Ethereum to $5k?🪁

Experts weigh in on Ethereum ETFs approval on price. ETFs could draw $4B in first 5 months. Ways to pitch ETH ETF. $3B ETH exit exchanges, so what? Who governs Ethereum? Bitcoin ETFs record flow.

Hello, y'all. Come and fly away with me? 💸

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

With the SEC greenlighting Ethereum ETFs, Ethereum shot up over 30% to $3,800 in May. All eyes are on the world's second-largest cryptocurrency - what next?

Analysts predict a late June launch for spot Ether ETFs, potentially pushing Ether prices past its November 2021 peak of $4,870.

Ethereum's Advantage: Some experts believe Ether could outperform Bitcoin due to less "structural sell pressure."

Unlike Bitcoin miners who must sell coins to cover expenses, Ethereum validators don't face similar cost burdens.

The bullish bets

Mike Novogratz (Galaxy Digital): A potential "seismic shift" in Washington could lead to much higher prices.

David Brickell (FRNT Financial): Positive economic outlook and crypto-friendly vibes signal tailwinds for Ethereum, potentially reaching $5,000 by June's end.

Joe Lubin (Consensys): A "floodgate" of institutional demand for Ethereum could lead to a supply crunch and drive prices up.

Jacob Joseph (CCData): He predicts a $3.9 billion influx into Ethereum ETFs within 100 days, but warns of potential headwinds from Grayscale Ethereum Trust outflows.

TzTok-Chad (Decentralised Options Exchange Stryke): Options trading suggests many are bullish on Ethereum exceeding $4,000, with some eyeing even higher prices. However, volatility is likely.

Bernstein Analysts: Expect positive price action due to pent-up demand, though Ethereum ETF flows might not mirror Bitcoin's.

Lennix Lai (OKX): Institutional investors are expected to jump in, potentially pouring $500 million into Ethereum ETFs during the first week.

Yet to see, but big money is on the move

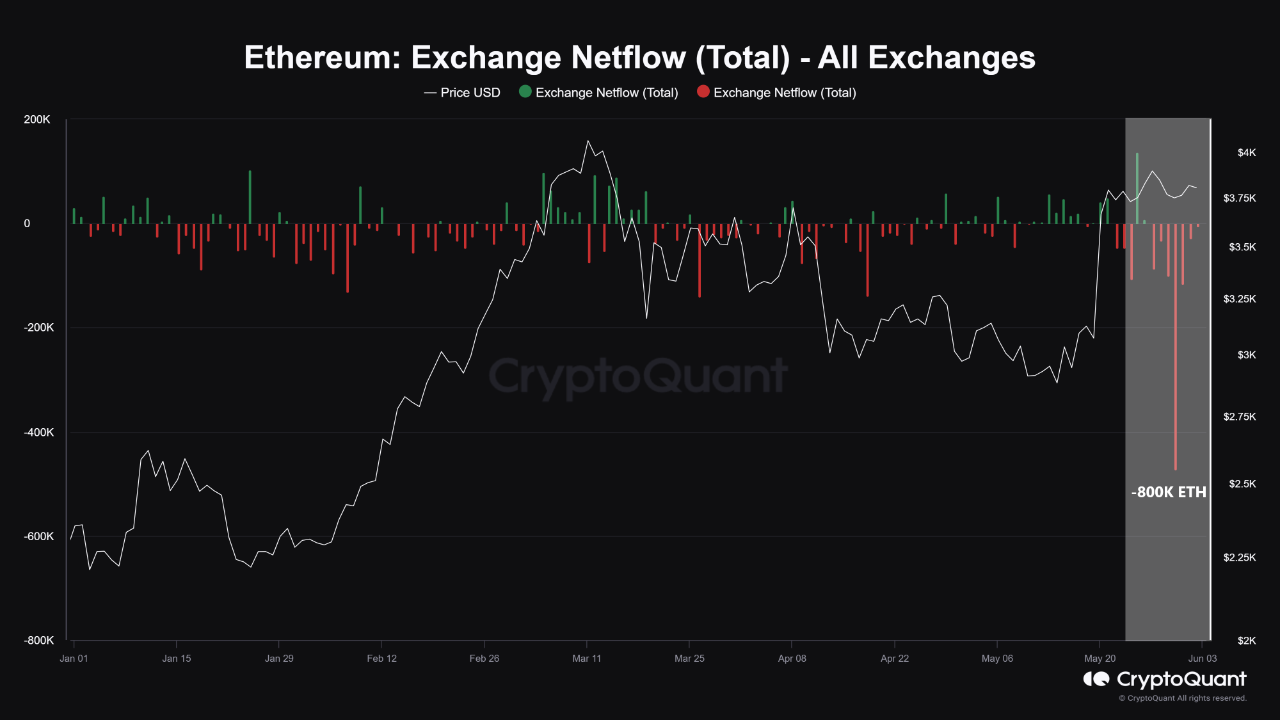

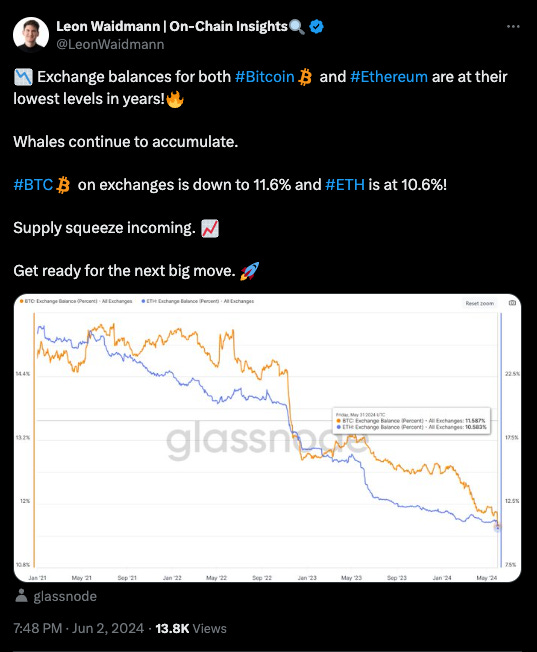

Following the SEC's approval, $3 billion worth of ETH (over 800,000 tokens) has vanished from exchanges, according to CryptoQuant.

Who's behind the exodus? Analysts believe it's a two-pronged attack.

Crypto whales smelling a price surge due to the ETF news and wanting to hold onto their ETH for dear life.

Institutional investors preparing for the ETF launch and stocking up to meet future client demand.

Why is this a big deal? Less ETH on exchanges means tighter supply, which could drive prices up in the classic case of "high demand, low supply."

Analysts like Burak Kesmeci at CryptoQuant are predicting a price bump for Ethereum in the medium term.

Grayscale's shadow looms: Concerns exist regarding Grayscale's Ethereum Trust, a $11 billion behemoth.

If it follows the path of Grayscale's Bitcoin Trust (which saw significant outflows after approval), it could impact Ether's price.

Ether options on fire?

Traders are betting big on Ethereum (ETH), with ether options showing higher volatility than bitcoin options. QCP Capital points to ether's option prices (implied volatility) being 15% higher than bitcoin's, reflecting traders' expectation of bigger price swings for ETH.In contrast, bitcoin option volatility has dipped since mid-May.

It’s about getting past Gary

Gary Gensler, chairman of the US SEC, said that the next step in the approval of the ETH ETF will take some time, which may indicate that the S-1 approval process may be slow.

Gary also made remarks that cryptocurrency exchanges are doing things that the law will never allow the New York Stock Exchange or traditional exchanges to do

Fox reporter Eleanor Terrett

How does Ethereum make decisions?

Short story: it's not by a bunch of token holders directly voting on proposals.

It turns out, a mix of different players call the shots, all happening outside the blockchain itself (off-chain) - a report by Galaxy Digital.

Who are these Mystery Governors?

Client Teams: These folks build the software that keeps Ethereum humming. They propose changes and discuss them before hitting the "implement" button.

Validator Node Operators: They have the power to accept or reject changes to the Ethereum network by choosing which software version to run.

The Ethereum Foundation (EF): While their influence has lessened, they still play a supportive role in Ethereum's development.

DApp Developers: These are the builders who create applications on Ethereum. They influence features and upgrades based on what users need.

Decisions aren't made in a vacuum.

Off-chain discussions happen in online forums like Ethereum All Core Developers calls and ETHMagicians.

Stakeholders hash things out and try to reach a consensus.

Block That Quote 🎙️

Bernstein analysts Gautam Chhugani and Mahika Sapra

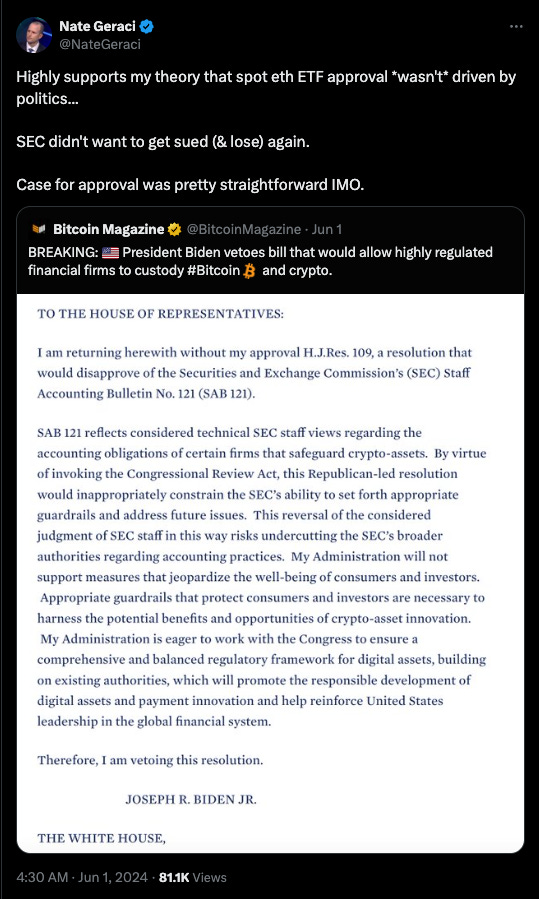

“Given the President vetoed the SAB 121 repeal bill, the political narrative looks less credible and likely SEC took a more pragmatic approach and avoided a legal battle.”

Analysts at Bernstein believe the SEC's green light for spot Ether ETFs wasn't a last-minute political move.

Some thought the SEC bowed to pressure from Democrats to win voters.

However, President Biden's veto of an anti-crypto bill weakens that argument.

“[The] SEC knew it was in a corner on ETH ETF, with the same regulatory set-up as Bitcoin ETF (same spot/futures correlation and ETH futures live, CME ETH futures market already signifying commodity status).”

The ETF Store President Nate Geraci agrees.

Did the SEC Just Surrender in the Crypto War?

Legal experts like Carlo D'Angelo believe the SEC's move weakens its own arguments against crypto. If Ethereum is a commodity (like oil or gold), it falls under a different regulatory body – the CFTC – known for a lighter touch.

Goodbye Howey Test?

This legal test determines if something is a security (regulated by the SEC). Crypto lawyers argue Ethereum ETFs suggest the SEC no longer has grounds to use this test on cryptocurrencies like Ethereum.

Three ways to pitch Ethereum ETFs

Ethereum is vying for a spot on Wall Street through ETFs.

But convincing traditional investors might require a new approach.

Here are three ways to pitch Ethereum.

Markus Thielen, head of research at 10x Research and Henrik Andersson, chief investment officer at investment management firm Apollo Crypto.

1. The Future of Finance

Ditch the technical jargon and focus on Ethereum's role in revolutionising finance.

Highlight its dominance in Decentralised Finance (DeFi), stablecoins, and tokenised assets.

Challenge: Ethereum's user base and upgrade pace have slowed, potentially weakening this narrative.

2. Decentralisation All-in-One

Pitch Ethereum as the platform for a decentralised future, encompassing finance, social networks, and even AI.

Emphasise its lead in decentralised applications (dApps) across various sectors.

Challenge: Competing blockchains emerge constantly, and Ethereum needs to maintain its edge.

3. The Faster Growing Bitcoin

Keep it simple: Ethereum is a faster-growing cryptocurrency with more potential upside compared to Bitcoin.

Highlight the lower market cap of Ether, suggesting more room for price appreciation.

Challenge: Ethereum's price dominance over Bitcoin (BTC) has declined, making it a less attractive alternative for some investors.

In The Numbers 🔢

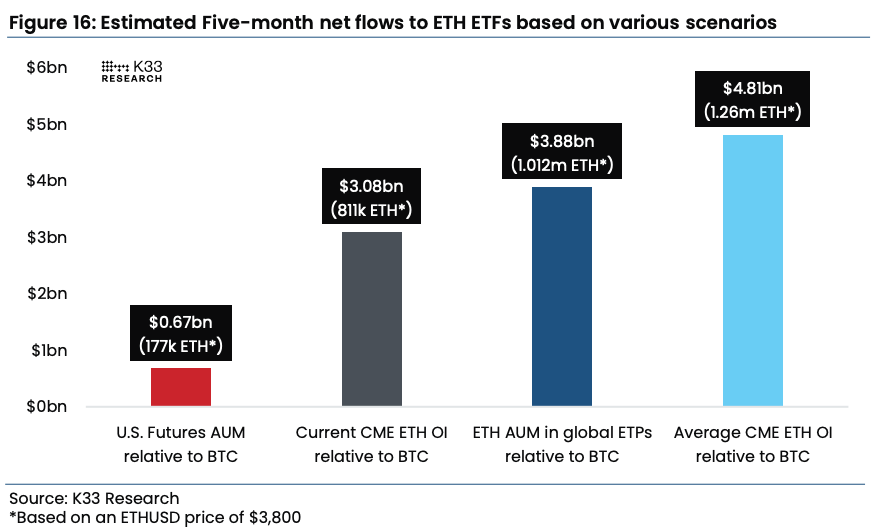

$4 billion

Ethereum ETF inflow prediction by K33 Research.

According to the crypto research, Ethereum spot ETFs could see a massive inflow within just five months of launch.

This prediction aligns with the success of Bitcoin spot ETFs, which have raked in close to $15 billion since January.

Institutional Interest on the Rise

Ethereum currently boasts a 28% share of the global market compared to Bitcoin. Similarly, Ethereum futures contracts on the Chicago Mercantile Exchange (CME) represent 23% of Bitcoin's open interest, highlighting strong institutional interest in Ethereum.

Based on these factors, K33 estimates Ethereum ETFs could attract between $3.1 billion and $4.8 billion, translating to 0.65% to 0.85% of the total Ethereum supply.

But, Bloomberg's Eric Balchunas expects Ethereum ETFs to capture 10% to 20% of the inflows witnessed by Bitcoin spot ETFs, which would still be a significant win for Ethereum.

Kaiko predicts the Grayscale Ethereum ETF could lose an average of $110 million daily in its first month, mirroring the experience of Grayscale's Bitcoin ETF launch.

This initial outflow could put downward pressure on the price of Ethereum (ETH) in the short term.

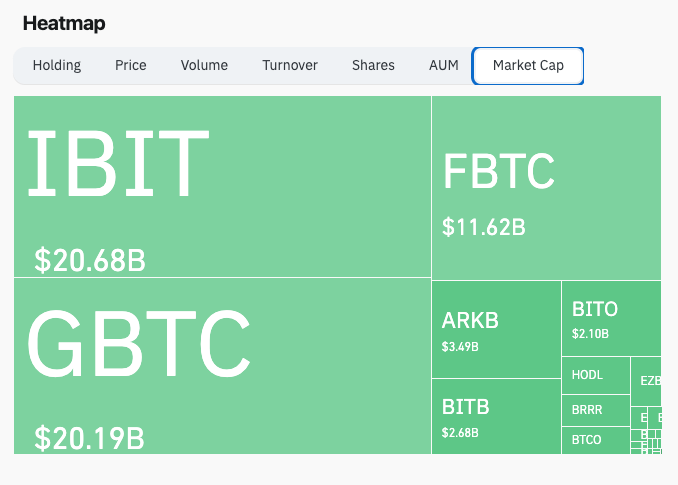

Bitcoin ETFs Gold Rush

A $887 million poured in on June 4th.

The second highest daily inflow ever.

This follows 15 straight days of positive inflows.

The total net asset value of Bitcoin spot ETFs is $61.46 billion.

Bitcoin itself seems to be responding well to this surge in investor interest. The price briefly touched above $71K on June 4, currently hovering around $70K.

Fidelity's "FBTC" fund raked in the most with $379 million, followed closely by BlackRock's "IBIT" at $274 million.

BlackRock's IBIT just surpassed a major milestone – $20 billion in assets under management.

And Fidelity executive believes most investors should have some allocation to Bitcoin.

The Surfer 🏄

BitMEX is offering 200x leverage for ether perpetuals ahead of the launch of US spot ether ETFs. The move is in response to the increased market volatility caused by the SEC's approval of spot ether ETFs.

UK tribunal begins hearing a $9 billion case against six exchanges that delisted Bitcoin SV in 2019. Plaintiffs claim that the exchanges owe BSV holders $9 billion for missed opportunities.

Worldcoin's proof-of-humanity project is extending its suspension in Spain until the end of 2024 or until a GDPR audit is complete. The German organisation responsible for auditing Worldcoin's compliance with GDPR is currently examining the project.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋