Hello dispatchers! Welcome to Wednesday's crypto dose.

A long week already?

An incoming president launching his own memecoin, then came the to-be first lady’s memecoin, followed by both of them crashing, and Donald Trump saying, “I don't know much about it (TRUMP official memecoin) other than I launched it”.

Meanwhile, Bitcoin has managed to sail past the $100K mark and is holding up well there.

Crazy times.

For today, though, we move our focus to the world’s second-largest blockchain Ethereum, which has found itself caught in a leadership crisis.

"The person deciding the new EF leadership team is me," said Vitalik Buterin.

When the man who worship’s decentralisation says something like this, you know the house is not in order.

Let’s look at what’s brewing.

Upgrade to paid to get full access to our weekly premium features (Wormhole, Rabbit hole and Mempool) and subscribers only posts. 2025 New Year special limited time offer - 38% off on our annual subscription.

The Crisis

For long, Ethereum has been facing scathing criticism from its own community.

On social media, memes have gone viral about ETH’s stagnant price, while the rest of the crypto seemed to be enjoying an industry wide bull-run.

Meanwhile, others are slamming the foundation for its centralised governance and project roadmap.

The crisis is hot and fresh now, but it follows a prolonged list of setbacks for the foundation.

May 2024: Conflict-of-interest scandal over EigenLayer advisory roles

Summer 2024: 99% collapse in base layer revenue post-Dencun upgrade

Q4 2024: Loss of DeFi market share to Solana

January 2025: Missed Trump memecoin opportunity to Solana

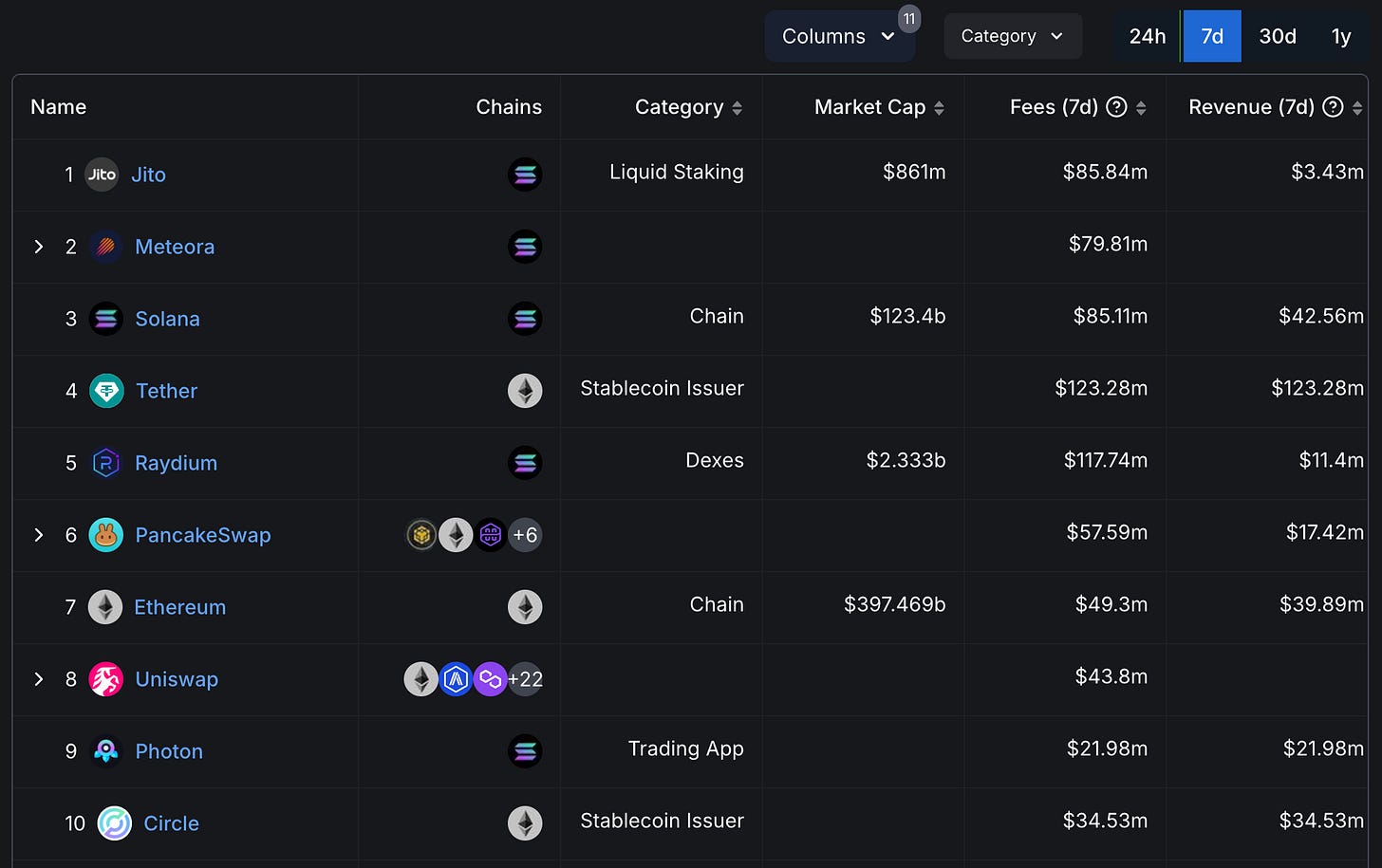

The current numbers show an even more glaring picture.

38% drop in on-chain activity

Balancer and Morpho down 65%

Uniswap volumes declined 40%

Layer-2 solutions struggling with $25.8 billion combined DEX volume

Average transaction fees stubbornly high at $5.50

Fallen out of top 5 in weekly fees

$49 million in weekly fees vs Solana's $85.11 million

ETH stuck below $3,500 since January 7

The gap between Solana and Ethereum widened further after Trump's memecoin launch drove Solana platforms like Raydium, Orca, and Meteora to record 200%+ volume gains.

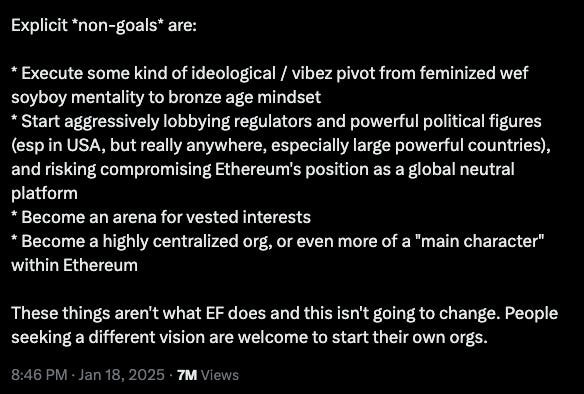

The Ethereum community is complaining about the network’s lack of efforts in building a public image and staying away from the corridors of political collaborations.

Instead, they claim the leadership team is more focused on technical objectives.

The Bulls' Rebellion

Ethereum stakeholders are also criticising about the Foundation's $900 million treasury management.

Three key concern areas.

Resource Management

Bloated budget and headcount

Insufficient developer support

Underutilised treasury assets

Lack of market responsiveness

Political Positioning: While XRP's CEO dines at Mar-a-Lago and Solana hosts Trump's memecoin, Ethereum remains conspicuously absent from the political arena and these prized opportunities. This self-imposed isolation comes despite Ethereum hosting Trump-backed World Liberty Financial.

Developer Relations: Core developers express growing frustration.

A generational divide has emerged in Ethereum's leadership approach.

The old guard was focused on technical excellence, resistant to political engagement and preferred gradual and considered changes.

Meanwhile, the new vision advocates are pushing for aggressive market positioning, support for institutional engagement, demanding for treasury activation and calling for leadership overhaul.

What now?

The Ethereum foundation did take notice.

Last week, it attempted to win back the trust of some of its loyal community members by rebuilding its social media presence to make it more public friendly?

That didn’t help.

The memes and criticism kept coming.

Crypto Twitter wasn’t the only one demanding change at the helm though. There were more.

Buy Once, Earn Daily Bitcoin Forever

Infinity Hash brings the best aspects of cloud and colocation mining into a transparent and reliable system that provides long-term cash flow.

Block That Quote

Anthony Donofrio, Ethereum founding member:

"The Ethereum Foundation is a paradox. Despite its commitment to decentralisation, it operates as a centralised entity, with a director, a treasury, paid developers, and an inner circle. These structures, while necessary for coordination, create tensions with Ethereum's decentralised ethos."

Donofrio wrote in an opinion piece on Coindesk that the Ethereum Foundation no longer carries the vision it once had to minimise internal and external threats both internal and external.

He also blamed the foundation for leaving its community feeling disconnected.

Ethereum co-founder and ConsenSys CEO Joseph Lubin proposed replacing Miyaguchi with a dual leadership structure: Danny Ryan, who led the Merge, and Jerome de Tychey, president of Ethereum France.

His message was clear - "We are now in a very different kind of environment in our industry. And it requires a very different kind of Ethereum Foundation."

What started as noise and rumours around Ethereum replacing Executive Director Aya Miyaguchi, soon turned into social media harassment against the director, including death threats.

Buterin condemned it as “pure evil” and gave a statement - a confirmation on the churn at the top level.

“We are indeed currently in the process of large changes to EF leadership structure, which has been ongoing for close to a year. Some of this has already been executed on and made public, and some is still in progress,” Buterin said in a post on X.

His post also spoke about what the foundation was trying to achieve with the changes to leadership structure.

That was not all. He also clarified the things Ethereum wouldn’t be doing.

Defiant leader? Still fell short of appeasing the audience.

Crypto influencer asked X users to “keep the pressure” on demanding for Miyaguchi’s resignation.

That was it - the snapping point.

Buterin wasn’t taking any more of this.

"No. This is not how this game works. The person deciding the new EF leadership team is me," Ethereum co-founder Vitalik Buterin said.

Damage Control: The 50,000 ETH Play

The Foundation's latest move reveals its scramble to regain community trust.

On January 20, recently appointed leader Hsiao-Wei Wang announced a significant shift in treasury management - deploying 50,000 ETH ($167 million) into DeFi protocols through a new multisig wallet.

The Foundation has established a new 3-of-5 multisig wallet structure for active DeFi participation. This marks their first major attempt to address longstanding transparency concerns over treasury management.

Paul Dylan-Ennis, prominent Ethereum commentator at University College Dublin, sees potential: "If there is a sort of middle ground that most people could rally around, it is probably the EF involving itself in dapps more."

The Foundation's historical approach to treasury management emerges as a central point of contention:

Past Practices

Converting ETH to stablecoins for operational expenses

Minimal ecosystem participation

Limited transparency in decision-making

Restricted DeFi engagement

New Direction

Active DeFi participation

Enhanced transparency through multisig setup

Direct ecosystem support

Public accountability measures

This pivot toward active ecosystem participation shows that the Foundation's traditional hands-off approach may no longer serve Ethereum's interests in an increasingly competitive landscape.

Token Dispatch View 🔍

Ethereum's current crisis reflects a fundamental challenge in crypto: how to balance ideological purity with market reality. While competitors court political influence and embrace market trends, Ethereum's leadership remains steadfast in its principles - perhaps to a fault.

Three critical insights emerge.

The Decentralisation Paradox: A foundation dedicated to decentralisation now faces criticism for centralised control. Vitalik's assertion of sole authority over leadership decisions, while perhaps necessary for stability, highlights this inherent contradiction. The 50,000 ETH deployment to DeFi feels less like innovation and more like a reluctant concession to market pressure.

The Cost of Principle: Ethereum's commitment to staying above the political fray made sense in crypto's early days. Now, as Trump launches memecoins on Solana and XRP's leadership dines at Mar-a-Lago, this principled stance comes with a clear cost: declining market share and developer mindshare. The numbers - 38% drop in activity, falling out of top 5 in fees - tell a story of principles meeting market reality.

Evolution or Extinction: The foundation faces a stark choice - evolve its governance while maintaining its core values, or risk relegation to technical irrelevance. The old guard's focus on technical excellence served Ethereum well during development, but the new era of mainstream adoption demands different skills.

2025's critical question will be whether its governance can adapt before market forces make that question irrelevant.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.