Ethereum Survives SEC 🏆

US SEC closes investigation in Ethereum 2.0. Why is crypto market down? ETH to $10k, possible this bull run? Hashdex files application for combined BTC & ETH ETF. Unpacking Ethereum’s Pectra upgrade.

Hello, y'all. Rising up to the challenge of our rival | And the last known survivor | Stalks his prey in the night | And he's watching us all with the eye of the tiger … 🥁

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

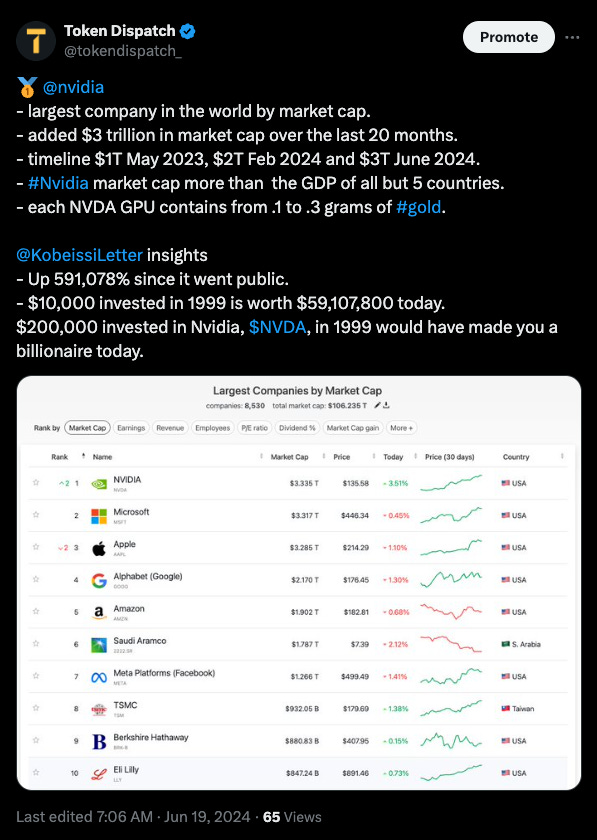

Who’s popping champagne corks today?

Nvidia, of course.

Who else? Humans of Ethereum.

The SEC threw in the towel on its Ethereum investigation.

That mean? The Feds are calling it quits on their attempt to classify ETH as a security.

Said who? Consensys.

Prominent Ethereum developer firm founded by Joseph Lubin, who co-founded Ethereum. Runs the largest crypto wallet - Metamask.

They sent a letter to the SEC on June 7.

Questioned their ongoing probe into ETH.

The argument: Spot Ethereum ETFs are approved in May = Ethereum, not a security.

SEC then replied saying that it is closing its investigation into Ethereum 2.0.

This implies the SEC won't pursue charges against ETH sales being security transactions.

A major win for the Ethereum ecosystem, including developers, tech providers, and industry participants.

This doesn’t end here.

Consensys wanted clarity on 3 key issues

ETH is a commodity, not a security - cleared.

Legal status of features within their MetaMask wallet, like Swaps and Staking. - unresolved

Protection for developers from SEC scrutiny - unresolved

What else happened on June 18?

Bloodbath.

Bitcoin, Ethereum, and other digital coins plunged in value.

Bitcoin dipped below $65,000, while Ethereum fell under $3,400.

Both down over 5% in the last week.

The entire market cap was down to $2.46 trillion - a 3.5% loss.

To make matters worse, nearly half a billion dollars in positions were liquidated.

Primarily targeted long positions: $432 million evaporates.

Spot Bitcoin ETFs? Only outflows

After clocking $580 million last week, Bitcoin ETFs recorded $146 million and $152 million in outflows in the first two days of this week.

What is it?

ChimpZoo - “This is the final dip. This is the dip to bait every bear into the market. What comes next will be a liquidation candle to send bears back into the shadow realm.”

10xResearch - “It has come as a surprise that Bitcoin is failing to rally despite weak inflation data, but the Ethereum and altcoin crash might have been predictable.”

Another way to look at it.

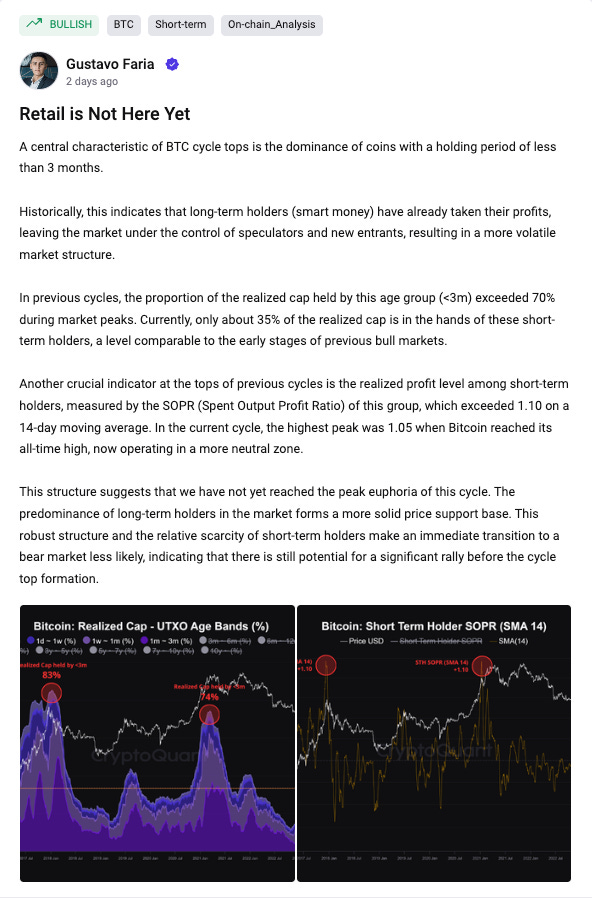

Retail investors, the lifeblood of past crypto booms, are staying on the sidelines this time around.

Block That Quote 🎙️

Crypto analyst, Tyler Durden (pseudonym)

“The most asymmetric bet in crypto today is Ethereum to $10,000”

Can Ether reach the $10,000 mark during the current bull cycle?

Tyler thinks so - “As annoying as that is, just the way the chips have fallen. We trade the market, not our emotions.”

Here's why this prediction is both exciting and unsettling.

The Bull case

A surge to $10,000 would be a 194% increase from ETH's current price - very profitable investment for those who buy in now.

Institutional money might flow in with the launch of the first spot Ether ETFs in July - a boost in the price.

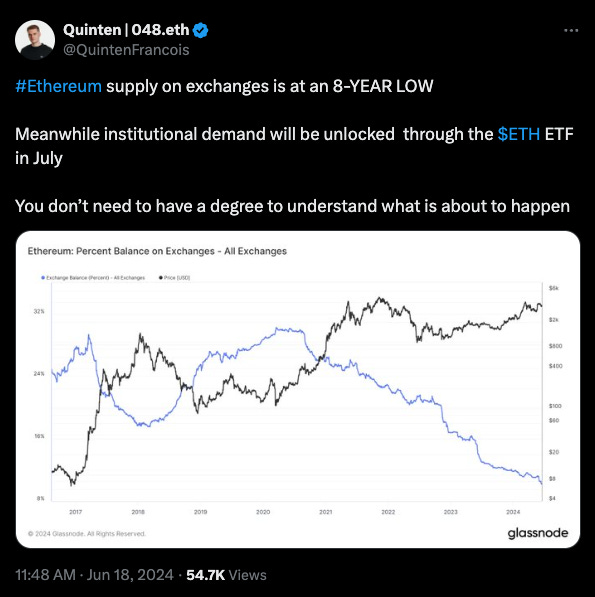

Ethereum's supply on exchanges is at an 8-year low - potential scarcity and price hikes.

The Bear case

ETH is currently struggling to break past $4,000, let alone reach $10,000.

The price has been on a downward trend for the past two weeks.

Even with a successful ETF launch, regulatory hurdles from the SEC could delay things.

The potential gains outweigh the potential losses?

In BTC’s case: Bitcoin's price rally was largely influenced by ETF inflows, accounting for 75% of new investments. ETFs launched in January.

It took just two months to reach its ATH of $73K on March 13.

“Ethereum’s recent pullback could be a gift” - Patrick Scott, crypto analyst.

Scott says that Bitcoin ETFs were the first of their kind, attracting new investors unfamiliar with crypto. Ethereum ETFs won't have that same "first mover" advantage.

Investors who jumped on the Bitcoin bandwagon may not be as eager to repeat the process with Ethereum.

Where’s Ethereum ETFs At?

Approvals, investment, and outperformance.

1. Seed money secured: Bitwise's amended filing reveals a $2.5 million seed investment for their spot Ethereum ETF, a positive sign for their progress.

The approval of the S-1 forms is necessary for trading to begin.

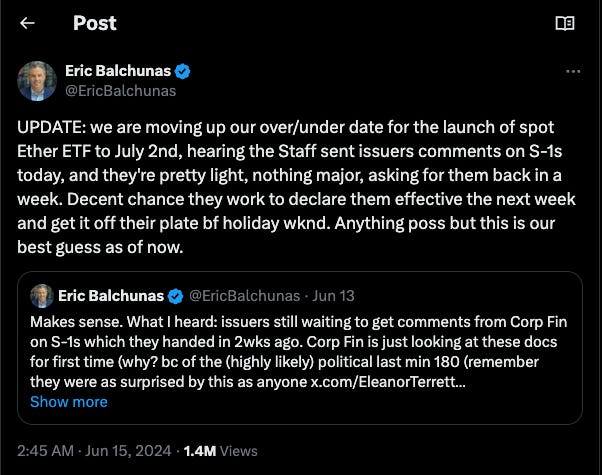

2. ‘Reasonable' comments from SEC: Ethereum ETF issuers have received comments from the SEC regarding their S-1 forms. The issuers have until Friday to address these comments and resubmit the forms.

3. Outperforming Bitcoin: Existing Ethereum ETPs (similar to ETFs but trade outside the US) are outperforming Bitcoin counterparts in anticipation of a Ethereum ETF launch.

Over the past four weeks, global Ethereum ETPs have registered net inflows of 86,472 ETH.

This mirrors the spike of inflows into Bitcoin ETPs in November 2023 ahead of the launch of spot Bitcoin ETFs in the US.

4. Institutions Undeterred by Staking Absence: 21Shares believes the lack of staking rewards in an Ethereum ETF won't discourage institutional investors due to the underlying asset's potential.

5. Combined BTC & ETH ETF on the Horizon?

Hashdex has filed for the Hashdex Nasdaq Crypto Index US ETF, which could be the first exchange-traded fund (ETF) to hold both Bitcoin and Ethereum.

This ETF would track the Nasdaq Crypto Index (NCI), which is heavily weighted towards Bitcoin (70.54%) and Ethereum (29.46%).

Read: Ethereum ETFs This Summer 🌞

In The Numbers 🔢

$35 million

Ethereum whale fire sale.

This comes as Ethereum's price dips below $3,500.

The whale who bought 150,000 ETH for $0.31 each during the 2015 ICO, is clearly sitting on a goldmine.

Why the sell-off? Could be a move to lock in profits as market conditions become less favourable.

This isn't an isolated incident.

Data suggests a broader trend of long-term Ethereum holders reducing their investments. The unmoved supply of ETH for 5-7 years has shrunk by over 22%.

But, Ethereum's supply on centralised exchanges is at an 8-year low - investors might be holding onto their ETH for the long term.

With less Ether readily available on exchanges, investors are speculating that a buying frenzy could ensue.

The logic? Fewer coins for sale means potentially higher prices for those who hold onto their ETH.

Unpacking Ethereum’s Pectra

Remember Dencun, the upgrade that slashed L2 fees?

Read: Ethereum's Dencun Upgrade 🦋

The next one is here: Pectra.

When? Scheduled for late 2024 or early 2025.

What is Pectra? A two-in-one upgrade.

It merges Prague (for the execution layer) and Electra (for the consensus layer) into a single powerhouse.

After Pectra, Ethereum will be more👇

Programmable for regular users.

Affordable for L2 transactions.

Efficient for smart contracts.

Flexible for validators.

What are features?

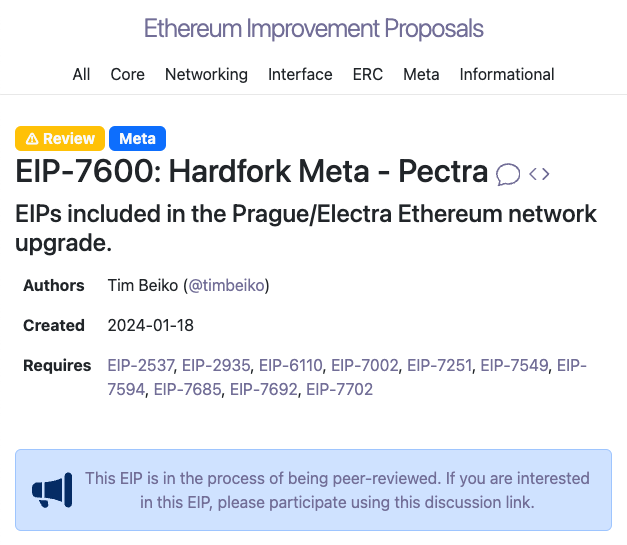

EIPs: A whole bunch of Ethereum Improvement Proposals (EIPs) are packed into Pectra.

Faster and Cheaper: EIPs like 2537 and 2935 make validator operations and data verification smoother, saving time and gas costs.

Stronger Staking: EIPs like 7002 and 7251 give validators more control and flexibility over their staked ETH.

L2 on Steroids: EIP-7594 boosts the efficiency of Layer 2 solutions.

Smart Wallets for Everyone: EIP-7702 lets regular accounts act like smart contracts for a short time.

Streamlined Contracts: EIP-7692 optimises the format of Ethereum contracts.

The Surfer 🏄

Ethereum scaling ecosystem's combined TPS reaches new all-time high. Xai, a layer-3 scaling solution for gaming applications, accounts for over 41% of transactions. Other top performers include Base and Arbitrum.

US prosecutors oppose motion to reduce Ethereum developer Virgil Griffith's 5-year sentence for violating sanctions on North Korea. Griffith was sentenced to 63 months in prison and a $100,000 fine in April 2022.

Ethereum restaking protocol Renzo has raised $17 million in funding. Renzo allows individuals to restake ether and other assets, earning them Renzo's liquid restaking token (LRT).

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋