First day blockbuster 👊🏼💥🔥

Bitcoin takes on the $9.4 trillion ETF market. ETFs debut with a inflow bang and a sharp price fall. MicroStrategy's Bitcoin holdings outvalue the company. Vanguard says "NO" to spot Bitcoin ETFs.

Hello, y'all. If you think you know your music, then this is for you frens👇

If you think you can boss it, a $500 Apple gift card is for you to win frens 🎁

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Bitcoin entered the $9.4 trillion ETF market.

Read this: Bitcoin ETF approved ✅ Hallelujah.

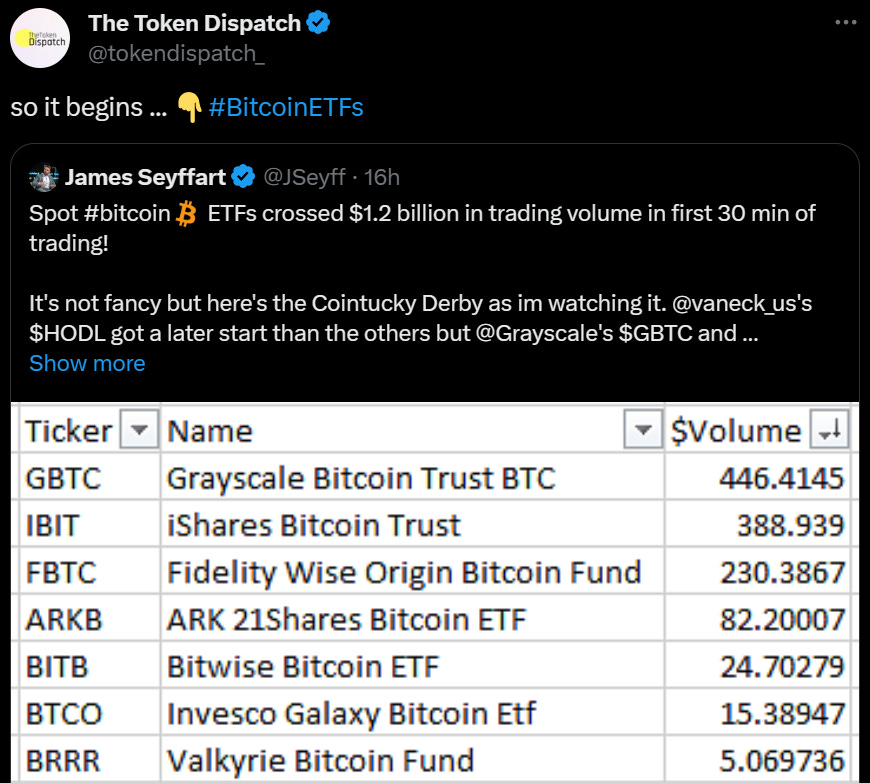

The first day of trading for spot bitcoin ETFs in the US witnessed approx. $4.6 billion in volume.

BlackRock, Grayscale, and Fidelity led the pack.

Grayscale Bitcoin Trust (GBTC) accounted for about half it (hit $2.2 billion).

BlackRock's iShares Bitcoin Trust (IBIT) recorded around $1 billion in volume, about 22% of the total.

Fidelity's FBTC ETF saw about $685 million in trading.

Over $1 billion in trade volume was recorded within the first 30 minutes for 10 new funds, following the SEC's landmark decision to approve spot Bitcoin ETFs.

Bloomberg analyst noted that IBIT's debut was comparable to the first bitcoin futures ETF, ProShares Bitcoin Strategy ETF (BITO), in 2021.

CoinShares' James Butterfill pointed out that the significant volume suggests a major inflow of investor capital, with a moderate impact on market price.

Hashdex's Upcoming Conversion: Hashdex announced its plans to convert its bitcoin futures fund to a spot product, pending SEC review.

ProShares Futures ETF Activity: BITO also saw significant trading, likely due to investors switching from futures-based to spot-based Bitcoin ETFs.

A need to purchase about 47,000 Bitcoin?

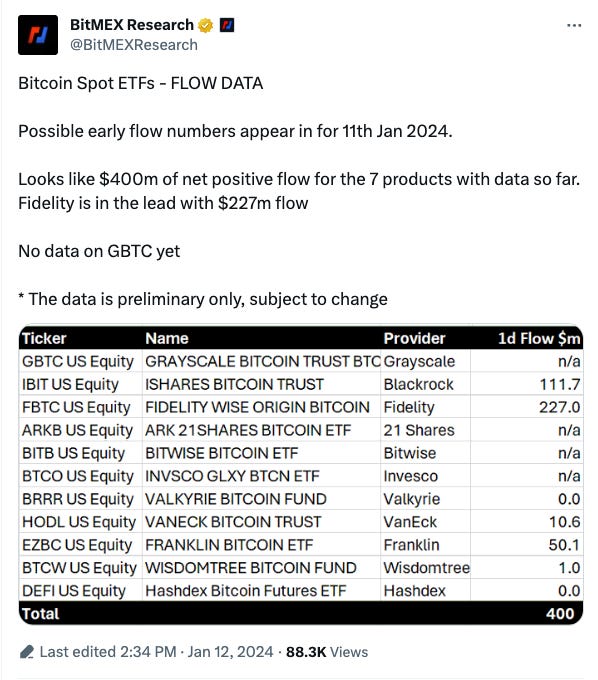

What about the total inflow?

According to BitMEX Research, the total net positive inflow of the seven spot BTC ETFs is $400 million, of which FBTC has a net inflow of $227 million, IBIT has a net inflow of $112 million, EZBC has a net inflow of $50.1 million, and HODL has a net inflow of $10.6 million.

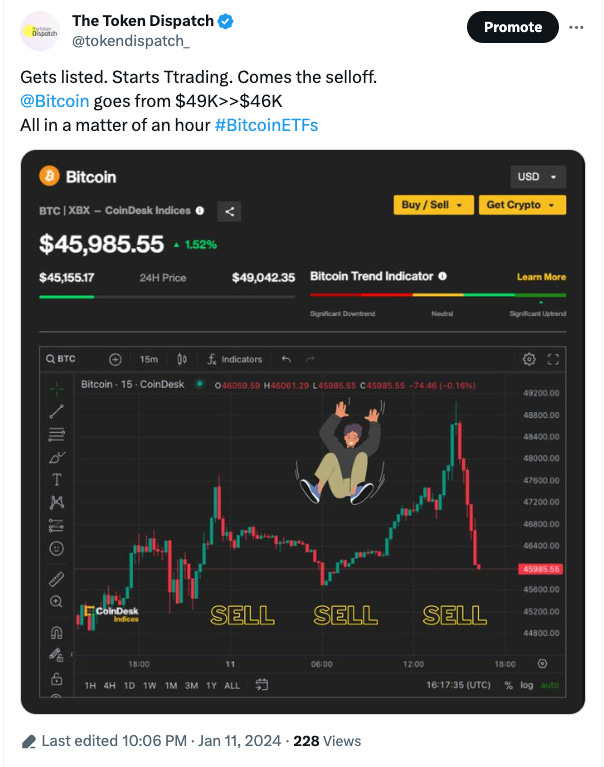

What's crypto without volatility?

New Era for Bitcoin?

Yes, with the SEC's approval of 11 US spot Bitcoin ETF applications, Bitcoin is venturing into the massive $9.4 trillion ETF market.

There are varying forecasts regarding the inflows into Bitcoin ETFs.

Eric Balchunas predicts a future market potential of around $150 billion for Bitcoin ETFs, with expectations of $15 billion inflows in the first year.

With Grayscale's GBTC already having about $30 billion, total spot Bitcoin ETF assets under management could reach around $50 billion.

Standard Chartered's Projection: The bank anticipates inflows between $50 and $100 billion in 2024, aligning with their Bitcoin price prediction of $100,000 by year-end.

Investment adviser Bernstein estimates more than $10 billion inflows in 2024, increasing to $80 billion in 2025. Over five years, they expect about $300 billion to be held by regulated Bitcoin ETFs.

Some predict $55 billion inflows over five years.

Comparison: The ProShares Bitcoin Strategy ETF had secured $1 billion within two days of its 2021 launch.

Grayscale's New ETF Filing

Grayscale filed for a covered call ETF that aims to generate income from its GBTC position following the SEC's approval of its spot bitcoin ETF.

The Grayscale Bitcoin Trust Covered Call ETF aims to generate income from GBTC positions and participate in GBTC's price returns. It won't directly invest in digital assets.

Grayscale released an ad now:

TTD MicroStrategy 😎

MicroStrategy's Bitcoin holdings now exceed company's value.

How?

The company's shares have dropped over 20% in January, erasing about $4 billion in market value.

Bitcoin has gained more than 10% in January.

And, MicroStrategy's balance sheet holds 189,150 BTC, valued at $8.7 billion, making its Bitcoin holdings worth over $1 billion more than the company itself.

Despite this, MicroStrategy's stock has nearly tripled over the past year.

The firm has earned over $800 million from its Bitcoin investments in 2024.

Some of MicroStrategy's Bitcoin was purchased with borrowed funds. Overall, the company is up about 49% on its Bitcoin investments.

Michael Saylor's Share Sale Plan: Former CEO Michael Saylor is selling 315,000 company shares, valued at approximately $170.5 million, to buy Bitcoin for personal investment and meet financial obligations.

Saylor personally owns more than 17,000 BTC.

MicroStrategy, previously a proxy investment for Bitcoin, may face challenges in attracting investors now that spot Bitcoin ETFs are available. Analysts suggest that MicroStrategy's software business could help mitigate Bitcoin volatility.

Where’s ETF?🚨

JPMorgan predicts that spot bitcoin ETFs in the US may not attract much new capital, but could see up to $36 billion in inflows from existing crypto instruments👇🏻

TTD Stocks 💹

Analysts at JPMorgan predict a possible slowdown for Bitcoin mining stocks with the launch of Bitcoin spot ETFs.

Mining stocks saw a decline in the first few hours of spot ETF trading. This included drops in stocks like Marathon, Riot, Bitfarms, Cleanspark, and Terawulf.

Despite the fall in mining stocks, Bitcoin's price climbed past $49,000 (trading at $46k atm), indicating a decoupling from mining stock performance.

According to JPMorgan, mining stocks might be overextended, trading high relative to their reserves and estimated mining income.

The report suggests investors might shift from mining stocks to direct Bitcoin exposure through the new ETFs.

Despite the anticipated slowdown, JPMorgan believes the fundamentals for mining companies remain solid, anticipating a strong year ahead.

ARK offloads more

Cathie Wood’s Ark Invest divested $4.4 million in Coinbase shares and nearly $4.3 million in Robinhood shares on Thursday.

Specific Trades

ARK Innovation ETF sold 26,301 Coinbase and 341,592 Robinhood shares.

ARK Next Generation Internet ETF offloaded 4,980 Coinbase and 23,838 Robinhood shares.

The sales occurred as both Coinbase(6.7%) and Robinhood (3.5%) stocks declined on Thursday, amidst the ETF approval.

Read: Why does ARK Invest Trim Coinbase Holdings by 133,000 Shares?

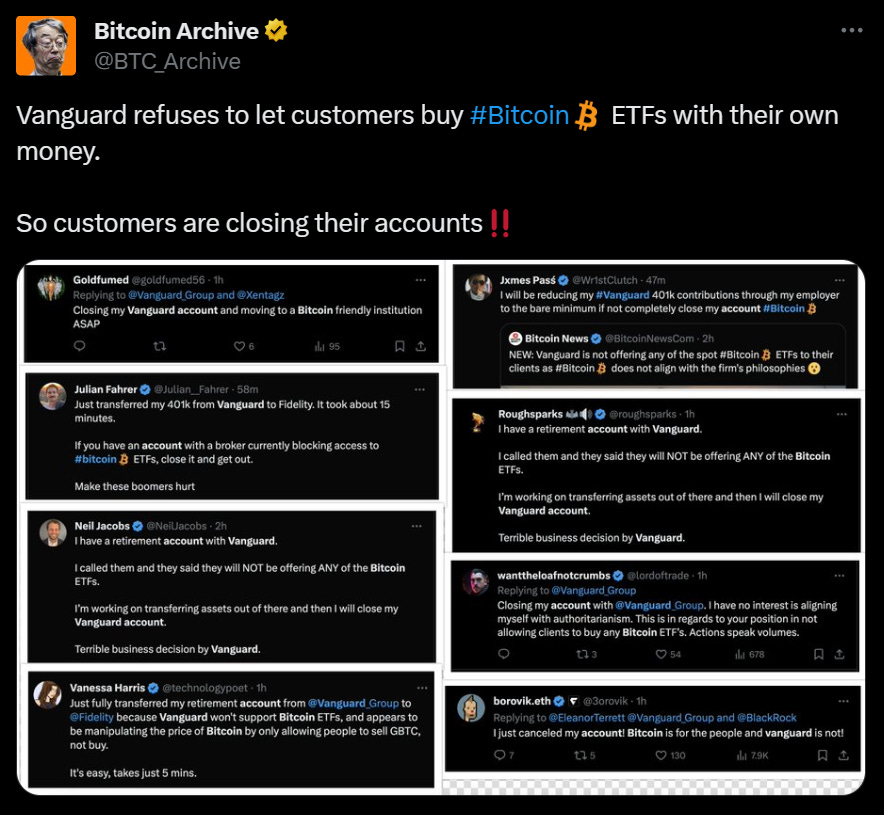

TTD ‘NO’🚫

Vanguard, a major investment management company, is not offering spot Bitcoin ETFs on its platform, aligning with its long-term investment strategy.

The company cites the high volatility of cryptocurrencies as contrary to its goal of generating positive long-term returns for investors.

Vanguard customer service stated that bitcoin ETFs are "highly speculative," "unregulated," and not suitable for the company's investment philosophy. Similar restrictions apply to other high-risk investments like leveraged ETFs.

Some Vanguard customers are contemplating switching to other platforms after this decision.

Other Firms' Approaches

Other major brokerages like E*TRADE, Charles Schwab, and Fidelity allowed the purchase of spot bitcoin ETFs.

Citi, Merrill Lynch, Edward Jones, and UBS clients reported issues purchasing spot Bitcoin ETFs on these platforms.

UBS is considering spot Bitcoin ETFs for aggressive investors on a case-by-case basis.

Citi has made a spot Bitcoin ETF available for institutional clients and is evaluating it for individual wealth clients.

Merrill Lynch is observing the trading efficiency of the ETFs before deciding.

JPMorgan, despite offering the ETFs, has issued a risk disclosure for investors.

TTD OpenAI📍

Introduction of ChatGPT Team

OpenAI introduces ChatGPT Team, bridging between individual-focused ChatGPT Plus and larger-scale ChatGPT Enterprise.

Includes a 32,000 context window and custom GPT creation for team collaboration.

The EU investigation

The European Commission may investigate Microsoft's 49% stake in OpenAI, the creator of ChatGPT, under EU Merger Regulation.

The inquiry will explore agreements between large digital market players and generative AI developers.

Specific focus on Microsoft's investment in OpenAI and its influence over OpenAI's operations.

Microsoft and OpenAI

Microsoft invested around $13 billion for a significant stake in OpenAI.

OpenAI tech integrated into Microsoft services (e.g., Bing, Office).

Inquiry may include Microsoft's influence on OpenAI's CEO changes.

Read this: Year of SAM outs 🫣 💣

OpenAI's NYT Legal Issue

NYT sued OpenAI for allegedly using its content unlawfully in AI training.

OpenAI refutes, citing "fair use," offers an opt-out for content usage.

Addressing a bug causing content repetition.

Collaborations with media like Axel Springer and dialogue with the News/Media Alliance.

TTD Surfer 🏄

Terra founder Do Kwon has requested a delay in his SEC trial to allow for his personal appearance.

Executives at Coinbase have offered to assist the SEC with its security practices after the SEC's Twitter account was compromised.

Near Foundation, the developer of the Near Protocol, is laying off 40% of its workforce in order to focus on more impactful activities.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋