Friend or Foe? 🎭

Brace yourselves, we have a bunch of tweets to look at. Is friend.tech really a friend? N. Korea steals BIG. OpenSea-NFT-royalty drama heats up. Tornado Cash? Busted.

Hello, y'all. Make sure you've claimed your collectible on Asset, and don't forget to give your books a »» Muzify «« spin? 🙌

You gotta listen👇

This is The Token Dispatch, you can hit us on telegram 🤟

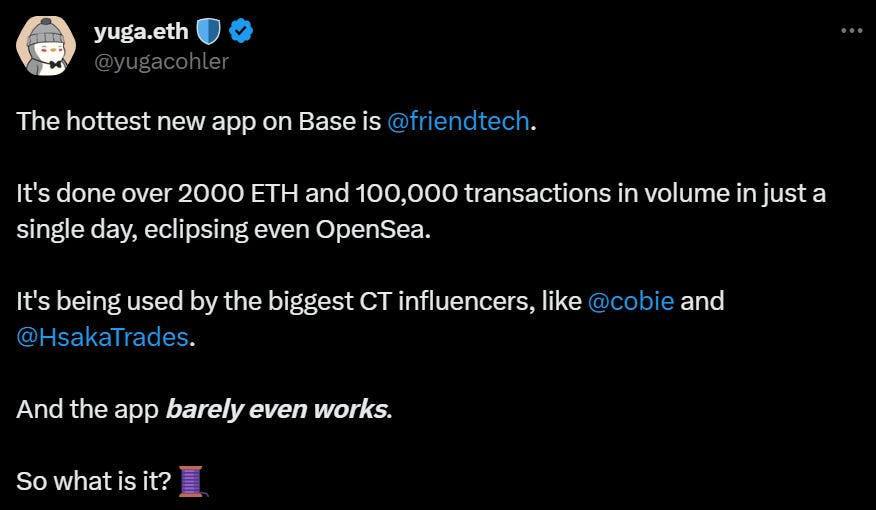

In just a week after its beta launch, Friend.tech is stealing the spotlight.

On Aug. 19, this newbie decentralised social (DeSo) network generated a whopping $1 million in 24-hour fees, cruising past crypto giants like Uniswap and Bitcoin.

What is it about?

Friend.tech lets you tokenise your social network. How? By buying and selling "shares" of your connections. Think of it as investing in a connection; in return, you get to send them private messages.

Economic Models: The platform's economic model is based on the growth of group shares, a fee structure, and point incentives. Friend tech charges a 10% transaction fee on each group share, half of which is distributed to the group share holders, and the other half goes to the treasury

Running on Coinbase's Layer-2 Base, Friend.tech has been on fire:

Launch Date: Aug. 11 (Beta version)

24-hour fees: $1.12 million

Fees since launch: $2.8 million

Project revenue till now: $818,620

Transactions count: A staggering 650,000+

Unique traders: Over 60,000

🧠 The brain behind the operation

The genius driving the project is the enigmatic developer, Racer.

A senior software engineer at Coinbase spills the beans about Racer's past endeavours, TweetDAO and Stealcam, both anchored in NFTs.

Friend.tech is Racer's vision to empower crypto influencers, letting them earn from trading fees and fortifying ties between Web3 projects and the big guns of the crypto universe.

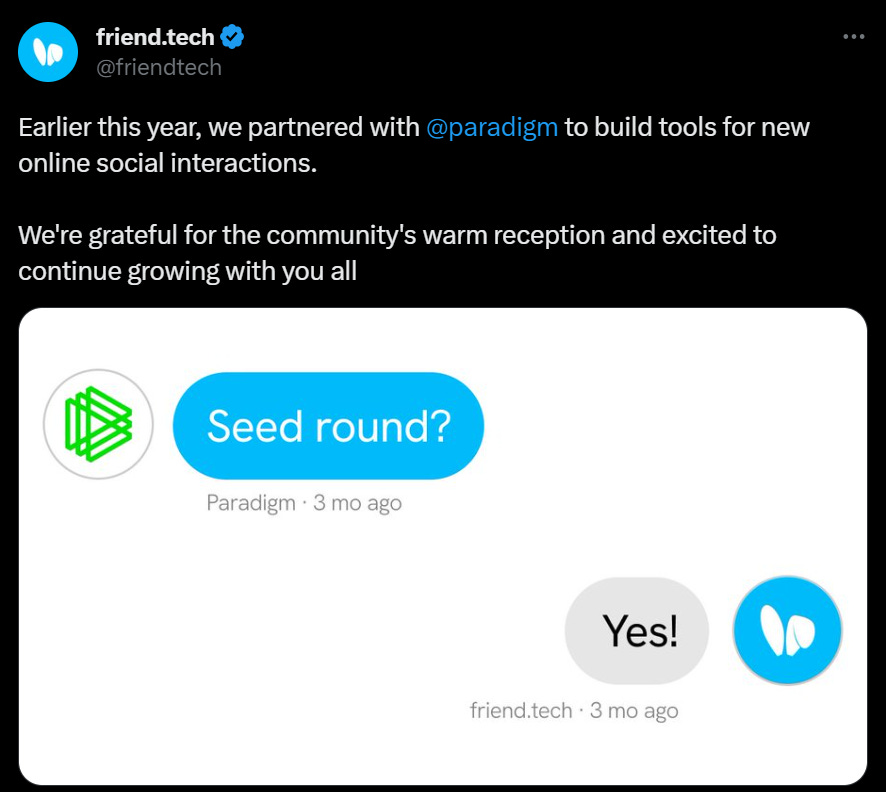

On Aug. 19, Friend.tech secured seed round backing from crypto VC giant, Paradigm. There was an initial spike in user registrations which slowed down during the week. However, there was a renewed interest when Friend.tech introduced its "Friday Points" airdrop for 44k users.

Every Friday, during its six-month beta phase, Friend.tech will airdrop 100,000 points to its users. These points will have a yet-to-be-revealed special purpose once the app scales up.

The ease of use

No app store download required, enhancing decentralisation.

Automatic funds bridging, eliminating complex transactions.

One-time ETH deposit, with subsequent share purchases and sales requiring no further transaction signing.

💬 Community opinion

Pros

Cons

A significant concern arises around data privacy. The desktop version of friend.tech lacks comprehensive information about its roadmap, founders, or whitepaper, essentials for any reputable crypto project.

Alarmingly, the site's privacy policy, a crucial document for potential users, is labelled as "Coming soon." This is troubling, as users are in the dark about their data's handling and storage. Additionally, mobile users are coerced into downloading the app, consuming valuable phone space.

In a nutshell, while friend.tech offers intriguing returns, potential users should be wary of the unclear data handling practices.

Andy Chorlian, an early adopter and founder of an NFT platform, showcased his profile valued at 47.4 ETH (~$88,000) on the site, which he later identified as a glitch. Regardless, Chorlian reported earning almost $1,000 shortly after joining. He credited the friend.tech team for creating a platform that resonates well with the Crypto Twitter community.

A good read👇🏻

A big win for team Base?

The rapid growth and acceptance of Friend.Tech among users signify a strong potential for decentralised apps on the new Base blockchain. It showcases not only the demand for such platforms but also their monetisation capabilities.

TTD Fraud 🦹🏻♂️

Glow Token vs Crypto.com

Glow Token LLC, a cryptocurrency startup, has filed a lawsuit against Crypto.com, accusing the major exchange of breach of contract after falling victim to a scam.

Glow Token CEO Bryan Lawrence transferred $250,000 and one Bitcoin to an account he believed belonged to Crypto.com, after being approached by individuals posing as the exchange's employees. However, in March, Crypto.com informed Lawrence that he had been scammed by imposters and had no record of a listing agreement with Glow Token.

North Korea's elite hacking squad 🇰🇵💻

North Korean hackers have reportedly stolen around $2 billion worth of cryptocurrency since 2018, with $200 million stolen in 2023 alone.

They are said to be 10 times more active than other malicious actors and have targeted the decentralised finance (DeFi) ecosystem, particularly cross-chain bridges. The hackers have evolved their methods, using phishing and supply chain attacks to compromise private keys and seed phrases. They have also developed complex money laundering processes to cash out stolen cryptocurrency.

$2 billion: Total crypto stolen by North Korea since 2018.

$200 million: Loot in 2023, making up 20% of all crypto thefts this year.

$650 million: Value stolen in the "Axie Infinity Ronin Bridge" hack.

$800 million: Stolen in three separate attacks in 2022.

Exactly & Harbor Attacks

Decentralised finance (DeFi) protocols Exactly and Harbor were hacked in separate attacks. Exactly Protocol lost 4,323.6 Ether (ETH) worth nearly $7.3 million, while Harbor suffered losses in various crypto assets. Exactly Protocol filed a police report and is attempting to communicate with the attackers to recover the stolen funds. The attacks are part of a series of security incidents in the DeFi space, including the recent theft of $61 million from stablecoin pools on Curve Finance and the exploits on Earn.Finance and Zunami Protocol.

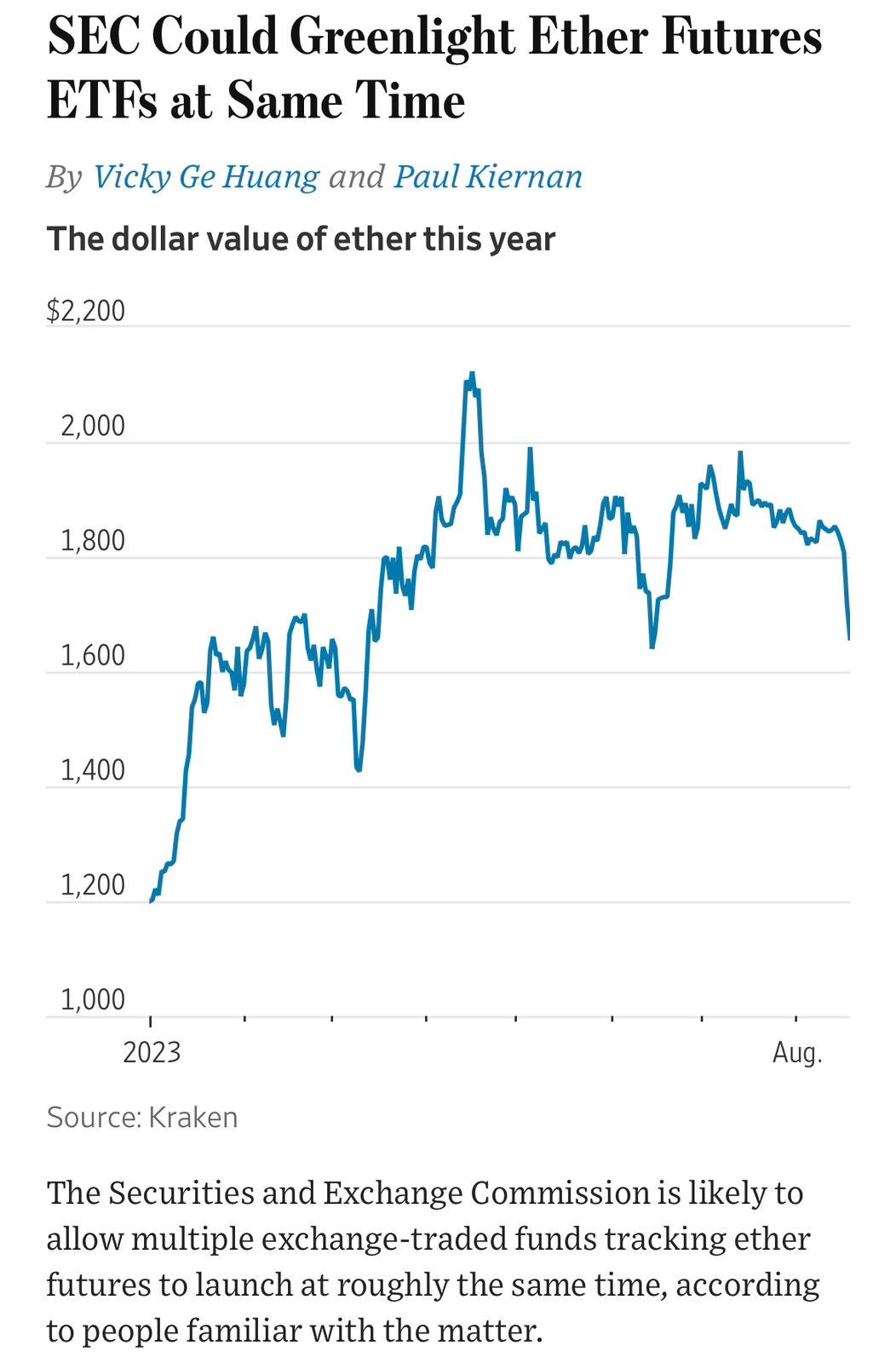

Where’s ETF?🚨

The SEC is expected to approve multiple applications for Ether futures exchange-traded funds (ETFs) simultaneously. Says a lil bird👇🏻

TTD WWF 💁🏻♂️

OpenSea declared plans to cease enforcing mandatory creator royalties—added charges on NFT resales that usually go to the original creators. These royalties generally range from 2.5% to 10%. The move is speculated to be a response to rival NFT platforms who've cut these royalties to attract buyers.

And of course, nobody's gonna shut up about that.

Mark Cuban, a renowned tech entrepreneur and owner of the Dallas Mavericks, didn't mince words: "Not collecting and paying royalties on NFT sales is a HUGE mistake by OpenSea." What adds spice? Cuban's an investor in OpenSea, having taken part in its $23 million Series A round in 2021.

Yuga Labs strikes back: Not to be overshadowed, Yuga Labs—known for the Bored Ape Yacht Club—announced its intentions to cut ties with OpenSea. Come February 2024, they'll stop OpenSea from trading their new and upgradable NFTs. Considering Yuga's $9 billion worth of NFT sales, this isn't a minor snub.

Also, BNB discontinued

OpenSea also announced that it will discontinue support for the BNB Smart Chain (BSC) on its platform.

TTD DeFi 🔐

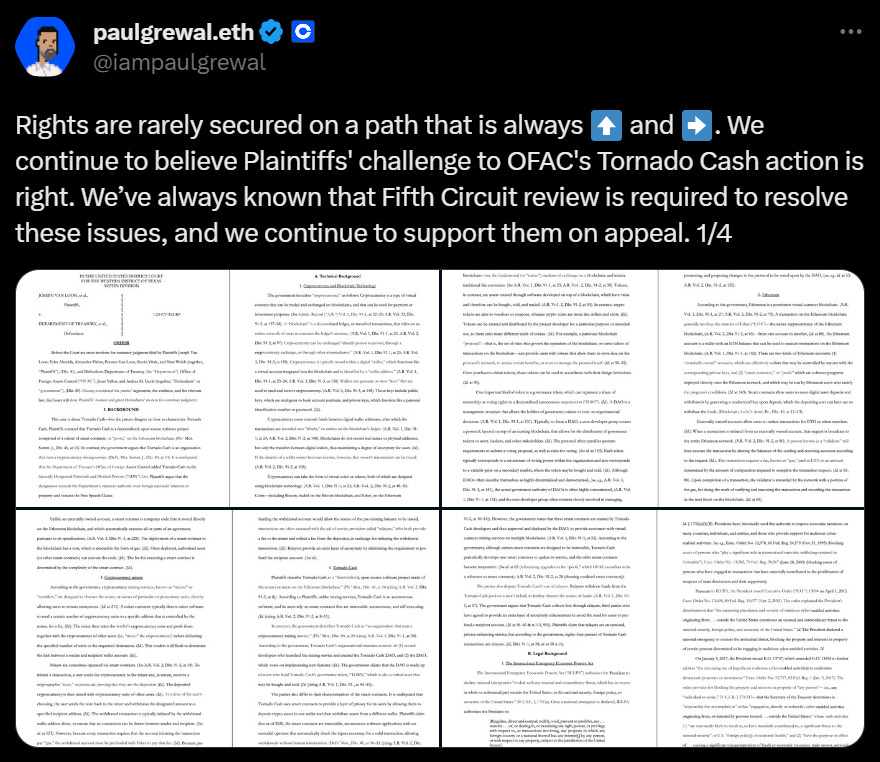

The U.S. federal court has affirmed the Treasury Department's sanctions on cryptocurrency mixer, Tornado Cash.

U.S. District Judge Robert Pitman rejected the claims of six Tornado Cash users who argued that the sanctions violated their First Amendment rights. The users intended to use the service for donating to political and social causes.

The legal challenge stemmed from the Treasury Department's move to list Tornado Cash on its Specially Designated Nationals and Blocked Persons List, accusing the service of laundering over $7 billion, including transactions for North Korean hackers.

Judge Pitman ruled that Tornado Cash can be legitimately sanctioned as an "association" and its smart contracts are considered "property" liable to sanctions.

Interestingly, the judge observed that the plaintiffs might have made a case under the Fifth Amendment, which opposes the government's seizure of property without compensation. However, this angle was not pursued by the plaintiffs.

Paul Grewal of Coinbase, supporting the lawsuit, suggested the need for appellate review.

TTD Surfer 🏄

A class-action lawsuit has been filed against Roblox, alleging that it enables minors to gamble with its in-game currency.

Ethereum Layer-2 solution Arbitrum has experienced a surge in new users following an airdrop of its native token ARB.

Crypto lender Celsius is moving closer to exiting bankruptcy as creditors prepare to vote on a plan to sell assets to the Fahrenheit consortium.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋