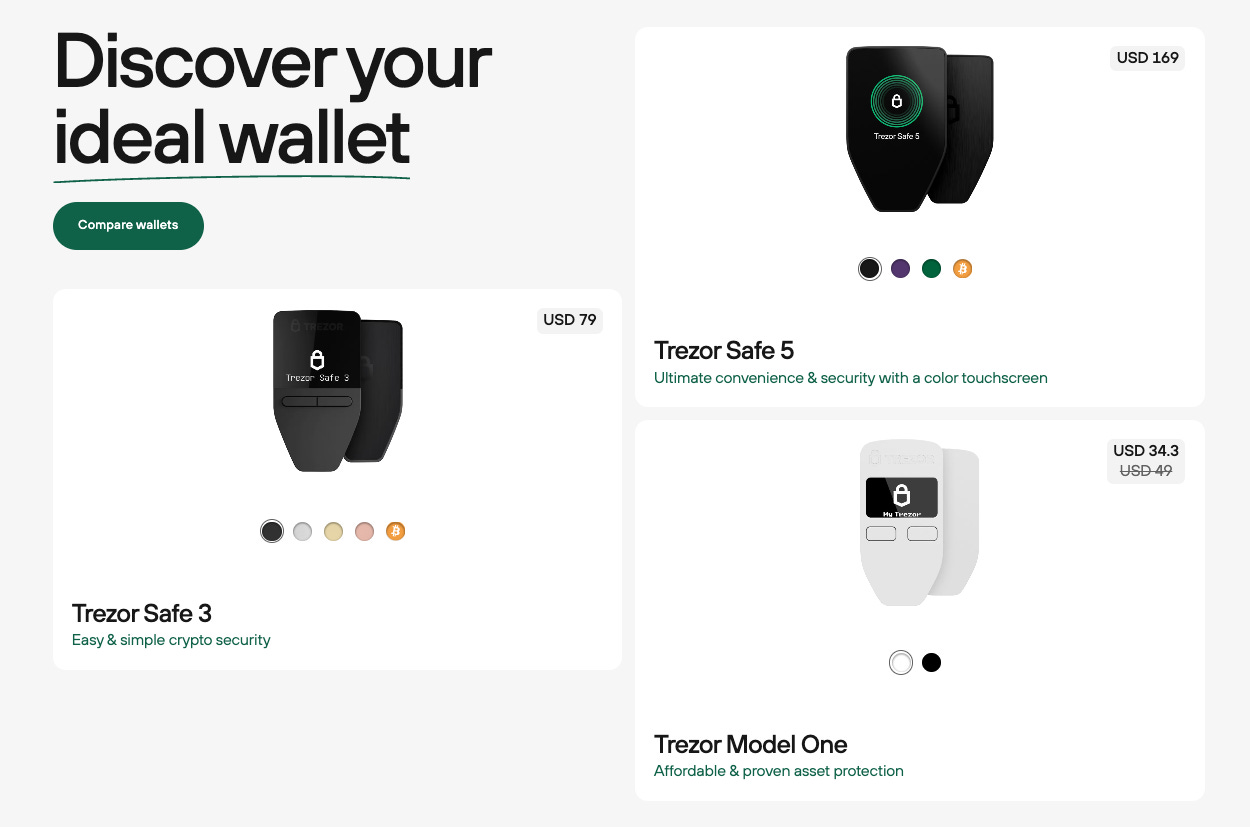

Today’s edition is brought to you by Trezor. The hardware wallet to protect your identity and coins. Get exclusive holiday deals with 30-50% off on select products 👇

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

GM! It's that kind of Thursday where everyone's trying to predict the future. Lucky for us, we've got data instead of a crystal ball.

From ETFs that didn't quite pop to upgrades that worked too well, Ethereum's journey has been anything but boring.

In today's edition we go round and out through the Ethereum 2024 landscape.

Why 2024 was Ethereum's most eventful "boring" year?

What top analysts think about ETH's 2025 prospects? (spoiler: they don't agree)

Upgrade to paid to get full access to our weekly premium features (Wormhole, Rabbit hole and Mempool) and subscribers only posts. 2025 New Year special limited time offer - 38% off on our annual subscription.

Ethereum in 2024: The Year of Almost

Ethereum's 2024 was like watching a Ferrari stuck in traffic — all that power under the hood, but never quite finding the open road.

While Bitcoin smashed through $100,000 and Solana went on a tear, Ethereum spent the year doing something far less exciting but perhaps more important: it was building.

Let's rewind the tape

The year started with a bang — not from price action, but from BlackRock's Larry Fink declaring he saw "value" in an Ethereum ETF.

This was traditional finance's biggest player tipping his hand.

Then came March's Dencun upgrade, which did something remarkable: it made Ethereum cheaper to use.

Read: Ethereum's Dencun Upgrade 🦋

Transaction costs on layer-2 networks plummeted thanks to "proto-danksharding" — a term that represented a major technical breakthrough.

Instead of sending ETH's price to the moon, these technical improvements had an unexpected side effect: they made layer-2s so efficient that they started drawing value away from the main chain.

It was like Ethereum had built a highway system so good that downtown lost its premium.

And then, July brought the most-anticipated breakthrough: the US Securities and Exchange Commission approved spot Ethereum ETFs.

The Feds called it quits on their attempt to classify ETH as a security.

Read: Ethereum Survives SEC 🏆

After years of Gary Gensler's famous "no comment" stance on whether ETH was a security, the approval effectively settled one of crypto's most contentious debates.

Ethereum wasn't just legitimate — it was institutional.

Read: Ethereum ETFs ▶️

The market's reaction was ... underwhelming.

While Bitcoin ETFs had sparked a buying frenzy in January, Ethereum's ETF debut was more like a polite golf clap.

Fall saw Consensys, one of Ethereum's biggest players, cut 20% of its staff amid regulatory pressures.

The ETFs were mostly ignored. Until…the Trump Effect. While the first four months since their launch invited lukewarm response, Donald Trump’s re-election triggered an explosion in November and December.

Currently, ETH ETF net flows stand at $2.52 billion, with BlackRock's iShares Ethereum Trust (ETHA) accounting for $3.5 billion, while the other issuers bled in red.

Trump's World Liberty Financial chose to build on Ethereum, marking an unexpected convergence of MAGA and crypto's most active development platform. They could have chosen any blockchain, but they picked the one with the most developers and deepest liquidity.

Trump's nomination of pro-crypto Paul Atkins as the next SEC chair suggested that the regulatory winter might be thawing.

Read: Crypto's Dream Regulator ✨

By year's end, Ethereum was chugging along.

Processed over $2 trillion in transactions

Hosted $68.22 billion in Total Value Locked (TVL) in DeFi

Maintained its position as the primary home for stablecoins with $110 billion in circulation

Attracted major institutional players from BlackRock to Deutsche Bank

And yet, price-wise, ETH remained stubbornly below $4,000, far from its all-time high of $4,878.

This created a puzzling disconnect: Ethereum's fundamentals had never been stronger, but its price wasn't reflecting it.

This divergence led VanEck analyst Matthew Sigel to slash his 2030 price target from $22,000 to $7,300, citing concerns about value leakage to layer-2s.

Others saw this as the coiling of a spring — potential energy building up for a massive move.

2024 might not have delivered the price action ETH holders wanted, but it laid the groundwork for something potentially more valuable: legitimacy.

In the end, Ethereum's "boring" year might have been exactly what it needed — a chance to prove it could grow up without blowing up.

Ethereum in 2025: The Analysts' Crystal Ball

If 2024 was Ethereum's year of building, 2025 is shaping up to be its year of breaking out — at least according to the analysts.

The predictions paint an intriguing picture.

VanEck leads with a relatively conservative target of $6,000 by Q4 2025.

Reasoning? They see Ethereum benefiting from a "regulatory renaissance" under Trump's SEC pick, Paul Atkins.

Steno Research goes bolder, calling for at least $8,000 and suggesting ETH will outperform Bitcoin in 2025.

"This expectation is partly based on the argument that Donald Trump's U.S. presidential victory is more favorable for altcoins than for bitcoin," analyst Mads Eberhardt wrote.

They're not alone — crypto veteran Michael van de Poppe expects the ETH/BTC ratio to break past 0.04 as early as January.

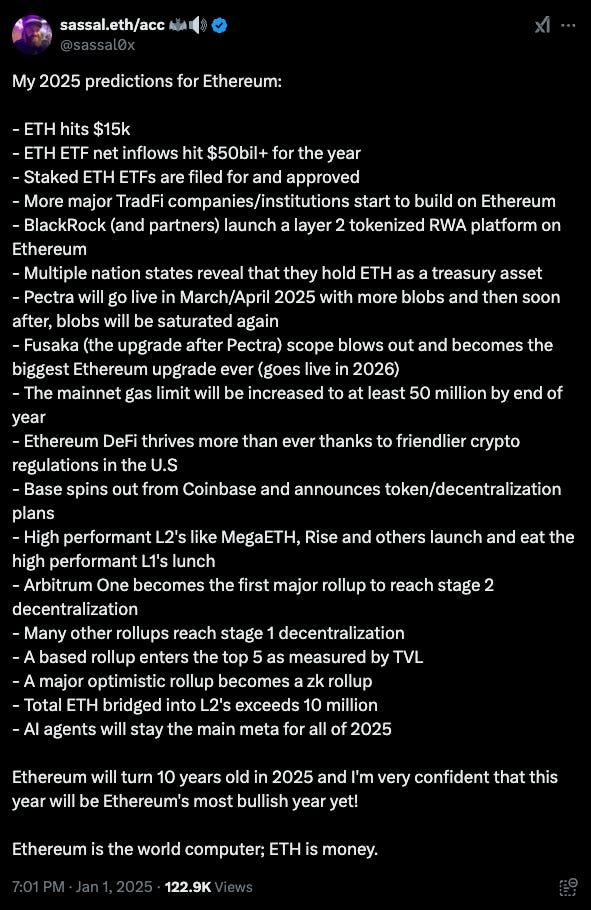

The most eyebrow-raising prediction comes from prominent ETH supporter sassal.eth, who sees ETH hitting $15,000.

Before dismissing this as mere hopium, consider his track record and the catalysts.

What's particularly interesting is how the analysts' focus has shifted.

In previous years, they obsessed over gas fees and transaction speeds. Now, they're talking about institutional adoption and real-world use cases.

Bitwise's Matt Hougan puts it succinctly.

"Ethereum sits at the centre of three of the biggest trends shaping crypto in 2025: the rise of stablecoins, tokenisation, and AI agents."

The stablecoin angle is particularly compelling.

With over $110 billion already circulating on Ethereum, and BlackRock's BUIDL fund backing new stablecoin projects, we're seeing traditional finance betting big on Ethereum's infrastructure.

But there's a catch.

10x Research's Markus Thielen stands out as a notable bear, warning that ETH might "struggle to deliver meaningful rallies" in 2025.

His concern? The growth rate of validators has turned negative, dropping by about 1% over the past 30 days.

“While we appreciate Ethereum’s volatility, we believe it remains a poor medium-term investment and expect ETH to underperform BTC once again in 2025 … As a result, our stance on Ethereum remains clear: ‘avoid.’”

This highlights a crucial debate within the analyst community: Will Ethereum's technical improvements translate into price appreciation, or will they mainly benefit the layer-2 ecosystem?

The upcoming Pectra upgrade might settle this debate.

By increasing validator capacity from 32 ETH to 2,048 ETH, it could fundamentally alter the network's economics.

Byzantine's CEO Gaia Regis calls it a potential "game-changer" for network efficiency.

The consensus? 2025 could be the year Ethereum finally breaks its previous all-time high of $4,878 — but that might just be the beginning.

Now, what do we think? Read on ...

Crypto Security Made Easy

Trezor has transformed crypto security from a complex puzzle to a user-friendly playground, so you can be the boss of your financial future? 🫵

Token Dispatch View 🔍

After diving deep into Ethereum's 2024 performance and analysing what the experts predict, it's time to cut through the noise and lay out what we actually expect for 2025.

Let's be real for a minute.

The bull case for Ethereum looks almost too perfect: a crypto-friendly SEC chair, major technical upgrades, institutional money flowing in, and AI agents building on the network. When narratives align this perfectly, it's usually time to look for what everyone's missing.

So let's start with what could go wrong.

The Bear Case: First, there's the validator issue that 10x Research's Thielen flagged. A 1% drop in validators might not sound like much, but it's the first such decline in Ethereum's history. If this trend accelerates, it could signal waning confidence in the network's staking model.

The Layer-2 Paradox: The better Ethereum's scaling solutions become, the more value they potentially drain from the base layer. VanEck didn't slash their 2030 price target from $22,000 to $7,300 on a whim.

What the Bears Are Missing: The validator decline isn't necessarily bearish — it could be a natural consolidation as the Pectra upgrade approaches. Why run multiple 32 ETH validators when you could soon run a single 2,048 ETH validator more efficiently?

As for the layer-2 value drain, this ignores a crucial dynamic: every L2 transaction ultimately settles on Ethereum. More L2 activity means more settlement fees for validators, even if individual fees are lower.

Our Base Case: We expect ETH to significantly outperform Bitcoin in the first half of 2025, potentially hitting $6,000-7,000 by mid-year. This aligns with Steno Research's $8,000 prediction but falls short of sassal.eth's ambitious $15,000 target.

The Verdict: Ethereum in 2025 won't be about any single catalyst — it will be about the network effect of multiple catalysts hitting simultaneously. We think it's more like a locomotive: slow to start but nearly unstoppable once it builds momentum.

Will ETH hit sassal.eth's $15,000 target? Probably not. It doesn't need to. Even our conservative case suggests returns that would make traditional finance blush.

Will investors have the patience to let the ETH thesis play out in 2025? Timing will be everything.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.